How much does the average American make in 2010? Examining new data on U.S. household income numbers and high income earners. 100 million Americans make less than $39,999 per year.

- 15 Comment

Examining the average income for Americans sheds a very troubling light on what has happened to income over a very financially destructive decade. If we look at the median household income in the U.S. this actually underplays the falling behind of wages because we are looking at households with multiple people working. Without a doubt the median wage is bolstered by two income families but when we break this out, we realize how challenging things have gotten for most Americans on a very personal level. You might even be one of these people (the odds are good that you individually make less than $40,000 per year given that 66 percent of individual Americans make this amount or less). For this article I will be looking at recent income data from the Census, Social Security, and also examine tax receipts for the Federal Government. What we find is a pooling of money at the top while most Americans have found a smaller paycheck with much less employment security. One startling fact that I found looking at Social Security information was that 100,000,000+ Americans earn an average of $39,999 or less a year (66 percent of all Americans). When we break down the cost of daily living and what one would expect out of a middle class lifestyle we get a better understanding of why so many people feel that they are being left behind in a dust cloud of economic verbiage.

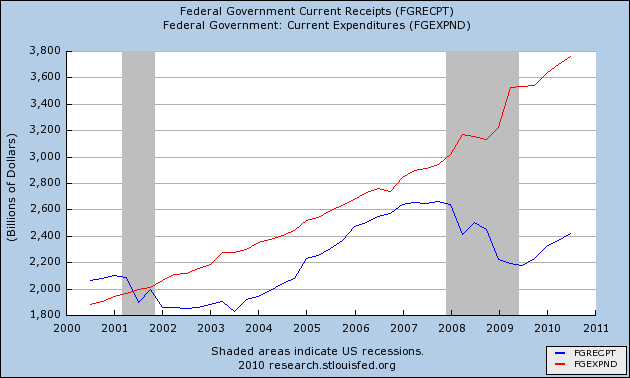

I first wanted to break down the average income of individual Americans through examining Social Security data:

Source:Â Social Security

For 2009 Social Security had 150,917,733 wage earners. Keep in mind that in some cases you might have people only working for half a year or part-time work but this data gives us an excellent personal look at the average income of Americans on a very micro level. One startling reality is that 72,000,000+ Americans earn $25,000 or less each year (almost half the wage earning population). This is why when we look at the median household income of $50,000 we come to the stark realization that two incomes are necessary just to stay above water. When only a few decades ago one blue collar income was enough for a middle class way of life (i.e., modest home, a path to a public college, etc) now two incomes are barely enough to pay for the daily necessities.

Another 34 million Americans earn an average of $25,001 to $45,000 per year while 33 million earn between $45,001 and $99,999. Going up to an average of $99,999 covers 93 percent of all individual wage earners in the country. This is where the vast majority of Americans reside. The numbers quickly dwindle as expected when we hit the upper income ranges. What is interesting is the vast difference between those who earn $20 million and $49 million and those who make over $50 million. The data reveals that over 353 Americans earned between $20 and $49 million and the average amount was $28 million. Compare this to the 72 that made more than $50 million with an average compensation of $84 million. To put this into context, the top 72 Americans earned over $6 billion in 2009.

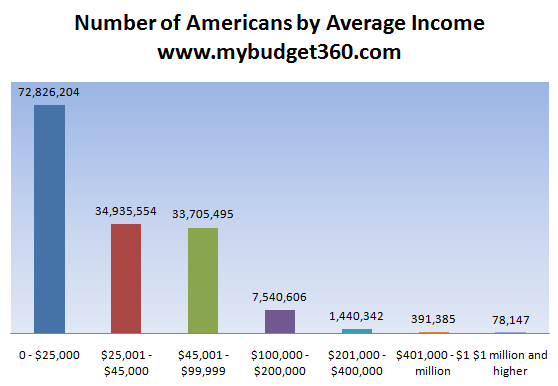

The lowest paid 24,000,000 Americans earned an average of $2,061. Again, this is merely to put all the data on the table. It also shows how tilted things have gotten. I wanted to see what the top 1 percent earned in total compensation for 2009 and compare this to the bottom half of wage earners:

Source:Â Social Security

“The top 1 percent of wage earners in America earned more than the bottom 48 percent of Americans. If you are wondering where the middle class is evaporating to it is rather clear.”

