Investing in the Future: Deflation in daily need items yet education and healthcare still go up? What is happening in our economy?

- 1 Comment

It is rather stunning how quickly deflation has appeared in the mainstream media. When it comes to reporting this financial mess, the media has really done a poor job doing thorough reporting or at least investigating this matter carefully. Wouldn’t you think that a piece of the financial puzzle this big in size would require a deeper understanding or at least a more balanced approach?

That is why today, we are now confronting the menace of deflation and most Americans didn’t even see this coming. Many bloggers and economist tried to issue a warning call but it fell on deaf ears. Just to prove this to you, just take a look at some of the headlines some as recent as June of 2008:

June 4, 2008 (Forbes):Â Bernanke says US Inflation too high

June 13, 2008 (Christian Science Monitor):Â Stagnation and inflation box in Fed

April 17, 2008 (New York Times):Â US Inflation Appears to Be Retreating

January 11, 2007 (Forbes):Â US Inflation is Likely to Moderate

July 11, 2007 (Channel News Asia):Â US inflation less sensitive to energy prices

Now I can go on but very little was discussed regarding deflation or even the prospect of entering a deflationary trap. We are in that corner now with the Federal Reserve essentially trying to navigate in world already operating on a zero interest rate policy. And wouldn’t you agree that $50 trillion in global equity evaporating is deflationary? Or what about the U.S. housing market seeing $6 trillion in housing equity evaporate? Those are deflationary forces.

Yet to paint with a broad brush is somewhat deceptive. As I have discussed with a budget for a $46,000 a year household and a $100,000 a year household, the way you navigate this economy is largely based by your financial resources. Yet the one area that can provide you a means to pull yourself out of a dire situation education, is actually still seeing prices rise. Healthcare costs are still high. So what we are seeing is an environment where the means of pulling yourself up from your bootstraps just got more expensive while your wages are stagnant or falling sharply.

That is why I have argued that to most Americans, this recession is going to feel like a minor depression. What we are seeing is deflation on major daily necessities like housing, energy, and wages while seeing inflation on selective items like education and healthcare. Let’s face it, you can decide to forego college but you cannot decide to live in a tent.

In today’s article we are going to look at 5 areas. 3 which are facing severe deflation and 2 which seem to be increasing.

Housing (D) – Deflation

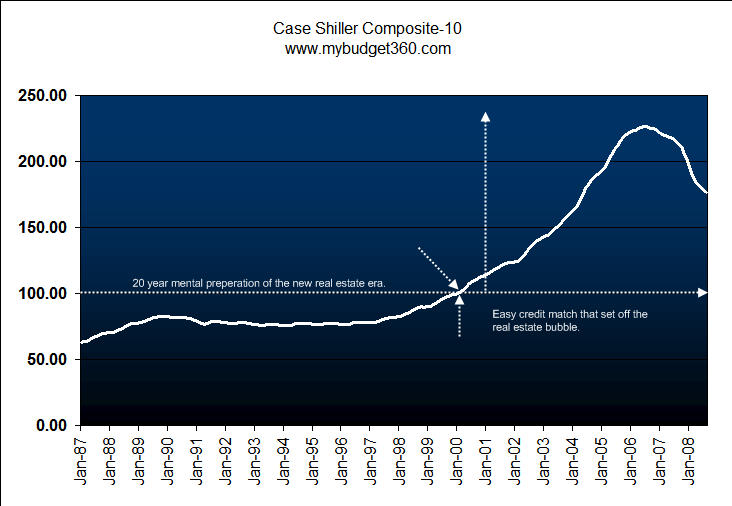

Housing prices are falling off a cliff. There is no question that there is deflation in the housing market. The absolute wealth destruction found in this area is arguably the reason we are now seeing an across the board global recession. Housing is now off by 22% nationwide according to the Case-Shiller Index. This wouldn’t be such a big deal but since 1979 housing now makes up more than our annual GDP.

You would think that lower prices would help the bottom line of many American households. Yet the problem is at the peak, nearly 70 of all Americans owned their home. Now you are telling the vast majority of the population that they are 22% poorer. The wealth effect and the psychological impact is both deep and pervasive. This is what is showing up in weak consumer sentiment reports. There isn’t a sign of pricing bouncing back anytime soon.

Fuel / Energy (D) – Deflation

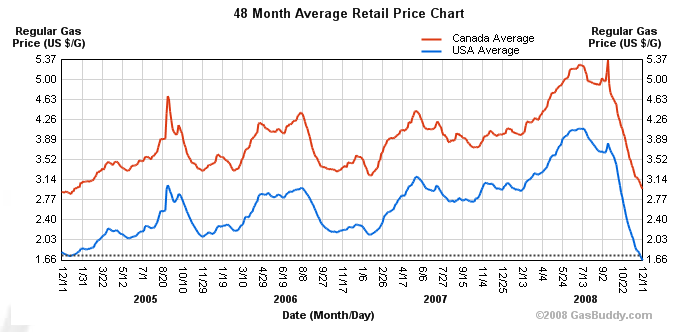

The oil bubble for the time being has burst. $147 a barrel oil seems like a distant memory when in reality, it was only a few months ago. Now oil is trading at $44 a barrel. That is clearly deflation. Many American households especially in the winter rely on a variety of fuels to heat their homes. This price collapse couldn’t have come at a better time. Or at least that is one way of framing the debate.

