Downey Savings and Loan: The Anatomy of an Option ARM led California Banking Disaster. Other People’s Money Delusion.

- 1 Comment

On June 15, 2009 the Office of the Inspector General issued their audit report regarding the failure of California’s Downey Savings and Loan Association (Downey). Now the story of DSL is important because it highlights the entire process of how we came to this financial crisis that now threatens the economic stability of the world. The market volatility that we are seeing is merely a reflection of what institutions like Downey dabbled in with their love affair with toxic mortgage assets. And California now has an 11.5 percent unemployment rate which is the highest in record keeping history. If we look at alternative measures, the state is probably closer to a 20 percent unemployment rate. Yet the 71 page report issued by the OIG is probably only being read by a few people. This report tells us much and gives us solutions as how to approach this problem.

Downey was taken over on November 21, 2008 by the FDIC at a staggering cost of $1.4 billion. This puts it into the top ten most expensive institutions taken over by the FDIC during this crisis. It is fascinating to note that in the report, we are told that the primary cause of Downey’s collapse was its high concentration of option adjustable rate (ARM) loans and its lack of documentation in loans:

“The primary causes of Downey’s failure were the thrift’s high concentrations in single-family residential loans which included concentrations in option adjustable rate mortgage (ARM) loans, reduced documentation loans, subprime loans, and loans with layered risk; inadequate risk-monitoring systems; the thrift’s unresponsiveness to OTS recommendations; and high turnover in the thrift’s management. These conditions were exacerbated by the drop in real estate values in Downey’s markets.”

This shouldn’t be a surprise to many. Yet the policy implications should be clear as day. There is no reason for these toxic mortgage products to exist. And the way we are currently handling the problem will only ensure a deeper and more prolonged battle. First, banks will get the message fast if the government stops buying or subsidizing any of these toxic assets. Banks will learn quickly never to make these loans again if we allow those institutions like Downey to fail completely because of their own decision to jump into this segment of the market. Instead, we are developing a public-private investment program designed to buy up these toxic products. What does this teach banks? It teaches them that making toxic products available is a worthy risk to take because if things get bad like they are in this current recession, then the government will bailout their risky behavior. The major losers here of course are average American taxpayers.

When Downey failed it had $12.8 billion in assets. I question the worth of the assets but that was the book value. Downey was a big player in the California housing market and was a player in the toxic mortgage waste that pushed the median price of a California home to the near $600,000 median price during the peak. Now, the median price is in the low $200,000s. They of course shifted from making more traditional loans to ever more toxic products that simply imploded the bank for short-term gains.

As we read the report, we are told that the OTS made constant recommendations to the bank but of course, the OTS was stripped to the very minimum because of bank lobbying over the past decade. The policy implication here becomes radically clear that if we are to have a legitimate oversight board, it must have the power to enact regulations on the books. That is probably one thing many people fail to understand right now. Many of the regulations necessary are already on the books. Yet the bodies governing these policies are so weak and pathetic, that banks were able to ramrod legislation that essentially made them shells with no ability to enforce the laws.

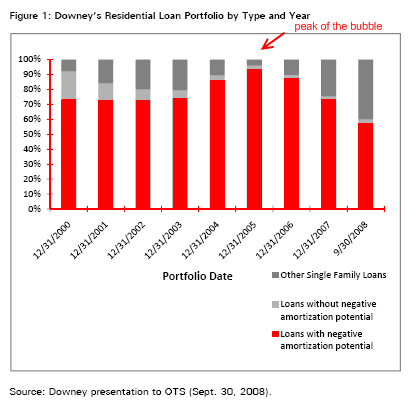

Downey by the end of 2005 at the height of the bubble had 91 percent of its single family home loan portfolio in option ARMs. They basically went 100 percent with this toxic product. 73 percent of Downey’s option ARMs had negative amortization potential which of course did occur and imploded the bank. Just take a look at this stunning chart:

And as the chart shows, Downey was in the game early on. Thus, their recast of 5 years on their typical option ARM started imploding much earlier and led to their demise in 2008 even before the major wave of option ARMs will swarm the market in 2010 through 2012. The disturbing facts also come out regarding teaser introductory rates which artificially allowed people to buy more home than they could afford. With the availability of “no-doc” loans anyone with a desire to get a loan got one. The fact that 91 percent of their SFR loan portfolio is option ARMs is appalling. Institutions here in California basically created a casino with housing even though agencies knew of the longer term implications. In regards to policy, this gives us clear implications:

1. Do not bailout any mortgage product that is an option ARM.

2. Government agencies overseeing these institutions must have teeth to act and stop companies before things get out of hand. Imagine the police with no power to enforce the laws on the book.

