Why millions of Americans will never retire: How the prospect of retirement went from a realistic goal to an outrageous dream for most American families.

- 3 Comment

Retirement was presented to many Americans as some kind of middle class rite of passage. It was odd to see so many fall under the spell of easy riches and generous retirement math presented to the public from the Wall Street financing machine. Many saw retirement as a distant object so far into the future but the future is now here. The middle class is shrinking and with it the dreams of retirement. I suppose it is important to define retirement before we go on since this is a relatively new concept as far as history is concerned. In the past, you worked until you died. Short of royalty, this was the typical life path. Retirement, at least how it was presented to modern American workers, meant a time in life when financial worries were gone thanks to a lifetime of work. In more practical terms this meant a combination of a pension, 401k/403b, and Social Security. Social Security was never intended to be the main retirement income stream for Americans but it is. Pensions are now nearly extinct in this low wage economic system. Many Americans in the early 1980s were presented with the Wall Street vision of retirement where many simply set aside money in 401ks and IRAs generating untold wealth to the financial kings. Wall Street was supposed to exercise some fiduciary duty to the American people but the opposite occurred. A massive bait and switch. Retirement is going to take on an entirely new definition given the current state of wealth in America.

Half the country has zero saved for retirement

As we were discussing earlier, there was supposed to be a three-legged stool for retirement composed of the following items:

-1. Pension

-2. 401k/403b

-3. Social Security

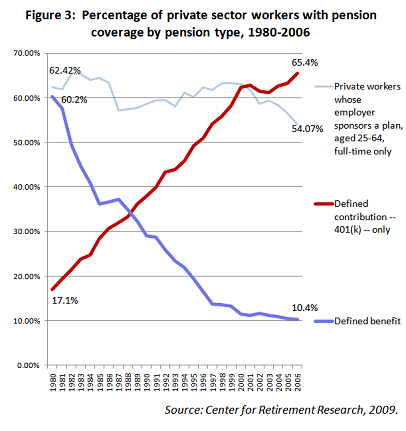

The number of Americans with a pension has fallen dramatically. In the early 1980s, close to 60 percent of private sector workers had a defined benefit plan (pensions). Today defined contribution plans are now the norm. The trend is rather clear:

So one leg of that already weak stool has been taken away for a massive portion of the population. Not off to a good start when the chopping down of this leg is hitting right when millions of Americans are hitting retirement age.

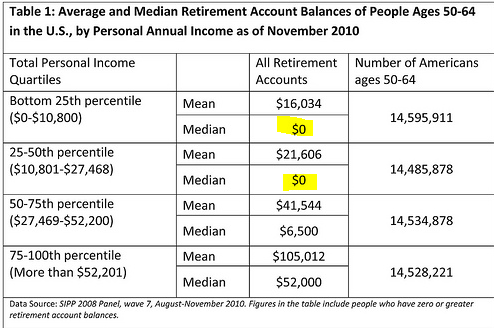

We’ve already discussed how young Americans are having a tough go at the economy because of massive student debt and low wage jobs dominating the economy. But what about Americans in the 50 to 64 age range that are now entering a point where retirement is on the horizon:

The second leg of the retirement stool is basically non-existent. Of those 50 to 64, in the prime years before retirement, half have nothing saved up. You would think those with higher incomes would be doing much better but the figures don’t look so promising here either. You would have to go to the top one percent of the country to see where the real wealth gains have gone in the last generation.

What you are left with then is one leg of this wobbly stool. Most Americans are going to depend on Social Security. Social Security is already falling behind because it uses the BLS CPI instrument to recalibrate for cost of living adjustments. Of course, this has understated most items including tuition, housing, healthcare, and food costs. Inflation is absolutely real and those that think that inflation is a minor annoyance should look at Argentina and then rethink their views.

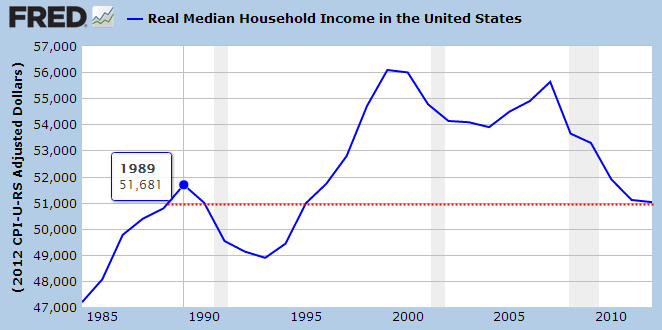

The idea that universal retirement was going to be a panacea for all was the dream presented by Wall Street in the early 1980s as the entire financial industry deconstructed our economy. Why go with stale boring pensions when you can gamble it all away in the high-frequency trading world in New York? This was the fantasy that was presented while household incomes slowly got eaten away by inflation:

The typical US household adjusting for inflation is back to where they were in the late 1980s. In fact, instead of moving forward people are moving backwards. Like the Red Queen’s Race, you have to keep running faster and faster just to stay in the same place. Such is the state of retirement in America for millions of family.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

kingsnake said:

Never fear, Uncle O and His Magic MyRA are here!

January 30th, 2014 at 3:52 pm -

Ametrine said:

No worries, haven’t you heard? The Great Obama is creating MyRA! It’s the answer to our prayers.

NOT!

I predict this will be just another form of Social Security account the government will raid.

January 31st, 2014 at 2:50 pm -

alphaa10 said:

For those who would inform themselves about the MyRA program–

http://www.whitehouse.gov/the-press-office/2014/01/28/fact-sheet-opportunity-all-securing-dignified-retirement-all-americansFebruary 3rd, 2014 at 2:56 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!