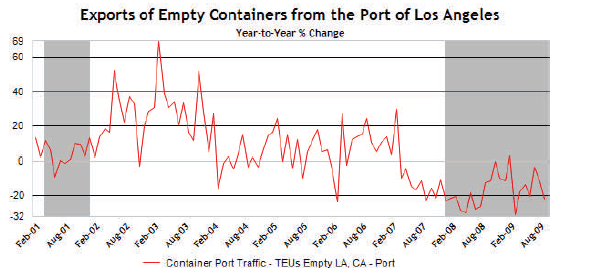

Breaking the Consumer: Exporting Empty Containers Declining. Consumer Credit is contracting at Rapid Pace. Is the Consumer Treadmill Showing Signs of Exhaustion?

- 2 Comment

If you know where to look, the American consumer is not buying into the U.S. Treasury and Federal Reserve great debt experiment. Port traffic is still declining and indicators show no sign of a major resurgence. If you look at the recent weak outbound pace of containers that are empty what we can expect is continued weak demand for imported consumer goods. Given that most of our goods are imported, this is a bad sign for our local economy but also global economies that produce those goods.

It is rather startling that so little focus has been given to job creation. 21 full months into the recession and there is still no concerted effort on stemming the massive unemployment problem. This issue is directly tied into the weak consumer demand. The American consumer is not in a spending mood. We can expand the access of credit available to banks but the access to credit is limited if they have no viable customers to lend to. Apparently banks now realize that giving money to those with no income history or capacity to pay debt back was a bad move. So why are they asking for so much liquidity even though they refuse to lend? The answer unfortunately is that they are borrowing liquidity to patch up their own problems. The American consumer is on their own.

If we look at the port traffic again, we show no immediate sign of consumer demand:

Source:Â Federal Reserve Board, Atlanta

We’ve been in negative territory on a year over year basis since early 2007, before the official start of the recession. Now this is an interesting data point. We should see an increase in traffic of empty cargo containers if demand picks up. Why? These containers are shipping off to pick up consumer goods. It cost money to move ships back and forth from one continent to another and without any demand, the containers just sit at port.

In what is a perfect example of this idle demand, we had some stunning pictures of “ghost fleets” of ships that are virtually parked in the middle of the sea waiting for consumer demand:

“(DailyMail) Here, on a sleepy stretch of shoreline at the far end of Asia, is surely the biggest and most secretive gathering of ships in maritime history. Their numbers are equivalent to the entire British and American navies combined; their tonnage is far greater. Container ships, bulk carriers, oil tankers – all should be steaming fully laden between China, Britain, Europe and the US, stocking camera shops, PC Worlds and Argos depots ahead of the retail pandemonium of 2009. But their water has been stolen.

They are a powerful and tangible representation of the hurricanes that have been wrought by the global economic crisis; an iron curtain drawn along the coastline of the southern edge of Malaysia’s rural Johor state, 50 miles east of Singapore harbour.

It is so far off‑ the beaten track that nobody ever really comes close, which is why these ships are here. The world’s ship owners and government economists would prefer you not to see this symbol of the depths of the plague still crippling the world’s economies.”

Logic would tell you that these ships are sitting idly by because of the decrease in consumer demand. The chart above showing a crash in outbound empty cargo containers should tell you that Americans are showing no immediate appetite for consumption. Given that the U.S. consumer is 70 percent of the economy, it is hard to understand where the stock market rally is coming from.

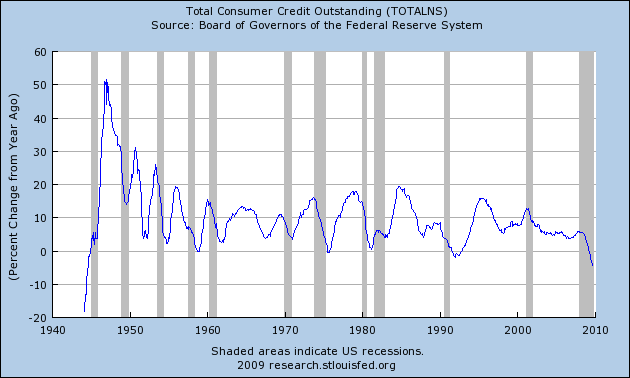

The U.S. consumer has seen a rise of $2.2 trillion in their net worth over the second quarter. This is still off by $12 trillion from the peak. And total consumer credit is still declining:

So the consumer is having less access to debt and has a weaker appetite for consumption. Yet the market is rallying? One reason could be the massive slam in the U.S. dollar since Q1 of 2009:

What a coincidence that during this time of a 50 percent consumer absent market rally that the U.S. dollar has fallen 15 percent. Much of this rally is because of a weaker dollar but also, massive injections of liquidity into the banking system. Unable to lend to consumers, many Wall Street casinos have decided it would be a better risk to gamble in stocks than to give out loans to American consumers. In the end, the bailouts were essentially a credit line extension to the biggest gambler in the casino who hit a major losing streak and is expecting to double down through the night to recover the losses. Chasing bad money with good is like seeing empty ships carrying no cargo and expecting that to be a sign of healthy consumer demand.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

D Cowley said:

I completely agree with you assessment and believe the worst is yet to come. I follow the Baltic Dry Index and regard it as a coal mine canary but I ran across this article this morning and it shocked me.

I would like your take.

http://www.businessinsider.com/us-container-trade-is-on-fire-2009-9Thanks

dcSeptember 22nd, 2009 at 6:20 am -

Sage said:

It certainly is an amazing picture of all those ships just sitting there with nothing to do.

September 23rd, 2009 at 2:52 pm