Blue pill of debt exchanges temporary increase in debt for inflation: Taking the blue pill of a fabricated world addicted on debt as US standard of living hits 10-month low.

- 3 Comment

Most of you have seen The Matrix where Neo is given the choice between taking the blue or red pill. The red pill would allow Neo to escape The Matrix and enter reality whereas the blue pill would allow him to stay wandering in the fabricated world of the Matrix. The US government in essence swallowed the blue pill for the moment using duct tape to smooth us over the debt ceiling. Reality is being avoided. This isn’t to say that the default should have been allowed to happen. Yet to call this a solution is laughable. We will be back at this in early 2014. Can’t ruin the holidays with reality. That is the grand solution that was achieved by our millionaire Congress. The problem is that with $17 trillion in total debt we are entering a situation where low rates are a must to retain solvency. Yet what if rates are unable to stay this low? Since this calculus is now set, you can bet that the Fed will do everything in its power to inflate our way into the next level of the Matrix.

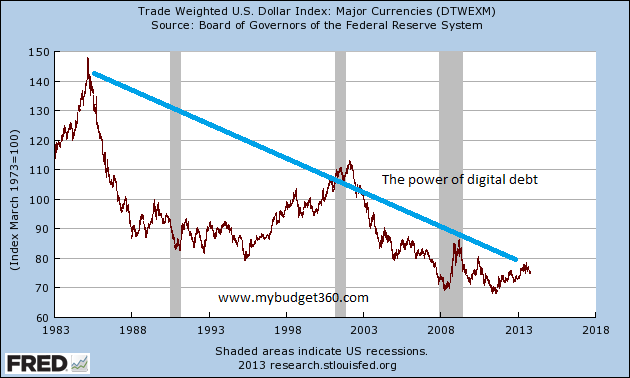

30 years of a declining dollar

The US dollar has suffered a dramatic 50 percent decline over the last generation:

What people are now starting to realize is that the next generation may not be so financially lucky. Half of all recent college graduates are unemployed or working in jobs that don’t require a college degree. The cost to attend college has far outpaced any economic gains in wages. So we are left with another bubble that is precariously close to bursting. Yet this is a system where we chase quick gains and avoid confronting real issues.

Take for example the housing bubble. No substantive reforms have come from the bursting of this bubble that led us into the deepest economic crisis since the Great Depression. Instead, banks are back to speculating and gambling and leveraging the rentier system where wealth is extracted from the real economy and shifted into the hands of Wall Street. Housing values are soaring not because the fundamentals of the economy are sound but because the system is flooded with cheap money. This cheap money is accessible to those controlling this economic Matrix based on digital debt. However this is slowly eroding our middle class as you now have over 47 million Americans on food stamps and 1 out of 3 Americans with absolutely no savings in what is the wealthiest nation in the world. Yet where is all this wealth aggregated?

The solution to the problem is the problem

We are fully addicted to debt. Let us be honest. The cure is the solution. Our system is built on access to debt. The crisis wasn’t started because a few families in inner city Detroit took on subprime loans on rundown properties. No, the issue was the side bets and derivatives that were placed on these markets by financial giants that added layer upon layer of risk. Detroit is still poor. Cleveland is still struggling. The working class in Las Vegas still have it tough. Yet Wall Street is rolling around in piles of digital cash.

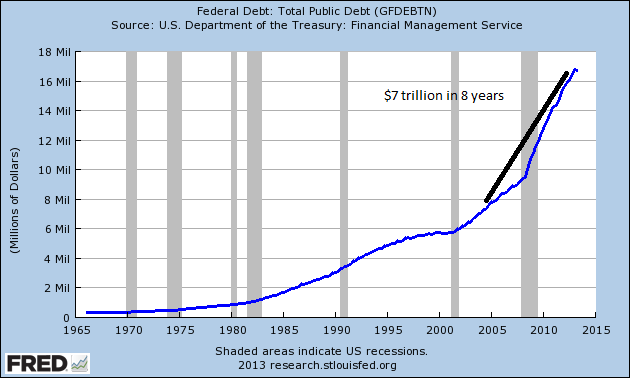

Who are we kidding when we think we have some control over our debt:

Does the above chart look like we have control? This is similar to most developed countries. We are operating in a debt based paradigm. It was interesting to hear the logic on the current shutdown. “No one likes debt and we need to deal with it, but this is now the way.â€Â Other comments went along the lines of “we need more debt to figure out how to cure this debt problem.â€Â What options do we have? The biggest option that we will take but the Fed will never announce is inflation. Yes, this is a great way to deflate our debt load as time simply erodes the value of today’s debts. Sucks for those holding the debt. A $30,000 car sounds normal today but during the first half of the century, it must have seem ludicrous. Welcome to the power of inflation.

We can rest assured that this is the path ahead. It is probably the only road the government and Fed are willing to take. They can’t make this announcement to global markets since a large part of those buying our debt are foreign institutions. Yet how else are we going to pay for this bill? From 2005 to 2013 we took on this debt from $7 trillion to nearly $17 trillion today! We added something like $10 trillion in eight years. Going back to 2000 the picture is worse. And you think it is going to get cheaper to support all the retiring baby boomers?

The government had a Sophie’s choice and decided essentially to do nothing. Keep the status quo. Swallow the blue pill and deal with this debt crisis later. Sounds very familiar to the financial crisis. Logically think about this. We are lurching to a debt spiral. For many Americans, the shutdown was a sideshow because they are already suffering dramatically as the middle class shuts down permanently.

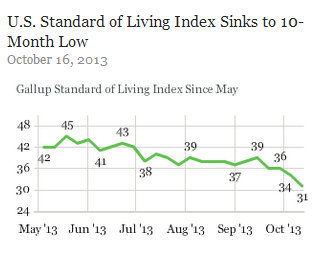

With that said, the US standard of living hit a 10-month low:

Source:Â Gallup

Keep taking that blue pill and pretend that approaching $17 trillion is no biggie. Have you noticed how much it costs for energy? Healthcare? Housing? College? No issue with 47 million Americans on food stamps? Of course the Fed wants you to believe that inflation is all a figment of your imagination.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Arizona said:

YOU GUYS want to worry about something?WELL here it is,DHS is empting out every reserve food warehouses in america ,and then taking the food to the LANDFILLS and burning it,AMERICA IS ABOUT TO SEE A “FAMINE” that will scare the world to death and kill millions of americans from starvation,now I know most people can’t get their arms around this,ITS over their head,BUT I see everyone is worried about their money,TRY BUYING A LOAF OF BREAD,with a wheelbarrow full of gold coins,WHEN THERES NO BREAD..ever went for a week with no food,try a month with no food,or a year with no food,THINK IT CAN’T HAPPEN,well ,america is going to find out the hard way, ain’t THEY…………

October 18th, 2013 at 9:22 am -

Mark said:

Another hard hitting and informative message. Thank You

October 18th, 2013 at 8:54 pm -

Jerry said:

the problem is there for all to see. forget the govt you have to take your own actions to survive. be your own bank and have it gold backed.

October 19th, 2013 at 3:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!