Substantial income inequality is not the path to a strong and vibrant middle class. 17 percent of Americans are either unemployed or underemployed so the lower end of the curve is dragging more people lower. Yet the top end remains rather strong. Some will argue that the very wealthy have also been hit. This is true and we have seen this in the top wage categories. But this is the difference between earning $50 million and $40 million. The marginal impact on lifestyle is minimal. Losing your income when you have a household making $50,000 combined and suddenly a $25,000 wage earner is gone can throw things into a tailspin.

There is nothing wrong with earning tremendous amounts of money. In fact, that is the spirit of capitalism. But how many Wall Street banker types that earned money betting on the failure of Americans while enjoying government handouts as protection made it to the top of the bracket? This isn’t rewarding capitalism but a modern form of corporatocracy. The reason the lower end became poorer is because those on the lower end had to shuffle and redistribute wealth to the higher end of the curve in the form of bailouts. Consider it a form of reverse trickledown theory.

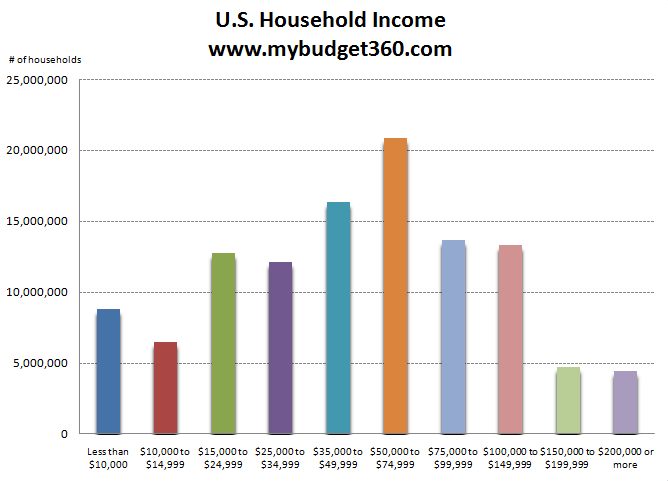

Let us now look at the median household income data from the Census:

Source:Â Census

The median household income for Americans is $50,221. The above curve seems more balanced out but Census data tops out at “$200,000 or more†so it doesn’t break down data as clearly as the individual Social Security wage data. 3.9 percent of households make more than $200,000 a year. So the incredible majority of Americans make less than $200,000 and this is for overall household data so we have many with two or even more income earners here. So why did the media object so loudly for having higher taxes for those making more than $250,000? Well refer back to the Social Security data. Also, the line was fed that many of these high income earners are the job providers of Americans. Of course the implicit and subtle argument meant that if taxes go up on this group they will fire more people. We can debate the merits of the tax increase at the very top but the amount of rhetoric we heard on mainstream TV shows you that the top 1 percent control much more than just the wealth of the country.

You also need to remember many of those at the top take money in various forms like capital gains which are only taxed at 15 percent. The vast majority of Americans have small amounts of stock and the bulk of their net worth is stored up in real estate. The crashing housing market has harmed them the most while the improved stock market has targeted a smaller segment of the population.

Since the peak, Zillow the real estate tracking company estimates that residential values have fallen by $9 trillion. Yet stock wealth has bounced back since the low in early 2009. When we look at income figures we see there is some troubling inequality in the system and it has only become magnified in this recession.

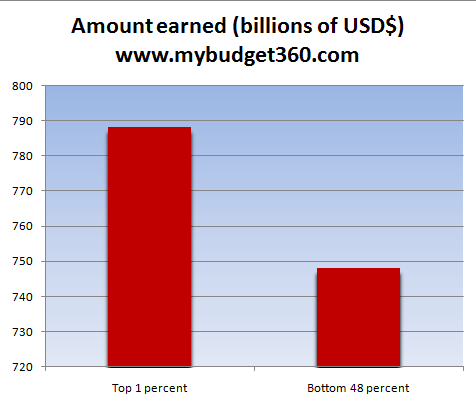

While this is happening tax collections for the government are back up yet spending in the form of bailouts, deficit spending, war, and other government expenditures has also increased much quicker and those at the top are the biggest beneficiaries:

