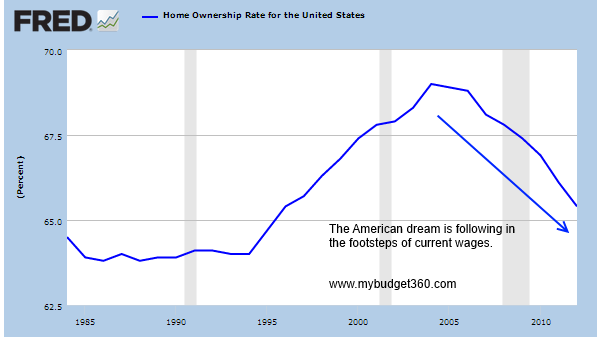

McWages for the McAmerica job recovery: The scorecard – 3.6 million higher-wage jobs lost due to recession with only 2.6 million added back. 2 million lower-wage jobs lost during recession but 3.8 million added since the recovery.

- 1 Comment

We are witnessing an economic race to the bottom. The recovery has largely been one of low-wage work. This is easily seen through the paychecks Americans are receiving. What isn’t readily visible is what is being slashed on the backend including healthcare, benefits, and the expanding impact of inflation on purchasing power. A report from the National Employment Law Project finds the continuing trend of the McWage recovery. This is a suitable name for what is occurring in this so-called recovery that is only exacerbating wealth and income inequality. For example, 3.6 million higher-wage jobs were lost due to the recession and only 2.6 million jobs in this segment have been added back. We are in a net-deficit of good paying jobs by 1 million. On the other hand, we lost 2 million low-wage jobs during the recession but have added 3.8 million lower-wage jobs during the recovery. A net add of 1.8 million lower-wage jobs. This is the kind of recovery being dished out by the bailout happy Wall Street and their aggressive behind the scenes shenanigans of raiding the pockets of Americans. The story is the same: corporate welfare and financial handouts while austerity and a race to the bottom for the rest.

The low-wage recovery

Higher paid industries like those in accounting and legal work for example shed 3.6 million jobs during the recession only to have 2.6 million being added back. However, the lower-wage industries like those in fast food, retailing, and hospitality lost 2 million jobs during the recession but have added a stunning 3.8 million back since. In reality, what is occurring is a two-tiered workforce. You have massive salaries at the executive level while we are growing an army of lower-wage workers that barely have enough to pay the rent. The middle class? Largely evaporating one worker at a time.

This matters for a variety of reasons but for one, it is showing a growing inequality gap that is booming in America that is deeply problematic. People realize that there will be gaps in income and wealth but the current system favors a plutocracy. Money is buying more influence in politics and the media already dishes out watered down content to keep the public numb and blind to what is happening. This is how we can have 47 million people on food stamps yet have a peak in the stock market. The majority of Americans own no stocks because they don’t have enough to save after they are paid their wages. The financial sector in the US has become a giant rent seeking apparatus that draws money and energy from the productive sectors in the country. Think of all the big bank bailouts. Just look at pay at the big banks and ask yourself what the trillions of dollars in bailout funds and central bank gimmicks have wrought onto the nation. Inflation is absolutely happening contrary to the watered down CPI.

Take a look at the net scorecard on what kind of recovery we are in:

Source: NELP

This is a very telling chart but illuminates what is going on in the country. Those in the top one percent have done exceptionally well during this recovery but most other Americans are falling further and further behind.

“Most Americans are playing out the Alice in Wonderland Red Queen’s race: you keep running faster and faster just to stay in the same place.â€

