Saying goodbye to the middle class concept of retirement – many workers plan to work up until they are 80 well beyond the typical life expectancy of Americans. How long will $25,000 last in retirement?

- 3 Comment

The romantic concept of being able to retire on a sunny beach with endless drinks is a modern notion largely pushed by mainstream advertising. It is hard for many middle class Americans to imagine a world where retirement is a luxury for the very few. However that is the path we are now following. The ability to retire is being severely impaired for most Americans given their lack of savings but also the massive spending occurring by the government. Recently we have heard that Social Security is expected to run out of funding far quicker than was once expected. This information in itself is troubling but couple that with the incredibly low to non-existent savings rate for younger Americans and you realize the day of reckoning that is lining up. Even recent data has looked at pushing the retirement age from 65 to 80 for some workers which might be hard to do given it is beyond the normal life expectancy of most Americans. The new retirement model appears to be no retirement.

The sources of retirement support

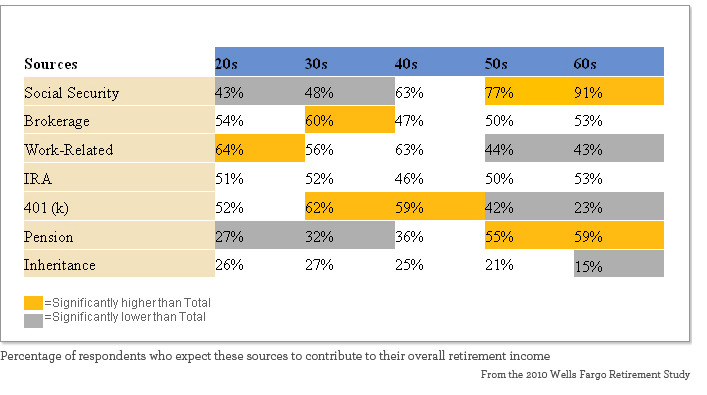

An interesting survey by Wells Fargo highlights the big changes coming in the concept of retirement for Americans. What it finds is that younger Americans are going to be less reliant on Social Security and pensions (not by choice) yet these same workers are largely funding the retirement of the 1 out of 3 current retirees that largely depend on Social Security for their income:

Source:Â Wells Fargo

For Americans under the age of 50 roughly one-third will have the ability to rely on pensions to help fund their retirement. Less than half will rely on Social Security versus the 91 percent that currently rely on this item. The survey found that most Americans realize where things stand in the game of retirement. When we examine current net worth figures we realize that most derive their net worth from the equity in their homes. With housing values still depressed it is apparent that many are feeling a wealth effect that is negatively impacting their balance sheet.

While Social Security funding is going to cause issues ahead, the cost of medical care is soaring. The costs are soaring at a time when savings are moving in the opposite direction. The costs of Medicare are going to put a strain on government finances. This fear is being reflected in the attitudes of many Americans:

While 43 percent of Americans worry about paying the monthly bills 60 percent worry about being able to pay the costs should an accident or medical emergency arise. These are items that are part of being able to retire at least with some semblance of peace. Yet it is becoming much harder with the current economy and the reality that most have not saved enough:

“(CNN Money) While respondents (whose ages ranged from 20 to 80) had median savings of only $25,000, their median retirement savings goal was $350,000. And 30% of people in their 60s — right around the traditional retirement age of 65 — that were surveyed had saved less than $25,000 for retirement.

As a result, many people aren’t in a hurry to quit their day jobs.

Three-fourths of middle-class Americans expect to work throughout retirement. And this includes the 25% of Americans who say they will “need to work until at least age 80” before being able to retire comfortably.â€

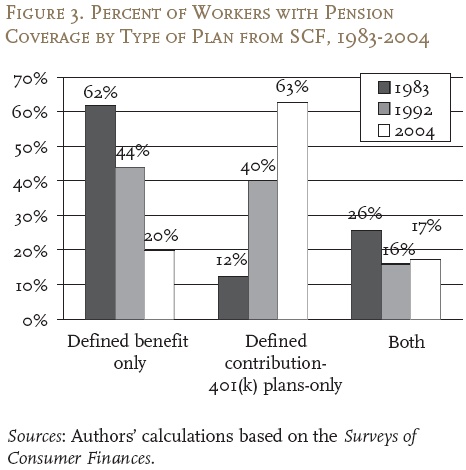

The above data is interesting because it does show that the average American realizes they need more for retirement yet is unable to save anything close to the amount. Given the costs of goods and simply living life it has become tougher for the per capita worker making $25,000 a year to save enough to retire comfortably. Younger Americans will have very little access to a pension moving forward:

In 1983 62 percent of Americans had access to a pension while in 2004 it was down to 20 percent and today it is likely much lower. Couple this with the low savings rate to begin with and you can see the problems beginning to emerge. Older Americans are going to need to plan on migrating funds to their own children as a retirement strategy. This might put a dent in the notion of traveling the world and playing golf all day long but the data suggests a difficult transition from the current notion of retirement with the actual facts on the ground. Many are planning on working until the age of 80, beyond the normal life expectancy of most Americans. In other words, people will need to work beyond the grave if they plan on having what was normally associated with a middle class retirement.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Thad P @ thadthoughts.com said:

Excellent examination of a myth dying a slow death: retirement. I think it was largely a glitch in time that lead people to believe you would reach a point where you didn’t work, didn’t contribute something to yourself and to your families. I have relatives who are still working well in to their 70s, and I don’t see that decreasing ever again.

May 29th, 2012 at 5:10 am -

DAC said:

Instapundit sent me here, this is a very depressing post. I really don’t know how this gets “solved” but as a mid-40ish person who takes saving seriously I suspect I will get punished for doing the right thing.

May 29th, 2012 at 5:55 am -

Kelly said:

My parents are in their 60’s, in excellent health and show no inclination to retire. In fact, my dad is looking for a different job that pays more. He sold his business several years ago and has been working for the new owner ever since, but he’d like to make more money. I think they’re both scared to death to depend on social security and who can blame them?? I’m 48 years old and I know it won’t be around for me when I retire. Anyway, where did this idea come from that you get to take your last 15 years of life off?

May 29th, 2012 at 6:51 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!