Only 4 out of 10 Americans has enough in their savings to pay for an unexpected expense: Half of the country is living paycheck to paycheck with no retirement plans.

- 0 Comments

There is little motivation to save when your local bank is offering close to zero percent on your savings account. And most Americans simply do not invest in the stock market. When it comes to saving money it is crucial to get into the habit of putting funds away for unforeseen events and expenses. Life has a way of bringing on unexpected expenses. The transmission falls apart, an unexpected illness, or having the roof blown off during a storm. All of these cause short-term disruptions to your balance sheet. Contrary to what the media portrays, most Americans are horrible savers. In fact, only 4 out of 10 Americans have enough in their savings accounts to pay for an unexpected expense. So it should also come as no surprise that half this country is not adequately preparing for retirement and will be depend on Social Security as their main, and for many only source of income in old age. Why do Americans save so little?

The lack of savings

Most people realize that putting away a few months of expenses is good financial hygiene. So the question then centers on the lack of people saving money. There are two main reasons: living beyond your means and simply having more expenses than income. Given the contraction of the middle class and inflation, many Americans are simply feeling the pinch of inflation combined with low wages.

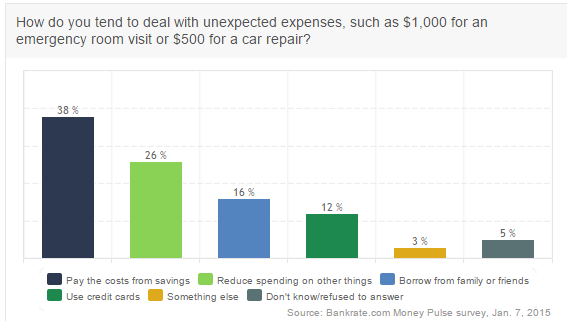

A recent survey found that most Americans are not prepared for an unexpected expense:

“(Bankrate) Still, that budget may be surprisingly brittle. If someone encounters a significant, unexpected expense outside his or her budget, such as an emergency room visit or a car repair, only 38 percent of respondents said they could cover it with cash they have on hand in a savings account or checking account.â€

An unexpected expense would then of course force people to dip into other accounts like retirement savings (if they have any) or go into debt. For many, going into deeper debt has been the result. I’ve written on the boom in subprime auto debt and how many car dealers are dipping their credit standards to find more potential buyers. A car is a necessity in many metro areas but many people opt to buy a car that is too expensive for their income. I think a good rule of thumb is don’t spend more than a forth of your annual income on a car. Do you make $50,000 a year? Then plan on spending $12,500 max. This of course would likely result in you buying a used car but there are great cars to be had for $12,500 or less. Just spend some time on Craigslist and you will find some excellent deals. You can also get financing for a used car but try and avoid subprime auto debt.

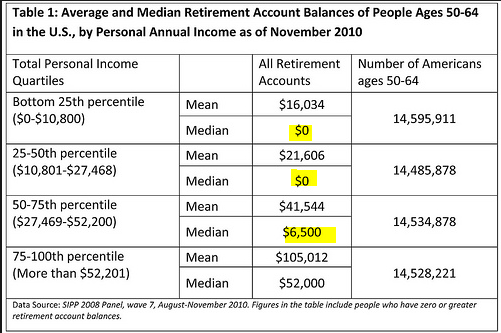

It shouldn’t come as a surprise then that many Americans are also not planning for retirement in any adequate fashion. Take a look at this data:

This is data for those 50 to 64 years of age and deep into the retirement planning period of life. You’ll notice that half of this group has a median retirement account of $0. That is correct. No money whatsoever. This is why roughly half of older Americans would be out on the street if they didn’t have Social Security.

Even those with higher incomes are not doing so well. The 50 to 75th percentile has a median retirement account of $6,500 and the top 75 to 100th percentile has $52,000. In other words, the vast majority of Americans are under saving for immediate emergencies and retirement.

Going back to the lack of savings:

“Without an adequate rainy-day fund, we are all living on a very slippery financial slope. The unexpected, unplanned expense is going to rear its ugly head and usually at the most inopportune time,” Cunningham says. “Things as small as a flat tire or one trip to the emergency room can wreck the budgets of those who do not have an adequate amount in their savings account.”

A slippery financial slope indeed. All it takes is a tiny bit of rain and the financial house of cards can come crumbling down.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â