A clash of generations – 1 out of 6 Americans receiving Social Security benefits. A larger share of workforce dominated by older Americans.

- 8 Comment

The bill is coming due. A stunning 61,000,000+ Americans receive Social Security, Supplemental Security Income, or both. Add another 46,000,000+ Americans on food assistance and you begin to see why we are running on borrowed time on a variety of fronts. With Social Security, working Americans are taxed for current retirees. This works when you have a large and young work base supporting a relatively small retired population. That equation is not our current situation. In 1960 you had nearly 5 workers for each beneficiary. Today that number is down to 2.8 and will hit 1.9 in 2035. For many young and less affluent Americans this is the time they will enter into retirement. If we are having a hard time funding current programs what is going to change the math down the line?

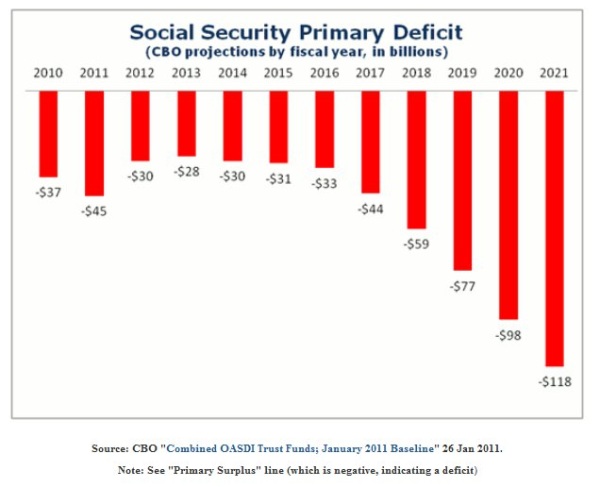

The infinite deficits

The current system is built on debt financing and spending money we don’t have. We are running deficits much quicker with Social Security than once expected:

This is now simply a reality. The one thing about Social Security however is that money is flowing into the system versus money just flying out to say bailing out the banking sector. The “trust fund†is nothing more than promises to pay people in the future but there is no giant bank account with trillions of dollars waiting to be paid out. For many young Americans struggling with the poor economy, Social Security benefits in the future seem more like a distant dream.

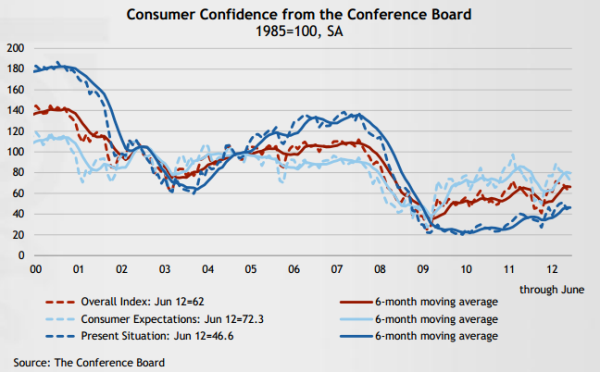

We are now officially three years out of a recession but of course the public does not feel this economic recovery:

The reality is of course most Americans have taken a major haircut to their investment portfolios. While a small part of our economy is protected by bailouts and massive disinformation, the rest are left to contend with a fierce version of market austerity. So it should come as no surprise that household net worth is down, wages are down, and low wage positions dominate the new jobs that do hit the market.

The math behind the deficits in Social Security are no mystery. This is one part of the economy we can predict with certainty:

The trend is unmistakable. We have a smaller pool of workers to support a quickly aging population. Here are some stunning figures:

People 65+ as a share of the working-age population

2010:Â Â Â Â Â Â Â Â Â 21%

2035:Â Â Â Â Â Â Â Â Â 36%

Not only will young compete against old, there will be a smaller pool of benefits to distribute out. The only thing that can remedy this is if the economy hits a boom cycle and wages and jobs increase. That is not happening and what seems to be the case is we are expanding our debt more and more.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

8 Comments on this post

Trackbacks

-

peter said:

THE GOVT. HAS STOLEN THE FUNDS FROM THE PEOPLE. THE PEOPLE WHO PUT IN THE FUNDS SHOULD BE GIVEN BACK THOSE FUNDS DOLLAR FOR DOLLAR PLUS INTEREST BASED UPON THE AVG. OF THE 30 YR TRESURIES. THIS WAS NEVER CONSIDERED A TAX BUT A PROGRAM GUAR. TO THE INVESTORS THAT THE MONEY WOULD BE HELD IN A TRUST ACCOUNT FOR THEIR RETIREMENT.

July 10th, 2012 at 6:20 am -

Don Levit said:

From a cash flow perspective, your analysis is correct.

Why is the interest redeemed of $45 billion in 2011 a cash expense? It is because the interest (and principal) of the trust fund have been lent to the Treasury over the years, to pay for current expenses.

If the interest had been left intact, it would simply have been liquidated, for it would have bee pre-funded.

Many people think that Treasury securities are equal to cash. Bruce Webb at Angry Bear thinks they are better than cash, for the Treasuries pay interest!

There are enough adherents of this “theory” that it has a name – the Trust Fund Perspective.

Adherents of this belief hold that Medicare Part D, which is funded 75% by general revenues and is a current expense – is fully funded!

Don LevitJuly 10th, 2012 at 9:25 am -

Glenn said:

Could it be that the millions of ‘early retirees’ opting to leave the workforce in pursuit of SSDI benefits are merely trying to get their share while they still can? I really wonder whether anyone who is under the age of 40 and contributing to the SS system could ever expect to be paid back their ‘investment’ in the system. The hordes of so-called disableds may not realize it but are probably making a smart decision by taking their early withdrawal.

July 10th, 2012 at 3:08 pm -

stephen said:

It is why the workers allowed for the Social Security Insurance Tax to be doubled under Reagan. Now that the folks who consistently raided the treasury are asked to pay back in it’s NOOOOOOO! Screw them all who made the workers pay for their excesses including McMansions, McYachts, McCars, McVacations and Second Homes in other countries. If they don’t pay into this system to maintain stability they will see a revolution happen and it will not be pretty when they come with pitchforks to your banks and workplaces.

July 11th, 2012 at 11:01 am -

TONY said:

Here is some good advice re: this article;

Eat, Drink, Be Merry, Make Friends with a Farmer, Buy a Semi-automatic 22 and Lots of Siver.

July 12th, 2012 at 11:51 am -

Ray said:

You forgot to mention all the money the govt. stole out of SS to fight both gulf wars! Nobody talks about getting the people off SS that did not pay in or who are faking disability.

July 12th, 2012 at 6:33 pm -

Bob said:

Peter,

“the people who have put in those funds should be given back those funds.” Well guess what you already have been ‘given’ this money. You were given this money in reduced taxes over the last 30 years.

In other words your taxes would have been higher if you hadn’t allowed the government to steal YOUR SSN money….that’s why YOU and your generation allowed the government to pilfer those funds.

YOU spent that money in the trust fund and it isn’t there anymore.

Sorry.

July 12th, 2012 at 6:50 pm -

laura m. said:

Glenn: we are early retirees, he took it at 62 in 2004, me in ’06. I told the person who signed me up, that the money was running out because the trust fund was never set up, and I didn’t want to wait till full retirement age. This country is stuck in stupid as good jobs move out of the country. We are not out of the recession but into a full blown depression big time. Politicians are lying scum, cannot be trusted period. Voting is fruitless as they are all NWO puppets. The people are ignored.

August 10th, 2012 at 10:48 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!