Is the stock market a sham for the middle class? Retail investors expected to pull out $475 billion in funds. Volatility index under pricing real risks.

- 4 Comment

The stock market is largely a source of entertainment or awe for most Americans instead of being a true source of wealth. In the United States roughly 42 percent of all financial wealth is aggregated with one percent of the population. One third of Americans have no savings at all so for this group, the stock market does not even enter the equation. Yet the stock market itself is now inching closer to record levels. Even volatility is abnormally low given that we barely avoided the fiscal cliff and are dealing with debt ceiling challenges once again. The stock market would signify that the American economy is doing fantastic. In reality, many people are still struggling and many organizations used the recession as a period to cut jobs and slash costs. The economy is still short four million jobs from the peak reached a few years ago yet here we are, with the stock market up over 100+ percent from the March 2009 lows. Is the stock market a sham for the middle class?

Stock market and jobs

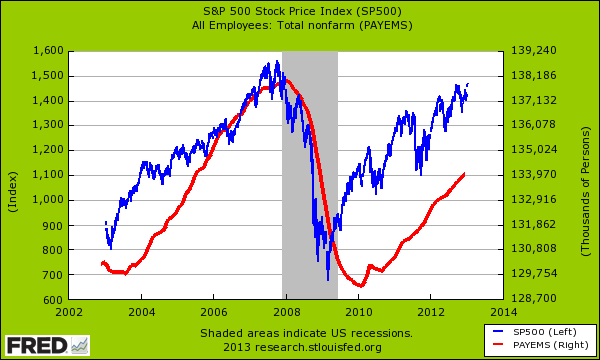

One of the more convincing pieces of evidence is measuring the stock market versus the number of people working:

While the stock market inches closer to peak levels, the employment numbers are four million below the peak reached when the recession started. What many companies have done is slashed costs and have squeezed more out of employees. This has been reflected in increased productivity figures. Yet this is not showing up in household incomes as demonstrated by wages. Don’t take my word for it. Listen to what those that are near to the stock market machine are saying:

“1) The middle class is dead. A few weeks ago I visited a friend of mine who manages a trillion dollars. No joke. A trillion. If I told you the name of the family he worked for you would say, “they have a trillion? Really?†But that’s what happens when ten million dollars compounds at 2% over 200 years.

He said, “look out the windowsâ€. We looked out at all the office buildings around us. “What do you see?†he said. “I don’t know.†“They’re empty! All the cubicles are empty. The middle class is being hollowed out.†And I took a closer look. Entire floors were dark. Or there were floors with one or two cubicles but the rest empty. “It’s all outsourced or technology has taken over for the paper shufflers,†he said.

“Not all the news is bad,†he said. “More people entered the upper class than ever last year.†But, he said, more people are temp staffers than ever.

And that’s the new paradigm. The middle class has died. The American Dream never really existed. It was a marketing scam.â€

Not exactly a positive sign for the middle class. What is also surprising is with all the debt inspired solutions, stock volatility is at multi-year lows:

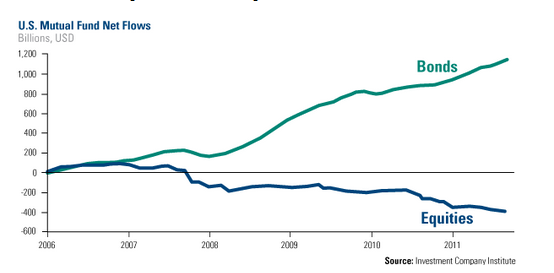

In other words those investing into the stock market are playing this as if all the issues in the economy were completely resolved. Retail investors have been yanking money out of the stock market however:

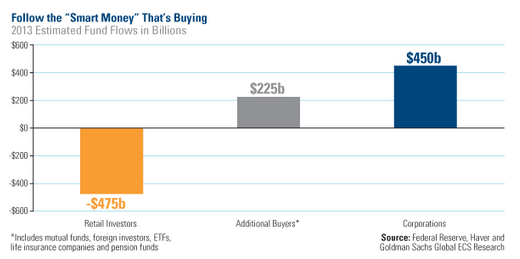

This trend from equities to fixed incomes is poised to continue deep into 2013:

It is estimated that retail investors will be moving out of funds to the tune of $475 billion this year. Big players will make up for the lag however. This is simply another sign of the hollowing out of the middle. Yet the market is not reflecting any volatility with current players. However this is not necessarily a sign that the underlying fundamentals of the economy are good. We have an unprecedented number of people working part-time gigs or contract positions in this modern day low wage capitalist system.   The stock market is largely a shell game for most of the public.

