Americans are slowly creeping back to their non-saving and debt based spending ways: Drop in the savings rate and shift in type of debts being taken.

- 3 Comment

The personal saving rate in the United States is on a multi-decade decline. Part of this has to do with Americans putting their money into alternative savings vehicles like 401ks and IRAs but a large part of this has to do with Americans simply not saving. Roughly one-third of US households have no savings to speak of. After the recession hit, the savings rate increased as Americans were forced to save money as access to credit halted and many started moving money away from stock invested vehicles. Yet this minor trend lasted only a few years. Americans are back to their debt spending ways but the type of debt that is being used has shifted. One of the big drivers of debt growth in our current economy is student debt. Credit card debt growth has slowed down but with the housing market turning around, more Americans are going into mortgage debt again. Are we setting up another debt crisis and are we forgetting the lessons of the 2000s?

The drop in the savings rate

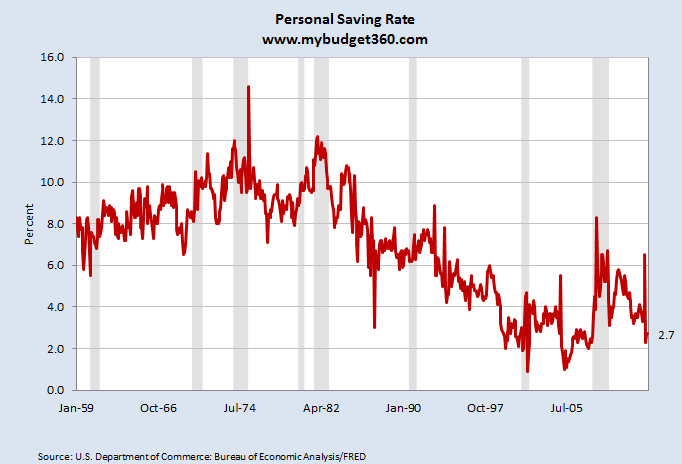

The personal saving rate in the US hovered around 8 to 10 percent from 1959 to the early 1980s. At this point, the trend definitely shifted much lower as Americans exchanged savings for purchases to using debt to finance immediate buying. At certain points in the 2000s we had a negative saving rate as people spent more than they earned. Today the personal saving rate is down to 2.7 percent. Assuming a household makes $50,000 a year gross, the total money saved in the year is $1,350. And we are being generous here looking at gross income and not after tax income.

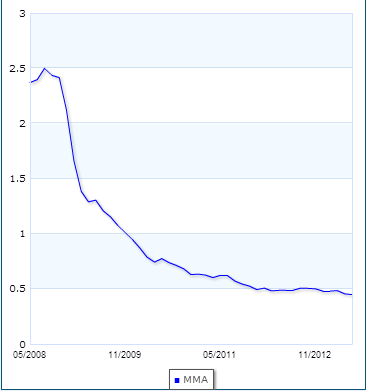

One of the major reasons for this drop coincides with the drop in interest rates:

Money market funds that pay better than regular bank saving accounts are paying about 0.5 percent interest. At this rate, inflation is eroding your savings and the money market account is basically a placeholder for your money. Keep in mind that regular bank saving accounts are paying close to zero percent. The Fed has setup an environment where people that save through these conservative channels will lose. That is guaranteed simply by inflation eating away your purchasing power. So many people are spending but do not have the income from savings to do this. Many are opting to spend via debt.

New forms of debt

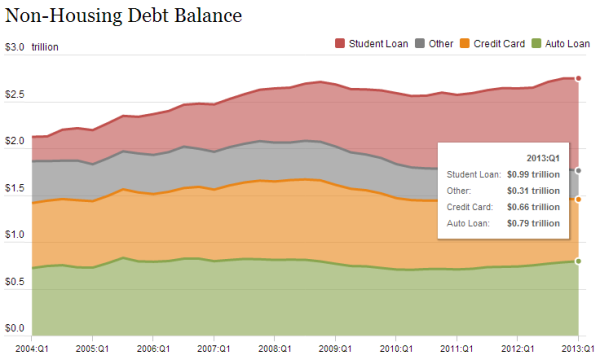

The biggest increase in debt for non-housing debt is coming from student debt:

