California facing $20 billion budget deficits deep into 2016 – $25 billion budget deficit starring California in the face for the next fiscal year and overly optimistic economic predictions.

- 3 Comment

California, the wealthiest state in our nation is facing some Herculean financial troubles yet again. As the elections came to a dramatic close, it was announced that a $6 billion budget deficit emerged from “miscalculations†of potential revenue streams. The current Governor was overly optimistic in many respects including an expectation that the Federal government would somehow throw like a wild pitch billions of dollars onto California’s doorstep. This did not materialize. So a lame duck session of Congress is left to deal with the current fiscal year gap of $6 billion but there is little incentive for the state Congress to act when new state legislatures are sworn in early in December. The new Governor will have no honeymoon period and the 2011-12 fiscal budget is expected to have a $25 billion budget deficit. The challenges California face are magnified by its decade long reliance on the housing industry for jobs and tax revenues. Let us examine the challenges facing California moving forward.

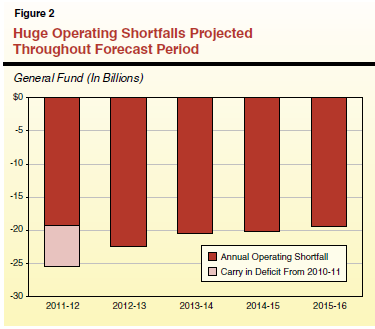

First, the $6 billion deficit is only the precursor to what is coming. California is expected to have $20 billion shortfalls deep into 2016:

Source:Â Legislative Analyst Office

The problem is one of spending but also of stagnant revenues. Pension costs are ballooning in the state thanks to decades of unchecked growth and Cadillac service for many retirees. When things are good, many deals were cut so you have people retiring at 50 or 55 with incredible pensions. No tiny stock portfolio can compete yet it is now clear that the taxpayer is on the hook for these if nothing is reformed. Given the anger from working and middle class Americans, it is unlikely that many will be happy about people receiving six-figure pensions while they are trying to find work. Just like the nation, you can’t cut taxes and expect to increase services. This kind of magical thinking is what got us into this mess. The Pied Piper must now be paid.

Here are some areas that were missed during the initial Governor proposal and their over estimation of revenues:

-Pension and Medical Care Receiver – $780 million

-Employee Compensation – $400 million

-In-Home Supportive Services (IHSS) Program – $300 million

-Lower Property Tax Estimates – $400 million

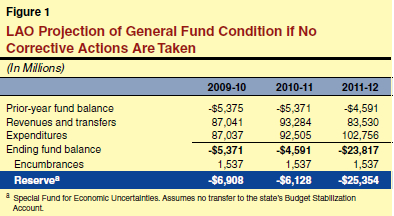

Now keep in mind the $6 billion shortfall is for the current fiscal year:

This is going to balloon in 2011-12 when expenditures explode by $10 billion.  Where is the money going to come from? California had two decades marked with extraordinary bubbles in technology and then real estate. So far no other bubble is knocking. The current unemployment rate in California is 12.4 percent with an underemployment rate upwards of 23 percent. Unlike the Federal Reserve California doesn’t have a printing machine so they will either need to raise taxes or make drastic cuts. It is unfortunate that cronyism in state government is a mirror image of what occurs in Wall Street. They are cutting services and squeezing the middle class by raising tuitions for education for example which is actually a benefit to the future economy. Instead of going after Cadillac retirement plans where the real money is they go after the future job base of the state. Is it any wonder problems are so deep in the state?

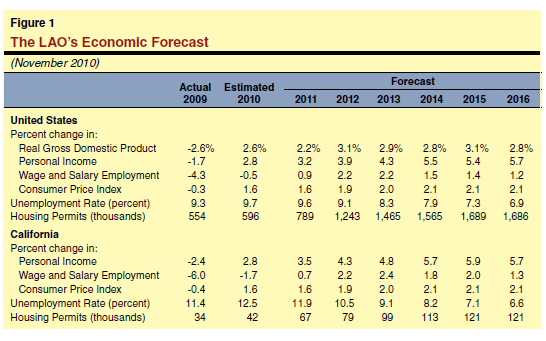

The LAO does excellent work but even their projections are optimistic:

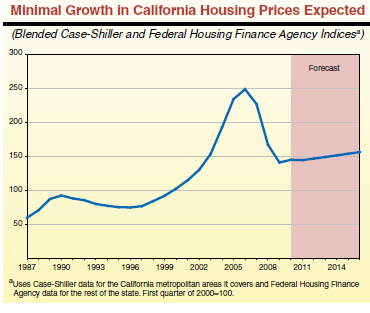

The LAO is projecting an unemployment rate of 6.6 percent in 2016. How can they see that far into the future? The current rate is 12.4 percent. What industry is going to add millions of jobs to make up this gap? We have yet to see this materialize. The big housing industry is also expected to grow modestly which I’m not sure is even what will happen:

It is the case that housing prices are largely still in bubbles in many cities across the state. So it is very possible that in the next few years home prices move even lower thus exposing an even bigger gap. Keep in mind the $25 billion deficit assumes these more optimistic scenarios.

California has made too many assumptions like increasing spending to record levels based on a once in a life time housing bubble. That revenue has evaporated into thin air yet the spending keeps trying to act as if we still had the housing bubble revenue. Something has to give. So in the next year, we will see either higher taxes or deeper cuts. Both of these will not be pleasant on the economy so gear up for some serious political battles ahead.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Tom said:

I live in Toledo OH, and our newly elected Mayor “a retired former fire chief” has just released his new budget, this borrows from all kinds of rainy day funds and cuts other services… Public school bus service has been severly cut, garbage rates increase twice a year and more,,,,, But, Firemen and Police will get a 3 percent pay increase, average Police and Fireman pay is 72,000 a year plus benies and they cry for more and our Union animal former Fire Chief will not say no. A crash is inevitable!!!!

November 16th, 2010 at 6:37 pm -

John said:

When will the dumb private sector stop voting for union crooks. Firemen, cops, teachers should never get one vote from non union people. Wake up America, the unions are robbing your kids and grand kids. Who do you think will get stuck paying for those ridiculous pensions and Free HC.

November 26th, 2010 at 12:09 pm -

Erick said:

Public employees and their so-called “Cadillac retirement plan” is a small part of the budget debacle. One of the major contributors to the chronic budget deficits in California are the millions of illegal aliens in California who receive taxpayer benefits yet who pay next to nothing in taxes. It’s time to acknowledge this fact as a major contributor to the deficit in California!

December 4th, 2010 at 7:56 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!