Why buying a home today makes little financial sense. 3 reasons why taking on a mortgage in today’s market is deep in speculation. Are homes still over valued? Tax benefit not as big as you would expect.

- 6 Comment

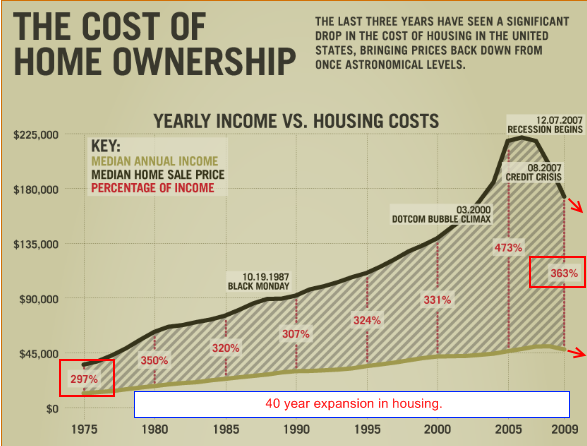

It is hard for many to believe that home prices in many of our largest cities are still overvalued. Part of this distortion has to come from living in a decade long housing bubble that has adjusted the perception of value and price. But in many areas home prices are still much too high relative to the income of local families. When disconnects occur here, bubbles are produced. The stock market is experiencing this since price to earnings ratios are still much too high for what businesses are drawing in through revenues. The housing market is off by 30 percent from its 2006 peak and weakness is now appearing once again now that the tax credit has expired and the Federal Reserve is finished with their mortgage backed security buying campaign. It only took a few weeks once artificial measures were taken off the table.

Home prices relative to income are still too high nationwide:

Source:Â Visual Economics

In fact, if we look at recent data the numbers are still too high:

Median Household income:Â Â Â Â Â Â $52,029

Median U.S. home price:Â Â Â Â Â Â Â Â Â Â Â Â $173,100

Yet on a nationwide basis, we are getting closer to the ratio of the 1970s. But on a more narrow level of cities and states, some areas are still very much in bubbles including California. It is a fascinating case of consumer behavior post-housing bubble. Since most of us have now been conditioned over the past decade that the only way to buy a home is to take out an enormous mortgage and leverage each penny of net income to a home payment, we have forgotten sounder times. In light of this, it might appear that home prices make more financial sense in today’s climate but they do not in many areas. Let us look at a few reasons why buying a home today is not a good idea.

Reason #1 – Smaller mortgage with higher interest rate better than big mortgage with small interest rate

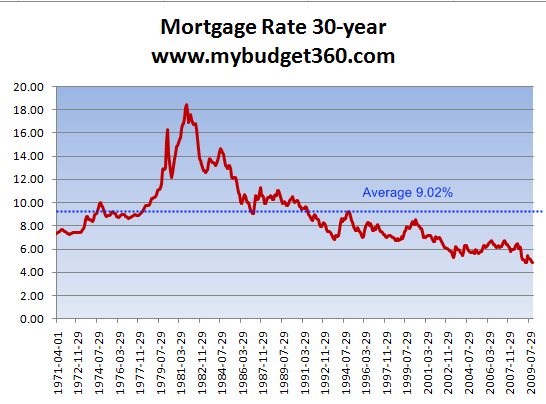

One argument you hear those in the housing industry continually make is “you should buy today because rates will rise.â€Â What they don’t tell you is that higher rates usually mean cheaper home prices and buying a less expensive home with a smaller mortgage and higher interest rate makes much more sense than buying an expensive home with a big mortgage and cheap interest rate. Before we walk through an example, let us look at historical mortgage rates:

Over 40 years of history shows an average 30 year mortgage rate of 9 percent. The current average that is lower than 5 percent is an anomaly. If we run a few scenarios, you will see that a cheap mortgage rate and an expensive home actually give buyers less power when it comes to paying down their mortgage.

We’ll run two scenarios with the current interest rate and the average to show why this occurs. We’ll assume a same monthly payment since this is usually what is used for debt-to-income qualifications so the home price will reflect this.

