Working for peanuts: Half of American workers earn less than $28,031 per year and household income now back to levels last seen two decades ago.

- 0 Comments

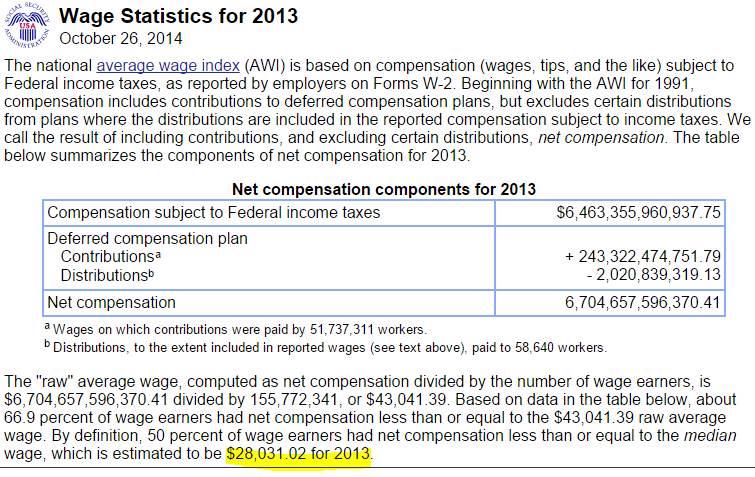

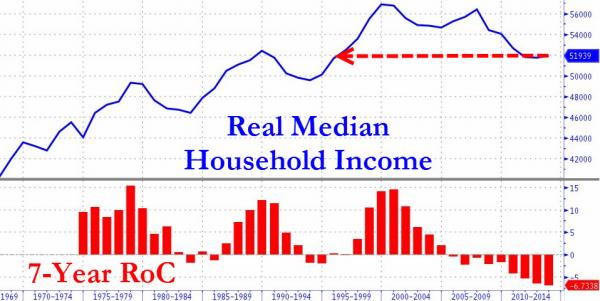

Every fall, two pieces of data are released reflecting the earning potential of American families and workers. The low wage economy has certainly taken a toll on how much Americans earn. Social Security data was recently released and shows that 50 percent of the country earns less than $28,031. This is the per capita wage. Given the high cost of living in many metro areas this is barely enough to get by. The assumption is that with the stock market doing so well, workers would also be sharing in the spoils of the recovery. Yet much of the growth in jobs have come in low wage opportunities that usually come with smaller benefits and shrinking paychecks. Adjusting for inflation households are earning what they once did nearly two decades ago. Is this truly an economic recovery? It all depends on how you define a recovery.

The middle of the road

The Social Security data reveals something telling about wages and that is, many people are living day to day and paycheck to paycheck. In many metro areas, the cost of living is expensive and people are seeing most of their income going to housing, food, healthcare, and for younger Americans student debt payments.

The Social Security data gives us a peak into the earnings of the nation:

Source:Â Social Security

$28,031 is the median point here. Not exactly a solid wage given the cost of other items in the economy. There are many colleges that now charge $40,000 to $50,000 per year in tuition alone. So you have a tough cocktail here between younger workers earning lower wages but at the same time, needing to service high levels of student debt. This is putting a drag on younger Americans.

Ultimately what most people look at when it comes to income is what they net per paycheck. Sadly paychecks are being squeezed because of the slow power of inflation. When all is taken into account Americans are simply using debt in the form of student debt, mortgage debt, auto debt, and credit cards to continue to pretend they are part of a robust middle class.

The middle class has taken a big hit in the last two decades:

Where did things go wrong? First, there is too much risky business with debt products. Many items with the implicit (or explicit) guarantee from the government are forcing the underlying costs of the good to go higher. Think of student debt and housing. The current financial system is creating odd incentives that in the end, are failing the public.

The typical US household earns around $50,000 according to Census data. But this is gross income. Subtract payroll and federal taxes, benefit costs, and other items and people see a lot less hitting their accounts on payday.

The low wage economy has pushed many people into working for relatively low wages in comparison to the cost of living in the nation.  Inflation is a subtle way of robbing the future to pay for the present. We are taking much from younger Americans to support the current financialization of the current system. So it comes as no surprise that wages are simply not keeping up. More data to highlight the discrepancy between Wall Street and Main Street.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â