Las Vegas is to the real estate bubble what Detroit was to the US automobile industry – Empty condo projects, apartments poorly built to face the desert sun, and the collapse of commercial real estate.

- 19 Comment

If Wall Street is the hub of American finance then Las Vegas was the manifestation of credit dreams going viral. Las Vegas, the beating heart of Nevada had a tremendous boom with the real estate bubble because it played into the narrative of making it big. Where else can unknowns strike it big and have their name put up in lights? With Wall Street feeding the frenzy Las Vegas seemed to be an endless playground of free flowing capital. During the boom it was hard not to notice the high end Rodeo Drive like stores of Gucci, DKNY, and Prada covering the floors of many casinos. The stores were full and money seemed to flow like the exhaust of Maserati’s cruising up and down Las Vegas Blvd. If heaven on Earth for kids is Disneyland Las Vegas was the heaven of debt. What once seemed as an endless dream has burst into a barren desert nightmare. Las Vegas once boasting some of the fastest growth rates now has largely led Nevada into having the highest unemployment rate of all states in the country. If Michigan was the result of the offshoring of American manufacturing and the demise of the US auto industry Nevada is the exclamation mark at the end of the credit bubble era.

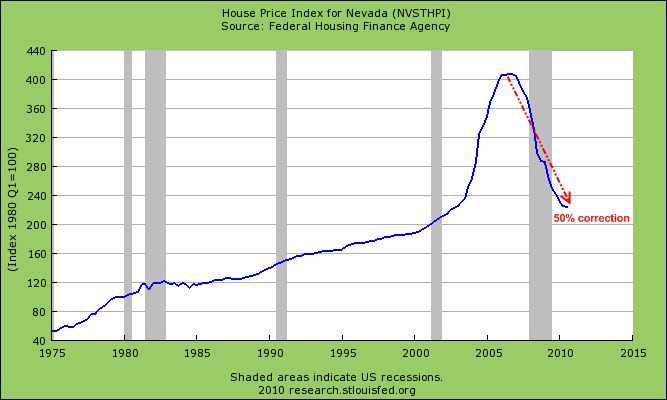

You only need to look at the drastic collapse in real estate prices to see how quickly the bubble burst in Nevada:

What took from 1980 to 2000 in terms of price growth was achieved in four years from 2000 to 2004. The rapid rise in Las Vegas was largely due to the real estate bubble, both residential and commercial. The bust in commercial real estate values in Las Vegas was all but set in stone but the bubble grew to a point where many started believing that the mania would last forever:

Source:Â Las Vegas Sun

The above photo is from an excellent article in the Las Vegas Sun. The above skeletal remains of a structure are of the proposed Summerlin Mall. This photo was taken in December 9, 2010 just in case you are wondering what happened with the project. Just like an empty Hollywood set the structure was designed without a deeper more sustainable outlook. If you build it, they will come was the apparent motto for many of these projects. Years later, the only thing that has arrived is the staggering bill:

“(Las Vegas Sun) As it happens, the best view of Ascaya, that Henderson hillside, is from a vast parking lot behind an empty commercial development, one built with the expectation that growth would drive demand for new shops. The parking is in the rear, presumably to give the front of the shops a more urban feel. But it’s a pointless, faux urbanism — most everyone will have driven to get here, and it’s set far off the road.â€

…Context. Now we’re on Gibson Road in Henderson, up the hill from Interstate 215, and there sits Vantage, a boxy, glassy modernist condo development; a historical artifact of the era of the credit boom, and, perhaps, delusional exuberance. It was a $160 million project, but no one lives there. It sits on the hill, surrounded by suburbia, like a hipster who’s stumbled into a church that he thought was a nightclub.â€

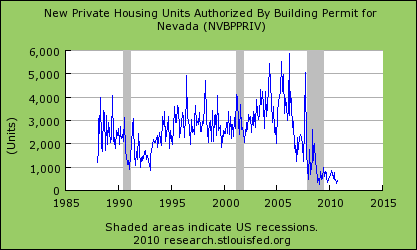

When you see these projects littering the Las Vegas landscape, you have to wonder how much of this has been bailed out by the American public through ancillary bailouts through the Federal Reserve.  The Fed would never openly come out and state this but they are some of the biggest gamblers placing it all on Wall Street red. Of course as many of these failed malls, condos, and apartments idly sit for future residents new building is non-existent:

