American Financial Dream Deferred: How the U.S. is Mirroring the Japanese Lost Decade after the Heisei Boom.

- 1 Comment

This weekend I decided to take a trip to a couple of local stores to pick up some food that didn’t involve turkey so I wouldn’t be fatigued of eating the same thing for the entire week. A chain grocery store had about five people on a Sunday when it typically would have many more. Now this can be written off as a random case given Thanksgiving but this pattern has been hitting for a few weeks. After that I decided to stop by a local dollar store to pick up a few items. The place was so full that I had to wait for parking. This is the reality of the recession. Deferring higher end spending for more low cost goods. Even with recent reports we are seeing that holiday shoppers are buying but not at the high end. With unemployment still stubbornly at the peak it is expected that families will be cutting back on spending.

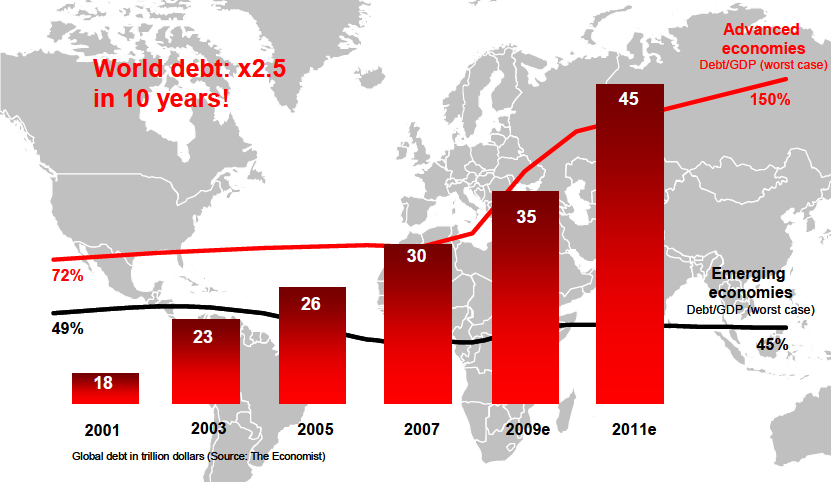

Comparing this crisis to the Great Depression may not be appropriate aside from the fact that we have high unemployment and an insolvent banking system. The U.S. Treasury and Federal Reserve have jumped in with all their ammunition to save the banking sector. The only problem is they forgot about the average American and the economy that we live in. As we go deeper into this crisis and already have a hint as to how policy will play out it is turning out to be very similar to the Japanese contraction and lost decade(s). Global debt is growing at breakneck speed:

Source:Â Societe Generale

By 2011 global economies will have close to $45 trillion in debt. Is this a far stretch? The U.S. already broke the $12 trillion mark. In order to compare our current crisis with Japan it is important to understand the history of their boom and bust:

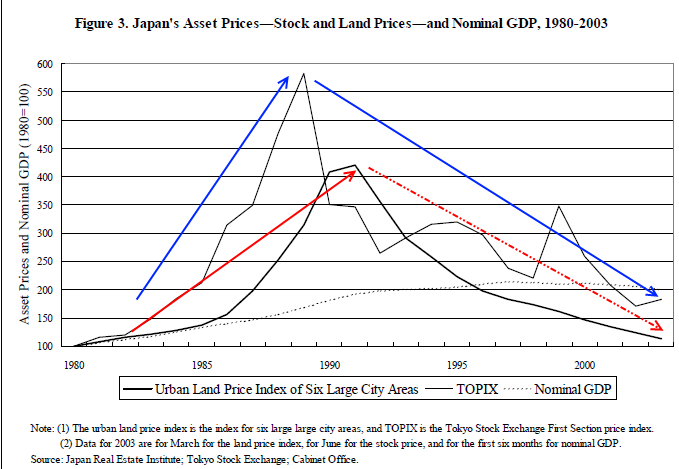

“(Baseline Scenario) At a high level of generalization, the causes of the bubble were similar to those we have just seen. Loose monetary policy (in late 1980s Japan, and in the U.S. this decade) and high savings levels (by Japanese households in Japan’s case, China and oil exporters in ours) created a large pool of money looking for investments to buy. Rising prices encouraged speculation in both real estate and stocks. Poor underwriting standards – due to some combination of government direction of investment and self-dealing within industrial and financial conglomerates – and an unconditional willingness to lend against real estate as collateral meant that banks made hundreds of billions of dollars’ worth of loans that were sustained solely by rising prices. When prices fell, those loans lost most of their value, crippling banks’ ability to lend to creditworthy borrowers and choking the economy. The lack of credit, combined with the negative wealth effect of collapsing asset prices, dampened economic growth, which averaged 1% per year for the 1990s.”