Also, many Americans drive so fuel prices are most notably seen through gallon prices. We are now near 4 year lows. This will put a few extra hundred dollars in the pocket of Americans who desperately need it.

This is great news right? Not exactly. The price fall is happening because of demand destruction. It would be one thing if prices corrected in a healthy economy. Prices fell because the economy isn’t healthy.

Wages (D) – Deflation

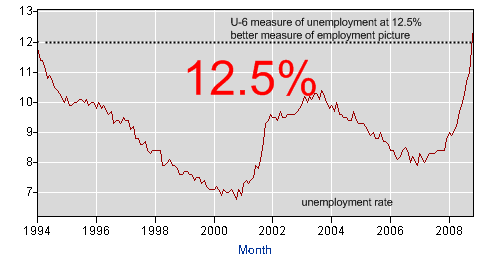

I’m not sure if you can find anything more deflationary than losing a job. The unemployment rate in the last few months has gone off the chart. This timing couldn’t be worse when many retailers count on holiday sales to make up for an already lackluster year.

If it wasn’t enough to have a decade of stagnant wages, now many Americans are battling with the prospect of losing their jobs. The reason deflation hit so bad during the Great Depression was because unemployment flew off the charts and it was a race to the bottom.

Healthcare (I) – Inflation

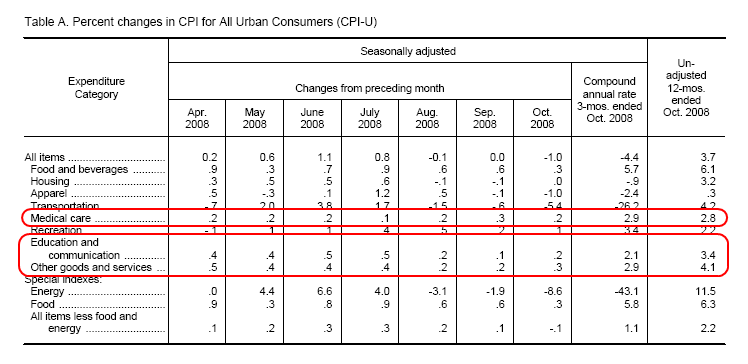

Now let us move on to two areas where prices have gone up. The above is from the latest BLS report on inflation (deflation). As you can see, even in the midst of this price crashing market, medical care costs have actually gone up! You may remember that healthcare was a primary topic in the debates in the early stages until the economy became unglued.

Yet there lies the problem. The dialogue now seems to place each case into a silo. If we went by the media as to what is currently important we would simply focus on the big 3 and giving loans to banks. Is this really the extent of our well thought out policy?

With healthcare, you enter an environment where prices tend to be inelastic. That is, most people will pay whatever they have to in order to stay alive or healthy. And since many Americans live a life of “pretend everything is okay” until it isn’t, many times people rush to the hospital with major and expensive symptoms. Our preventive system is simply flawed. According to the Center for Disease Control (CDC), 66 percent of Americans are either overweight or obese. That is stunning! This leads to many of the top causes of illness and death including heart disease, type II diabetes, and cancer.

So unless we change our daily habits on a large scale, the healthcare sector can charge whatever they want and they are bound to have a steady line of clients. It is time we address this issue as an economic one as well.

Education (I) – Inflation

The chart above also shows education costs holding up. In fact, here in California the University of California and California State University systems are all raising their fees this year because of budget problems. That is right, the primary source of education for residents just got 7 to 10 percent more expensive. And we are seeing this across the nation:

The cost of attending college keeps going up and up. Â In fact, the above chart is already out dated since prices went up for the 2008-09 school year:

“(CollegeBoard)Â There’s no escaping the fact that college prices are rising. According to recently released reports from the College Board, most students and their families can expect to pay, on average, from $108 to $1,398 more than last year for this year’s tuition and fees, depending on the type of college.

But there is good news. There is more than $143 billion in financial aid available. And, despite all of these college price increases, a college education remains an affordable choice for most families.”

Now let us assume you worked in the finance, insurance, or real estate side of our economy and were laid off. The few areas that are expanding, those in healthcare and engineering for example, will require focused education.  What does that mean? Going back to school unless you have an engineering degree or medical training.  So the cash strapped American is already dealing with lower wages (or none) and facing the prospect of going back to school if they wish to stay competitive.  A tough spot to be in.

So what will many do? Easy. Not go to school. Here in California, the first entry point is the community college which services 2.5 million students a year.  It is a bargain at $20 a unit. But guess what? The state is facing a major budget short fall. Classes are already being cut, hiring is frozen, and not all courses are being slotted for the upcoming semester.  So students need these classes to transfer to the state schools which just upped their fees.

You can see how this plays out like one domino being tipped over. Â Saying deflation is happening across the board is not necessarily true. Â There are a few areas where prices remain high but this isn’t a good thing. Â Where we want to see inflation (a little) is in wages and employment. Â That isn’t happening.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Tom said:

There is always the possibility that the USD will go bust and put the FDIC and Treasuries at risk. Imagine if China, Saudi Arabia cash in their US bonds all at one time, everyone rushing to the door at the same time. Not inconceivable given the recent market action.

Or take the banks. What if there’s a nuclear bomb exploded in a major city and there is a run on the banks. They are only required to keep a few percent of deposits on hand.

The deflation will not last forever. Eventually all the trillions being distributed as bailouts will cause hyperinflation. How soon that might happen is anyone’s guess. But it is inevitable.

December 15th, 2008 at 3:12 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!