Bank of America has $2.3 trillion in assets but $956 billion of that is made up in loans. Think those loans are valued at current market levels? The FDIC would have a challenge even breaking up one too big to fail bank.

- 3 Comment

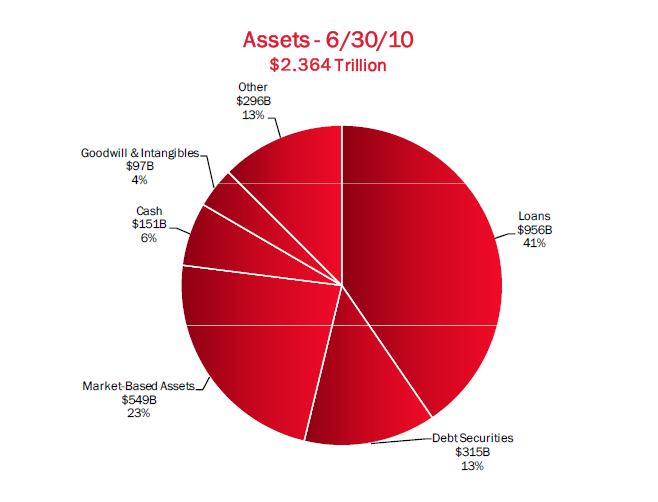

The FDIC has a herculean challenge in confronting the too big to fail banks. There is little doubt that having institutions that are too big is part of the reason for the current systemic crisis. Yet through the last few years the solution has been to make these banks even bigger allowing their web to spread even further and deeper into the economy. The FDIC has an insolvent Deposit Insurance Fund (DIF) backing up $13 trillion in banking assets. And what the banks call assets is simply stunning. Bank of America for example has $2.3 trillion in assets (or a larger amount than the annual GDP of California). Yet 41 percent of the assets are backed by loans, predominately real estate loans.

Let us take a look at the breakdown of the $2.3 trillion:

Source:Â Bank of America mid-year report

I’m not sure if the public realizes that banks can label loans as assets based on accounting rules. This would be like calling your auto loan an asset but keep in mind an asset to you is likely a liability to a bank. How many loans are still priced at peak levels here? Bank of America currently has a market cap of $132 billion. Let us assume that the loan portfolio is overvalued by 15 percent. That means we are talking about an overvaluation of $143 billion, enough to wipe out the current market cap. The current structure of the system is to pretend that the assets in the too big to fail banks are still somehow worth more than what the market will pay.

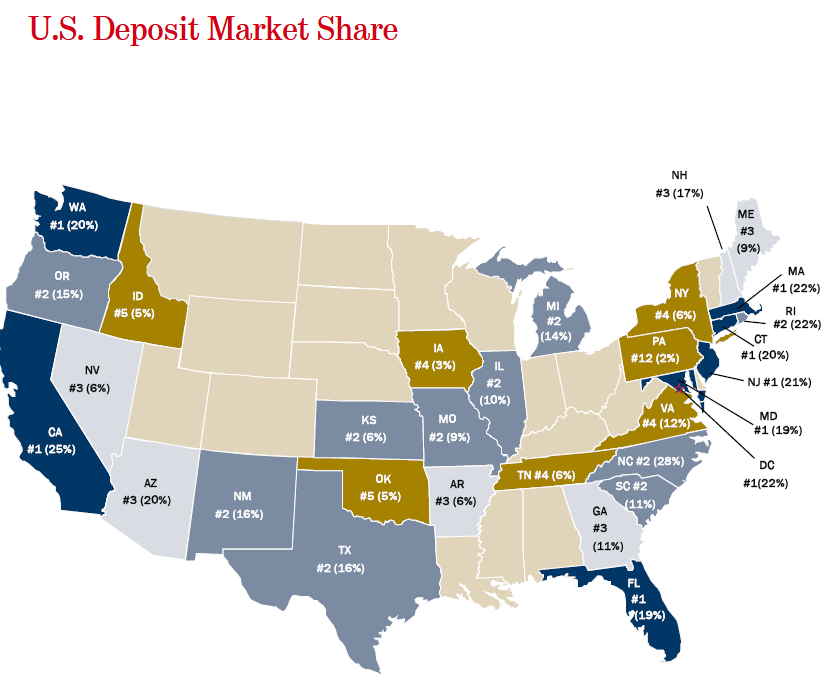

It is interesting given the current foreclosure moratorium crisis to see where Bank of America dominates:

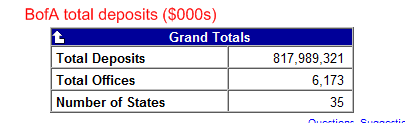

Bank of America is the number one deposit bank in California and Florida where the biggest bust of the housing market is taking place. Bank of America has $817 billion in total deposits at their institutions:

Source:Â FDIC

Here is where you can see why the pretend game is virtually the only way out at least from the perspective of the banking system. How in the world will the FDIC insure $817 billion in deposits if they have an insolvent DIF? Where will the money come from? If you guessed the taxpayer you would be right. So in essence the FDIC is merely the intermediary right now between the too big to fail banks and the taxpayer. It is interesting that in the last few weeks bank failures have slowed down yet the troubled bank list keeps growing.

