Commercial Real Estate Collapse Bigger than Subprime Implosion – Why is the Market Ignoring the $3.5 Trillion Commercial Real Estate Market Implosion? Pricing in Another Bailout.

- 1 Comment

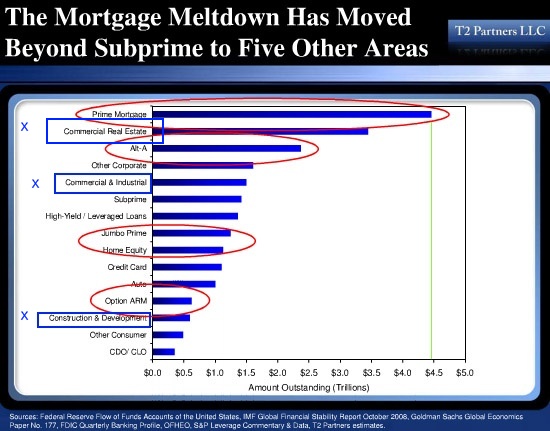

Most people that follow real estate even at a cursory level have heard of the problems in commercial real estate. The enormous $3.5 trillion market in commercial real estate (CRE) has deep and profound problems. At the peak CRE was estimated to be valued at $6.5 trillion. Today the value is closer to $3.5 trillion or closer to the loan amount outstanding. This market is now sitting in a zero equity position. In fact from market trends it is very likely that much of CRE bought during the last few years is significantly underwater. This trend is a few years behind the residential housing bust that shocked the markets into record declines. Why is the market not reacting as negatively to the bust in CRE as it did to residential housing?

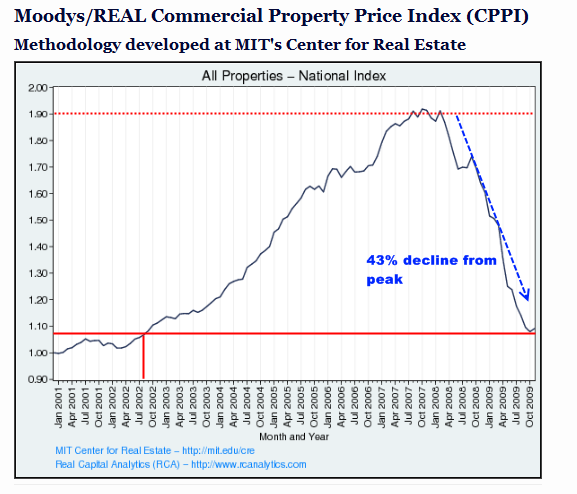

Commercial and construction loans combined are bigger than the entire subprime market and CRE values have now fallen by 43 percent from their peak across multi-family units, hotels, and retail space. And with the CRE collapse there is a harder time selling off this space if there is no economic demand for certain spaces. You also have a smaller pool of borrowers looking for retail space. Take for example retail space near empty suburban housing divisions. With the busted homes if you lower prices enough, there will be a market created at a certain point. Yet this takes time. But with commercial real estate you may have no market at any price. Much of the CRE space is used as a business. With no business there is no need for CRE. So we have a giant $3.5 trillion market of loans that are largely toxic but the market seems to be ignoring this. Take a look at the combined CRE collapse from data collected by MIT:

And the worst isn’t behind us. It is still to come:

“(Moody’s) The delinquency rate on CMBS conduit and fusion loans increased by more than 50 basis points in January, bringing the total rate to 5.42%. The total delinquent balance is now more than $36 billion, a $3 billion increase over the month before. By dollar and basis points, this is the largest increase in the delinquency rate thus far in the downturn, as measured by the Moody’s Delinquency Tracker (DQT).â€

Source:