College Marauders – Student loan debt inches to $900 billion when only in 2000 it was at $200 billion – Most expensive colleges in country charging nearly $60,000 per year in tuition.

- 3 Comment

College education is a dream for many Americans. What the current recession is showing us is that having a college degree is a substantial benefit in getting ahead as long as you don’t put yourself into the abyss of student loan debt. This has been magnified by the fact that low skilled work and blue collar jobs are either outsourced or simply do not pay a competitive wage to keep up with the current cost of living. Average Americans do not have a 4-year college degree because if we look at the data 1 out of 4 adults in the United States has a bachelor’s degree or higher. Given that many of the sectors with future job growth including engineering and healthcare require advanced degrees it is crucial to have the foundational background to be competitive in these sectors. However like most anything in life, not all college degrees are created equal and chiseled from the same stone and with student loans people are able to do irreparable damage by chasing a degree that has little return on investment.

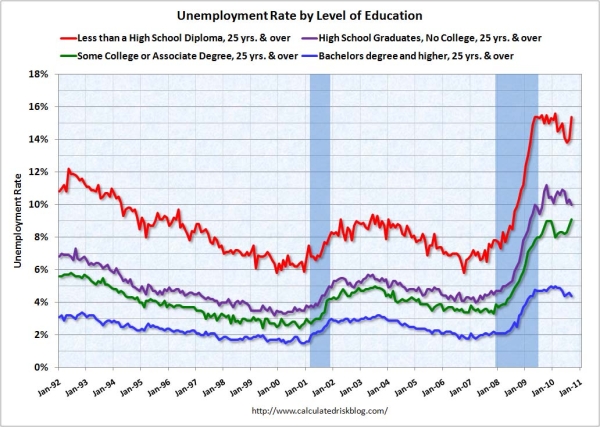

First, let us be open about the data and what it shows is having a college degree does increase the likelihood that you will have a job:

Source: Calculated Risk

The unemployment rate for those with a high school diploma is roughly 10 percent while those with at least a 4-year degree are closer to 4 percent. However, the above chart doesn’t show the new burden that many college graduates have of incredible amounts of debt which past generations had not had to wrestle with. The cost of being middle class seems to get more and more expensive in the U.S. As we know, 44 million Americans receive food stamps in the country. We do have a large number of Americans barely holding it together financially. But those with college degrees and massive debt are finding it harder to stay afloat. Part of this has to do with the soaring cost of a college education:

Source:Â Agora Financial

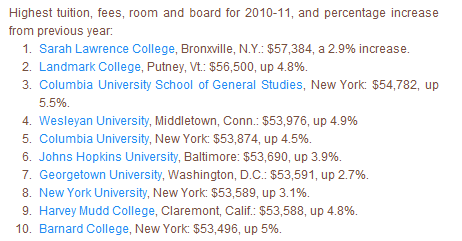

The cost of college has outpaced virtually every category including medical care costs and more important household income. In order to pursue a college education many have found it necessary to go into student loan debt. The stories of people working at a dime store and paying for their education become harder and harder when public schools cost $20,000 per year and private schools are inching closer to $60,000 per year in tuition:

Source:Â WalletPop

The average American makes $25,000 per year so remember that as you look at the annual cost of Sarah Lawrence College at $57,000. Part of the allure of college is having an education that will lead to a more fulfilling and successful life. The implication with any college is that your time spent will eventually yield real results in the economy. Many people are now realizing that not all college degrees are priced at the same level. For example, you can attend New York University and major in engineering or major in history. Your debt load is likely to be the same when you exit but your earning potential will not. College staff would like to say that you should pursue your dreams no matter the cost but when you are paying over $50,000 per year you have to ask what economic damage will be caused by doing so. This might be a lot to ask a 17 year old high school student. Unlike mortgage debt that you can walk away from, student loan debt sticks with you. There is no walking away from it unless you leave the country for a very long time.

College debt far surpasses credit card debt

We have crossed a troubling threshold where student loan debt has passed up total credit card debt. This is a dramatic shift only in the last decade.

“In 2000 total student loan debt stood at roughly $200 billion while credit card debt was at $625 billion. Today credit card debt is at $790 billion while student loan debt is now closer to $900 billion. In one decade we added $700 billion in student loan debt. This is money that needs to be paid back by new working professionals and will be a drag for years to come.â€

Many do not want to talk about student loan debt because it is incredibly embarrassing especially if the college degree has not yielded success in the employment market. Many think that they have failed as a college student by saddling their lives with massive amounts of debt.  Take a look at this account:

“(Liz Weston) Dear Liz: I really screwed up. I decided I wanted to go to a private college and am now saddled with $145,000 in private student loans and $30,000 in federal student loans. I am working on my master’s degree and am about to have a child. I’m looking at payment options for when I graduate and am very scared for my family’s future. I can’t afford to pay $1,000 or more a month in student loans and I really want to buy a house so my family can have a home. What should I do?

Answer: You may have to give up your dream of homeownership. Maybe not forever, but probably for a long while.

The amount of debt you took on is staggering. In general, people shouldn’t borrow more for an education than they expect to make the first year out of school — and there aren’t many jobs that pay $175,000 at entry level.

Your options are few. You typically can’t erase student loans in bankruptcy, and there is no statute of limitations on the debt, meaning your lenders can pursue you until you’re dead.â€

In other words, that debt isn’t going anywhere. What I find amazing is how in the world do we allow people to go this deep into debt with Federally backed loans? Just like the housing bubble, banks should exercise a fiduciary responsibility especially when they are lending out money that is backed by U.S. taxpayers. I’m all for personal responsibility but what about having the banks lend out their own money? You might notice above that most of the debt is from private loans. Well guess what? The government backs that up to.

The biggest portion of money does come from the government when we look at the aggregate data:

Source:Â Fidelity

Close to half of undergraduate aid comes from Federal loans so it is no surprise why the cost of college just keeps going up and up. In fact, now investment banks want you to save for two decades to send your kid to college:

As we have seen recently, the stock market is no guarantee of solid returns so now people are supposed to put their savings into Wall Street so they can then borrow money from the government that is doled out by banks so people can go to college? Student loan debt is even more troublesome than mortgage debt because there is absolutely no walking away from it. Plus, you have for profit colleges that in many cases are equivalent to paper mills and prey on lower income Americans. Does that sound familiar (i.e., subprime)?

College costs continue to go up because the data is being branded in a way to deceive people. “Sure, a college graduate makes way more than someone with no degree.â€Â But then they don’t bother to break down the actual incomes from various majors or school quality. They also don’t talk about how much of your income is going to go to debt payments once you graduate. Picking a good school and not going into massive debt is intelligent and a wise financial move. But given the $900 billion in student loan debt and revenues of for profit colleges something tells me we are in for another debt crisis.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Pedrito said:

So what makes a degree from a NYC based institution of higher learning intrinsically more valuable then a degree from any other school?

You learn street smarts 8-)) ?

March 9th, 2011 at 10:54 am -

Randolph Miller said:

Students need to shop by price for a college. Seriously, can you learn ten times as fast or ten times as much because you pay ten times as much? My advice to students, start by going to a community college for two years. It’s dirt cheap and the schedules are usually very good. Once you finish all the basic math, science, speech, writing, and so on, then you can transfer to a four year college and get a degree.

March 9th, 2011 at 11:24 pm -

Dumbfounded said:

$900 billion in school loans proves without a shadow of a doubt that we are now the dumbest nation on the planet.

Happy Graduation

March 30th, 2011 at 6:42 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!