A nation in the pangs of deleveraging – The long-term trend of a declining dollar and a collapsing middle class.

- 3 Comment

As Americans go out to vote many go blissfully unaware of the reality that our total public debt is now above $16.2 trillion. If your only source of information was the mainstream press this fact rarely came up in any debates or journalistic investigations. The discussion of stagnant household income never even came up in any of the important debates. It was all simply accepted that the decrease in the standard of living was somehow a normal part of the process. The squeeze in the middle is so extreme that we have dollar stores symbolically cropping up in places like the Silicon Valley and Beverly Hills. Rich and poor but very little left for the middle. While momentum continues to ebb the economy forward we are entering what you can describe as stagnation. An economy limping along while American households slowly undergo a painful process of deleveraging.

The great deleveraging continues

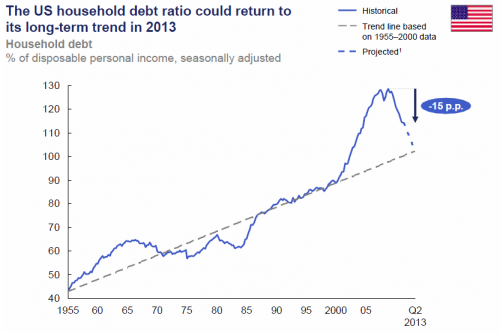

US households continue to deleverage as they undergo bankruptcy, foreclosure, and simply paying off existing debts. The appetite for new debt has been largely capped as the banking system recapitalizes through various subtle bailouts. The same result has not occurred for US households:

US households are still highly levered with debt. The system is lubricated by the machinery of debt. This is why at the core of the crisis the issue of debt was so vital. If you remember during the heart of the financial panic all the excuses given to bailout banks with blank checks were to “keep the credit markets going.â€Â But keep them going for what group of people? The American public has been largely deleveraging to adjust to the new economic reality while the banking sector has the most favorable access to debt in modern history courtesy of the Federal Reserve.

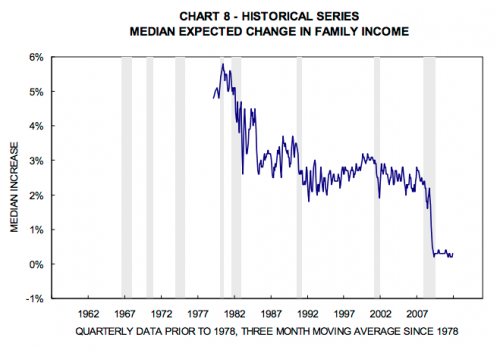

The great stagnation can really be seen if we look at actual household income:

Since the 1970s household income growth has been shrinking year after year. Proponents of a weak dollar hypothesis need to look at data like this and ask again why a weaker dollar is good for America. It is clearly good for a select group of people but overall, it has been a crushing blow for the middle class. Things were heading lower and lower until they have finally stalled out.

The 2000s were a period of reconsideration and people simply did not want to believe that income growth was stalling out so debt was the solution. You build up credit as a nation. The US as the biggest economy in the world has latitude here but we went ahead and turned our entire economy into a debt based casino. The days of yanking money out of homes for vacations and cars was simply a method of spending years of future income in the moment. That bill is now here and the ability to finance it all with debt is growing weaker and weaker.

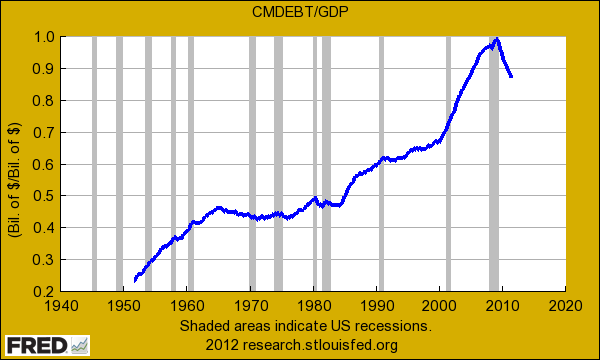

One good way of measuring this is looking at household debt and GDP as a ratio:

Since the 1950s the trend was rather clear. Then we peaked out in the 2000s. The US has reached a peak debt situation. So to keep on spending without actual production would likely lead to a similar outcome down the line. So as people go out to vote we need to remember that this is a multi-decade long trend. We are going to need more than one election to change this trajectory or we can get used dealing with more of the same for the middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Paul Verchinski said:

All debt is not equal. Our debt we largely owe to ourselves. The Chinese have around $1.1 Trillion. Japan owns 1.0 Trillion. However, the Fed owns about $6.3 Trillion. The rest is owned by public and private investors based in the US. In other words. most of this we owe to ourselves.

November 7th, 2012 at 6:55 am -

clarence swinney said:

Thanks always the best

November 7th, 2012 at 7:29 am -

household manager said:

Thank you for the nice piece of information here.

November 10th, 2012 at 5:00 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!