The Doctrine of Preemptive Bailouts and the Biggest Bailout you haven’t Heard About: The U.S. Treasury Plan C and the $3.5 Trillion You will be Paying.

- 9 Comment

Last week a story which gained very little traction hit the financial newswires. The U.S. Treasury is working on an internal project informally called “Plan C” which seeks to deal with further problems in the economy before they occur. The anonymous report came out stating the administration is reluctant to commit any additional money especially to the level mentioned in the report. However this is a disturbing new development in our bailout nation since this is one of the first times that the U.S. Treasury will try to preemptively deal with a financial problem.

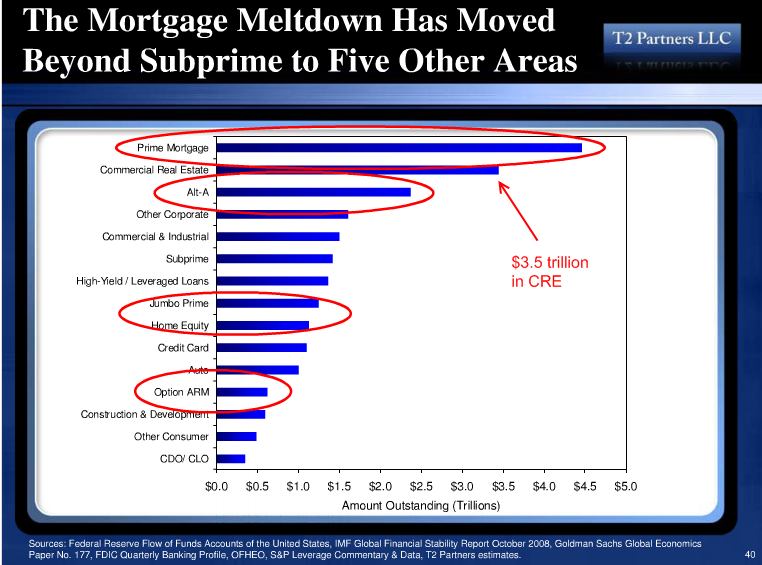

The issues with this Plan C is that it is setup to be a buffer on further deterioration in various loan categories but the big one is commercial real estate. The commercial real estate market is gigantic and many of those loans are still active:

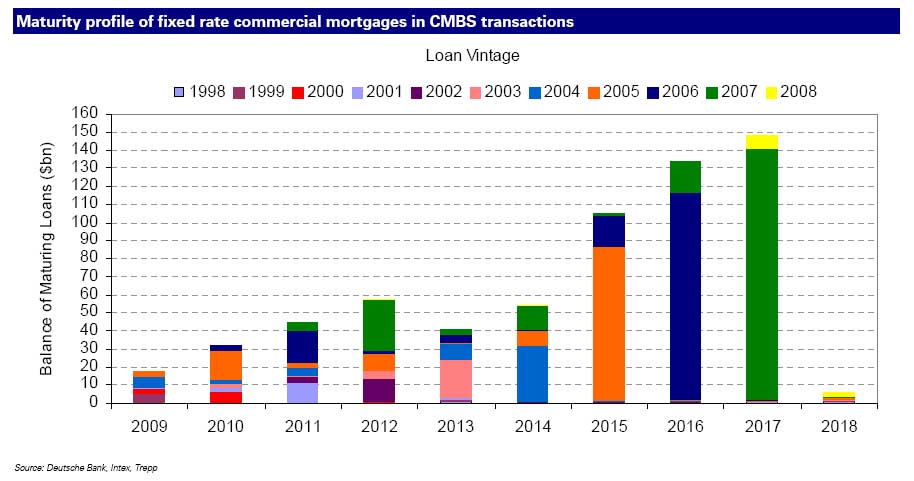

Some $3.5 trillion in commercial real estate loans are out in the market. The problem is complicated because commercial real estate holders simply rollover their debt into new loans. That of course has changed since the economy and credit markets have shutdown and many of these properties are now severely underwater. Take a look at how many loans will be turning over:

*Source:Â ZeroHedge

The amount of maturing loans in commercial real estate will double in 2010 and will continue upward into 2010. The chart is very clear and this is only for debt in CMBS and not held by regional banks which is over $2 trillion. This is the next multi-trillion dollar bailout you have yet to hear about. In fact, while many are discussing a second half recovery higher up officials are already planning a bailout for the commercial real estate industry. The challenge with this bailout is you are asking a public with 26,000,000 unemployed and underemployed Americans to shoulder the debt of largely speculative plays. To many it is palatable to bailout the residential real estate market because the public can understand that (even if it may be wrong) or bailing out the 2 large U.S. automakers. Yet bailing out the commercial real estate market is going to be a political nightmare.

