The 401k has been a disaster for most Americans: Only 44 percent of private sector workers participate in a defined contribution plan.

- 11 Comment

Failing to plan is planning to fail. If this is true, most Americans are planning to live in retirement with very little money and are going to rely heavily on Social Security to get by. That is the case today where most retirees get the bulk of their income from Social Security. Back when the 401k plan was introduced, the thought was many people would squirrel away money each month and after 30 or 40 years of working, there would be a large nest egg thanks to a raging stock market. Stock market growth has tempered and most people just didn’t participate. So now as many Americans enter retirement age most are realizing they are going to work until they die. The 401k plan was introduced in 1978 and the end result for most Americans is that it has failed.

The 401k plan

The 401k program is really the tax code for where individuals could set aside money tax deferred to plan for retirement. In theory this is good, however with the shrinking of the middle class, many Americans have less money to save. The program as it turned out really just benefitted a small segment of our population that had excess income to stash away.

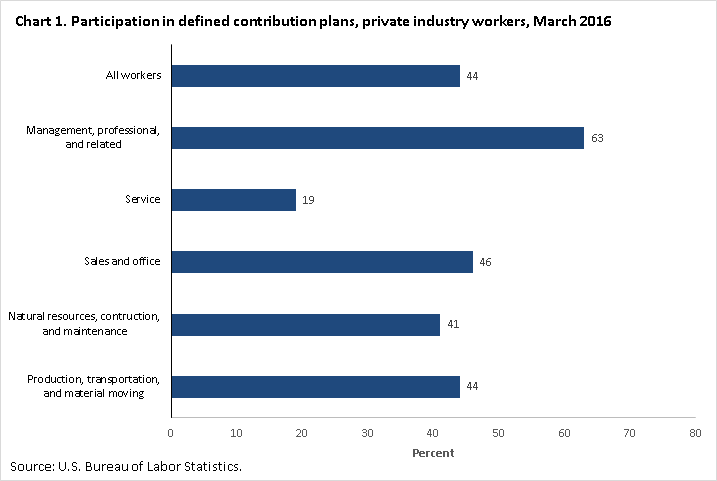

Take a look at private sector workers and their usage of 401k programs:

Source:Â BLS

Only 44 percent of private sector workers even participate in a 401k. This means the person that has $100 in an account is also counted here. But take a look at how many service sector workers participate in this program. Only 19 percent of service sector workers even utilize a 401k and that is the biggest portion of our workforce where many young Americans are ending up.

Since pensions are largely gone, this means that 56 percent of Americans are fully hoping that government support will be there once they hit retirement age. That is a scary proposition.

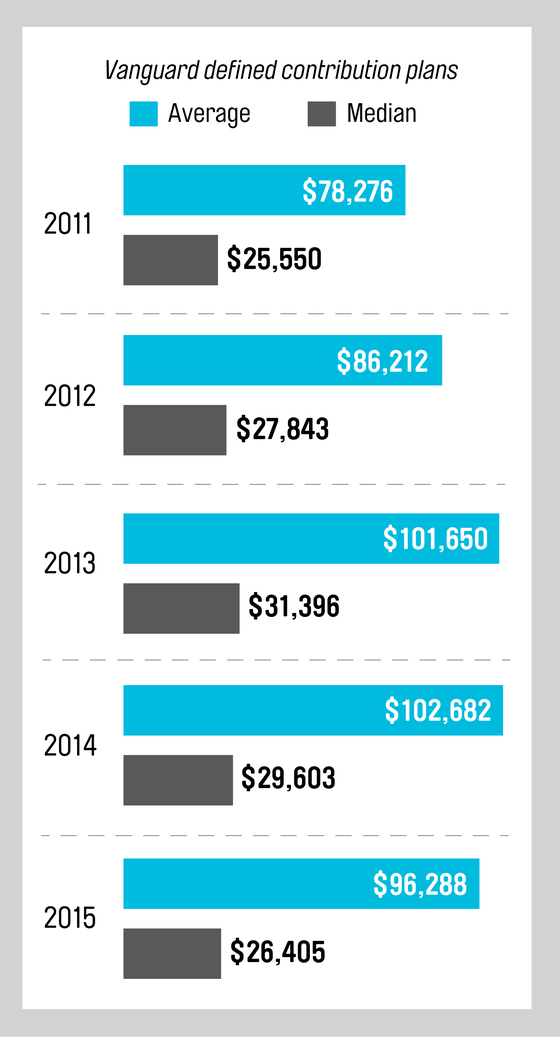

But let us look at people that actually save for retirement. How much do they have saved?

The average is worthless in this data because you have outliers that have millions of dollars saved skewing the results. The median is the most telling figure here. In 2015 the median amount in a 401k was $26,405. That is one broken leg with a hospital stay away from zero. And keep in mind this is only for those that actually participate in this program (which is fewer than half of Americans).

Why are Americans saving so little for retirement? There are a few reasons:

-They simply are too broke to save

-The stock market has turned into a wild casino

-Many options within 401ks are loaded with wild expenses that eat away at your returns

-Lack of financial literacy

Someone trying to get by is not looking at 30 years down the road when their baby needs diapers. The rent needs to get paid. So these daily pressures cancel out any budget planning. It is important to save and to plan for the future. Given the above figures however, most Americans are hoping the government is going to be there when they are no longer able to work or have no job generating income.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

Rufus T Firefly said:

No sympathy for you losers who were too stupid enough not to save. Enjoy your job working until you die while I enjoy a wonderful retirement because I was smart enough to plan for the futur.

