Driving our way into poverty: Subprime auto debt continues to expand while domestic auto production remains weak.

- 6 Comment

Americans love their cars. Urban sprawl with poorly designed city centers has made driving a near necessity for most people. During the credit crisis, one of the problems that occurred was that too many loans were being made to people that had no ability of paying their debt back. We see this trend in full stride once again in the auto industry. Subprime auto lending is back in a big way. The vast majority of non-housing debt growth in the last 12 months has come in the form of auto and student loan debt. As we all should know, a car loses value the minute you take it off the lot. Sure, these new cars come fully loaded and are virtually spaceships but it will cost you especially when the per capita wage in the country is approximately $26,000. Given that the average new car costs $30,000 most people need to go into debt to finance this purchase. We are now seeing a big wave of subprime borrowers purchasing cars. What can possibly go wrong?

The resurgence of subprime auto debt

Yield hungry investors want to put their non-tangible banking paper into play and going the auto loan route is one way of doing this. Since the housing market is already being crowded out by big money, the next play is with auto debt. We are seeing a healthy number of new loans going to those with lower credit scores which ironically favor those who take on more credit lines yet manage them well. Sort of like giving a gambler a line and asking him not to use it in Vegas. Of course, the credit crisis was brought on by crony finance and this is once again rearing its ugly head.

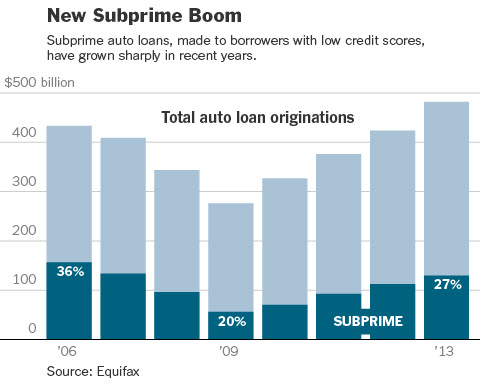

Take a look at the growth in subprime auto debt:

At the peak of the credit mania, 36 percent of auto loans were going to subprime borrowers. In 2009 when we were washing away the years of malfeasance and financial leverage, we saw 20 percent of auto loans falling in the subprime category. Slowly but surely we are now back to 27 percent of the pool and total originations are back to record levels.

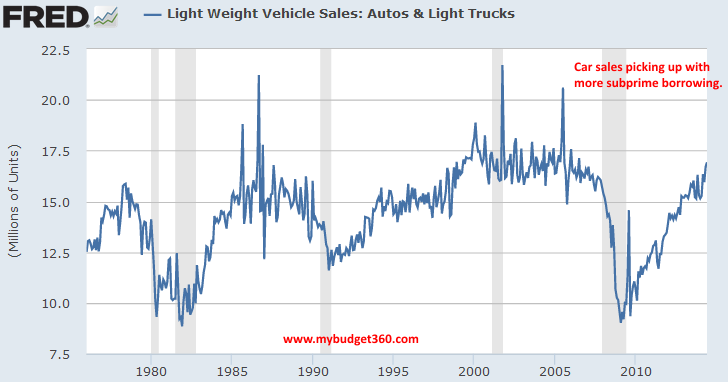

What is interesting is that sales are not as high as they once were yet total loan volume is at a record:

At the peak, we were nicely hovering above 17.5 million auto sales per year. This last month, we hit 16.9 million and this was for one month of data versus a consistent trend. So why more debt for fewer cars being sold? Do you remember our friend inflation?

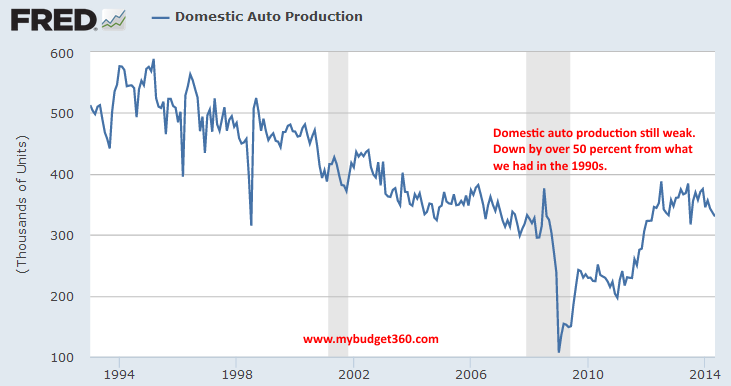

What is even more telling about our economy is how many cars are being produced domestically:

We are producing 50 percent fewer cars in the U.S. than we did in the 1990s yet we are consuming the same amount of cars. Do people think this does not have any long term repercussions for our country? We are already seeing some of these problems hit as money and inflation from abroad comes rushing back in. The U.S. is being flooded with low wage jobs since there is now a global race to the bottom. People don’t have the money to buy the cars outright so they simply go into debt. Some have a hard time paying their debt but lenders are all the willing to make more risky bets given that all of this is backed by the Federal Reserve. The financial system has an unlimited safety net. You do not.

Maybe buying a new car is seen as a treat in a very tough economy. Watch any sporting event and you will see virtually every other ad being one for automobiles. Forget about gasoline that stays above $4 a gallon. People seem to be on a treadmill when it comes to debt.

One of the most glaring stats above is the one regarding domestic auto production and our annual consumption of cars. There is a price to pay when your consumption and production is out of balance.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Ame said:

Just last week my husband was saying he was amazed at all the new cars on the road in our area. We don’t live in a high-paying area, either. We were wondering how the people could afford new…and now you answered that. Sub-prime auto loans!

Wow.

July 27th, 2014 at 12:25 pm -

Kory said:

My wife and I make double the median household salary but we cannot even afford a new car. We are driving two vehicles, one is 10 years old and the other is 16 years old (no current payments).

July 28th, 2014 at 4:23 am -

cachon said:

I got so many offers for 20 or 25 Grands to buy new car. even I had a B/K last years

July 28th, 2014 at 8:10 am -

roddy6667 said:

People with bad or no credit who get financed for a car not only pay a higher interest rate, they overpay for the car. I worked with a guy who had absolutely no credit who bought a used Dodge Durango SUV. He looked cool to his peers, but according to Kelly Blue Book, he payed $19,000 for $13,000 vehicle.

July 29th, 2014 at 1:38 am -

arno said:

95 % of those new cars on the road are leased.

July 29th, 2014 at 7:03 am -

Dagny said:

OK, so how do we short subprime auto debt?

August 4th, 2014 at 10:41 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!      Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!      Â