The coming deleveraging for Canada – Unit labor costs in manufacturing above US labor costs and household debt-to-income at 160 percent.

- 3 Comment

Our neighbors to the north in Canada are going to face a serious deleveraging shortly. This isn’t hyperbole or some off the wall call but based on evidence of what happens when economies get into too much back breaking debt. If the largest trading blocs, the US and Europe had to have their day of reckoning how is it that Canada will be immune from the same economic forces of debt? Bubbles do not pop in perfect harmony. They pop in a disorderly and loud fashion and momentum picks up once the unraveling begins. Canada has one of the biggest ongoing housing bubbles and contrary to the rhetoric we see, they have households deeply in debt. In other words, they are leveraging to the hilt just to keep this charade going. Yet this can only go on for so far.  Obviously bubbles can last for a very long-time (i.e., US housing from 1997 to 2007) and can surprise many people. Let us take a look at a couple of reasons why Canada is going to face a heavy deleveraging.

Canadian household debt

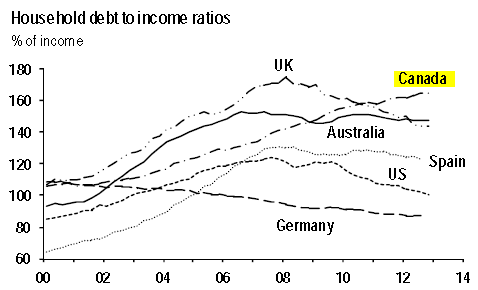

Canadian households are deeply in debt:

At the peak of the US housing and debt bubble, US households had something close to 120 percent debt-to-income ratios. Canada today is above 160 percent. So they are fully into uncharted territory. Household debt is incredibly high largely because of the massive Canadian housing bubble. Housing is the biggest expense in both the US and Canada. Contrary to what we hear, it is not different this time. In fact, given the massive debt we see, it is likely that the deleveraging event in Canada will be even more painful.

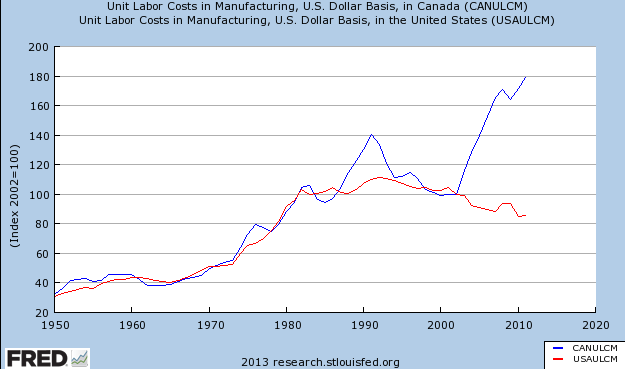

Canada’s labor costs are much more expensive than US labor costs:

This is problematic in a world driven by low wage labor. Households in Canada are maintaining their current spending via debt. This was a common experience that was had in the US as households were trying to maintain a middle class lifestyle while wages were stagnant or even falling. Canada has massive household debt relative to income and labor costs are also very high. The global markets are punishing. Look at places like Spain with high labor costs and big housing bubbles. It will take years if not decades to get to a more balanced out economy.

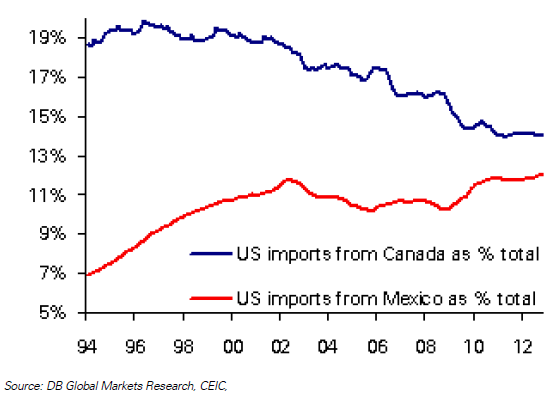

Canada is also losing an edge when it comes to maintaining a lion share of exports to the US:

You can see that over the last 20 years, Mexican imports have narrowed the gap. This is largely driven by the low wage nature of our current global economy and the aforementioned high wages in Canada. Something will give and is giving. But like any bubble, things get wilder at the very end:

“Bloomberg: – Canadian housing starts unexpectedly increased for a second month in March and building permits rose in February, evidence that low borrowing costs are supporting construction.

Starts were 184,028 at a seasonally adjusted annual pace during the month, up from a revised 183,207 in February, the Ottawa-based Canada Mortgage & Housing Corp. said on its website today. In a separate report, Statistics Canada said building permits rose for a second month in February on a rebound in non- residential projects.

Construction has been supported by some of the lowest mortgage rates in decades, along with historically cheap borrowing for businesses, even as the government tries to tighten the mortgage market amid concern prices in some cities have become inflated.â€

Low rates and cheap borrowing. Of course it will be different this time around. Right?Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Stephen Verchinski said:

so what is up with Australia? Is their market driven by low wage labor as well or is it as shown by the comparison of canada to mexico more an issue of who is your buyer of the goods you are producing?

April 21st, 2013 at 3:33 pm -

Lynn said:

What you fail to understand is our government is not carrying debt to any significant portion compared to the US. Also those that are carrying mortgages are doing so under the banks who are regulated by the government so if you have a mortgage, you can afford a mortgage. Housing prices have ballooned over the last few years, yes, that is correct but the debt that most Canadians carry is ONLY for housing and the banks in Canada work with the population to help them through difficulties, not kicking them out in the streets. The US lent money to everyone, whether they could afford the payments or not. In Canada getting a mortgage is not as easy and you have to qualify. Our banking system is regulated by the government, not a free for all. You are comparing apples to oranges! Canada’s banking system is strong and healthy as is our economy and most Canadians have a lot of equity in their homes. My house is worth $650,000 but I have over $400,000 in equity. If the market falls, I will still continue to pay my mortgage and live in my home. We also have retirement money, separate from our home equity. Canadians are conservative by nature which is why our banks are so golden.

September 29th, 2013 at 1:46 pm -

Rene said:

I wish Canadians had a financial website as good as this one! Lynne is an example of how badly out of touch most Canadians are on these issues (delusional) If you take the entire federal debt of Canada and add to it the insured mortgage obligations of CMHC (our freddie mac and fannie mae) you get over 1 trillion dollars more than doubling the national debt. That does not count provincial and municipal debts. Then there is out of control borrowing for automobiles which are much more expensive here. Add to that the credit card and student loan debts and its just as massive a gas bag, as any other bad example you can find. So far only two of us out of 34 million made it here to comment on this article. Don’t hold your breath waiting for more to arrive!

December 5th, 2013 at 9:52 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!