Of course the U.S. Treasury would like you to believe this is merely a precaution but most of the last precautions we have heard about have turned out to be trillions and trillions in full on commitments shouldered by the American public:

“(WaPo) We are continually examining different scenarios going forward; that’s just prudent planning,” Treasury spokesman Andrew Williams said.

The officials in charge of Plan C — named to allude to a last line of defense — face a particular challenge in addressing the breakdown of commercial real estate lending.

Banks and other firms that provided such loans in the past have sharply curtailed lending.

That has left many developers and construction companies out in the cold. Over the next few years, these groups face a tidal wave of commercial real estate debt — some estimates peg the total at more than $3 trillion — that they will need to refinance. These loans were issued during this decade’s construction boom with the mistaken expectation that they would be refinanced on the same generous terms after a few years.

The credit crisis changed all of that. Now few developers can find anyone to refinance their debt, endangering healthy and distressed properties.”

The end of the road has been reached for commercial real estate. Many regional banks jumped into the commercial real estate market since they had little chance of competing with big subprime and Alt-A mortgage factories like WaMu or Countrywide. Many regional banks saw this as a way to stay competitive in local regions across the country. This is a much more diverse problem and the tentacles of the commercial real estate bust will be felt in every state.

These loans were made on strip malls, doctor’s offices, and drive-through restaurants for communities that are hurting from the recession. This is an enormous amount of debt that is out there that will surely default since there is no way to refinance this debt since many of these projects are literally underwater. Take a look at the composition of over 8,000 banks and thrifts across the country:

Factoring in construction and commercial loans you arrive at a stunning 26 percent of all loans in FDIC banks and thrifts. This is a staggering figure and the U.S. Treasury is well aware of this. The question isn’t whether there will be major defaults here but who will shoulder the cost? So far, each consecutive bailout has largely been taken up by the U.S. taxpayer. The problem of course is the cost of all these bailouts will eventually catch up through a tanking dollar and possibly the long-term viability of our economy. Plan C is a preemptive bailout on an entire industry. The reason the government is devising a plan is that these loans will start going bad in large amounts and they are gearing up on a process of dumping this large mess on the American people. Yet it is going to be a politically hard sell for many to bailout a strip-mall from some large developer.

And make no mistake, the market for commercial loans is all but closed:

You are reading the above graph correctly. In the 1st quarter commercial loans fell by a stunning 50 percent on a quarterly basis.  And the amount of bad loans is only growing:

If you haven’t heard of Plan C you soon will. The commercial real estate bailout is the next ploy from Wall Street and the U.S. Treasury.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

Robert Thurber said:

All I have to say is this ‘GREAT government we have (lol) is a f00king joke. Their motto is “Fail to plan or Plan to fail”

Reality check folks

July 14th, 2009 at 5:59 am -

Stu said:

This is a wonderfully written article on where we are heading in terms of future debt. If you allow me to indulge myself, I would like to offer up some opinions on some of your comments.

From your article you said:

“However this is a disturbing new development in our bailout nation since this is one of the first times that the U.S. Treasury will try to preemptively deal with a financial problem”

When did the U.S. Treasury get the power to set policy and dictate arrangements? I realize that our U.S. Congress is as dumb as a rock and totally incapable of managing, presiding over, controlling or any other form of being in charge, but they are the governing body… er they used to be any how?

