The debt reckoning has arrived: Total debt owed now approaches $60 trillion while Fed wrestles with interest rate confidence game.

- 8 Comment

Some people may be oblivious to the recent historical interest rate moves being experienced in the bond markets. Many on Wall Street probably assumed that the Fed had an unlimited ability to pull the wool over the eyes of the American public. Yet the reaction with interest rates concludes an interesting chapter in American central banking policy. The Fed can no longer preach for a lower interest rate. After the brutal reaction, the Fed has softened its rhetoric on the “taper†of quantitative easing even though there is really no evidence showing the Fed is tapering anything at all. The quick reversal in interest rates signifies a strong reaction by the market. It is fascinating to see how much outside money is now flowing back into the US to purchase stocks, real estate, and other real tangible goods. In other words, global investors are now demanding payment for all that cheap credit lent out. The era of cheap debt is now reversing and the piper is demanding to be paid.

Total debt owed

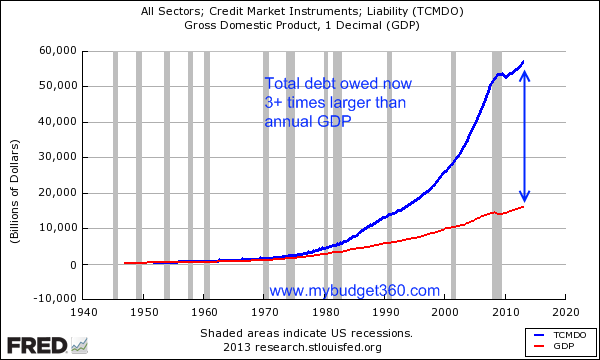

The total US debt markets are now over 3 times our annual GDP:

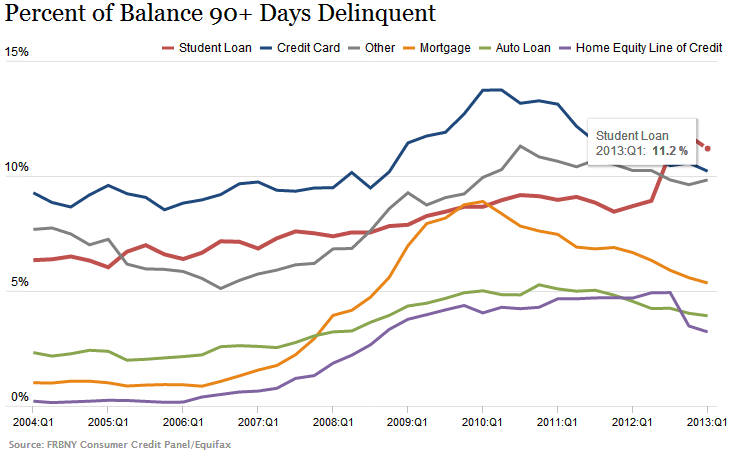

We have largely become a nation built on debt. There were a few recent headlines championing the growth in household sector debt ex-mortgage debt but the reporting failed to acknowledge that the bulk of debt growth has come at the hands of student loan debt. And why would this be a problem? The problem arises from the record level of student debt delinquencies:

In other words, one of the most problematic debt sectors is seeing the largest growth at a time when many are unable to pay it back. Yet somehow, this passes as a good sign for the recovery. Even though the $1 trillion in student debt is enormous, it is merely one part of the bigger debt market that now approaches close to $60 trillion. The interest rate move is significant in the bond markets because a bond is merely a promise to pay a loan back with a fixed rate of interest and all initial principal.

What we are seeing however, is a reversal of cheap debt coming back to flood the markets at the expenses of a dwindling middle class.