The above chart is rather startling. The data seems to be drawn to the zero line with a magnetic like pull. Las Vegas built so much excess housing that it will be a drag on their economy for years. For example, take a look at this condo project that was built close to residential areas without any thought of their customer or market:

I just notice how wide the windows are and anyone that has been in the Southwestern desert realizes that this is like an oven in the middle of hell. The air conditioning bill on these places would be like the equivalent of an auto payment each month. Yet Wall Street was more than happy to make loans to dirt gamblers since they were sending the loans off in toxic packages to pension funds and naïve investors around the world. In the end, their wallets were deep in the green thanks to taxpayer funded bailouts and all that was left for everyone else was brown dirt painting the horizon with empty shells of buildings.

“It seemed any project, no matter how preposterous, could make money. Thus, Vantage. Any number of condo and hotel projects on the Strip could also fit in this category.â€

…Foolish consumers. Investors thought they could make a quick buck, while families who merely wanted to own a home thought they had to buy now, lest they be left out in the cold. They were like people in a food line who gorged themselves on whatever the developers fed them, fearing this was the last meal, or fearing that the next meal would be unaffordable. So they ate and ate and ate, and then borrowed more money to keep eating, until they got sick.â€

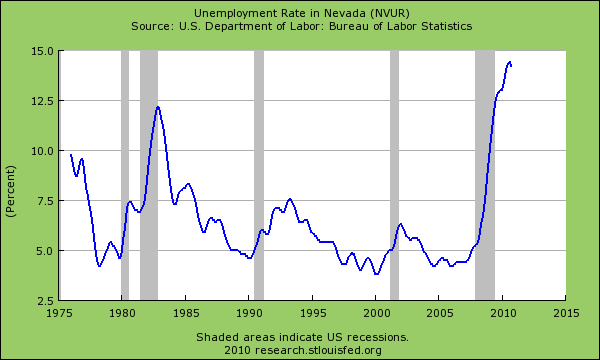

As the real estate bubble burst and Wall Street went into a tailspin the heart of the housing mania seemed to implode simultaneously:

Nevada that had an unemployment rate under 5 percent suddenly finds itself with an unemployment rate flirting with 15 percent. A double-down and a bust. Yet none of this would have been possible if credit wasn’t flowing from Wall Street so freely. And Wall Street would not have made these loans if it didn’t have an insurance policy from the Federal Reserve that it would bail it out no matter how absurd the bet. This is the endgame of the American big bet thanks to Wall Street. Americans who looked to Wall Street for financial wisdom found nothing more than slick haired gamblers willing to make a fast buck on poorly built projects that did nothing to improve the lot of the people in the immediate area. The Las Vegas Sun article puts together a sobering contrast of Wall Street and government synergy:

“As we pull away from ManhattanWest, we pass an empty lot with a sign: “FDIC owned property. No trespassing.â€

Sort of sums up the entire debt fiasco we are now living through. Manhattan, the home of Wall Street gamblers had a sister development in the desert that is sitting empty decaying under the desert sun. Why emulate a place that is largely designed to strip away productivity and wealth from producers in the economy and stick it in the middle of the desert? Unlike Manhattan and Wall Street, Las Vegas doesn’t have a lifeline to the Federal Reserve. Las Vegas is merely another victim in the biggest casino of all which is operated by the Fed and Wall Street.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!19 Comments on this post

Trackbacks

-

Sudsy44 said:

I wonder if foreigners will pick this stuff up as the dollar continues its decline and the properties decline in the amount of dollars needed to buy them, a double deal. All of my investment properties are paid off, yet if I had waited and not paid off my properties I would have some more cash in hand pick up 2 to 3 times the properties as i have now for the same money I paid for what I have today.