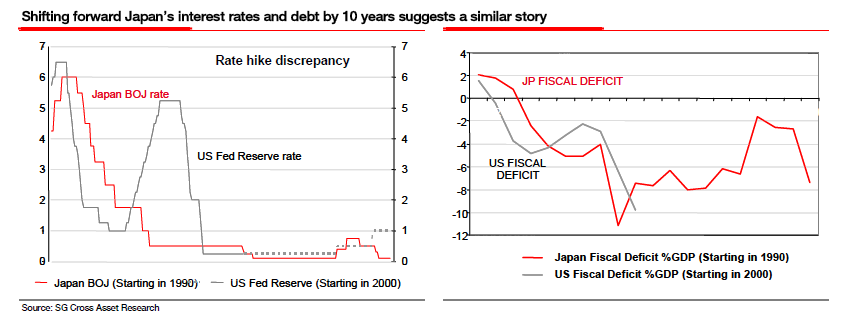

It is important to note that Japan has been in a multi-decade malaise. No “V” shaped recovery but a very long “L” situation. Japan’s government sat back initially but then decided to bail out the banks and infuse massive amounts of fiscal stimulus. The Bank of Japan like Alan Greenspan and Ben Bernanke slashed rates to their zero bound:

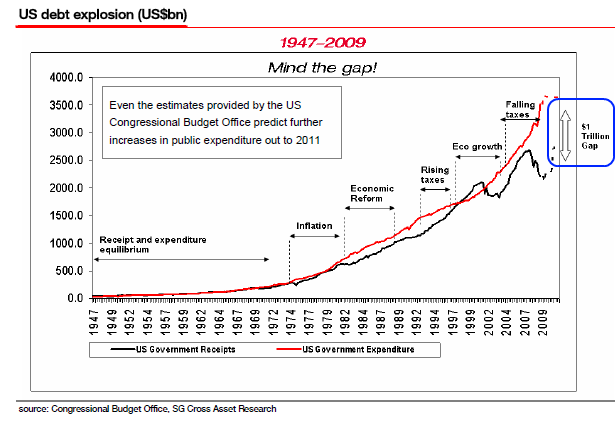

The above chart shows a similar path. The big difference of course is the minor push up in the early part of this decade but this occurred in the back drop of a booming stock market and real estate bubble. Japan has been in the doldrums since the late 1980s. In fact, if you look at the chart above Japan has held onto record fiscal deficits for years and we are now following a very similar path. Our current budget deficit of $1.4 trillion is enormous:

Japan contented with a busted stock market and crashing real estate sector with bailing out an insolvent banking industry and also, pushing rates to the zero bound. The idea of letting banks keep overvalued assets at peak prices is something many of us are now getting familiar with. With $3 trillion in commercial real estate, much of it overvalued, it will be interesting to see how banks move on this. If current actions are any indication, banks are merely going to delay mark-to-market and value assets at inflated prices. This did not work for Japan. Why? The banking sector became a vampire leeching off the productive sectors of the economy. They couldn’t put their assets on the market because it would render them insolvent. In the end, it stunted growth. Keep in mind that Japan also managed to stay somewhat prosperous because it was able to export into a booming global economy. Demand for goods such as Toyotas, Hondas, Sonys, and other high cost goods was strong. But these are higher end products that typically ship to wealthier economies. How will they do in the current global contraction?