3. Clearly these products had no life outside of the bubble. They should be labeled as

such and any institutions engaging in these products goes forward at their own risk. No bailouts ever.

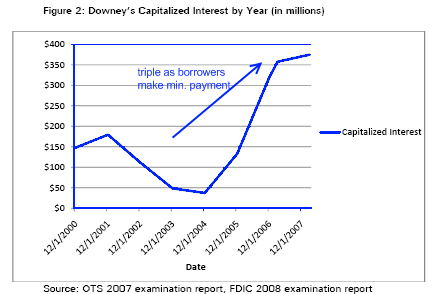

And of course, the method of accounting allowed the bank to book capitalized interest as income even though borrowers were electing to pay the very minimum which in reality, meant the institution was getting closer and closer to the end:

The policy implication is clear. This was never income. How in the world banks could be allowed to do accounting this way is insanity. Yet much of the first quarter of 2009 profits booked by banks were because of the suspension of mark to market and this kind of accounting shenanigans. We have learned nothing. The policy implication is clear. Banks should not be allowed to book these items as income.

The chart below shows the insanity reached by institutions like Downey:

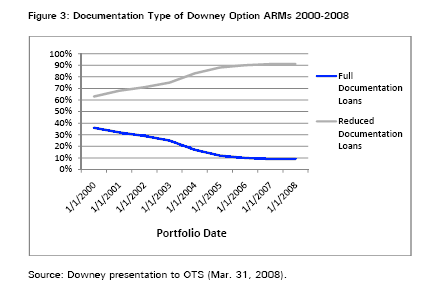

Even as problems started rising with Downey, up into 2008 over 90 percent of loans made were with reduced documentation! That is, the vast majority of their business was liar loans. Now, these are the potential loans that we will be buying through the PPIP. These are the loans made to speculators and people delusional in California thinking that $600,000 home prices were justified. These loans should fail and through foreclosure, the market will find a price for them. The PPIP by all means should have a clause banning any purchase of options ARMs or Alt-A products. End of story.

The report tells us that by the end of 2007 the option ARM portfolio started facing major stress. Yet Downey as the chart shows above kept making those loans. Why? The system was built on casino like rules. Mortgage brokers kept selling products that yielded the most for them while putting the most risk on the borrower. Management was chasing profits so they didn’t care. In the end, it became an ultimate moral hazard. If banks are required to hold these loans, this will not happen. Just use common sense. Would you lend your money out like this? Of course not. But this was the “other people’s money” delusion pumped out by late night real estate snake oil salesman that became mainstream for the decade.

The fact that the report tells us that Downey was unresponsive is a joke. This is like a person speeding down the highway going 100 miles per hour not “responding” to a cop and his siren. Do you think the cop would just let him go and say, “oh well, I’m sure he’ll slow down later.” It is this kind of nonsense that has made the banking industry the ultimate oligarchy in our country since they are not only guiding policy, but writing it. The case of Downey Savings and Loan gives us clear policy implications yet we are not following what is in front of us. If we keep letting the banks loot this country with the aid from the U.S. Treasury and Federal Reserve, there will be a repeat of this kind of bubble in a few years in some other industry.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Jaime Lopez said:

I no longer have my home , question is do the executives of Downing Savings and Loan still have theirs?

I was one of the fools that did not understand what I was doing when I took on this home loan.

We had a fixed home loan due to be paid off in ten years, never late pay, credit scores of 780, now lost our home, near retirement, no money, bankrupt, what to do? No one has answers.

We were the good people, doing everything right, following the american dream, and going the extra mile.

We were foster parents, and bought this house with the soul purpose to raise children that others could not, 35 children were raised in this house. Right before we chose to get a new home loan, we now had 5 teens all had lost other homes because they were unable to maintain for some reason,acting out, fighting, etc. we were able to get each turned around and stablized. We decided we could use a pool to help these children bond.

That was our mistake, we never recoved once we signed on the dotted line.

All these children lost their homes, their schools, their friends, bedrooms, beds, even our family got torn apart.

Has anyone asked these executives how they were able to sleep at night in their own beds knowing how many families got left out on the streets? These children were at the cross roads of their lives trying to make hard changes and make a better life, only to have it all taken away by an unconsionable act from a coward. Jaime Lopez x foster mom San Jose CalifAugust 3rd, 2012 at 8:09 am