December 21st, 2010 at 4:39 pm -

Derk said:

Very thorough article on Lost Wages, NV. Just to add:

the U-6 (Real Unemployment) is above 20% in Vegas & likely rising in Detroit West.December 22nd, 2010 at 5:44 am -

Jaime said:

unfortunate! these images remind me of post-apocalyptic scenes from Mad Max and Book of Eli. It just seems like everyone gave up. Las Vegas has become america’s little dirty secret–let’s call it “the after-tsunami-scene”. Wall Street probably thinks Las Vegas should be swept under the rug and forgotten. “Let’s find the next dream”, they say…. to plunder. Shales?

December 22nd, 2010 at 8:22 am -

William Wallace said:

I always enjoy reading yr well written posts and the great graphs. Thank you for yr efforts

December 22nd, 2010 at 8:47 am -

belindabg said:

As a victim of the demise of Las Vegas, I can only say that the worst part of all of this is the complete disregard for all those people who bought homes, thinking we were doing the ‘right’ thing. I bought a total of three homes in Las Vegas; one in 1994 which is worth a lot less than the 175K I paid for it new; a condo in Henderson purchased in 2004 which has since been foreclosed by Chase Bank in the MIDDLE of their negotiation process for a Loan Modification that they never gave me; and one of the beautiful high-rise security condos on the south end of the Strip, bought in 2004 for 380K and now on the market for an abysmal 85K with NO TAKERS.

In the economic collapse, I lost my 250K per year career, my marriage, all three of my homes, my health, and my life savings. I NEVER DID ANYTHING WRONG. I didn’t buy at the peak of the market, I had great cash reserves in excess of 150K, and my credit was stellar – no funky loans. But when I lost my job, I spent my savings floating the mortgage payments (in retrospect, a big mistake, I should’ve walked earlier and taken care of ME, because these dishonest Lenders never did). Husband of 17 years walked out when I lost my job and money and couldn’t support him anymore. My parents lost 5 rentals (their life savings) and the strain brought back Mom’s cancer – she died six weeks later from a brain tumor. Dad is 80 and freaked out.

I have a herniated disc in my back and can’t find work in an economy where there are NO JOBS. Four years ago I had a home, two rentals with positive cash flow, a marriage, a wonderful career where I was earning more every consecutive year, health insurance, and a bright future. Now I’m 50, unemployed, bankrupt, all my savings is gone, properties are foreclosing, and I have nowhere to go and no place to live. What are people like me supposed to do??? I have two friends who were in this same boat who have already committed suicide.

I guess for some of us, that’s the ONLY light at the end of this tunnel. I hope the perpetrators of this ‘credit scheme’ ROT IN HELL and DIE A HEINOUS DEATH – THEY DESERVE IT.December 22nd, 2010 at 12:06 pm -

BOMBOVA said:

Very poignant comments posted above. Bone chilling reality. My in basket ” i am retired with 50K pensions ” here in Vancouver Canada, has offers for: 2 bd room condos, 1,400 sf. for 37,500 usd , 20 min. from the strip. with financing after 25% dwn. at 4% balance for 20 years. To close the deal, “they” offered a duplicate , for a total of 70,000 with the same conditions. The mortgage was with British money. The offering was built in 97 with 4 out of 5 rentals, Computer illustrations of sales, are showing a monthly decline of this real property at 1.0 to 1.25 percent per month. Sudsy44, i agree, i think there is good properties to be had. It, is just that i don’t want to be sitting alone in the desert Thomas Gx, in Vancouver Canada

December 22nd, 2010 at 3:23 pm -

NAME said:

With all this talk of doom and gloom I still see lots and lots of shopping at the mall.

Corporate profits are still high.

Fuel is still around $3.

Its like we have 2 economies that havent meet.I wonder if this whole forclosure mess has allowed people to not pay their mortgages so instead they are just spending that money to prop up the economy?

December 22nd, 2010 at 4:15 pm -

davidfromtexas said:

To belindabg,

Please don’t take this as being kicked when you are already down… There is hope.