Low interest rate scenario – 5% 30 year fixed

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $250,000

30 year mortgage:Â Â Â Â Â Â Â Â Â Â $237,500 (using a 5% down payment)

Monthly principal and interest:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,274

Total interest over life of loan:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $221,482

High interest rate scenario – 9% 30 year fixed

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $165,000

30 year mortgage:Â Â Â Â Â Â Â Â Â Â $156,750 (using 5% down payment)

Monthly principal and interest:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,261

Total interest over life of loan:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $297,298

On the surface, this appears to be a good deal. By paying more with a lower rate you have more flexibility. But let us assume this family is able to contribute $300 more per month. What happens then?

Low interest rate scenario $300 additional monthly payment (239 payments – 19 years)

Total interest over life of loan:Â Â $137,388

High interest rate scenario $300 additional monthly payment (188 payments – 15 years)

Total interest over life of loan:Â Â $135,437

Here is the big difference. With $300 more per month, the person with the high interest rate can pay off their loan 4 years faster and save on their interest payments as well. This is the leverage of having a higher interest rate and a lower priced home. Also, the requirement for down payments is shifted lower since the price is moved lower. This is good if the person ever decides to sell their home in the future because more people can qualify for the home. The heavily exotic mortgage market simply caters to the idea that home price is the most important factor in housing. It is not. Affordability is the most important factor for long-term sustainability.

Tax benefits over sold?

One of the oddest pitches about buying a home is the tax deduction. The fact of the matter is, most homeowners live in cheap enough housing that the standard deduction is all that is needed without the mortgage interest deduction being taken. In fact, only a handful of states like California benefit from this tax deduction even though most think this helps them (probably from not understanding the complicated tax system). To be honest, the mortgage interest break actually helps out the wealthiest in our country.

“(Tax Foundation) For tax year 2008, a little over one quarter of the nation’s tax returns claimed the mortgage interest deduction, 26.8 percent of the nation’s 143 million tax returns. Rates of home ownership are much higher than this, but many home owners don’t claim the deduction. Often they live in low-cost homes for which the deduction isn’t large enough to make a tax difference, so they don’t itemize deductions on their tax returns. In addition, home owners who have paid off their mortgages make no interest payments to deduct.

The average tax return in the U.S. deducted $3,279 in mortgage interest; that includes all tax returns, even the non-homeowners and non-itemizers. Counting only the tax returns that deducted mortgage interest, the average amount was $12,221.â€

This is a stunning revelation. The homeownership rate is approximately 67% but only 26.8% claimed the mortgage interest deduction. So much for that sacred cow of housing right?

Reason #2 – Price to earning potential of home is still unsupported by long-term trend

Home prices in many cities are still in mini-bubbles relative to the income of families in those areas. California is a prime example:

According to the California Association of Realtors the median home price in California is $306,000. However the median household income is $60,000. This means the home price is 5 times the annual household income of a family in the state. Take for example the following:

Median household income:

1969:Â Â Â Â $9,302

2008:Â Â Â Â $57,000

California median home price:

1969:Â Â Â Â $24,640

2008:Â Â Â Â $500,000

So back in 1969, the ratio was 2.6 and at the peak it was close to 10. Today even at 5, it may appear to be lower relative to the peak but it is still too high. Expect this ratio to come back in line in the 3 to 4 range. This has historically been the case for most areas across the United States. Many states are actually back in line but many cities still think they are somehow immune to this trend.