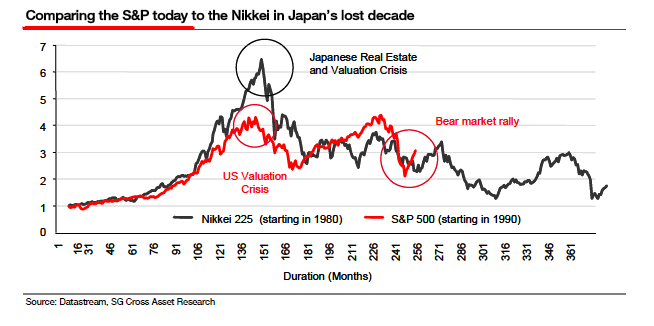

The stock market path of the Nikkei and S&P 500 seems similar:

Over 20 years and the Nikkei is no where close to the peak reached in the late 1980s. It is possible to muddle through for a very long time. In fact, the Nikkei has been moving sideways with a tendency to the negative for 20 years. The current stock market rally does not reflect market fundamentals and is merely a reflection of all the liquidity injected into the system. But like Japan, all this does is keeps an insolvent banking sector walking for a few more years while the overall economy stays in a frozen pattern:

“One of the major barriers to expansionary policy was the weakness of Japan’s banking system. The asset price collapse and economic slowdown meant that increasing proportions of their loan portfolios became non-performing. Because writing down these loans to their true market values would have caused banks to become insolvent, they kept them on their books, rolling them over (extending bad loans indefinitely) in order to avoid having to take writedowns. As a result, the banks were severely undercapitalized and largely unable to engage in new lending. It was only in 1998 or 2003 (depending on whom you ask) that the government got serious about cleaning up the banking sector, letting weak banks fail or forcing banks to accept new government capital.”

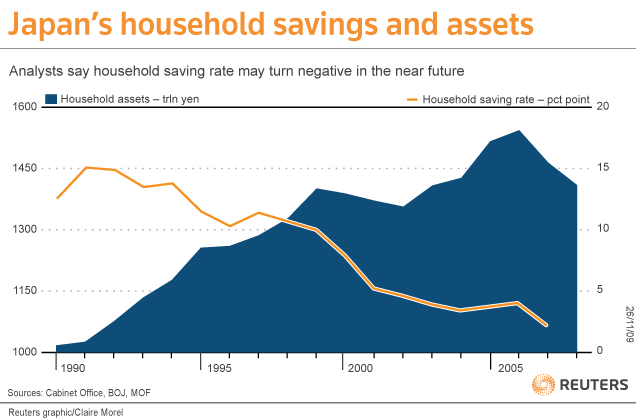

This is all sounding very familiar. Yet talking with friends about this, many dismiss this out right and say “well in Japan, they are big savers so they can do this.” In reality, as Japan’s population has aged the savings rate has reflected the U.S.:

Analysis expect this rate to go negative:

“(Forbes) Japan has lived beyond its means since the 1990s thanks to massive domestic savings. Households own 1,441 trillion yen ($16.3 trillion) in assets, mostly deposited in banks, which then buy JGBs. Foreigners hold about 8 percent of outstanding JGBs.

An ageing population has eroded the savings rate to about 3 percent from more than 10 percent a decade ago and household assets have declined about 8 percent from a 2007 peak, mainly because share prices plunged after the global financial crisis.

Demographics suggest the savings rate could turn negative in a few years.

‘Like the United States, we will need foreign investors at some point,’ said Koji Ochiai, senior market analyst at Mizuho Investors Securities. ‘I doubt they will be attracted to such low yields.”

And this isn’t so different from the U.S. American household net worth has taken a major hit of $12 trillion in this crisis but it is still sizeable in terms of real estate, stocks, and savings. And this ties in with our big group of baby boomers. They will draw down on their savings and stocks in retirement. That is after all what a 401k, 403b, or pension is for. To become your income in retirement. But many are realizing that with stocks lower and the economy uncertain, some will have to defer that American dream of retirement or at least taper it down.

