401(k) Investing and Retirement Planning: How to Plan for Your Future

- 0 Comments

Retirement accounts such as 401(k)s are an absolute must in planning for your future. There is a classic book, The Richest Man in Babylon by George Clason that really captures the essence of what it takes to become financially secure. The theme is that you must pay yourself before you pay anyone else. It is a simple yet profound message. The majority of Americans nearing retirement do not have adequate funds to support them through their non-working years. Social Security for many will only provide a modest sum of support. The average Social Security check is $1,002 per month. Try living on that in many metro areas across the

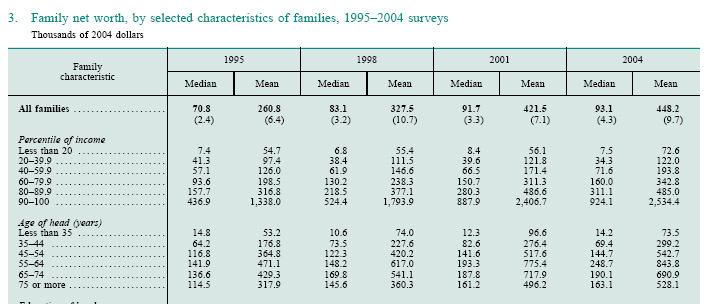

What you’ll notice for 2004, is the vast divide between the median net worth of $93,100 and the average of $448,200. Even at the peak savings age, 55-64 you’ll notice that the median net worth is $248,700. Given that many Americans will live into their late 70s and early 80s, $250,000 won’t go far over 15 to 20 years. So people need to plan for their retirement.

401(k) plans are employee sponsored retirement accounts. The benefit is that you pay into the account a portion of your wage and it is tax deferred. The major perk of deferring income taxes is that you allow a more sizable portion of money to grow and compound over the years. This is the ultimate paying yourself first strategy. Next, many employers will match your contributions to a certain percentage and this is similar to receiving free money.

Most 401(k) plans will give you an option to invest in a variety of mutual funds, bonds, and other stock plans. Some funds are target specific and diversified making investing very easy. For example a 2040 plan will invest with an allocation that has you gearing up for retirement in 2040. As you near the date, the portfolio will rebalance into a more conservative holding since you may not have that many more years to ride out the bumps of the fluctuating market. You also get the perk of dollar cost averaging. Once you set a specified amount, let us assume 10 percent of your income, it will automatically be deducted from your wages, placed into the account and invested. This helps since you mentally adjust to not seeing the money and it also forces you to save. With a negative national savings rate, it is important to pay yourself first.

So how long will it take you to become a millionaire? Let us run a few different scenarios:

Starting Balance: $1,000

Saving $300 per month at 11 percent: 31 years

Saving $500 per month at 11 percent: 26 years

Saving $700 per month at 11 percent: 24 years

The point is, the early you start the better. The 11 percent is based on historical market returns over the past. Keep in mind that a 401(k) should only be one tool in your retirement planning. I will go into other investment ideas such as currencies, commodities, inflation protected savings bonds, and real estate that should also be a part of your overall financial profile in other articles.

If you haven’t started a 401(k) or a 403(b) the public sector equivalent of a 401(k), there is no reason not to open a Roth IRA or Traditional IRA. With a Roth IRA, your capital gains will not be taxed once you reach retirement age. With a Traditional IRA, you are able to write off the portion of your contributions on your tax returns while paying capital gains once you start taking money out. The reason you should max out your 401(k) and 403(b) first is that money is tax deferred. The money you put into a Roth IRA and Traditional IRA has already been taxed thus lowering your overall return.

The major point is that if you haven’t started, get going now and start planning for your future. Make sure to pay yourself first!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!