FDIC holding banking system by a thread – $13.2 trillion in assets backed by -$15.2 billion Deposit Insurance Fund. 19 Banks hold 50 percent of all banking assets out of 7,830 institutions. What needs to be done to restore the banking system for the American public.

- 5 Comment

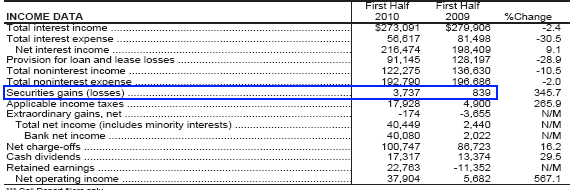

It was interesting to see the spin regarding the FDIC quarterly report this week. The report was largely a reflection of the way we now categorize profits in the banking system. Banks made a nice amount of profit through trading securities (on bailout leverage) while at the same time cutting back the amount of capital available to the American public. The number of institutions decreased by 104 but interestingly enough, the number of employees grew in this sector. Why? The too big to fail banks are simply getting bigger and stepping in where other smaller banks have failed. The amount of assets held at the 7,830 institutions is a stunning $13.2 trillion and who really knows if it is even that amount. To a bank, a loan is an asset and with mark to market suspended they can value these things at absurd bubble level prices.

Let us look at some key details in the report:

Source:Â FDIC

First, you’ll notice that the amount of assets backed did decrease by over $100 billion. If the economy is supposedly growing, you would expect this number to increase as well. Next, you will see the incredible amount of commercial real estate and industrial loans (this is the bailout that is currently occurring but the government and banks don’t want you to know about). How can an industry that has lost 104 institutions add employees? Simple, when you have the U.S. Treasury and Federal Reserve bankrolling your finances you have more capital. Over 95 percent of all mortgages made this year are backed by the Federal government so why do we even need banks serving as middlemen here to skim additional profits? Why not let the public borrow directly from the government for say a 30 year fixed mortgage? The underwriting is already computerized and IRS data is already in the government’s hands (heck, at least you’ll know the government will check this as opposed to the no-doc fraud of the too big to fail banks). Either way, the report is more of a reflection of banks not realizing losses and pretending all is well.

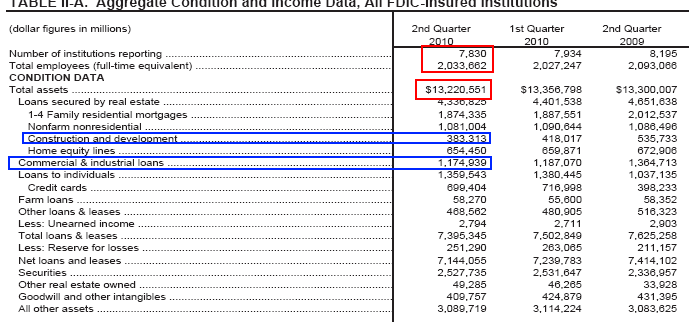

The big 4 banks control a large amount of banking assets in the system:

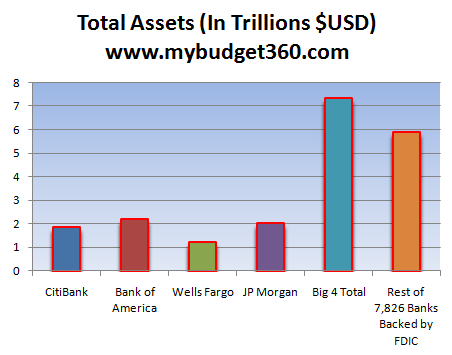

So even though we have nearly 8,000 banks, the bulk of the assets sit with a small number of banks. I’m not sure why the report was spun as being good especially when the Deposit Insurance Fund (DIF), the fund that backs the assets of the banks is actually in the red for $15 billion:

This is the fourth consecutive quarter of it being in the red yet it is perceived as being good. Keep in mind that this also has to do with programs like HAMP and also CRE delays because banks are basically ignoring bad loans with these stop-gap measures so this helped here. After all, if you didn’t have to recognize the actual value of an asset then you can still claim the inflated price and boost your assets. For those that were pushed into HAMP, banks were able to shift toxic loans onto the taxpayer bill. As we now know, over 50 percent of these loans re-default so instead of them going bad on the bank’s books, they will now go bad and the taxpayer will have to cover the entire bill. The FDIC report title should have included “shell game†somewhere.

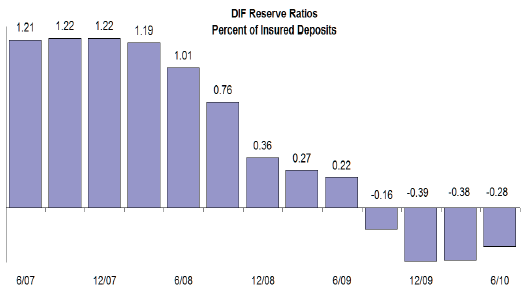

Banks also are making a tremendous amount of money through their security divisions:

Banks have increased their securities gains by 345 percent in the last year. Charge-offs are up because in the real economy, middle class Americans are having a tough time paying bills with such a weak economy. Banks continue to speculate on Wall Street and make money with taxpayer leverage.

Solutions?

