The casino of Wall Street enters official correction territory: S&P 500 has increased on the back of a massively expanding Fed balance sheet.

- 0 Comments

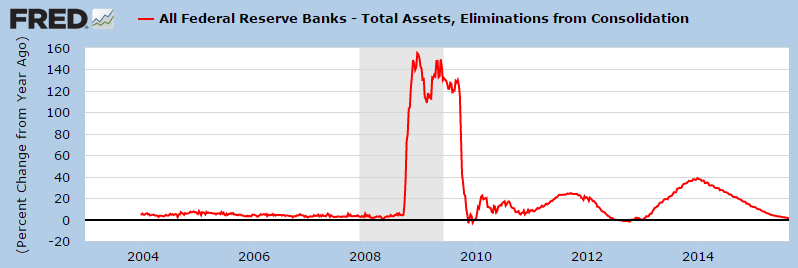

The casino effect of Wall Street is being played out in full. The Fed balance sheet recently stopped growing at an astounding $4.5 trillion. This is the first time in nearly three years that the balance sheet has slowed down in large part for the oncoming rate hikes that seem to never materialize. The market is largely funded by a few and wealth concentration has increased over the last decade into fewer hands. You need a buyer if you want to sell so many large investors are unloading inflated stocks, real estate, and bonds onto unsuspecting dupes. In China, a large part of the public jumped into the market and many only have an elementary school education. Today many are getting an education on the casino nature of the stock markets. In the US a large part of the bull market has come from the Fed expanding its balance sheet to ungodly proportions. The Fed balance sheet since the financial crisis has grown from $800 billion (mostly Treasuries) to $4.5 trillion of QE junk and asset swaps that are still lingering. The public realizes this is one giant charade and that is why they are revolting in the political arena.

Wall Street is juiced by Fed easy money

You can track the massive growth in the S&P 500 directly with the Fed’s growing balance sheet. Take junk assets from the banks and allow more credit to flow into Wall Street hands. Where did it go? It went into the stock market and real estate. Too bad the bailouts only helped to enrich those least needing it, the financially connected. Average Americans were given debt access to auto loans, student debt, and credit cards. Not exactly vehicles for developing wealth. The typical American is getting slammed by the consequences of these actions in the form of inflation that is hitting under the radar.

Don’t think the Fed’s balance sheet had any say in the expansion of the stock market? Look at this chart:

There is nearly a perfect correlation here because of course, this allowed banks to lend more and take on bigger risk but little of this risk made it into the public’s hands. It largely went to Wall Street which essentially replicated the bubble from the last financial crisis – ever expanding debt and inflating real estate is back.

You can see the markets now entering correction territory dropping by 10 percent in a relatively short period. Why? One reason could be the perception of the punch bowl being taken away:

Since the financial crisis hit, this is the first time in many years where the Fed’s balance sheet is actually slowing down in terms of growth. Of course this is in large part to QE being done but also, the Fed jawboning about future rate hikes. But they’ve been saying this at every false start for the economy. This is a runaway credit induced market yet again.

Everything can remain good as long as prices keep going up. But that is similar to a Ponzi scheme. You need people to continue to buy to keep the machinery going. At this point with current valuations it would appear that it is prime pickings to sell inflated assets to the public. In China, the market has reversed in extreme fashion and it is important to pay attention here because China is now the biggest economy (depending on what figures you look at).

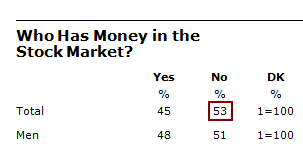

Most Americans are not paying attention to the stock market because they don’t own stocks:

“A Pew Research survey in March found that 53% of Americans say they have no money at all invested in the stock market, including retirement accounts.â€

Americans are more concerned about jobs and wages and with low wage jobs dominating the marketplace, frustration is mounting. They are also voicing their frustrations through the political system. This is why the political landscape has turned into a circus.

The stock market is now in correction territory. The Fed has committed verbally to a rate hike. If they don’t proceed, this would indicate that they are merely running a giant con-game (as in a pure confidence game). This correction might be in the early innings.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â