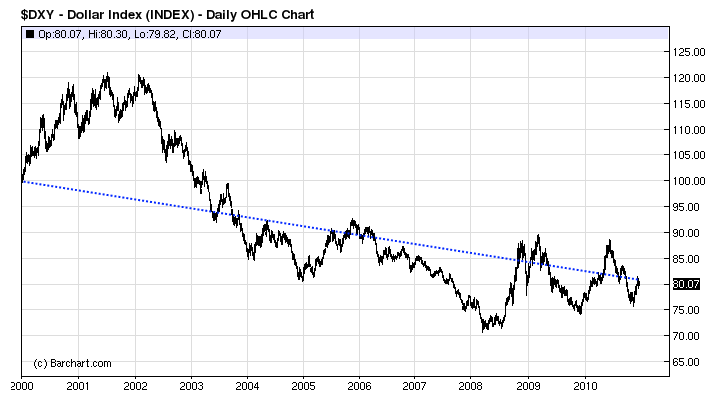

In essence the bailouts have gone to the wealthiest and many of the top have argued the uptick in tax revenues is somehow natural. It isn’t and you can just look at the above data. This is merely income redistribution but not how most of us would think about it. After all, why would the wealthiest in the U.S. need to take more money from those at the bottom rung? We are now back to 2005 levels of revenues. Yet this in itself is a bit deceptive because the purchasing power of the U.S. dollar has fallen over this decade as well:

The U.S. dollar is down 20 percent from the start of the decade. What this means is the purchasing power of Americans has eroded over this time. It is also the case that wages have gone negative over the entire decade with stagnant pay and inflation chipping away as well.

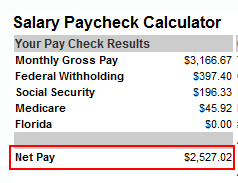

So how much does the average American make? $38,000 even when we add in billionaires and everyone else. This is the individual amount. It would be tough to even come close to a middle class lifestyle with that income. Let us run a quick scenario:

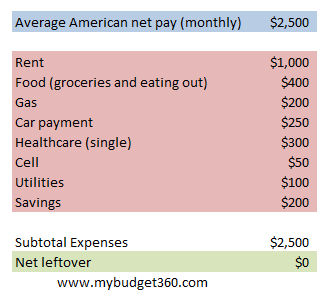

The average American is taking home roughly $2,500 per month. We are using Florida as an example here. Let us just run some quick numbers to see how far that $2,500 will go:

What happens if the car breaks down? What happens if you get a cavity? What happens if you lose your job? You can see how tight the budget is above and we are keeping it basic. Many are told by financial planners to sock away 9 months of emergency funds. It will take years for the average American to put away $22,500. Is it any wonder why millions of Americans rely on Social Security as their main source of income? Millions of Americans are still on verge of losing their unemployment insurance and are basically one check away from being on the streets conjuring up visions of soup lines of the Great Depression. The average income doesn’t even come close to paving a way to a middle class lifestyle. What you have is a shrinking middle class where people are working harder and harder yet being thrown off the treadmill one by one.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!15 Comments on this post

Trackbacks

-

Randall Flagg said:

Those 72 people at the very top should be very worried. We are DEEPLY into revolution territory, and the way things are going, there will be blood.

December 11th, 2010 at 3:27 am -

Barry said:

I didn’t enjoy the post, not at all. But it verifies what I have come to

believe: Republican politicians want to destroy the middle class and

reduce the USA to a Latin American-like mess with the vast majority of wealth in the hands of the few; a shrinking middle class who will keep their mouths shut because they are getting along okay right now and have been deceived into believing more taxes on the super rich will lead to fewer jobs; and a rapidly expanding lower class that can be exploited and forced to be subservient to their masters. The opposite of what made this country great!December 11th, 2010 at 5:57 pm -

EH said:

Going by IRS AGI/return figures for 2008: 50.6M of 142.4M returns were under $22,000. So fewer than 92M were over $22,000. Of course many of these returns are dual income.

BLS figures: About 139.4 million employed people in the US, (~300 million total population, ~238.7 million not in school or otherwise incarcerated) ~28 million part time, ~25% of total employed earn less than $10/hr.

A decent estimate based on BLS and IRS figures is that about 90 million (+/- 10%) earn enough to afford to pay modest bills, (~$20,000/yr. before tax)

The effective employment rate (not unemployment) counting only those earning at least $20,000/ year on an individual basis is thus only 35-40%.

December 12th, 2010 at 3:26 am -

Richard said:

It is a sad state of affairs. People in this once great Republic are JOB (just over broke). The people who run the government, it is not the elected people, are have fun. Just make us all poor and broke and total control is theirs. They have us by the short and curles and now the pull.