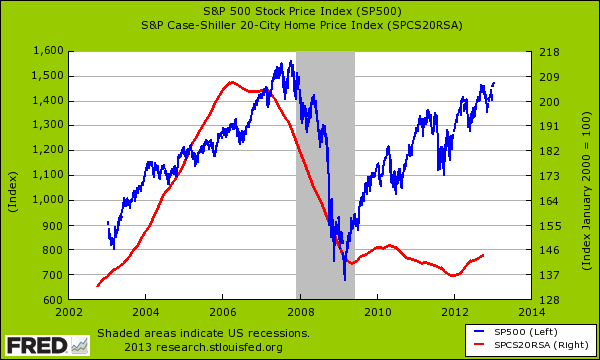

For most Americans, home is where the wealth is:

Even with the run up in real estate prices in 2012, home prices are still down by over 30 percent from their recent peaks. Keep in mind much of this is happening because of very high leverage being injected into the mortgage markets by the Federal Reserve, not income growth. So the move up in prices is merely a reflection of more added leverage. Large investment banks are making good money once again thanks to the Fed setting up a system of socializing losses and privatizing gains. The stock market is a giant sideshow for most Americans and many are simply pulling their money out.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

4 Comments on this post

Trackbacks

-

American said:

Great article. Makes perfect sense.

January 18th, 2013 at 10:47 am -

Dan said:

Great post. I suppose the new housing bubble will run pretty far as the Fed will likely just keep printing (i.e., buy the mortgages “assets†from the bank brokers). I wonder how long this will go on until a threshold is reached for losses that then changes the system; but if the public backing of mortgages continues, which it is and will, I would imagine the failure rates on mortgages will become irrelevant and thus housing prices will remain decoupled from income for purposes of mortgages issuances.

January 18th, 2013 at 2:45 pm -

dk said:

The so called “middle class” is basically just the lucky members of the working class. There are some slight cultural differences between the lower and upper “working class” but basically they are all slave wagers, depending on others for jobs and making the owners rich.

Unless you are the owner of something, not working for someone else, you don’t really own anything, not even the shirt off your back since you are basically just renting your survival from job to job.And it’s true the stock market is a total scam. It doesn’t represent real ownership since you don’t get real proceeds from the business operations but only when the relative value of the stock increases (based on psychology that is in no way tied to business profit and loss).

Basically it is the largest human pyramid scheme.

The corporations have pushed stocks because when they do the IPO they get free money for something that isn’t real, whereas otherwise they would have to issue bonds and pay real interest to get access to the same money.The stock market allows corporations to get money for free instead of paying interest on bonds.

The masses are being fooled into funneling their limited money into giving corporations free capital in the form of the fake stock market, instead of a real investment like vanilla bonds which protects the principle and gives guaranteed returns.Which is exactly what the bankers want, since it means the masses will never have real savings, and forever be dependent on the owners of the means of production for jobs.

Basically keeping them working class slaves.June 22nd, 2016 at 4:07 pm -

williejoe said:

For the average peon worker investing is basically the same as visiting Las Vegas and playing the games. A investor has no say in the way business is run nor what government does. They are like a leaf on a lake. Whatever way the wind blows. For a fast example, the 2 trillion “stimulus” under DJT. It is hurtful to the worker, it harms the economy and it will ultimately cause inflation (the devaluation of the dollar). Will the peon have any say about that? Nah. Besides, once your investment money is in, it will take a week or two to draw any of it out. Likely, there will be costs to be paid when you ever get the first dollar of YOUR own money. There are rules that will cost you penalties in some cases, as well. In good times it will make money but the investment firm will likely get the first two percent of its earnings. Inflation will get some and Uncle Sugar as well as your state will take a bite, too. Saving it outside of investing it is a zero or minus action. Unless you have an inside on what actions a big business is about to take you are in a poker game and everyone else is in on scalping you, except you. At least if you have the money in your cookie jar even though it is losing value by the day at least you can get your hands on it. Still, don’t take my advice invest, invest, invest. I once asked a person overseeing my investment this question: “Is there any situation where you will tell me to take my money out instead of holding on until things get better.” She never gave me a straight forward honest answer.

May 15th, 2020 at 7:51 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!