We all accept that banking is a necessary part of the economy. Yet no other industry has the ability to pause accounting rules to suit its needs or has such control over the government. There is a deep need to separate commercial and investment banking. Since the Great Depression, we have seemed to avoid falling into another major economic calamity for over 60 years. Yet as time went on, regulators were thinned out and regulations were stripped away. Each crisis progressively got bigger. So today, we now have a crisis that is the largest since the Great Depression but banks have learned well from that time. They have learned how to mitigate public anger by pumping out propaganda (i.e., if you don’t bail us out we won’t make loans etc) and at the same time have consolidated power in the hands of a few banks.

Commercial banking should be treated as a utility. We all need banking and banks wouldn’t survive without the government. So there is a social contract here. Liken this to water, electric, or any strictly governed industry. This component should include mortgages (95 percent are already government backed), debit cards, checking, savings, and credit cards. Since these industries are protected by government and taxpayer money, they should be incredibly over regulated and have a strong enforcement branch protecting consumers. People will point to Fannie Mae and Freddie Mac as big failures. Well who was doing the gate keeping? The banks. After all, you can’t go to the corner to get a Fannie Mae checking account. But all the big banks including BofA, JP Morgan, Wells Fargo, and Citi currently pump out mortgages that are backed by the government. We seemed to do well for many decades when banks made these loans but under strict underwriting (i.e., big down payments, income verification, etc).

The other part should be the investment banking component. If banks want to leverage their own capital in the stock market and operate like hedge funds, so be it. But absolutely no bailouts no matter what. The example that is currently set is basically that if you become too big, the government will bail you out no matter what. And why do you think the number of smaller banks are disappearing all the while bigger banks are growing? This is the current reward system. Until this changes, you can rest assured another gigantic bailout is around the corner. After all, no one saw the flash crash day in May coming and we still have no explanation for it. Dose that instill confidence in the banking system or even our capital markets?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Creative Destruction dot US said:

Shittibank, JP Moron, Bankrob America and Goldman Sucks run this country. The social contract was torn to pieces when the bailouts ran into the billions and now the trillions. But now the federal reserve and central banks throughout the world are beginning to realize that there is no quick fix. i believe the federal reserve will die soon and I look forward to dancing on the grave!!!

Get your angry, humorous and righteous t-shirts, caps and bumper stickers at http://www.creativedestruction.us/

Anger and humor hopefully leading to extraordinary reform and a revolution in financial life.

September 2nd, 2010 at 10:34 am -

e. schrooge said:

total debt?

$201T = two hundred T.E.A. = tom, trillion

says Kot li koff, etc., Sam’s debt + unfunded liabilities

g.d.p. c $14T fourteen tril.September 2nd, 2010 at 12:35 pm -

CLARENCE SWINNEY said:

Why do not members of Congress have staffers copy all writing in this forum. mybudget.360.com

They could have nuke bullets to fire at Right Wingers.

This is excellent FACTUAL informationThe mass of people get faux information off Talk Radio and such misinformers as Fox.

They truly believe what they hear.

America is in serious trouble.

This is not a 1981-1982 or 1991-1992 RecessionThis is a 1929-1930 Depressive Recession.

Difference?

SAFETY NETS.

Imagine no Social Security–Medicare-Medicaid-Food Stamps-Unemployment Insurance–Veterans Health care–Veterans Pensions-Student college loans-Disability Coverage

It would be a revolution.

Yes! The Great benefits were created by Democrats under Objections by Republicans

Republicans always known as Country Club Party.

Take care of Rich. They create Wealth and jobs.

Labor is just a Burden.How in xxxx can one vote a Republican into Washington???

OK! Republicans you have won.

1% own 43% of our total financial wealth

1% get 25% of our Total Individual Income80% get 7% Total Financial Wealth

1%=1,400,000 workers

80%=112,000,000 workers=shafted big time since 19801979-2007

1% had 281% Increase in Income–65% Increase In Wealth

Middle Class got 25% Increase in Income-) No increase in WealthAmerica the ONE PERCENT Nation.

Thank you Reagan-Bush II-Conservative Congressmen

20 years of 3 Conservative Presidents-18 years Senate-12 years House-6 years total control

Housing Tsunami-Financial Volcano.

99,000 Net new jobs per month versus Carter-Clinton 222,000.

9 international conflict involvement

1 by Carter-Clintonp.s. Country Clubbers-Wall Streeters still do not own 7% of the Wealth.

Damn it! We made it. We are God’s Anointed. Give it to us.

Take it from those lazy indolent peasants.We worship $$$$$$$$$$$$$$$$$$$$$$$$—ONLY

clarence swinney

cswinney2@triad.rr.com

political historian since 1991

Lifeaholics of America

author-Lifeaholic-story of workaholic failure to lifeaholic success

author–forthcoming-How Democrats created a Great Middle Class and Conservatives are determined to destroy it8 more like Bush they will have succeeded

Oh! How badly we need those 2,300,000 good paying jobs transferred to China for $2 per day labor under Bush eight disastrous yearsSeptember 4th, 2010 at 7:08 am -

Alex S. Gabor said:

Keep up the excellent work and research!

The International Bank Activities Reform Commission Loves You!

Perhaps you should join in the 500 Trillion Claim Filed by them:

September 7th, 2010 at 5:59 pm -

opephowdelt said:

Bravo, un’ottima idea

February 14th, 2012 at 9:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!