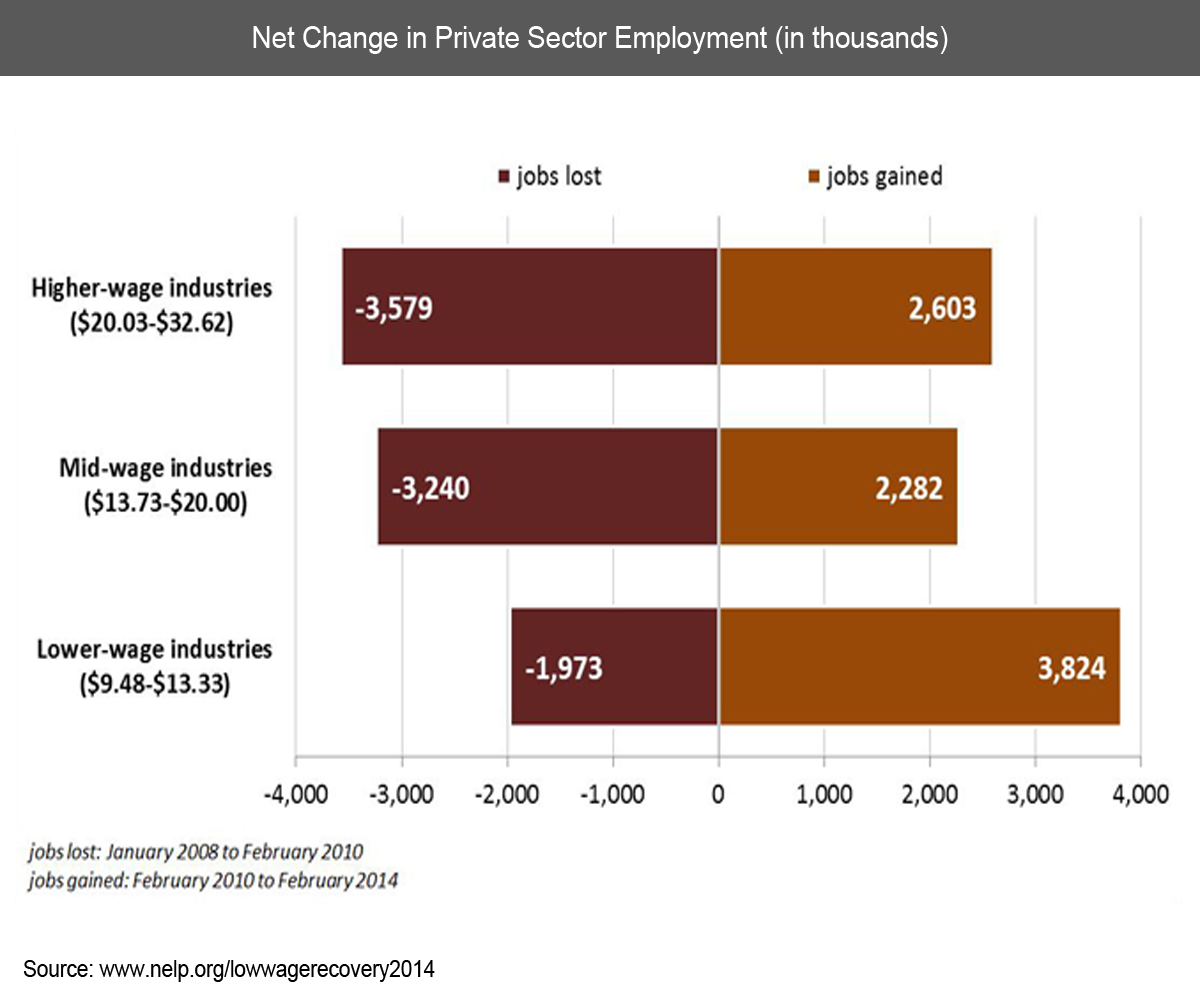

The above chart truly shows what kind of job recovery we are facing. The McJobs are outpacing the middle class jobs. Can someone really get by in the US making $9 or $13 an hour? Not if you want decent healthcare, a college education for your kids, and the ability to own a house. However, the structure of the bailouts has allowed large banks to flood the housing market and crowd out regular Americans. This is why the homeownership rate continues to fall even though interest rates are very low:

Being a homeowner in the US used to be the cornerstone of a middle class life. That is now becoming much more difficult as fewer Americans have the income needed to support such a big purchase. Also, many have a hard time coming up with a down payment because banks have juiced up the system where low rates focus only on the monthly payment but fail to look at the actual base cost of an item. In other words, they try to trick people with low monthly payments while jacking prices up. In large part, this was the entire mission of QE and all the other bailout programs – basically freeze accounting rules, lower rates into negative territory, and let banks rewrite their balance sheets. In the end, what you have is an economy where housing prices are going up, college costs are soaring, healthcare costs are going up, yet incomes are stagnant and falling on an inflation adjusted basis.

The race to the bottom is on and the circus of this election year is kicking off. The theme should be the middle class but good luck having any champions for that cause. Remember, lower-wages and watered down benefits save someone money. Just look at the wealth gap in this country and you can see how things are playing out in this McWage recovery.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Brian said:

Do you have any articles on the impact of young workers by older workers refusing to retire? I work at a fortune 30 company and currently 20% of the workforce is currently in the “able to retire” window. By 2020, that number could be 50% if people continue to stay and not retire.

April 28th, 2014 at 5:31 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â