The shackles of consumer credit in a low rate environment – Banks would rather leverage low rates from the Fed than lend money to cash strapped American households. 15 percent average rate on credit cards and typical savings account rate near 0 percent.

- 1 Comment

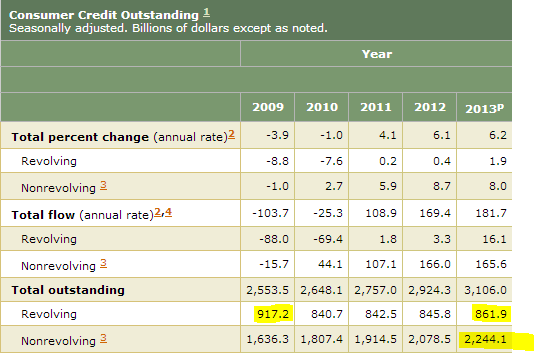

In a world where debt equals the ability to purchase large items, access to debt is king. For this reason banks are the new modern day oligarchy since they have a nearly unlimited line of credit with the Federal Reserve. The public during the credit bubble days had access to nearly unlimited debt via mortgages, home equity loans, auto debt, credit card debt, and student debt. Since the credit bubble burst, access to credit has been severely limited to the public. It is interesting to note that credit card debt, the lubricant of our consumer economy is lower today than it was in 2009. Some $56 billion has been taken away from the credit card market for American consumers. Banks have the ability to loan but choose to speculate in real estate investments since many households simply do not have the incomes to back up large purchases. Part of being addicted to debt is that the withdrawal is painful yet banks have not faced any retrenchment while the public has been forced to adapt to credit austerity.

Credit card rate arbitrage

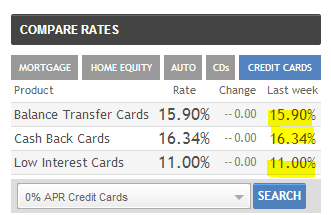

One of the most obvious ways that banks gouge the public is through high interest rates on credit cards. First, you have banks being able to create money out of thin air. This is part of our fiat based system. Of course, banks are hungry for leverage when it comes to their own speculation but not with the public. That is why credit card debt has contracted. However, as the Fed has artificially lowered interest rates banks continue to charge incredibly high prices on credit cards as reflected by average interest rates. In other words, the Fed’s low rate gamble is not filtering down to the average American.

Here is a clear example of corporate welfare versus aiding the public. Credit is supposed to be the oil that fuels the economy, not the main source of speculation for banks. The banking tail is wagging the real economy dog. So let us look at current rates:

Typical cash back cards have an average rate of 16.34 percent while low rate cards have an average rate of 11 percent. Low rate cards of course are reserved for those with pristine credit and given the troubled balance sheet of many Americans, few qualify for these.

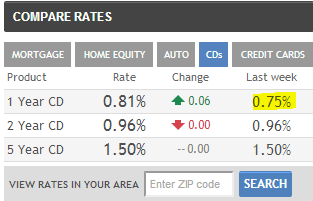

Keep in mind the Fed funds rate is essentially zero. Banks have the unique privilege to borrow at an extremely low rate (this is why banking profits are so outrageous). If you wanted to save some money in a certificate of deposit, how much could you get?

The average one year CD has an interest rate of 0.81 percent. So think of the massive margin here. Say you go into the bank and put in $10,000. After one year, the bank will pay you $81. Say the bank lends $10,000 out at 15 percent on their credit card. After one year, the bank will collect $1,500 in interest alone. With this kind of racket is it any wonder why the financial sector has so much power?

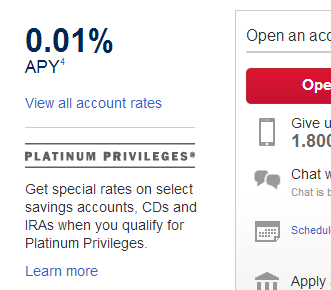

It gets even better when you look at traditional savings accounts:

Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â

Â

This rate is from one of the largest banks in our country. Basically they are a formalized mattress for your money. Most too big to fail banks are providing an interest rate that is hovering extremely close to zero percent. The margin here is completely in favor of the banking institutions.

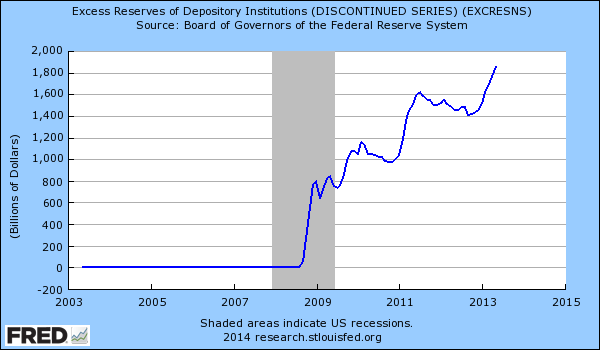

Banks rather speculate with Fed money than lend to public

Banks have the unique ability to make money out of thin air. The Fed has pushed interest rates lower in hopes of spurring more borrowing in the economy. However, banks would rather lend and speculate within their tiny network instead of lending this money out to the public. Take a look at current excess reserves:

This is money that can be easily lent to households but it is not. Instead, we have inequality rising as banks lend to a tightly controlled network and lock out the public. And this money is funded by the Fed, an entity that is both public and private yet serves the interest of large banks. It is interesting to note that since 2009 banks have suddenly had a taste for residential real estate and are crowding out regular home buyers. Why? Because these low rates provide a massive buffer to speculate. If you can get a loan carrying a 0 or 1 percent interest rate you have a wide margin to make mistakes. Yet the public is dealing with 15 percent credit card rates and 4 to 5 percent mortgage rates. Then you wonder why banks continue to make record profits.

The only two sectors of consumer debt that have grown dramatically since the recession ended is student and auto loan debt, not exactly good debts to have:

While credit card debt has gone down by $56 billion since 2009, student and auto debt is up a stunning $608 billion over the same period. There is already a massive crisis occurring in the student debt market. Next to housing, an auto purchase is the biggest purchase Americans will make. But unlike housing, cars begin depreciating from day one. So shifting people into auto debt isn’t exactly a positive when it comes to building wealth. The fact that inequality is at levels last seen from the Gilded Age should tell you something about the structure of our current economy. Even though interest rates are low on the banking front very little of this is trickling down to the public. It certainly isn’t being reflected in the rates being charged on credit cards.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

roadrunner said:

I have a credit card from Capital One. Because of various car repairs,dental/medical and other sudden emergencies,I had to run the balance up to 3700.00. For the first 6 months, my minimum payment was 34 dollars per month. At the 7th month my minimum payment was jacked up to all of 75 dollars per month…then started to inch up to 80 dollars per month. When I first saw that payment go up to 75, I called them to ask why I was suddenly being charged what I consider a penalty interest rate. I was told pretty much that “thats the way it is.” No other explanation. My statements read that I was being charged 13%, which was a variable rate..(danger). When you send in a 100 dollar payment and 41.00 of that is subtracted for interest, it sure seems to me that in effect, I am paying around a 40 percent rate. It would take 15 years to pay off. I suffered under this yoke until I received an offer to take out a fixed rate loan at 8 percent for 5 years from another bank. I used this loan to pay off my balance from this predatory 1st loan.

February 15th, 2014 at 7:43 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!