Alan Greenspan on $100,000 White-collar Comedy Tour: Quantitative Easing and Changing our Economic and Financial Language.

- 1 Comment

Alan Greenspan continues his White-collar $100,000 speaking fee comedy tour in which he tells the audience that he had nothing to do with the housing bubble. Those expecting to see a mea culpa concert from the former Fed Chairman are going to be waiting for a very long time. According to the majestic maestro, a low interest rate environment has nothing to do with encouraging people to borrow. This line of thinking from the U.S. Treasury and Federal Reserve is precisely the reason we created an ecology that was conducive to planting and growing excessive debt.

You would think that we have learned a lesson about excessive liquidity but the current Federal Reserve has gone even below the 1% Fed funds rate and is now hugging the zero bound range forcing the Fed to do the modern dance of quantitative easing. What is quantitative easing? When the central bank reaches the zero bound like in our current economy causing monetary easing an impotent pursuit, the central bank then begins to purchase items such as treasuries and corporate bonds from banks and other financial institutions with money it has created ex nihilo. That is, out of thin air. Quantitative easing isn’t “printing money” but the central bank does create additional credit by merely increasing their balance sheet. It is the electronic version of printing dough for banks.

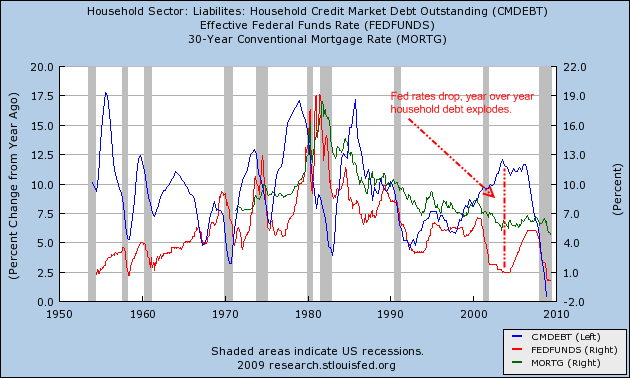

Now to blame the entire housing bubble on Greenspan is not entirely correct. However, what he did do was create an environment, with the blessing of the Federal Reserve and U.S. Treasury to create the biggest debt bubble in history. Let us take a look at how year over year debt matched up with the drops in the Fed funds rate:

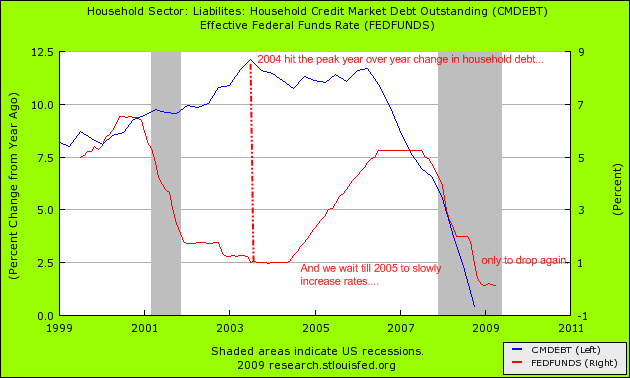

There is nothing more telling than the above chart. The year over year change in household debt moves in near perfect synchronization with each subsequent cut in the interest rate. Each cut increased debt exponentially. The market in 2004 was telling us to cool our jets with debt:

In 2004 household debt hit a year over year peak. It simply could not go anymore. The market was screaming “hike up the rate Greenie! I have green shoot smoke coming out of my nostrils!” At this point, anyone and everyone with a pulse had access to enough funds to buy any home of their choosing. We hit the comical apex of the debt bubble. The 30 year housing bubble reached a hilarious climax where no job, no income, and horrible credit meant that you were a perfect candidate for an adjustable rate mortgage with a 1.25% teaser rate (thanks Greenspan!). And of course Greenspan warned us about those toxic mortgages in 2004 that even in 2009, still linger on the balance sheets of banks like a crazy ex-girlfriend. Or did he?

“(February 2004 – USAToday) Overall, the household sector seems to be in good shape,” Greenspan said.

Americans have been buying homes and refinancing mortgages at a record pace in the past several years, lured by low interest rates. Most mortgages are fixed rate, so consumers can prepay when rates go down but do not face higher costs if rates rise. Under adjustable-rate mortgages (ARMs), which made up about 28% of mortgages in January, borrowers usually have lower initial rates but face the risk of higher payments if rates in the broader economy rise.

While borrowers can refinance fixed-rate mortgages, Greenspan said homeowners were paying as much as 0.5 to 1.2 percentage points for that right and the protection against a potential rate rise, which could increase annual after-tax payments by several thousand dollars.

He said a Fed study suggested many homeowners could have saved tens of thousands of dollars in the last decade if they had ARMs. Those savings would not have been realized, however, had interest rates shot up. ”

“American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage,” Greenspan said.”

That Greenspan. Didn’t I tell you he was on a White-collar comedy tour? In that first chart that I included above, I also put in the historical trend of 30 year fixed mortgages. You know, the traditional tried and tested kind once used in mortgage burning parties? As you can see, rates did decrease but nothing to the absurdity of the adjustable rate mortgage market. We now know how painfully stupid that move was. In fact, Greenspan also commented how great mortgage equity withdrawals had become to the vitality of our economy. This guy isn’t the main reason for the current economic mess but he was the captain of the varsity debt bubble cheerleading club.

During this debt induced decade we have also redefined a few terms in our language:

Debt has now become credit

Usage: We are currently suffering a credit crisis.

Junk bonds are now known as high yield bonds

Usage: These high yield bonds sure screwed up my 401k!

Casino has now become the derivatives market

Usage: I was going to gamble at the MGM but decided to buy some AIG derivatives!

Toxic mortgages are now known as legacy assets

Usage: I hate toxic mortgages but man, I can’t get enough of these legacy assets!

Creating money out of nothing is now quantitative easing

Usage: I despise creating money out of nothing but I sure love them quantitative easing!

Now this is important because it has softened the negativity of what these words really signify. What we are suffering through is the bursting of a debt bubble. We have a market full of junk securities. The market is full of toxic mortgages. Yet you wouldn’t know that from the headline numbers. In fact we have 24,700,000 unemployed or underemployed Americans yet in the headline number, we only hear about the 13 million unemployed. Apparently working 10 hours a week at Wal-Mart for minimum wage is considered fully employed. This would be a prime candidate for Greenspan’s wonderful adjustable rate mortgage product of yesteryear. Income stagnant or dropping? Go into debt!

Greenspan is the epic debt creator and is so good at filling a room with nonsense that he can fool people into paying him $100,000 for yapping about his legendary monetary failures. Like the Wizard of Oz, except in his tool box he has monetary easing and interest rates and his road is paved with quantitative easing. Time to finance those ruby red slippers.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Phinance said:

I don’t like Greenspan and his lax monetary policies, but everyone is to blame from this. RE agents, buyers, banks and lenders, government officials, lobbyists claiming everyone “deserves” a home, etc.

May 20th, 2009 at 3:16 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!