December 17th, 2016 at 7:10 pm -

Steve said:

The 401K plan is not a failure. My wife and I both participated in plans for the bulk of our working lives and even after the 2008 crash had enough to fund a reasonable lifestyle (in conjunction with one defined benefits retirement and SS). That more people don’t contribute isn’t the fault of the tax code, but of their lack of foresight.

December 19th, 2016 at 9:09 am -

GoneWithTheWind said:

Were you being sarcastic or facetious saying it “failed”? Clearly it didn’t fail for 44%. You can bring a horse to water but cannot make them drink. To claim the program failed is to ignore it’s success for 44%.

December 19th, 2016 at 9:09 am -

Wally said:

The 401K is a failure. Limited choices for investment, hidden fees and in the end, only deferred taxes. The premise was that the average working man had to gamble his retirement savings in the casino of Wall Street in the hopes that even though he had no background in finance, he’d be able to make an appropriate selection that both protected his investment and returned at least a small return on it.

It also worked on the premise that salaries would have remained high enough that the average working person could afford all of the day to day costs of life and still have 8 to 10% of their salary to stash away. With the falling salaries of the last 40 years, that’s become difficult at best and impossible at worst for an “average” worker and the number in this article bear that out.

Cudos to the two braggers above for being able to stash away enough to keep them comfortably. We live in a world now where you grab what you can for yourself and fu*k everyone else because they’re obviously stupid or just not as brilliant as you. Merry Christmas Christian.December 22nd, 2016 at 4:39 am -

jb said:

401k is not a disaster imo. It will be a disaster if your company limits your investment to its shares, or mutual fund subsets, or restricts access to funds so individuals are unable to withdraw and invest in other instruments/assets using leverage. Also, the 401k was not designed to be THE retirement nest-egg, it’s purpose was to supplement the other two (at that time) retirement vehicles–enterprise-sponsored defined benefit plans, and government-sponsored plans (SSA, RRB, etc). Somewhere in the 1970’s, organizations realized the costs of defined benefit plans (and the promises to all those baby boomers) would exceed simple 401k plans [hint: what does that tell you about Social Security?] and began to eliminate this as an offering to new-hires (plus outsourcing labor to avoid additional hidden costs).

December 23rd, 2016 at 9:35 am -

James M Shaw said:

Why are Americans saving so little for retirement? Article fails to tell us that their “averages” a;so include 25-35 year olds that have only begun to start to save, thus radically understating how much retirement savings are actually saved and available at retirement.

December 24th, 2016 at 4:43 pm -

The trueth said:

The 401 is a scam made to keep wall street rich.do you read theprospective they send out?

Do you read the mice print?

Do you understand all the myraid of fees and hidden fees they charge you?

If you can change your own flat tire, do it yourself. If not, expect the tow truck guy to rip you off.

December 25th, 2016 at 10:37 am -

The trueth said:

The bond market is twice as large as the stock market.

The real estate market is larger than both the stock market and bond market.Commodotities are not an investmentment.

Curious how stock brockers only want to sell stocks. Must be the awesome commissions

December 25th, 2016 at 10:41 am -

Cathy125 said:

The real winners in the retirement game are husband and wife govt workers. Cushy, do-nothing jobs with great bennies, and then fat retirement checks after an early retirement.

December 26th, 2016 at 12:04 pm -

deimos said:

we put 15% into a 401K for years, never bought a new vehicle, didn’t try to keep up with the neighbors, rarely went out to eat, learned to cook from scratch at home and brownbagged it to work. It only took 25 years but we have a combined savings of about $700,000. Not a vast fortune but I am not counting on the government to do anything except screw the public. Although I must say any 401K is still not yours until you withdraw it. It is just a series of 0’s and 1’s on a computer screen right now. Try going to a bank and using it as collateral for a loan, you will be laughed out of there. If you can’t stand in front of something with a firearm and guard it, you don’t own it.

January 2nd, 2017 at 5:44 am -

BenefitJack said:

The Tax Reform Act of 1978 gave us Internal Revenue Code Section 401(k) as a means to CURTAIL deferrals of compensation by higher paid individuals. Note that the joint committee on taxation, in evaluating IRC 401(k) indicated that deferral activity would be so effectively curtailed as to reduce the budget impact to “negligible” – meaning zero or less than zero in terms of the impact on budget revenues.

The 401(k) is no more of a disaster than the IRA. Both are only effective if you have the discipline to save and make saving and investing, in terms of retirement preparation a priority.

The fact is that most people who have access to a 401(k), just like most people who have access to an IRA (all wage earners) have no other alternative – they didn’t in the 1980’s and they don’t today.

All that said, one of the few places the War on Poverty has “succeeded” is in reducing poverty among folks over age 65. 40 years ago, it was in the 30% range, today, it is just barely 10%. Bottom line, the 75+MM baby boomer’s retirement prospects (where a sizeable minority did have retirement preparation as a priority) are dramatically better than those of their grandparents and great grandparents.

January 9th, 2017 at 10:40 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â