Best Performing Investments for 2008: Can Real Estate actually be one of the Best Investments for the Year? 5 Strong Performing Areas for the Year.

- 1 Comment

Investors had very little place to hide this year. Without a doubt, 2008 has been a tumultuous year for virtually every class of investment out there. The stock markets are seeing one of the worsts year on record since the Great Depression losing globally, an estimated $32 trillion in market capitalization.

Since we are a few short weeks away from closing the door on 2008, we can now look at various investments for the year to see how they have performed relative to other measures. Tried and tested measures like dollar cost averaging did very little if you had your money tied to Fannie Mae and Freddie Mac.  What use was it to have the safety of bonds if they were anchored by the albatross of Lehman Brothers?

Today, we are going to assess the damage but also look at various investment areas to see how bad the damage was for the year.

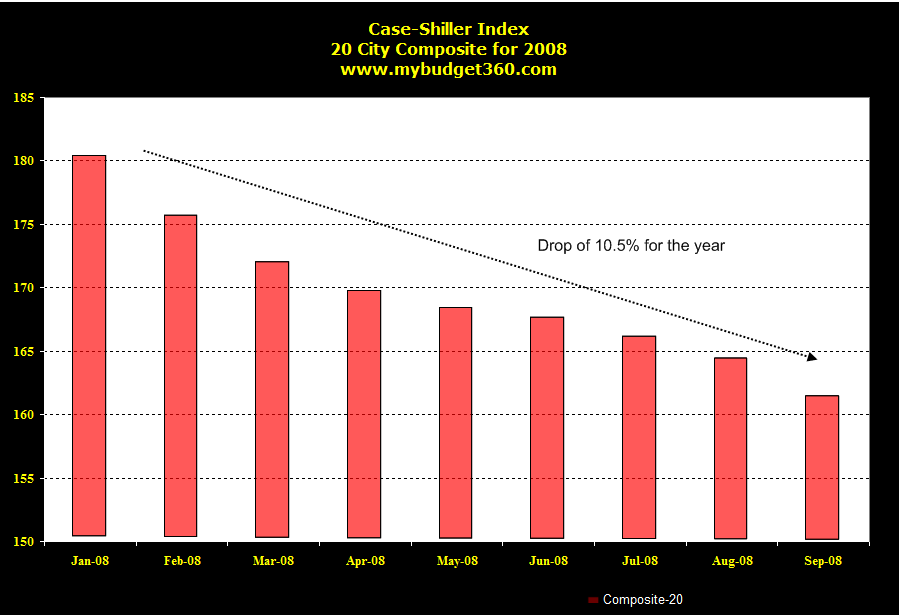

Area #1 – Real Estate 2008Â

*Click for larger picture

We all know that real estate has been underperforming horribly for the past year. Yet there is a novel perspective that is making the rounds on the internet that real estate is actually out performing the stock market.  This argument is both dangerous and deceptive. If we look at the above data, we can see based on the Case-Shiller 20 Composite Index that real estate in these large 20 metro areas is only down 10.5% for 2008. Not bad in comparison to the stock market.

Yet this argument fails to highlight certain areas like California where property prices have fallen 40% in one year. In addition, one failed aspect that isn’t mentioned when this argument is spewed is that real estate has the advantage and as we are all learning the disadvantage of leverage. Let us run an easy example.

Say you invested $10,000 in the stock market via the S & P 500. You put all that money in on the first trading day of 2008. At this point, you would have lost 40% of your investment due to the current market condition. That is, your $10,000 is now only worth $6,000. Pretty painful indeed.

Let us assume you bought a really nice home for $200,000. We’ll go ahead and assume that you lost the 10.5% from the Case-Shiller chart for the year. How much have you lost? Your home is now worth $21,000 less.

Even though that 10.5% decline may seem innocuous, it really isn’t because of the power of leverage. Most stock investors aren’t leveraged to the hilt.