Human nature avoids acceptance of the truth that all of us make mistakes, and that all of us do things “wrong”. It is perfectly natural to feel victimized when circumstances are seemingly out of your own control. However, the truth is that all of us are sinners and that all of us do wrong. To say that “I NEVER DID ANYTHING WRONG” demonstrates that you do not fully understand the human condition and yourself.

Have you ever considered why anyone who does not have the necessary funds would want to purchase 3 homes? If you rationalize that the purchase of 3 homes was an investment, then have you not considered that investments should be bought with resources that you already own? Going into debt in order to finance an investment is high risk, no matter what the economic environment. High risk means that there is a good chance that you could lose everything.

Just because it seemed that everybody else was doing what you were doing doesn’t make it right.

It is time for you to recognize that you are one of millions who believed a lie. Yes, you are a victim of others who also sinned. However, it is time for you to begin to examine yourself instead of trying to blame others. Once you recognize the truth of your sinful condition, then perhaps God will have mercy on you and heal your broken condition.

Jesus Christ said, “come to me, all you who are weary and burdened, and I will give you rest”. Cry out to God the Father, seek Him, ask for the forgiveness of your sins, and He will heal your broken condition.

December 23rd, 2010 at 7:44 am -

C said:

Sold mine, got tired of paying the property or municipal taxes and fees which are generally insane here in Wisconsin. RE problems are local and acute. Chinese investors bought a foreclosed mall down in Milwaukee not to long back, not a bad idea.

December 23rd, 2010 at 7:50 am -

sharonsj said:

I’m reading about rich people who can’t pay their mortgages either, but the banks are not foreclosing because selling a McMansion is even more difficult. Meanwhile, I also know educated professionals who are going broke because the bills are more than they earn. It’s harder if you own a home and have to come up with $8000 a year in property taxes and $14,000 in mandated health insurance, like my friend in Massachusetts. She’s not sure how long she can keep her house.

I was smart enough to pay off my mortgage, and I live in a rural area with much lower taxes. Still, it ain’t easy.

December 23rd, 2010 at 8:06 am -

The Fox said:

belindabg, you did do something wrong. You were greedy. You weren’t satisfied with a $250k/year salary so you bought two more homes as investments (rental properties) and you crapped out. You gambled and lost, it happens all the time at the casinos in Vegas. Like it or not, you played a part in the housing bubble. What did you learn? Hopefully to be humble, live simple, quit being greedy, quit being obsessed with money, and rediscover your life’s purpose. You’ve hit rock bottom and survived. Now you gotta decide to either fight or quit. Hopefully fight. Those people who committed suicide decided to quit life because they couldn’t adapt. Adapt is the key word. I knew bad times were coming. Who didn’t see haughty people living far beyond their means. It was obvious the whole thing was a house of cards.

I have a buddy who sold real estate in Vegas during the good, fast money years. He told me of cashing checks ranging from $5,000 to $12,000 several times per month. He made a killing in Vegas but he also lived the high life and spent cash like nothing. He rented a huge home close to the strip and drove nice cars. He partied very hard. He lived a dream for some people. When the crash happened he left Vegas and came back to his hometown state. He now lives in a studio apartment and makes about only $18,000 a year. He talks about how absolutely greedy and careless he used to be. He wishes he would have saved more money from the good years. But he has adapted. Rags to riches to rags. Life moves forward. You learn. Adapt.

December 23rd, 2010 at 12:26 pm -

Baylee said:

By far, this is the most interesting article I have read on the economics of Las Vegas. Normally, what is written is “spin” on whatever angle the writer is trying to put on the story. I live in So Cal and am a frequent visitor to LV. On several occasions I considered investing in property up there but was “put off” by the fact that real estate was being driven by unnatural laws of supply and demand. I recall a seminar that I attended, in Las Vegas about 4 years ago where a speaker from the Las Vegas Convention and Visitors Authority was telling the audience, “We have plans to build the mono rail and casinos all the way to the border.” He went on to say, “Las Vegas is unique. It is recession proof!” I thought to myself, “What a buffoon!” If one actually observed all that damn desert for miles, around the valley, one would know that the law of supply and demand, in a recession would, one day catch up to the Las Vegas housing and casino boom. History has a way of repeating itself and apparently not many lessons were learned from the 1970s and early 80s. It is a shame that so many lost so much from the unethical behavior of Wall Street, bankers and our Federal Government.