December 12th, 2010 at 8:55 am -

sharonsj said:

Where do you get these numbers? My land line and computer hookup is $85. Satellite TV is another $85 (because I can’t get reception otherwise). And only $100 total for utilities? That barely covers my electric bill. And my heating costs run another $300 a month. By the time I’m done, there is nothing left to save, let alone spend it on cheap plastic crap from China.

December 14th, 2010 at 1:55 pm -

surfaddict said:

I think you better check but I’m pretty sure many of those 400 or so earners of $30M + are employed by NBA, NFL, MLB. Bread and circuses, we have arrived there!!!

December 14th, 2010 at 3:14 pm -

Sharron Clemons said:

Going by IRS AGI/return figures for 2008: 50.6M of 142.4M returns were under $22,000. So fewer than 92M were over $22,000. Of course many of these returns are dual income. BLS figures: About 139.4 million employed people in the US, (~300 million total population, ~238.7 million not in school or otherwise incarcerated) ~28 million part time, ~25% of total employed earn less than $10/hr. A decent estimate based on BLS and IRS figures is that about 90 million (+/- 10%) earn enough to afford to pay modest bills, (~$20,000/yr. before tax) The effective employment rate (not unemployment) counting only those earning at least $20,000/ year on an individual basis is thus only 35-40%.

December 21st, 2010 at 2:58 pm -

Karl Quick said:

Barry… If it is the Repubs fault, it sure didn’t do much good taking congress away from them in 2006 and taking away the Whitehouse in 2008. Look at the expenditure an receipt graphs to see the actual results.

To author of blog…. I think surfaddict makes a critical point. At the very high end, large salaries are paid primarily to athletes and entertainers. Money people grow investments, not bank accounts. They invest heavily in their businesses and their salaries mean very little. This makes it very hard to compare. Remember, the CEO who works for a dollar a year may well be growing a business that pays the salaries of 20,000 people (directly and indirectly) and generates tax revenues for the federal government of over $200M in FICA taxes alone. …yet if he doubles the value of the company stock he owns over 5 years may average a huge profit or a tiny one depending on how much stock he owns.

How do we balance all of this? …is a miser rich if he dies before he spends any money? …is a swindler like Madoff rich because he spent a lot but actually owed vastly more?

Where do the working rich get their money if we don’t give it to them to see them perform, play, advise us or sell us the things they make?

If they get their money from us, is it fair to say WE effectively paid their taxes for them?

The answer is not taxes but competition. We need many many small companies so everyone has a good chance of becoming a CEO.

Maybe the better idea is to tax on the basis of waste and inefficiency. The wealthy we all hate is the one who flaunts his wealth on foolish things… Not the rich guy who gives it mostly away to charities.

October 15th, 2011 at 8:39 pm -

Tim said:

Yup we are in a tight one now. Corporations and their owners make efficient and streamline processes eliminating jobs and export jobs to save cost yet do not lower prices. Amassing huge profit and wealth, there is only so much gold, therefore only so much money to print before you chop gold into smaller less valuable bits to cover the notes. So they hold on to all of this wealth, banks too, not spending on squat while we and the government who gains money from big corp has to treat big corp special and give them breaks and loopholes praying that they spend their huge sums of money on creating wasteful technologically irelivent jobs with no garuntee of that actually happening. 15%tax on 20,000 income is way harder on someone than 50% tax on 20mil income so no they aren’t paying their share. Between banks, bull, and everything else they bailed out it stands at about 2.5 trillion dollars. What if we devided that among the bottom 75 million people, you get 33,000 is PER PERSON. In many cases that is over a year worth of earnings. Instead of that we bailed out those who turned their backs on the very people who made them wealthy in the first place. Viva la revolution.

October 20th, 2011 at 11:16 pm -

jesse said:

I guess the real question to ask is not what should be taxed on who, whether it’s 15% on 20k or 50% on 20 mil or whatever, but more so who should be implementing these laws.Who is really in charge here?Why do we vote for a president who’s actions recant his promises.How come if everyone is suffering, no one is doing anything about it?People want to protest,start parties, hold rallies,for what?What do they do?People need to stick together in times like these.Families need to stick together.Communities and friends stick together.Their are no loyalties anymore, no trust.It’s every man for themselves and divided we will all be weak.(not to preach but damn).Also the the thing i’m seeing more of is the guy who wants to live in a society built by others and maintained by others,but just walking around bumming cigarettes,finding ways to scam on paying for food,and getting by doing the bare minimum not because he’s handicap,but because he’s lazy and thinks america is his mother.All the outsourced job are our fault.Demanding more money while doing a shittier job,being lazy and self entitled.The system is far from perfect but so are the citizens who live in it.JFK said it best when referring to what you can do for your country.Tangent or not these are topics of discussion that are just as important as taxable wages

