The Great American Bank Heist – On the Day we Reach a Monthly Foreclosure Filing Record Banks Announce Record Profits and the Stock Market is up 80 Percent.

- 4 Comment

It is rather fitting that on the day we hear about banks reaching record profits once again, because after all it is so difficult to borrow at zero percent and gamble in the stock market and make a gain, that we also find out that March was the highest month of foreclosure filings ever (and we’ve had some bad months). If there was ever a more clear indication between the split from Main Street and Wall Street this is probably the strongest indicator so far. I’ll include the charts below but being blunt about the situation, the bailouts worked. If we define “worked†as boosting banking profits once again while 40,000,000 Americans are on food stamps and 17 percent remain underemployed then all is well again in the economy. Yet this isn’t what the American people bargained for in the bailouts. In fact, they didn’t want the bailouts if you remember the massive anger from both aisles calling their representatives. But the cronies didn’t listen since they receive millions in lobbying dollars and $13 trillion went to Wall Street in the biggest wealth transfer witnessed by the disgruntled American public.

It should be obvious the real economy is still a mess. The latest foreclosure data is merely a reflection of failed government programs but more importantly, the absolute greed and robbery committed by Wall Street:

Just look at that chart. We’ve had an 80 percent stock market rally in one year and today, we are at the peak of foreclosure filings. That is, Americans getting kicked out of their homes because they are unable to pay their mortgages. So much for banks using that money to help people stay in their homes and keeping the credit markets open as they preached. JP Morgan announced stunning profits for the first quarter. How did they make their money?

“(Yahoo!) NEW YORK – JPMorgan Chase & Co. reported a $3.3 billion first-quarter profit on big gains in the financial markets even as the Obama administration pressed for limits on banks’ trading of risky but lucrative investments.â€

$3.3 billion is fantastic. But how did they make that money?

“Investment banking, especially bond trading, generated the bulk of JPMorgan’s profits. The bank said that division earned $2.5 billion, up 50 percent from a year earlier.â€

So their gambling division made up the bulk of their profits. How are they helping out consumers with those billions in taxpayer dollars?

“JPMorgan said it lost $1.3 billion on its real estate portfolios, slightly more than the $1.1 billion it lost the previous year. Signaling that it expects further credit weakness, the bank set aside $3.3 billion for real estate loan losses, up from $3.1 billion a year earlier.

The bank’s losses in its credit card business fell to $303 million, while provision for future credit card losses also dropped to $3.5 billion.â€

The formula is simple for these banks. Use the taxpayer money to enrich their elite class under the guise of helping average Americans. They have robbed the American people and much of this was all legal. Yet we all know that there is something royally flawed in the financial system since it is the legislature that develops the laws and many are bought by the Wall Street crowd. So this 80 percent stock market rally if we dissect it is being propelled by banks gambling:

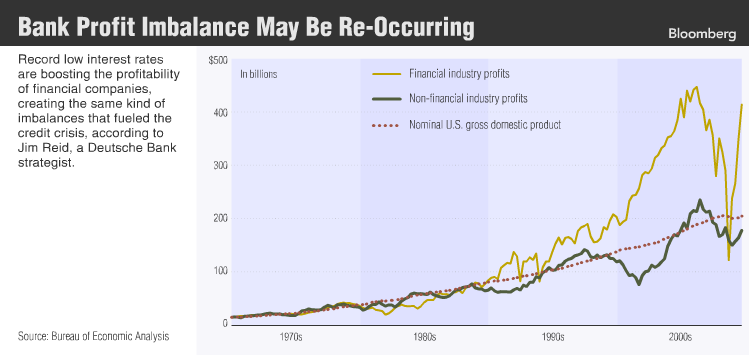

Source:Â Bloomberg

Notice how non-financials (i.e., the real economy) is only seeing a slight uptick in profits? This probably has to do with 15 million unemployed Americans and another 9 million working part-time looking for full-time work. But given there are 6 workers for every 1 job opening, things will be slow going. Unless you are the corrupt banking sector. In that case, you can borrow at zero percent and buy Treasuries, foreign currencies, stocks, or whatever it is and make money hand over fist while the real economy remains in the trough. Why would you expect anything to be different? We have yet to have one single piece of serious legislation hit the table for financial reform. These banks are back to their same antics.

So what should be done? Break the banks up. Commercial banking should become more boring and what it once was, the lubricant to get the real economy going. Right now it is merely a vampire sucking the blood out of the productive sectors. Investment banking will be pushed to the edges and if banks want to gamble their own money then that is fine. But right now they are gambling taxpayer money trying to get back to even while shifting all the toxic credit out of their books. Privatize gains and socialize losses. With a system like that, is it any wonder the banks are back to record profits?

And you have to ask yourself how is it that banks while pushing a record number of foreclosure filings are back to record gains? It is actually very simple. They can shift the crap to taxpayers as they have through the FDIC, HAMP, suspension of mark to market, and other absurd gimmicks. Then, they can use taxpayer money primarily funded through the Federal Reserve and U.S. Treasury and then gamble on the stock market. But don’t be surprised when the market falls through again. And why wouldn’t it? The real economy isn’t really improving. For $13 trillion we sure got bunk but add up the Wall Street market cap and profits and you can see what occurred.

It is a simple formula to understand. And with no rules being changed, things are back to normal for the banks. Too bad the other 95 percent of Americans are still dealing with the repercussions of the actual economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Kurt said:

And yet…the amounts that banks loaned out last quarter are directly inverse to the gains posted by the Dow…

The less they lend, the more gains are posted. This, my friend, is disgusting.

April 15th, 2010 at 2:50 pm -

Tom said:

Always remember: Stealing from the poor is theft. Stealing from the rich is mere re-distribution.

April 16th, 2010 at 5:06 am -

Jim said:

Actually, it is no surprise that equities are going up. We only need to look at history. In this case the Wiemar Republic after WWI. As the currency was being debased the equity markets rose … almost keeping pace with the inflation … that is what is happening here. Money is moving into the equities … whether it is a bubble or not … that $13 trillion has to go somewhere.

April 16th, 2010 at 6:26 am -

Richard said:

And yesterday C. Dodd said bank reform is needed. Lets see, he voted on bringing amesty to illegals, voted to dissolved the Glass-Stegal Act, voted for the bailouts, voted against American auto, helped out source jobs, voted for Nafta, etc, etc, etc.

Where are the jobs, where is the loyality to legal American peoples?

Go green, and recycle all of Congress.April 16th, 2010 at 10:06 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!