December 24th, 2010 at 12:28 pm -

Muzie said:

Interesting comments.

belindabg considers herself a “victim” when she took out 700-800$K in total mortgage debt to leverage herself with three completely undiversified investments. There’s this thing called “risk” in investments. It’s no use crying on people’s shoulders you “did nothing wrong” when you put money at risk investing. Investments don’t just always go up – time to grow a backbone and assume your losses. You simply lost the coin toss.

Then you get Sudsy who only wished he could have bought 3 times more properties so he could peddle them to some other foreign sucker. He sounds confident, so his coin toss must have been a win. So he believes this is all just temporary, and investments can only go up as well.

Greed and greed, is what this all amounts to.

December 26th, 2010 at 6:33 pm -

Robert said:

“…up the hill from Interstate 215, and there sits Vantage, a boxy, glassy modernist condo development; a historical artifact of the era of the credit boom, and, perhaps, delusional exuberance. It was a $160 million project, but no one lives there. It sits on the hill, surrounded by suburbia, like a hipster who’s stumbled into a church that he thought was a nightclub.â€

Very poetic riff, that. And what did Arnold Shwartzenegger, of semi-comatose Kalifornia fame propose- high speed rail to Las Vegas.

What more morally bankrupt idea could humanly be possible(perhaps it was too much to expect someone who had spent so much of his life portraying soulless homicidal automatons to act human): transporting zombies at warp speed to gamble their family’s last dollar, and then be incinerated in one of the condos facing west.December 29th, 2010 at 3:48 pm -

marc said:

I have recently discovered your blog… your articles are very well written. An important voice in uncovering the truth behind this mess we are in.

January 3rd, 2011 at 12:40 am -

Mad Guy said:

I was on the front lines of this. Worked for a real estate developer. They were building nothing but crap and corrupt government officials were approving it all. No driveways? No problem. No yards? So what? I was living in a ghetto apartment complex at the time (a HUD property) and I was a new father. I wanted a house. The prices kept going up. I already couldn’t afford the crap my own company was selling, so I looked elsewhere.

Most homes had appreciated beyond the range of affordability for me. I managed to buy one with a creative interest-only loan from Countrywide. A year later, the house appreciated $50K, seemingly justifying my decision.

Now it is worth little more than the down payment I put down. I can keep making the payments, but since our gov’t bailed out the banks I don’t feel any guilt about walking away from it. They were supposed to be the experts. They convinced me that house prices would keep going up and then plateau. It’s a nest egg, they assured. What a crock! Why shouldn’t they suffer from a bad investment decision like the rest of us?

And I wasn’t a greedy turd like some people, with three houses already under my belt. I just wanted a house to live in. This was my first and only house. Now I don’t have job and don’t know what to do. Thank you Goldman Sachs. I hope you burn.

January 4th, 2011 at 3:48 pm -

Real Estate in Las Vegas said:

The property market in Las Vegas is a great investment if you have the longevity to wait out that the current slump pass.

March 18th, 2011 at 2:42 am -

Rick said:

American economists and politicians in white shirts and blue ties are the dumbest people on Earth.

April 7th, 2011 at 2:01 pm -

Joe said:

Four Years have past here in Las Vegas and the Real Estate is now back on the uptick. About 50% rise from the 2010 prices with some areas even more. Houses on the Gibson Rd Single Story 2000 sq ft are now going for 350K and moving about 5K month up. Is this start of another housing bubble? I have noticed both another free flow of cash has been the Medical Marijuana business. People are going to the bank with 5K monthly checks that used to get maybe 1K a month and they are spending it like no tomorrow .. and these are the bottom front line employees. This seems like an even bigger bubble…and I hate to think what the results from this bubble.

July 9th, 2014 at 1:39 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!