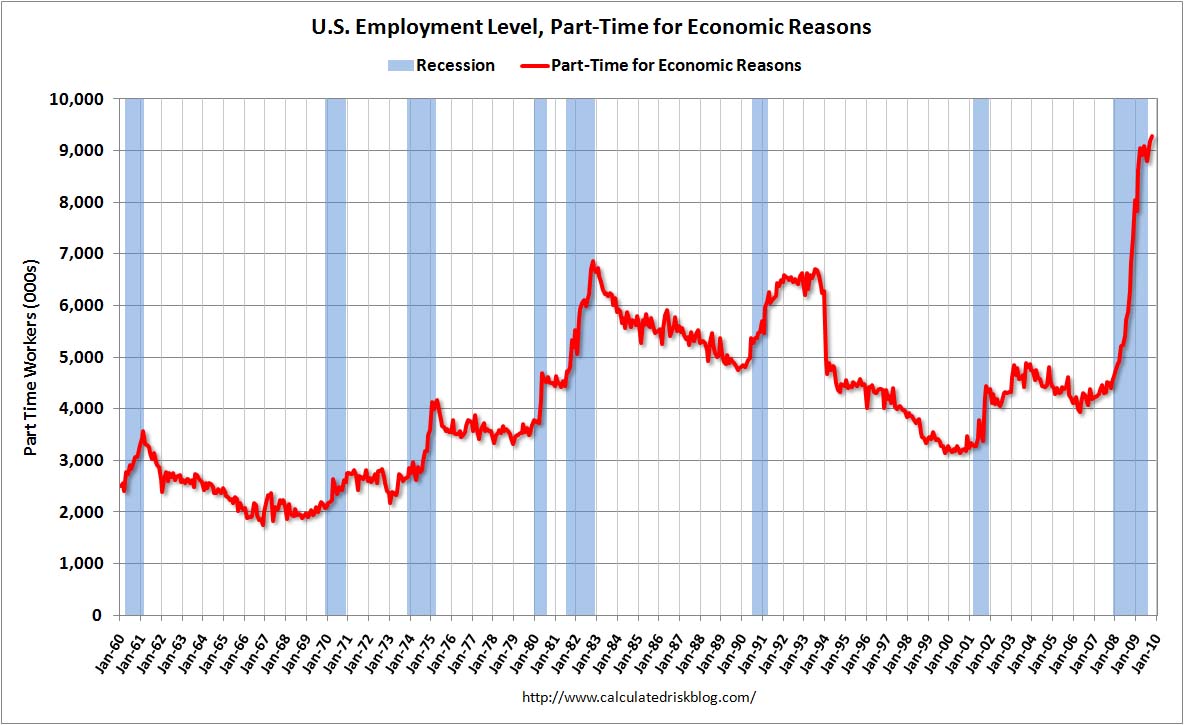

The U.S. Treasury and Federal Reserve are gambling with the U.S. dollar. They believe that they can systematically devalue the dollar and slowly allow inflation to wash away our massive amounts of debt. Japan tried this. It hasn’t worked. Now, with savings dwindling and the global economy depending less on exports, they are in a deep mess. The U.S. is in a tough spot. What many people don’t know is that in Japan, one-third of all workers are part-time workers. The headline stats always show a low unemployment rate but these people are counted as fully employed.  One thing we have seen spike in our current recession is the rise in part-time employment:

Source:Â Calculated Risk

This is the highest percentage of part-time workers we have had on record. And there is no sign of this trend reversing. If Japan is any guide, this is going to be a permanent reality of our new economy. No job security, minimal benefits, and multiple jobs throughout one lifetime. If we stay on the current path doing everything Japan has done, why are we to expect a different outcome? Remember the big deficit we currently have? Where revenues don’t even come close to matching spending? Take a look at Japan:

At a certain point, the two major carry trade currencies in the world are going to meet their maker. No country can spend this much without higher interest rates. The current low zero bound market is more a reflection of global fears that still remain. But there is ample evidence to examine Japan and our similarities. Major stock market bubbles followed by major real estate booms and bust. And Japan has demonstrated that real estate can remain depressed for 20 years:

What Japan might have bet on was some sort of asset appreciation. This way, at least some of the value would be regained but that didn’t come to pass. The U.S. Treasury and Federal Reserve is betting the entire country on this and putting their entire faith in the banks. But without jobs why are we to expect that home prices will go up? With less people buying goods, why are we to expect commercial real estate to boom?

The American dream is being deferred. Japan had their dream postponed for two decades and it looks like they are entering a different phase of their downturn. With our lost decade on hand already, is it possible we have another decade of stagnant growth? Until we start seeing job and wage growth, Japan might be an outline of our future. The American and Japanese dreams are looking very similar.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Azeem Jiva said:

Not sure where you live, but I went to the Central Market (highend, organic grocery store) in Austin on Sunday and it was PACKED. There are lots of variances between cities and some are weathering the recession better than others.

November 30th, 2009 at 7:32 am