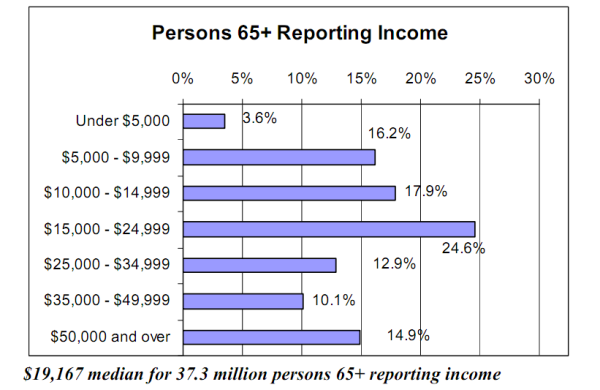

The Coming Demographic and Financial Disaster – Median income of Americans 65+ is $19,167. What happens when less affluent youth move back home and clash with older generations?

- 0 Comments

What happens when a society that prides itself on a middle class and self-sufficiency suddenly starts losing both? For over a decade the middle class in the US has been shrinking. This isn’t some speculation but is reflected in the stagnant household income data. You also have a giant demographic train in that many baby boomers are now retiring in mass. Over 10,000 baby boomers enter into retirement each day and many have an inadequate amount of savings (if any) to get them through the leaner years. Couple this with a less affluent younger generation and you have a recipe for financial and social turmoil. Many of these younger Americans, many saddled with large student debt, are moving back home with parents that have seen their entire home equity evaporate. Do you think these are happy households especially when the median income of those 65+ is $19,167?

Median income of the old     Â

There seems to be this misconception that older Americans are simply well off. The data shows us otherwise:

Source:Â US Dept. of Health

What is troubling about the above data is that during some of the most affluent decades in US history, most Americans have very little income in older age. In fact, most rely on Social Security as their primary source of income:

“Social Security constituted 90% or more of the income received by 34% of beneficiaries (21% of married couples and 43% of non-married beneficiaries).â€

How is this even possible? Keep in mind the average Social Security payout is roughly $1,000 per month and this is fixed. Since the government has juiced the CPI data most of these fixed income Americans are seeing their energy and healthcare costs soar all the while they are told inflation is virtually non-existent. Try arguing that after going to the grocery store.

There is also this sense that since many older Americans own their home, they are somehow immune to the housing bubble. That is not true:

“In 2009, 48% of older householders spent more than one-fourth of their income on housing costs – 42% for ownersâ€

Many older Americans still spend a lot of money on housing even if they are owners. Much of this comes from property taxes and costs associated with owning a home. Since many older Americans do own their home this housing bubble crash has harmed their largest asset.

As time presses on more and more of our population is going into retirement. Lower birth rates and more Americans making it into older age conjure up memories of Japan:

Source:Â Baby boomer stats

-There are approximately 77.6 million baby boomers in the U.S.

-The baby boom phenomenon is responsible for over half of all consumer spending in the United States

-80% of all leisure travel is taken by boomers.

-Every 8.5 seconds a baby boomer in the U.S. turns 50 years old.

-The baby boom generation is the largest generation in American history.

-On January 1st, 2011 the very first Baby Boomers turned 65

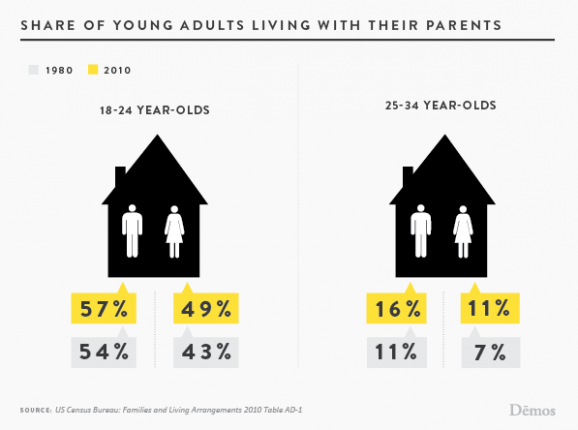

Baby boomers tended to also be big spenders (at least they were during the debt bubbles). But what now? The strongest spending group is losing a large part of their wealth with the housing crash and many are exiting their peak earning stages. From the Social Security data, we realize many did not save in what was likely the most affluent times for America. With many younger Americans carrying major debt loads and finding items like pensions disappearing, how will they prepare for retirement? What access to savings do they have? Homes are still expensive for many younger Americans and that is why millions have moved back home:

A society that has preaches independence and pushes out young at 18 will have a hard time dealing with boomerang kids coming back home. Many younger Americans will feel the strain as well especially if they “did the right thing†and went to college but now find a tough employment market and being back home. This demographic train has left the station and nothing will slow it down.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!