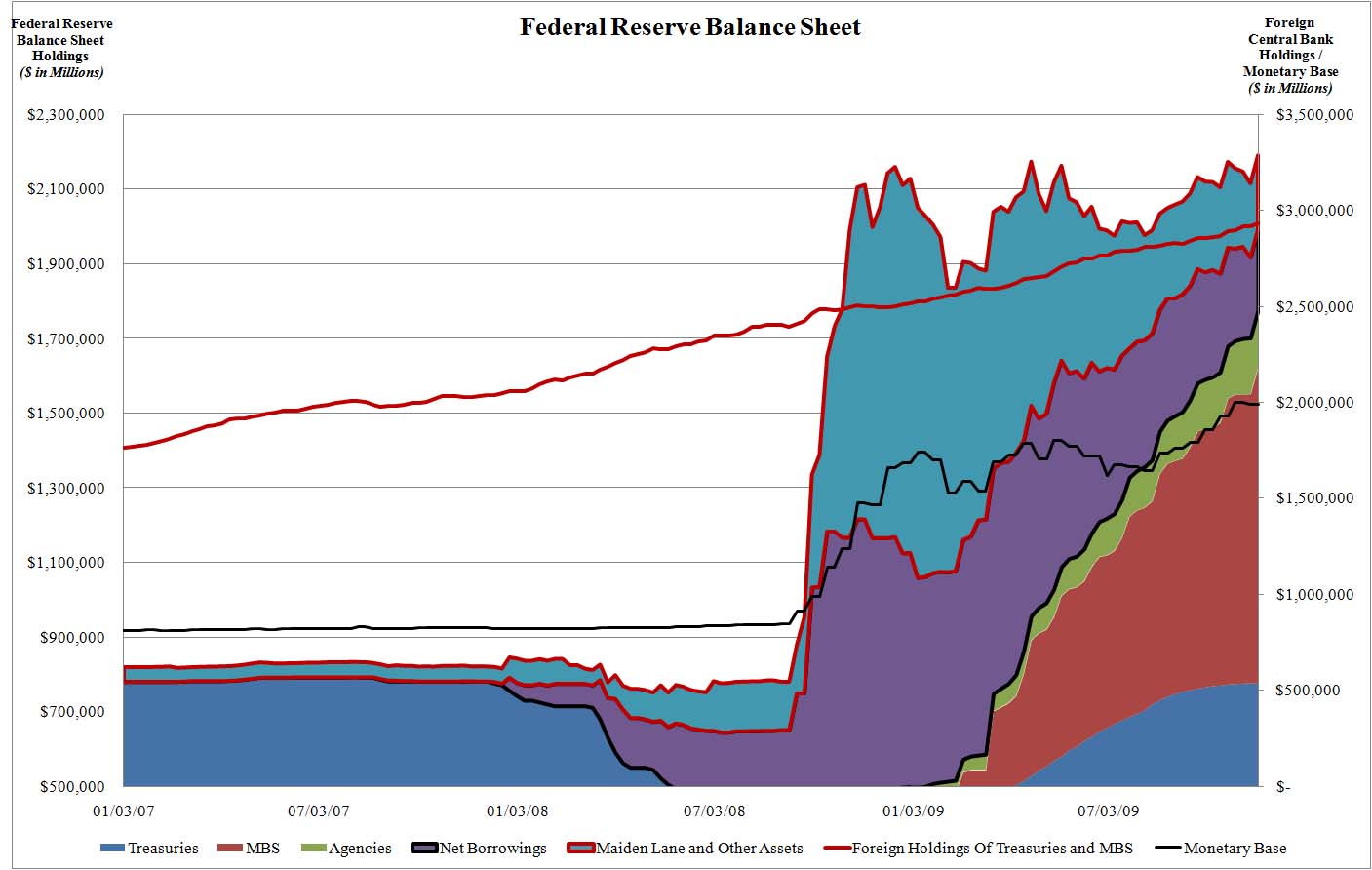

Reason #3 – Mortgage rates will go up

The U.S. Treasury and Federal Reserve have been systematically pushing mortgage rates lower. For example, the Federal Reserve just finished buying up $1.25 trillion in mortgage backed securities. The Fed balance sheet is already overfilling with mortgage backed securities, loans taken from banks, and other items which never were intended to fall under their prevue:

Source:Â Zero Hedge

This is not normal. Historically we have never been in a position like this. It is unwise to think that mortgage rates will stay low for an indefinite amount of time. Already the credit markets are starting to push rates higher because of the risk inherent in the current debt riddled system. Buying today assumes and is a bet that we can go into trillions of dollars of debt with no interest rate repercussions. This is a giant gamble and the markets are acting like a volatile casino.

To buy today is a big bet. There is too much that makes this market volatile. Aside from the above, there is also a large amount of shadow inventory which will keep a lid on price appreciation for years to come. Betting on housing today is probably the biggest gamble many will make.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

B-Tucky said:

Fortunately none of the above applies for cities like Austin Texas! We never had a bubble here and our robust housing appreciation in the last few years has been supported by our local industry and population explosion!

May 25th, 2010 at 10:48 pm -

JT said:

Great article! Now I just need to get all my friends and family to understand this as they continually try to pressure me to buy.