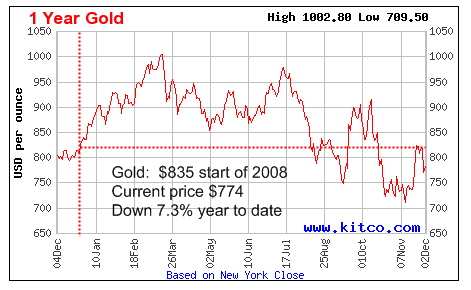

Area #2 – Gold

Gold has taken a big hit this year. Or at least that is how it would seem from all the negative headlines surrounding this commodity. As the chart above shows, gold opened the year at $835 an ounce and is currently trading at $774 an ounce. That is a decline of 7.3%. The reason this declines seems more vicious is the fact that gold had hit a peak price over $1,000 an ounce back in the first quarter of the year.

Overall there has been a flight to safety and gold has benefited from this. Even after the massive global deleveraging gold has held its own. Many investors are wishing they can say that they are only down 7.3% for the year. Going forward, gold may be a good play for a couple of reasons.

The Federal Reserve and U.S. Treasury are doing everything they can to destroy the dollar. They would love nothing more than a steady inflation to occur. The worst thing that can happen is deflation and we got a taste of that last month with the CPI. Why does the Fed and U.S. Treasury fear deflation? Well first, we are massively in debt. If prices keep declining, the debt we currently have actually gets more expensive because we are paying off a debt that was valued much too high. With inflation, we can pay back that debt little by little as the value of the debt is eroded over time.

No one really has a crystal ball but seeing the actions of the U.S. Treasury the Fed and now talks of a gigantic fiscal stimulus package in 2009, we can easily assume these 3 large players want to see steadily higher prices.

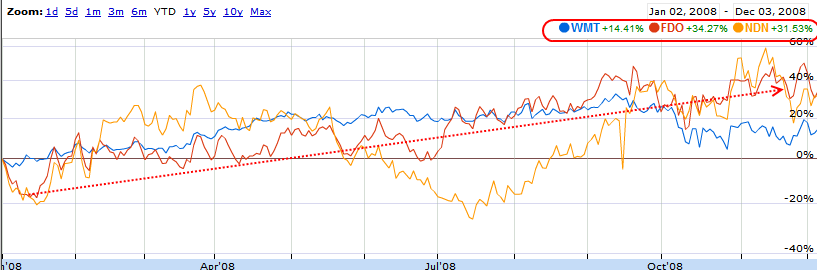

Area #3 – Necessity Stores

*Click for larger picture

What if I told you that there were retail stores that were up 14%, 31%, and 34% for the year? Most analyst wouldn’t even know where to begin to look for these good deals because they don’t get the struggles Main Street Americans are facing. These 3 stores; Wal-Mart, Family Dollar Stores, and 99 Cent Stores have out performed the market incredibly. Heck, even putting your money in the mattress would have outperformed the market this year but these stocks have had excellent gains.

You need to remember that many of these stores make money on volume. With the incredible economic calamity we are facing their customer base is growing. Thus their volume has increased. At a certain point, I would expect to see some more strain hitting these stores in particular Wal-Mart but so far, they are sufficiently out performing the market. If you expect the economic conditions to be tough next year, you can expect many people that once shopped in higher end stores being forced to shop here. It is simply an elastic decision in economics.

These stores should be positioned to have a decent year next year. Maybe not as good as 2008 but certainly out performing the overall market and other retail outlets.

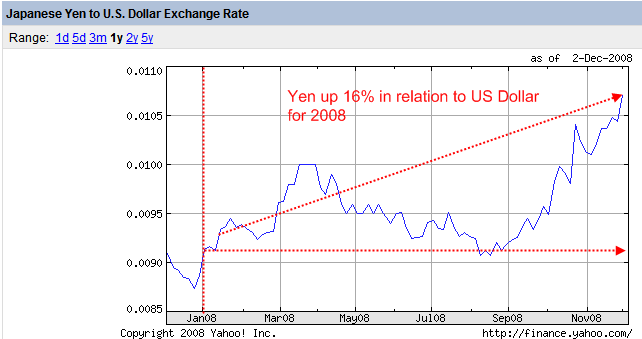

Area #4 – Foreign Currencies

If you would have plunked down your U.S. Dollar into Japanese Yen during the start of the year, you would be up 16%. I made this call back in February of 2008 and it looks like it was spot on. Not exactly a major gain but a nice little double digit gain. This is what I had to say regarding the Yen at the time:

“The Yen is up 14 percent in relation to the dollar in a one-year timeframe. This has a major potential of moving upward since we are seeing an unwinding of dollar debt. The Japanese hold an inordinate amount of US debt and if the unwinding continues, expect the Yen to continue to rise.”