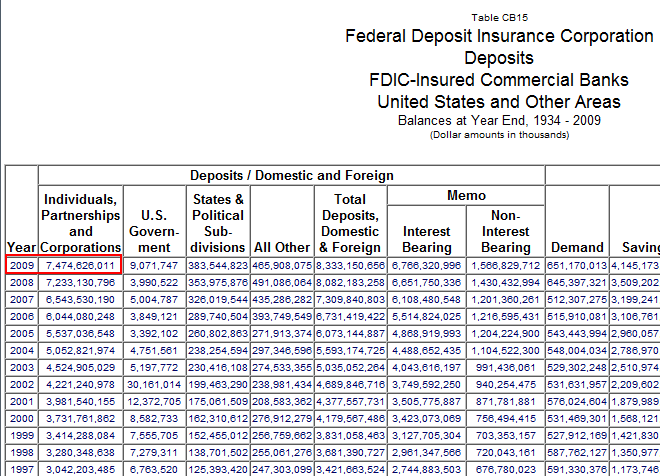

And Bank of America is only one of many of the too big to fail banks out there:

$7.4 trillion in deposits are in FDIC insured banks. All this is being backed up by faith and confidence in the system. This is similar to how banks claim their “assets†are worth more than what the current market will pay for them.

It becomes apparent why none of the too big to fail banks has been taken apart. The current mechanism in place simply is unable to handle even one bank. Yet this is absolutely necessary. Otherwise, the banks will merely get bigger and we will have a bigger crisis down the road. Nothing will be averted just by keeping the current system in place. As we are seeing with the negligent work on foreclosure paperwork these banks are unable to gain the confidence of the public. These are the same banks that charge billions of dollars in overdraft fees and sock customers with charges from every angle.

Yet it might appear that the calm on the FDIC front means something is starting to brew:

“Oct. 8 (Bloomberg) — The Federal Deposit Insurance Corp. has authorized lawsuits against more than 50 officers and directors of failed banks as the agency aims to recoup more than $1 billion in losses stemming from the credit crisis.

The lawsuits were authorized during closed sessions of the FDIC board and haven’t been made public. The agency, which has shuttered 294 lenders since the start of 2008, has held off court action while conducting settlement talks with executives whose actions may have led to bank collapses, Richard Osterman, the FDIC’s acting general counsel, said in an interview.

“We’re ready to go,†Osterman said. “We could walk into court tomorrow and file the lawsuits.â€

Time to get some of the money that was made by the banks during the crisis and regain some of those ill gotten profits. These banks were bailed out by the taxpayer and have done nothing but enrich their bottom line while the middle class has been dismantled over the last decade. It seems like the public is finally wising up to the key culprit of the crisis here.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Creative Destruction dot US said:

I will believe the lawsuits when I see them.

Confidence in the system will return when the fraud is prosecuted.

October 9th, 2010 at 1:40 pm -

droubal said:

I agree with just about everything in the article. My only complaint is that the conclusion mentions banks as the only entity that is guilty.

The banks were able to get away with this larceny because congress passed laws that allowed them to do it. Repeal of Glass-Steagall, the Commodity Futures Modernization Act, exemption letters for the big banks. All these changes allowed bankers to rob the public. Many of these same things happened in the 20’s, that’s why we had laws like Glass-Steagall.

Finally, the sheeple are to blame. Why do we keep electing the same incumbents back to congress? We now have multi-generational family dynasties in government.

We have to vote out all incumbents. Politicians need to have no job security unless they do what is good for the country, instead of what is good for themselves.

If, we, the voting public can’t figure this out, we are doomed.

Actually, we are probably doomed anyway, we have waited too long.October 10th, 2010 at 6:39 am -

Bozzy said:

Although I am not an American, I thought this was a stunning and relevant article of wider applicability than simply the USA. The deleveraging, rotten assets and fairystory balance sheets rather than some form of mark to market valuation issue is a pervasive and worldwide problem, and simply will not go away.

October 13th, 2010 at 6:05 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!