December 1st, 2011 at 12:31 am -

compubyte said:

Barry You need to wake up dude.. IF you think the Republicans are the cause of this. You are sadly mistaken.. YES.. they cause issues. but so do the Democrats.. POLITICANS are the cause of this issue .. not Parties. .. using your theory . Heck. Obama has raised the debt of this country by over 2 TRILLION DOLLARS in 4 years.. WHO DO you think is going to pay that money .. AMERICAN TAX PAYERS.. Democrats are the ones who have ALL THE GOV. Programs.. walfare. food stamps. section 8.. all of it.. Dems want to HELP people which is nice and all. but all that HELP cost MONEY.and raises OUR TAXES to give Money to other folks who can’t afford to live. yet can afford Booze and cigarettes and drugs.. GO TO ANY LOW INCOME area.. and drive around. it’s a FACT .. 80% of them smoke cigarettes at $5 A DAY OR MORE.. Drink. do drugs. and are unemployeed.. you think this is the republicans fault they are there? FACT . democrates put these programs in place to help the ‘poor’ .. unforunatley THIS DOES NOT help them.. just waste more $$$

February 11th, 2012 at 6:54 am -

Doug Frame said:

It’s funny how liberals just post wise crack comments when Conservative usually place facts and logic with their views. Politicians are a huge problem. Progressive politicians are very dangerous to what America stands for and are doing a great deal to kill the shinning city on the hill. Obama is their leader and is systamatically dismantalling capitolism in America. Why?

March 10th, 2012 at 4:49 pm -

Richard J. Ross Sr. said:

I have read the comments above on 8/14/2012!

Here is what scares me. The fact that our government finds it more important to send our tax dollars to people who heat us? Also the job creation is not in our country? but in country’s that will not buy our products?

Now for the fools who live here and buy all the foreign products and bitch that we have no jobs here????? Why do they paid $2-300.00 for sneakers?????

This is a sample! How many things can you come up with that the goverment thows our money at , that keep use form achiving a better LIFE!!!August 14th, 2012 at 6:23 pm -

J Vic said:

“The data reveals that over 353 Americans earned between $20 and $49 million and the average amount was $28 million. Compare this to the 72 that made more than $50 million with an average compensation of $84 million. To put this into context, the top 72 Americans earned over $6 billion in 2009.”

Who are these 425 people. That can’t be right, with all the high paid celebrities – movie stars, musicians, as well as athletes, and CEO founders of companies like Google, FB, Yahoo, and so on. There has to be a few thousand people in this category of income

February 1st, 2013 at 8:04 am -

Dan said:

The problem is not republicans. It’s ignorant to think so. It’s the Obama administration who increase taxes on the wealthy, which does affect them, however they can only tax so much. The rest of the tax increase goes to the middle class. That’s the harsh truth of it. That’s why the distance between the top 1% and the rest is becoming so far. The wealthy will continue to be wealthy but will without a doubt take hits, causing them to cut back on employment, which in turn just slows the economy down. The government is so inefficient. Want to know what millions of your tax dollars may go to? Here’s a few: some idiot who forgot to turn off the lights in some government building ($30,000 of tax money gone right there), some random scientific study on something pointless like studying fish we already know, going to programs like Obamacare (which is a tax, it will jack up insurance rates as well, while denying proper care to those who need it immediately because there has to be an “exception made”). What people need to know is that Obama just isn’t helping anyone. He’s hurting the middle class far more than any other president would. I’m a republican but I’d much rather have Hillary or someone else other than Obama. $17 trillion in debt? Ha, looks like that’ll be the next generation’s problem to deal with. Liberal media wants you to think that republicans only care about white, rich, Christian males who run large and small corporations. With 72 million people living on less than 39k a year? Can’t just be Bush’s fault after Obama bin Laden has been in office for nearly 5 years. Meanwhile the wealthy are doing just fine, but don’t think they’re not struggling in some aspects. More taxes wont do anything but prevent them from employing people. That’s the truth and its being played out right now. So, cut back government spending, lower taxes, and more people WILL be employed and the income level will rise as the economy begins to take off once again.

June 11th, 2013 at 4:44 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!