That logic still holds true. Hedge funds are going to be facing massive redemptions and there is no reason to believe that we are done yet. I would say that the unwinding may be getting closer to a bottom. What occurred is investment funds borrowed cheap and Japan had one of the lowest rates. Well Ben Bernanke is going to put us on par with Japan pretty soon.

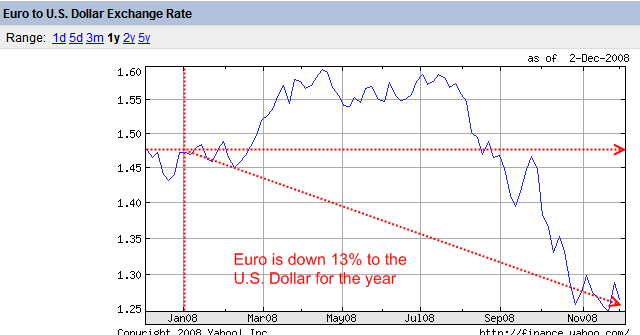

Another currency I talked about was the Euro. This is what I had to say about the Euro back in February:

“The Euro is up 15 percent in relation to the dollar in a one-year timeframe. The Euro as you may know through its central bank, has not kowtowed to the markets like the Federal Reserve who has decided to let the dollar go into a free fall. The ECB has held rates steady and also the currency has a small portion backed by gold. The dollar is simply backed by the full faith of the US government. If this faith wanders, the dollar will continue to go down.”

Well the Euro is now down by 13% for the year. Why? Well the ECB bent over and did the same moves our Federal Reserve did. In addition, the Eurozone is now in a recession just as we are so their currency took a hit. The biggest damage came from the ECB breaking down. I would not be looking at the Euro going forward. They have property bubbles larger than the U.S. and economies that are simply taxed to death.

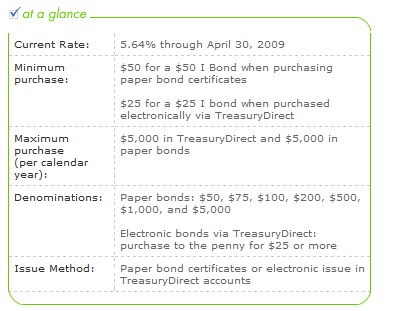

Area #5 – I-Bonds

Back in July I talked about U.S Savings I-Bonds. These are great little investments that pay a fixed rate and a rate that is based on the CPI.  The intent of I-Bonds is to track inflation. Given the recent contraction with the CPI and prices dropping, we may see a short-term drop here but given what the Fed and U.S. Treasury are doing, at a certain point it looks like we will see further inflation.  Currently I-Bonds are paying 5.64% until April of 2009:

As I discussed in the previous article, the U.S. Treasury earlier this year reduced the maximum amount of I-bonds you can purchase to $5,000 per year.  Previously, the limit was set at $30,000. These are good little safe investments to have in your portfolio since they will never lose money.  You certainly may see a low rate this upcoming adjustment simply because of the price destruction we are seeing via short-term deflation but given all the policies and bailouts we are seeing, it is hard to see how we won’t see inflation later in the near future. Ben Bernanke is a major student of the Great Depression and he has stated either implicitly or explicitly that he’ll “drop money from helicopters” before letting us see deflation.  Given his actions, I think he is serious about that.

So those are a few safe places that have done well for the year. Â Of course the past isn’t indicative of the future but keep your head straight, diversify wisely, and be prudent since 2009 will prove to be a more volatile year.

1 Comments on this post

Trackbacks

-

Excel Forum said:

Thanks, Ted, for your comment. Things certainly have changed when it comes to commercial real estate.

July 8th, 2010 at 8:02 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!