Fed confidence game

The Fed is walking a fine line when it comes to the psychological confidence game. After the massive reaction in the bond markets the Fed quickly softened its stance:

“(CSMonitor) Federal Reserve Board Chairman Bernanke spoke at an economic conference near Boston Wednesday, saying the Fed will continue to pour stimulus into the US economy — at least until unemployment and inflation improve.â€

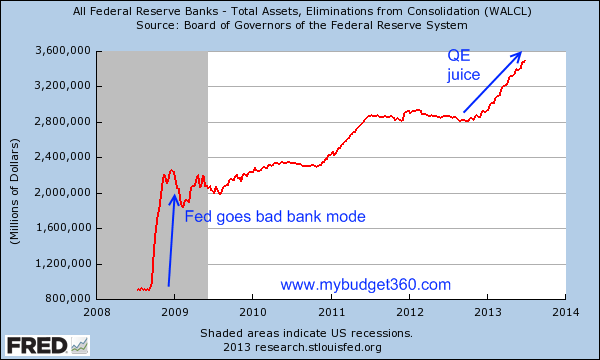

This is an incredibly quick change of heart here and the statement provides a vast window in which the Fed can act. While the Fed talks about easing QE and other programs, the evidence shows nothing to this effect:

The Fed’s balance sheet which remains unaudited in any significant way shows no sign of tapering or slowing down. We are quickly on our way to seeing the Fed’s balance sheet hit $4 trillion. The Fed is essentially serving as the one giant bad bank but is also the key player (only player) in the mortgage markets. Without the unprecedented intervention in the housing market, real interest rates would be around 6 to 7 percent for a typical mortgage. We have no way of finding out the real rate since an artificial market has been created.

The chart above shows a very clear pattern. The Fed since the crisis hit in 2007 has expanded its balance sheet from roughly $800 billion of liquid items to $3.5 trillion of questionable securities and artificially low mortgages (via QE and the MBS program).

Yet as many of you are well aware, the US is increasingly borrowing money from the world. The world realizes that the Fed is merely bluffing so guess what? Money is now flowing back into US markets to purchase stocks, real estate, and other goods pushing up prices while the middle class is literally living paycheck to paycheck. This is one of the reasons how it is possible to have a booming real estate market, a record in the stock market, while the middle class shrinks, and 47 million Americans are on food stamps. To sum it up, global investors are calling the Fed’s bluff and are now diving into the US market to buy it up on the cheap with a growing erosion of US dollars.

Interest rates react

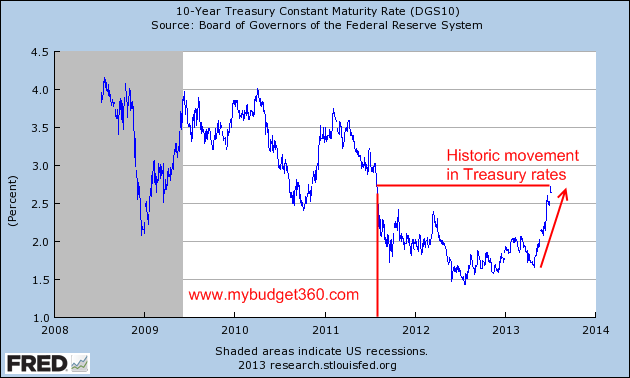

The markets once realizing the Fed was reaching a reckoning when it comes to debt, decided to react as you would imagine:

