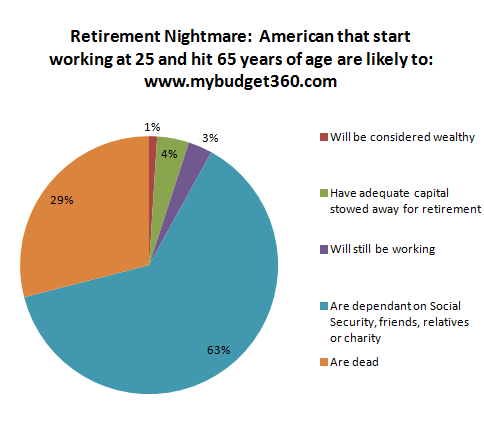

A day of reckoning has arrived to retiring Americans: 63 percent of Americans that start working by the age of 25 will be dependent on Social Security, relatives, or charity by the time they hit 65.

- 5 Comment

The notion of retirement is a fairly new one outside of wealthy circles. For most of civilized history, people worked until they died. Not a glamorous way to go but that is simply the course of human history. Only until recently with the emergence of the middle class was there a general semblance that retirement may be accessible to all. However looking at actual figures reflects a very different picture. It is hard to get a perfect balance sheet as to where older Americans stand today since there are many differing resources floating out in the market. Yet one thing is consistent and that is, older Americans are entering into a major day of reckoning with not enough. Older Americans are woefully unprepared for what lies ahead in retirement. Many are basically at the mercy of Social Security, family, or charity. Not exactly the retirement paradise Wall Street started pitching to the masses starting early in the 1980s. The reason this has gone on for so long is the political system is co-opted by big money. Over this period of time real substantive reforms could have occurred. Instead a generation has passed and many have nothing to show for it even with the stock market at record highs.

Retirement plan number 1: have no savings

Everyday roughly 6,000 Americans hit the age of 65. Too bad 36 percent of Americans have nothing saved for retirement. The typical cost of medical service for someone 65 and older and living 20 more years is $215,000. Given that many have nothing, they are simply one medical event away from the poor house. This is why programs like Social Security and Medicare are protected with such fury by older Americans. In many ways, this is their only form of wealth in retirement. Most do not participate in the Wall Street casino.

Some interesting figures regarding older Americans:

63 percent of Americas hitting the age of 65 will depend on Social Security, friends, family, or charity assuming they started working by the age of 25. I suppose if you weren’t working then retirement should be obviously off the table. Many are even in a more troubled position by being deeply in debt. To save for retirement, you need to have disposable income left over once the bills are paid and with inflation slowly eating away at purchasing power, many are starting to see their dollars are not going as far as they once did. Sure, the Fed says inflation is low and the BLS has inflation plodding along but compare the prices of the following from today and a decade ago:

-College tuition

-Medical costs

-Housing

-Cars

-Food

Still think inflation is not happening? And this is even scarier for older Americans living off Social Security with a Cost of Living Adjustment index that will look at the CPI measure for inflation. Slowly, they are being pushed out of the market. It is called purchasing power erosion.

As you would expect, older Americans spend a large amount of money in healthcare and also buy a good number of cars:

Those 50 and older account for:

77% of all prescription drug purchases

61% of all over-the-counter drug purchases

47% of all auto sales

The last point ties in with the subprime emergence in auto loans. Many older Americans with blemishes on their credit history are now buying cars thanks to financial intuitions looking for another segment of the economy to securitize and sell off to the world.

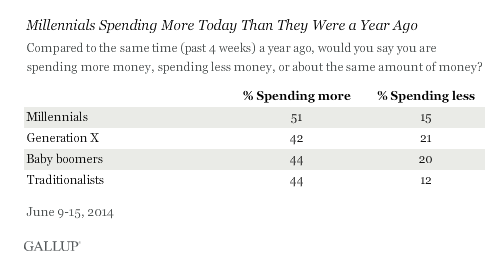

And this cycle is likely to persist given younger Americans are basically spending more of their income versus saving it for a rainy day:

51 percent of Millennials say they are spending more today than they were last year but when we look at net worth data, we find less money being saved. The feeling of course is that this is a problem for another day. With thousands of baby boomers hitting 65 years of age each and every day more strain will be put on programs that were never intended to be lifetime pension funds. You can only kick the can down the road so far before having to pick it up. The day of reckoning is falling on many older Americans and Congress and Wall Street really have any little sympathy to what is unfolding.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Ame said:

Has anyone ever done the AARP Retirement Calculator? It’s bogus because it assumes income RISES each year. Most people I know have seen their income stagnate either through lay-offs, being fired and can’t find another job, being demoted, pay freeze, etc.

Wasn’t it mentioned in a previous article on this site that real wages have not gone up in at least 10 years?

So, how is a body supposed to save more if they aren’t making more, all while prices of everything are going through the roof?

AARP is supposed to be on the side of the average retiree but they don’t know a thing about what is really happening to them. I wonder if the people who run that organization are the out-of-touch 1%?

Probably.

August 29th, 2014 at 2:33 pm -

PJ said:

And don’t ever forget – it was the AARP who jumped on the Obamacare fiasco EARLY when they made their sweetheart deal with the WH. They sold out their constituency for 30 pieces of silver, just for the job security of the administrators.

August 30th, 2014 at 6:40 am -

charlie said:

AARP sold out the old folks they claim to support by promoting Obama and his promise to “change the fabric of this country” They stood to gain millions from his “if you like your insurance you can keep your insurance” scheme of obama.

Their offer of “discounts” to seniors are nothing but crumbs to get you on their liberal adjenda. No thanks.August 30th, 2014 at 6:01 pm -

Mike bobier said:

First off the new definition of retirement has been changed again by the elitists in congress. It is work now until you die. They got to have somebody paying taxes otherwise the retired folks are going to realize that the Harry Reid’s and john boehners of the elitists have had their hand in the cookie jar siphoning off funds to pay for mommasita’s 15 kids and to help her illegitimate offspring in Mexico to swim across the border for free food that they get. That’s why you will never see the privatization of social security because then they won’t have the money to pay for their vote. AARP is one of the biggest Antiguan organizations there is. They say they have seniors best interests at heart but the cold hard truth is if they cared about seniors, who happen to be a group that the animals the progressives have turned loose on them prey on, then they would and should advocate the arming of all senior citizens who have their faculties about them and still live on their own..I would even go far as to say they give your dues money that you pay to support Antigun politicians who support the disarmament of not only the elderly but of every God fearing American in this country.

August 30th, 2014 at 8:28 pm -

sharonsj said:

Mike, you will see the privatization of Social Security if the Republicans (abetted by some Democrats) have their way. The Repubs have been trying for years so that their wealthy donors can make even more money at our expense.

Neither party has stopped the outsourcing of jobs, the off-shoring of tax money, or the illegal aliens. Yet the Repubs seem to be more concerned with a woman’s womb than what happens to that kid when it’s born. It’s time to head for the hills, drop out, grow your own food, and get ready for the STHTF.

September 5th, 2014 at 12:50 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!