May 26th, 2010 at 8:27 am -

Craig Biesterfeld said:

The analysis is interesting. Have you looked at how rental prices overlay with the mortgage prices. It seems to me that despite the volatile nature of the market, folks will need to live somewhere. In a practial sense even if the data supports not buying a home where would someone live? If the answer is for them to rent a home would not simple economics drive a supply and demand for rental similarly as for real estate?

May 26th, 2010 at 10:24 am -

darrell simon said:

Good points but alas…. many many assumptions. I would like to hear (you have my email) your response btw maybe we can both learn something.

a) “Scenerios involving different interest rates whereby someone can pay off a mortgage early.”

fact is that most people will not have the loan long enough to pay the mortgage off. In investment properties a high interest rate can kill your cash flow. I believe that both scenerios have value… it depends on the individual and what their goals are.b) “Home ownership ratios income of a family to average house price.” No. It simply does not work that way in some parts of the country which is why real estate is a regional market… In san francisco rental properties are the primary means of home interest. People who work for a living do not buy houses, they are unaffordable, that is the market! In Detroit someone working (if they can find a job) can buy a home. Rental contracts are a form of ownership…. a good lease is an interest in property and a more realistic guage than trying to assume that people can buy a house in all markets in this country… its the same in most of Europe, people do not own property.

c) “Interest rates will rise again.” Really! I mean they will rise and they will fall and they will rise… housing is a market and things change in a market.

The mistake that people make is to assume that because housing is cheap, or expensive or whatever.. it is a bad investment. The truth is the value of real estate will always be in how it is financed and leveraged. If you can properly finance a real estate transaction and you can generate capitol then it is a good deal. People do not finance real estate intelligently and then wonder why the value is not there…. Investors are the worse culprits… these idiots bought investment properties for full price in bidding wars and wonder why they are under water? Its like my bucher buying his lamb chops from another butcher then selling them to me and wondering why he makes no profit. When you buy to rent you buy at a discount its in the financing and if it is not appreciation or not you are screwed.

I disagree that people should not buy. You should buy if yu can finance the deal at a profit and/or afford the property you are buying. If yu want a florida beach front property and can afford it, get it financed in a manner that it is affordable and can afford the down payment… what else is better to do with the capitol? put it in the overpriced stock market? Buy more Gold? Buy more soap and dried food for the apocylipse? haha Seriously Real estate as compared to the value of a dollar and other commodities is not overpriced when considering the value of the dollars used to pay for it.

Hence I think your comments may apply to some individuals with some scenerios involving a mortgage… i.e. if you can find somoense who will be in the same house over 10 years. I do not think it applies as a principle that is universal, most people take the most leveraged deal with a mortgage because they want more capitol up front where it is worth more…. yes you should buy accordingly but this is a different (albeit equally important issue). The truth is that smart people in real estate leverage their purchases and only buy at a discount to get appreciation.

May 26th, 2010 at 2:43 pm -

d patel said:

I liked your ideas, but I think it’s okay for me to buy a home now. One, I live in Louisville, KY, where we didn’t have a boom or a real bust. Unemployment is a small drag on housing here. Your first reason tells me it’s a good idea to buy now. Waiting for interest rates to rise (post european-crisis and whatever other non-american crisis that will occur leading to lower interest rates here) and then waiting for 6 months to a year for home prices to start dropping slowly is too long for me. I need to get a home now. I’m paying three times my income. Buying ( a large 4 bedroom home) versus renting (a two-bedroom apmt) is only $1700 vs $900 — not a bad deal! Any thoughts would be appreciated.

May 27th, 2010 at 7:37 pm -

bulfinch said:

Darrell

RE: SF: The prices on residential real estate in and around SF are some of the most overpriced in the nation. The pendulum simply hasn’t come full swing in that market thanks to both the religious mindset that ‘it’s just different here’ and a whole host of interventionist programs both state and federal, not to mention Prop 13. Land hording is not a good thing; a rent seeking economy is also not a good thing. Affordable housing hinged to local salaries/wages IS a good thing. No matter what part of the nation you live in.

And just as home ownership is not for everyone, neither is renting.

Interest Rates:

Interest rates have been manipulated by the Fed to an all time low for far too long. It warps the market, and indeed, was the major impetus in the last housing bubble. This particular bit of interventionist Fed policy is not simply the result of normal market phenomena. Housing may be a market, but it is not a free market.

May 29th, 2010 at 2:13 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!