13 Million Negative Equity Homeowners and Negative Equity FDIC: The Shackles of Debt Leverage on the American Economy. FDIC $8.2 Billion in the red with 552 Troubled Banks on the Revised List.

- 0 Comments

The third quarter was devastating for banks and homeowners. To show the growing divide between Wall Street and the American economy, the FDIC just released its third quarter banking profile. The FDIC fund is not only broke, it is now in the red to the sum of $8.2 billion. We’ve been warning that the fund was insolvent for over a year but now the FDIC has joined millions of homeowners in the negative equity category. The problem with the system is we have a fund that is now negative, backing up some $4.5 trillion in U.S. insured deposits. Who will be on the hook when more banks fail? Isn’t the economy supposedly recovering?

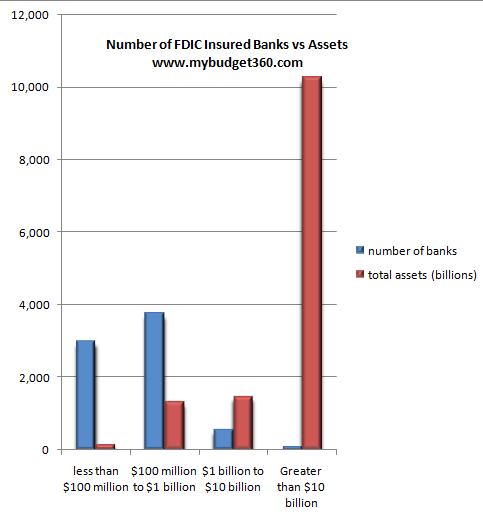

The FDIC also updated their problem bank list and it has grown from 416 in the second quarter to 552 in the third quarter, a 32 percent increase. We issued a warning that when this crisis hits a real trough, that over 1,000 banks will be obsolete and gone.  Much of this problem has to do with how assets are distributed amongst the big banks:

This is the new version of our economy. $13 trillion in total banking assets at over 8,000 institutions. But if we look closely at the data we will find that roughly 110 banks hold $10 trillion of all these assets. In other words, you can have 7,000 banks fail and only 30 percent of the system’s assets would be affected. Talk about too big to fail.

But with the growing list of problems and losses to the FDIC banks somehow miraculously turned a profit in the quarter:

“(WSJ) Despite the turmoil in the industry, banks posted a modest $2.8 billion profit in the third quarter of 2009, as their securities portfolios recovered and banks with less than $10 billion in assets saw margins improve. Bank profits were more than triple the $879 million they earned in the third quarter of 2008 and improved from a $4.3 billion loss in the second quarter of 2009.”

Now how is it possible to turn a profit when banks are failing and putting the FDIC in the red and using taxpayer bail outs to stay afloat without some form of accounting chicanery? The reason is simple and it is because banks now operate like hedge funds and have used the stock market recovery to prop up their bottom lines with little benefit to the American consumer. Just look at banks like JP Morgan that in their last earnings report, showed most of their income stemming from their investment branch. In their retail lending they have pulled back on loans and credit cards which are really a bigger factor for the average American.

And troubled loans keep growing because in the real economy, things are still in a deep recession:

“Troubled loans continued to pummel U.S. banks in the third quarter. Loan loss reserves topped $60 billion for the fourth quarter in a row, dampening profits. Meanwhile, banks charged off a net $50.8 billion during the third quarter, an 80.5% jump from the third quarter of 2008. The industry’s annualized net charge-off rate rose to 2.71%, the highest since records began in 1984.

Though noncurrent loans continued to climb during the quarter, the rate of growth of such loans slowed for the second quarter in a row. Noncurrent loans increased by 10.5% to $366.6 billion during the third quarter.”

If you are wondering how banks can turn a profit of a few billion even though they saw noncurrent loans increase by $366 billion, you would probably need to ask Bernard Madoff how he does his accounting. The U.S. Treasury and Federal Reserve are allowing this shell game to occur because they really need the Ponzi scheme to continue. They want the public to believe all is well even though banks are bleeding red. In their narrow world view, the heart monitor of the economy is Wall Street but clearly it is no longer a good measure of the vitality of our economy. With 27 million unemployed and underemployed Americans, how is it possible that the stock market rallied by 60 percent in a few short months? This is a legitimate question to ask. I heard someone on Bloomberg radio happily discussing the praise of “cost cutting” to maximize profits. These people are blind in connecting the reality that our consumer driven economy is not being helped by firing people for one or two quarterly profits while stunting the balance sheet of millions of Americans.

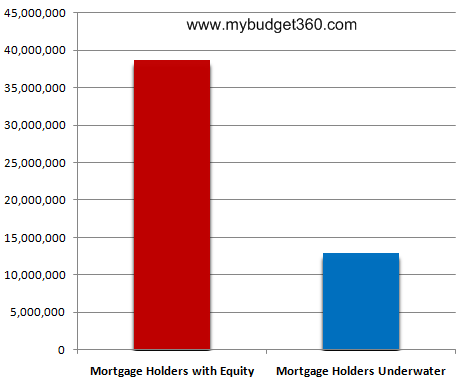

Loan Performance recently released a report that shows that 1 out of 4 mortgage holders are now underwater. If you want a chart of this data, this is how it looks:

Approximately 13 million American mortgage holders have negative equity in their home. What this means is they are in a worse spot than even a renter. If they had to sell, they would actually need to bring cash to the table. Or, they can do what many are doing and simply let the home go into foreclosure. And how many of the other homeowners are near negative equity? After all, you need over 5 percent in equity just to break even after all sale costs are factored in.

The bottom line is the FDIC is seeing a negative equity position in their banking system. Sure, they can do financial maneuvers that yield short-term profits but then what? We are approaching an underemployment rate of 20 percent in this country. These banks would not be standing without taxpayer bail outs. They have the gall to increase credit card rates to 79.9 percent and even impose fees on people that simply do not use their credit cards.

At a certain point, there is going to be a massive uprising against the financial sector. There is only so much deception the American public can take.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!