The mega Chinese stock market bubble:Â Over half of new investors only have a junior high education or less and the Shanghai Composite is up 100 percent in one year.

- 1 Comment

I still have vivid memories of Japan’s massive bull-run in stocks and real estate. For many years the consensus was that Japan had found a secret method of perma-growth and prices would only go up. Down was not in the vocabulary. We are seeing similar perceptions and narratives when it comes to China’s roaring economy. Let us make this clear, China is clearly growing and at a very fast pace. I don’t think that is subject to debate. But what is up to debate is that valuations in real estate and now stocks are fully out of hand. In other words, a bubble is fermenting. There are a few key metrics that really reveal to me that we are heading into deep bubble territory for China. The first is that the government has stepped in dramatically to curb real estate speculation and this has done very little to curb the rush for real assets. Next, we see the stock market through the Shanghai Composite being up 100 percent in only one year. But finally, a large portion of new entry level investors only have up to a junior high education and many new investors do not even qualify as literate. You still think valuations are fine? Let us take a look.

A rapid rise in the Shanghai Composite

Many investors realize that property markets are in trouble so are shifting their money into other forms of investment. One of those is the stock market. In the last year the Shanghai Composite is up 100 percent. This is an incredibly fast jump especially since China’s economy is not booming at such a quick pace which is to be expected. Money is rushing in as a form of speculation but after the fact. The big burst in growth already occurred.

Take a look at the rapid rise:

It should also be noted how quickly gains were given up when the last correction hit. Money can flow in and out so quickly and many investors are under the mindset that the Bank of China is able to step in and prop up anything at will. That is simply not the case.

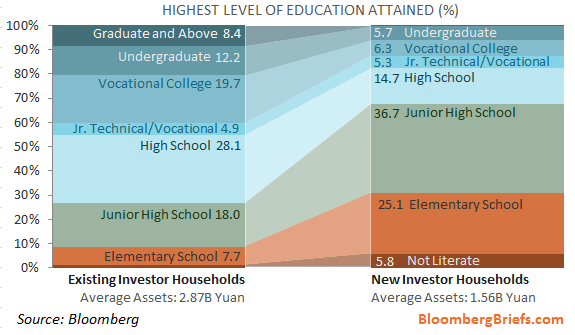

What has been dramatically troubling is seeing the level of education of new investors:

This. 67.6 percent of new investors only have a junior high education. 25.1 percent of this group only have an elementary school education and 5.8 percent can’t even read. That is the definition of speculation and also signifies that the entire nation is now participating in this mania. We’ve seen similar things in the US when the tech boom was happening in the late 1990s and every grocery store clerk, taxi cab driver, hair stylist, and dog walker had tips on the next Microsoft. Unfortunately this chart doesn’t bode well and also signifies some sort of mania spreading throughout the country.

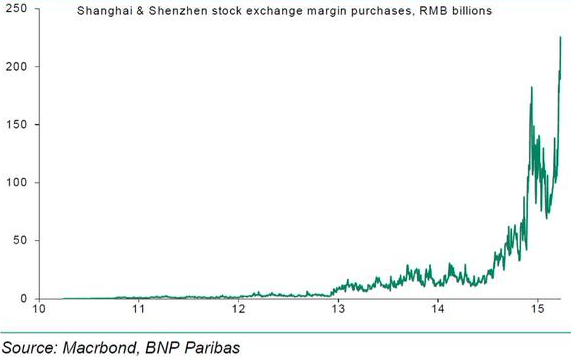

One of the biggest forms of risky speculation is when people buy stocks on margin. Using essentially borrowed money to leverage your bet higher. Take a look at margin buying volume:

This is the picture perfect definition of speculation. In the US we realize that the Fed has juiced up stock markets but little of this has trickled down to regular households. In fact, most households don’t even own stocks. In China we are seeing many households with barely enough to pay the bills suddenly becoming the next stock buyer in a market that has just went up 100 percent in the last year. Transparency and valuations are suspect although there are many that feel the Chinese government will step in no matter what happens. Perhaps. But will it keep valuations this high? Once a mania unfolds it is hard to contain.

Corrections are always bound to happen. We’ve seen manias all across the world at many points in history. Every single time we are told by some that it is different. Unfortunately it is never different. Timing is everything and rarely do we hear from those that get hosed in the stock market.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Roddy6667 said:

“only have a junior high education” Considering the low quality of American education. that probably makes them more educated than the average American investor.

April 9th, 2015 at 7:52 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â