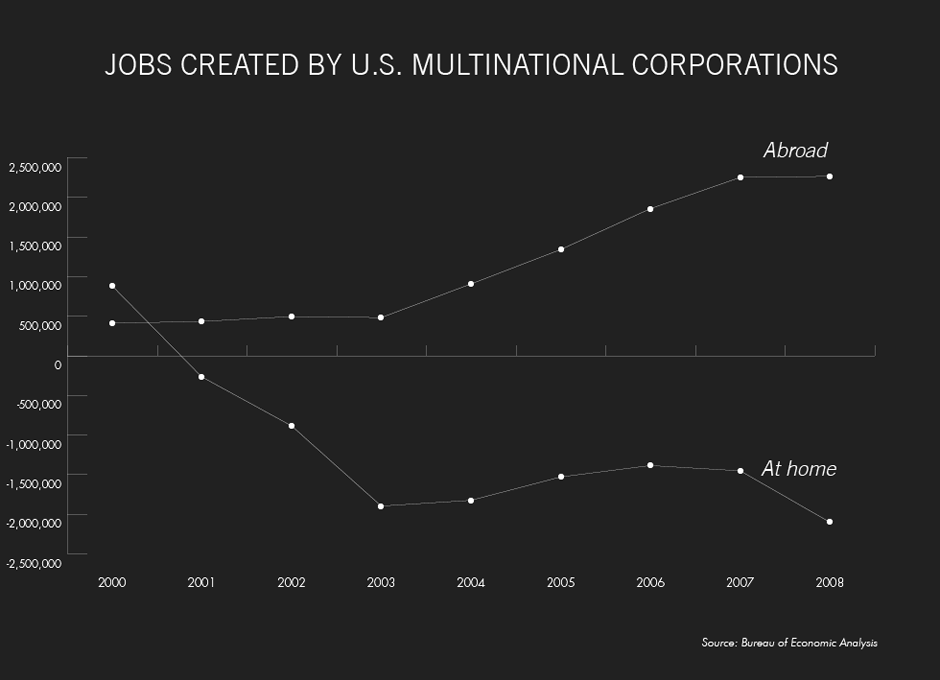

The above move pushes the 10-year Treasury rate to its highest level since 2011. Keep in mind the debt markets and Fed balance sheet have continued to grow since that time. While this is a blow to domestic financial institutions leveraging the daylights out of low rates, it will also hit consumers who are on a razor’s edge when it comes to their finances. In reality, the stock market gains from many large companies are not trickling down to Americans because many of the large companies are adding jobs outside of the US:

There is simply too much debt floating in the market and the Fed is backed into a corner. Global investors realize this and are choosing to drive dollars back into the US by buying up real estate, stocks, and other tangible investments. So you have inflation coming from outside forces while the middle class essentially has watched the Fed assist banks and Wall Street in parceling off pieces of the domestic economy to global buyers. The underlying key to remember is this is happening at the expense of the middle class given that the top echelon of our society has benefitted mightily from this arrangement. The reckoning is here and there is a limit to how much debt you can have while not adding any value domestically.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

Don Ross said:

The mind set is; as long as the music keeps playing, debt doesn’t really matter. After all, money is debt and debt is money / vice versa, so to speak.

The crash of ’29 came (in part) because people really believed in real assets and the physical wealth they represented. The double entry accounting system worked. It worked because (outside of crime) it was the only game in town. It kept people honest and anchored in reality.

Today, the intellectual repository of financial common sense has been adulterated by esoteric computer trading programs and the adulation of the rich and famous. Financial failure, unlike ’29, carries no stigma.

In America, being rich and failing is a mutant badge of honor; to be poor and have never tried is a crime against the American ethos.

Debt … no problem.July 12th, 2013 at 4:38 am -

Arizona said:

IT don’t really matter what the FED says,if the queen wants to bail out her banks,fine….but that don’t mean the american people OWE ANYONE A DIME,so they can stick their deth claims up their butt,and when they collaspe the dollar,they better have a dam good place to HIDE,cause the trouble they have caused will come out of their ass,and if all the criminals in government think they have gotten away with robbing america blind,WRONG,we’re going to feed them to our dogs,there going to discover they made a mistake……………………

July 13th, 2013 at 8:10 am -

Barn Cat said:

Total debt is closer to $200 trillion.

July 13th, 2013 at 3:44 pm -

Anti-Dan said:

Well, Dan. It won’t go on forever, ok, bubba?

July 13th, 2013 at 10:27 pm -

Cristine said:

Sophisticated analysis, yet presented in logical and clear manner for those not educated in the current financial sector lingo. Brings together the meaning of scattered news reports into a full picture.

July 14th, 2013 at 8:11 am -

kingsnake said:

“The era of cheap debt is now reversing and the piper is demanding to be paid.”

Or in the immortal words of “Goodfellas”: “F*** you, pay me.”

July 14th, 2013 at 12:10 pm -

Mark Davis said:

Hang the politicians and banksters !

July 15th, 2013 at 8:53 am -

therooster said:

The debt currency paradigm we will be vacating has been a facilitation for real-time applications. The USD and all other floating currencies are/were not intended to be settlement currencies only. The application of currencies is only a stop gap measure within the “apprenticeship” of becoming real-time measures for 21st century real-time gold-as-money. Gold has always been a great classical store of value, but the underlying distribution systems lacked the features to provide gold the tremendous liquidity it now exhibits in real-time (floating) market context. The problem with monetary gold systems of the past wasn’t the bullion. It was the FIXED value. The FIXED peg had to go before any viable bullion based monetary system could have long term stamina. This is a market process, however, not one that can be done from a top-down impetus.

July 15th, 2013 at 6:43 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!