The big financial lie – How growing income inequality, too big to fail banks, and stock market delusion swindled the American public and dissolved the middle class.

- 4 Comment

The American banking system has spread systemic risk all across the economy with laser point precision but very few are even aware of this grim reality. It would seem that only those who understand the system from the cavernous inside and have little to lose can actually speak out against the system as they see it. Bernard Madoff recently called the United States Government a Ponzi scheme. As it turns out many of the biggest banks in this country knew something was suspect with Madoff’s incredible gains but wanted a piece of the action instead of exercising a fiduciary responsibility. Madoff is guilty of swindling investors, many who were greedy and didn’t even bother to ask how Madoff was able to generate 20 percent year over year returns. Wall Street and the investment banks however are guilty of a larger crime by defrauding the wealth of working and middle class Americans. The fact that three years into the crisis and no serious reform has taken place causes us to pause in baffling amazement at the ability to ignore the obvious financial errors. Our banking system is being held up by blind faith while the real wealth of the country is siphoned off to the top.

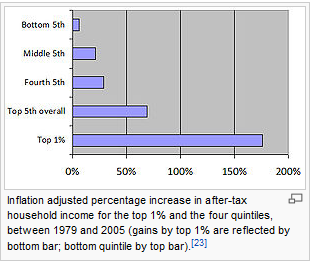

Look up and you can see where the income went

Source:Â CBO

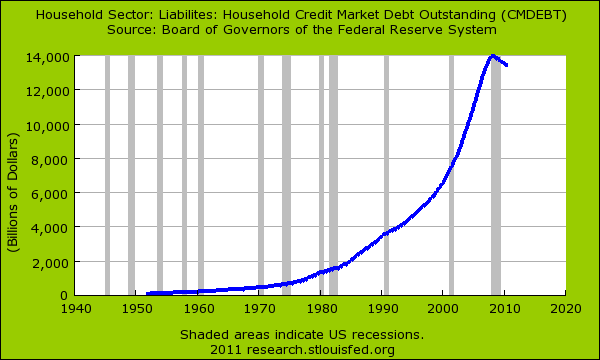

If we look at a period of 26 years from 1979 to 2005 you can see where the real income gains landed. The bottom 60 percent of Americans saw tiny gains in this quarter of a century period. The true income gains went to the top one percent just like a helium balloon floating up to the sky. What do we have to show for this period? We get the deepest crisis since the Great Depression and an unemployment and underemployment rate of 17 percent topped off with the biggest nationwide housing bubble ever to grace this landscape. The American public at large was swindled for many of these years. What glossed over all these problems was the large amount of debt that was mistaken for actual wealth by most working class and middle class Americans. Since income gains were mediocre at best, Americans in order to maintain a middle class lifestyle went deeply into debt instead of examining why they needed so much debt in order to maintain a middle class life:

Americans fell into a debt trap and mortgaged their entire future while little by little the productivity gains and real wealth were being dragged up to the top. As Americans became more and more comfortable with debt, many turned a blind eye to the incredible leverage used by Wall Street banks to speculate in archaic investment vehicles that served no other purpose but to make a few incredibly rich at the expense of the public.

“These financial instruments did not advance our economy or society but used surgical precision to cut out real wealth and transplant it in the hands of the few.â€

That is the massive problem of our current banking structure. Gains are privatized in the hands of the few and losses are socialized to the masses. Banks don’t even bother hiding this shell game since they have both political parties bought. The Federal Reserve openly shows the toxic junk loans they now own thanks to American taxpayers with no remorse. It is public knowledge and the Fed seems to operate like the FDIC in the notion that if you lie enough and pretend all is fine, that eventually the public will fall in line. This seems to work until it doesn’t like we saw in 2008.

The government is going deeper and deeper into debt and we are resembling the debt incurred during WWII:

Source:Â Dshort.com

The above chart is incredibly important to understand. The big Federal debt incurred during WWII was largely visible by our involvement in the war. Today we are inching closer to this level and there is nothing remotely close to what was going on during WWII. The chart also doesn’t highlight the massive debt liabilities we have coming due which weren’t a problem in the 1940s when the Federal debt as a percent of GDP was above 100 percent. We have trying years ahead. Most of the recent debt was brought on by the massive bailouts of the Wall Street banking system. How is this sustainable? Add into the mix the millions of baby boomers flooding into retirement and you have to wonder where things go from here.

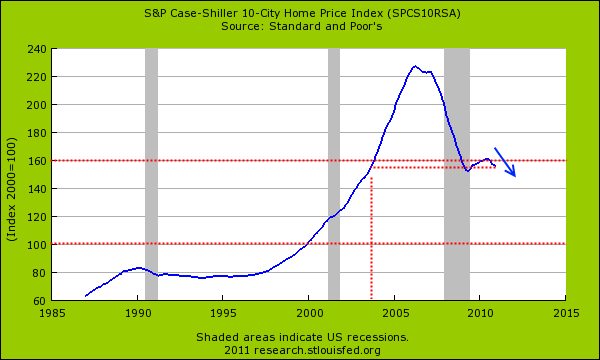

The number one asset of Americans going back down

Americans store most of their net worth in the equity of their homes. This is why with the housing bubble it must have felt for many homeowners that they found a modern day El Dorado. Instead of enjoying the piece of mind brought on by equity most were convinced by marketing campaigns to tap out their “trapped†equity and spend like there was no tomorrow. Housing seemed to be the gift that kept on giving. But this was only possible through massive leverage and Wall Street creating a casino for mortgage backed securities and other products like CDOs that simply operated as paper games for the wealthy. Now that this game has collapsed Wall Street has taken their losses and pushed them onto the taxpayer while allowing the American public to shoulder the burden of their decades of horrible and irresponsible speculation. As the above chart shows with the Case Shiller Index home prices are moving back down on a nationwide level. One of the creators of this chart Dr. Robert Shiller has hinted that home prices may fall another 15 to 25 percent:

“(NY Times) Robert J. Shiller, the Yale economist who is the author of “Irrational Exuberance†and who helped develop the Standard & Poor’s/Case-Shiller Home Price Index, put himself in this last group. Mr. Shiller said in a conference call on Tuesday that he saw “a substantial risk†of the market falling another 15, 20 or even 25 percent.