Your chart showed the following:

CHART: “2015, 2016 & 2017 show vintage loans from the exact same period that the Subprime implosion was and continuing with Alt-A, Jumbo Prime, and Prime now blowing up” It says “Years 2005, 2006 & 2007 are the vintage dates of the majority of these loans”

All I can say is WOW!!! We already know from history what we can expect from Subprime residential home loans and starting in 2015 we will be witnessing the equivalent in Subprime commercial building loans implosion which will be much worse than residential in so many ways. For starters can you say jobs…

The residential home reset schedule takes us through 2015 if I am not mistaken, so we pick up right from there with commercial by your charts and estimates. That places us in a situation far worse than the lost decade of Japan. When we finally clear out the last of the residential housing debt losses (well maybe not in the banks via the Fed unfortunately) in roughly 2014 / 2015, we will be crushed in the next 3 years with unprecedented commercial loan defaults that will make the last 5 or 6 years look like childs play in terms of how to deal with it.

This quote was quite commical:

” “(WaPo) We are continually examining different scenarios going forward; that’s just prudent planning,†Treasury spokesman Andrew Williams said”

Try something called a balanced budget. I do believe it should be your main charter as an agency. Never allow printing / borrowing without the resources available within the vault. Our vault is empty… GET IT!!!

This paragraph is stunning:

“The amount of maturing loans in commercial real estate will double in 2010 and will continue upward into 2010. The chart is very clear and this is only for debt in CMBS and not held by regional banks which is over $2 trillion. This is the next multi-trillion dollar bailout you have yet to hear about. In fact, while many are discussing a second half recovery higher up officials are already planning a bailout for the commercial real estate industry. The challenge with this bailout is you are asking a public with 26,000,000 unemployed and underemployed Americans to shoulder the debt of largely speculative plays. To many it is palatable to bailout the residential real estate market because the public can understand that (even if it may be wrong) or bailing out the 2 large U.S. automakers. Yet bailing out the commercial real estate market is going to be a political nightmare”

The American public has not come to terms with the reckless spending and mandated social changes to our society because they are not paying for it yet. The average joe doesn’t pay anymore than he used to in taxes or bills towards the payment of this reckless and criminal in my opinion behavior this administration is placing on peoples futures and their childrens futures… NO IDEA!!! Most people don’t pay attention until it affects them, and then they awake. By printing and borrowing money this administration has kept the general public and even the business area as well away from the feeling of the hit they will ultimately take. That is until now…

People and more importantly small businesses are starting to add it all up. They are not buying the hype any longer and are realizing that they were sold a bill of rotten goods. When the amasses awake it is really tough to place them back into a slumber. A $600 / $1200 check won’t work, and don’t dear try another stimulas if this takes hold. Don’t forget boys 2010 is just around the corner but I digress…

And finally this:

“In the 1st quarter commercial loans fell by a stunning 50 percent on a quarterly basis”

That is a number we will see replicated again and again and yet again I am afraid to report…

God speed and thanks for sharing!

July 14th, 2009 at 3:41 pm -

3trillions is nothing said:

3 trillions here 3 trillions there, that’s nothing we can’t auction.

Obama have 4 trillions auctioned so far (7/14/2009) in less than 7 months. It only takes a printing press some paper and ink, oh and the ok from Bernanke or whoever owns the FED.July 14th, 2009 at 6:53 pm -

Stock Forecasting said:

Thank you so much for such a nice detailed information…

July 15th, 2009 at 2:04 am -

jimbo said:

With low oil prices, oil companies are not investing in new production. In the meantime, current fields are entering a period of depletion. I personally believe in peak oil but what I just said is from an investment point of view. So whether or not there is/will be geological caused oil shortages, there will be under-investment caused oil shortages.

July 23rd, 2009 at 7:21 pm -

Druff said:

I believe that last 2 charts are not % changes, but $B changes (see LHS). Thus far we have seen nothing.

It will get worse, but we have yet to see the real pain yet.

July 30th, 2009 at 11:17 am -

Pissed said:

Doesnt this pale in comparison to the derivitives problem?

July 31st, 2009 at 11:38 am -

Deak Dementhe said:

Got Gold???

August 1st, 2009 at 5:52 am -

Joe in JT said:

I bought my small house for cash. I wait for “deals” on used cars, desperate seller needing cash. I have several cars all paid for. So what’s the problem Pilgram?

Anyone who takes out second and third mortagages then uses the money for a Carnival Cruise ride deserves to live in a cardboard box.

August 1st, 2010 at 5:03 pm