Source:Â New York Fed

Student debt is now well over $1 trillion and is the largest non-housing related debt in our country. Credit card debt, auto debt, and other kinds of debt have only modestly grown since the recession ended. Student debt has gone on an unrelenting path upwards adding close to $800 billion in debt over the past decade. This is a problem especially when many graduates are finding their more expensive degree is not yielding the returns they expected in the current market. Unlike a car or a home, there is no collateral after you have a degree. You need to think wisely about the degree you pursue and how deeply in debt you are willing to go.

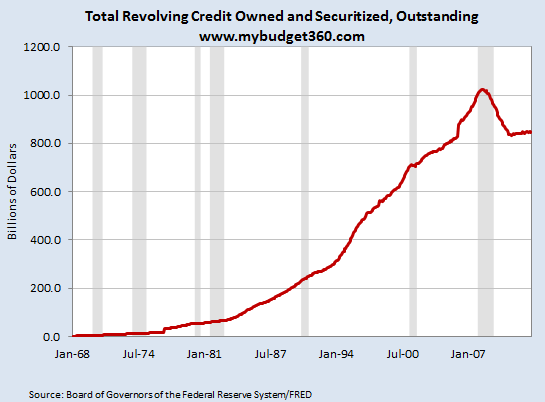

Credit card debt doesn’t seem to be the new choice of debt either adding more evidence that student debt is the big drag in the current debt economy:

After touching $1 trillion revolving credit, mostly through credit cards, has pulled back since the recession hit. Student debt is not exactly a big help given that credit card debt at least went to consumption and added fuel to our economic engine. Student debt is a drag on the future consumption power of young Americans especially when many are exiting with degrees that provide very little benefit in the current economy.

So it looks like student debt is the big culprit here and Americans are back to embracing debt but a different kind of debt. Student debt is expanding and so is mortgage debt courtesy of low mortgage rates. However combined with a low personal saving rate we are looking very similar to the last decade where spending through debt was a big reason for economic growth. Unless households actually see some real gains to their incomes we are simply setting up for another debt based crisis.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Ulysses said:

Re: The personal saving rate in the United States is on a multi-decade decline.

Forget about all these charts and graphs and homilies and look at the realities for a change.

With a fiat currency which has lost over 90% of its purchasing power over the last four decades and counting, with a Federal Reserve which is determined to keep eroding it with institutionalized inflation (a/k/a QE) and with artificially depressed interest rates designed to discourage saving, what is so surprising about it?

In fact, in a fiat (phony) currency based economy where financially responsible behavior is penalized and irresponsibility is rewarded, saving is not only futile and meaningless, it is positively suicidal.

People are not stupid and will instinctively do whatever is needed to protect themselves from official insanity and if you want them to save then fire their lunatic policymakers and give them something worth saving.

May 27th, 2013 at 6:44 am -

RUSS SMITH said:

Hi!, Patrons Of My Buget 360 Et Al:

It seems irrelevant to me to blame OUR forward looking students; when they know that they have a pre-determined time line in which to acquire their degrees etc. don’t you agree? If they were provided better options they would choose them wouldn’t they? It’s one thing to point out the different direction in which people are choosing debt but it’s quite another to realize that part of this is due to OUR unbalanced economic system that now limits students’ choices or they can walk away from geting their educations? Please tell OUR economic system to change in behalf of our over burdoned with debt students trying to acquire their educaions so that they can help the hbalance of societ build a better futrue for all.

RUSS SMITH, CA. (One Of Our Broke Fiat Money States)

resmith@wcisp.comMay 27th, 2013 at 10:53 am -

Maggie@SquarePennies said:

Young people know they will earn more with a college degree than without. Students need to pick majors that will pay enough for them to pay off their loans. Debt from a college education still takes a lot of time to pay down, but young people are making real commitment to do so. I think the government should subsidize college tuition for the good of the society and the economy.

May 28th, 2013 at 8:00 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!