The 20-city Case-Shiller composite is already off 31.2 percent from its peak, according to data released Tuesday. Average home prices in Atlanta, Cleveland, Las Vegas and Detroit are below the levels of 11 years ago. A drop the size that Mr. Shiller says he thinks could happen would put Chicago, Dallas, Charlotte and Minneapolis there, too. It would create a lost decade for housing in much of the country even before the effects of inflation.â€

This seems completely plausible. The real economy is still in shambles and most of the income gains are aggregated at the top. These people are not buying up the properties where most Americans live. Most Americans pay their mortgage from an ever shrinking paycheck. So how in the world can home prices go up without the income to back it up? The Federal Reserve has made rates fall below market only to seduce more people to buy homes they cannot afford with government backed loans. The end goal is to create enough inflation that the junk loans on bank balance sheets including commercial real estate debt will somehow disappear in the dark of night. That is the plan but so far what we are seeing is an inflating away of the American middle class.

For these reasons it looks like Wall Street is inflated with the S&P 500 rallying 100 percent from the March 2009 lows:

Source:Â Dshort.com

How can it be that the stock market is rallying so strongly when unemployment is still extremely high? How can it be so high when household income has gone stagnant for over a decade? What gives when the biggest asset of Americans, a home, is actually going down in price? Why then is the market rallying so strongly? Part of it has to do with the bailouts and lack of financial reform. Banks are merely chasing profits abroad instead of investing and lending to average Americans. When you can borrow from the Fed near zero it isn’t that difficult to turn a profit. The Fed has told the biggest lie and that was that the bailouts were geared to helping average Americans when in fact they were geared to helping the most elite in our country by shoring up their stock portfolios and recapitalizing the banks that led this nation into the Great Recession.

What then of reform? The banking system needs a complete overhaul. Investment banking and commercial banking need to be split right down the middle. There should be a zero guarantee on any investment bank activity and absolutely no access to the Federal Reserve. You want to gamble you do it with your own capital. It is simply amazing that we haven’t had this accomplished even after having our own rendition of the Great Depression. Instead, to solve the problem of too big to fail the too big to fail got even bigger. To solve our debt problems we went into deeper debt. So not only are the banks central to the crisis not brought to justice but they are rewarded to become even bigger with taxpayer backing. It is amazing that people aren’t on the streets because of this.  This isn’t a chapter from Alice in Wonderland or 1984 but the serious financial reality of today. The stock market rally is based on fumes just like we are to believe that the $5.4 trillion in deposits at FDIC insured banks is somehow “backed†by a deposit insurance fund with no money. It is entirely based on faith. Since moral hazard is now built into the system you can rest assured another crisis is only around the corner. Why are we to expect anything different? The amount of toxic loans still out there is enough to sink the entire banking system. Instead, we are to pretend that all is well because the banks now have access to the hard work and system we know as the American economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Jon McIntyre said:

I hear liberals, progressives, and those in the center talking about the facts you have very nicely laid out. What has happened to the global economy is so glaringly obvious if you simply look at the charts and pay attention to the facts. Class warfare has beeen waged upon the middle class and the poor. God, I just wish someone on Fox News, some republicans and conservatives were talking about this. They almost seem to be runnig cover for the multi nationals while pointing fingers at liberals and progressives. Come on conservatives, we need you to join the fight. Rational and sane people of all ideological perspectives need to come together, set their ideologies aside, and confront the issue directly. A war has been waged upon us common folk by the super powerful and uber wealthy. And those who have waged this war go by both liberal and conservative but the one thing they all have in common is they have wealth and power and they want more. Greed and lust for power is a disease that spans across all ideologies. Come on conservatives, we’re waiting for you guys to join the chorus and come to to Washington and Wall St. with us with pitch forks and torches. Where are you?

March 1st, 2011 at 10:49 am -

Bill Reichard said:

Here is something to consider – we have a financial banking system

where all deposit and withdraw transactions are electronically

controlled, by date and by transaction. How is it, that when all that money was withdrawn at the ‘meltdown’, did not one person have

the foresight to find out just where that money went to. Same thing with 9-11. It was not withdrawn by the general public.

WE NEED A FULL OPEN INVESTIGATION, and if we do not, it will surely happen again, and again. SOME HIGH LEVEL BANKS AND OFFICIALS

should be in prison. WHERE are the banking investigations??????Right there in black and white, and no one pursues this.

We’re about to lose what little is left of the American Dream.

March 1st, 2011 at 12:12 pm -

George said:

It is a well known fact that the United States Citizens are just completely brain-dead. That nothing has been done and no one arrested, except the scapegoats, and the big dogs keep the game rigged to their benefit is proof enough that it is the end of the USA as we’ve known it, and it is gone.

Nothing but the deflating and suffering left.

March 1st, 2011 at 3:00 pm -

Ellie said:

Mr. McIntyre, do you watch Fox news? I hear about this all the time on various programs on the network. It’s almost the only news and opinion channel I watch. Every “side” gets a say, and both sides talk about the banking issues pretty frequently. I don’t hear anyone saying this is not a huge problem that must be fixed.

March 10th, 2011 at 2:02 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!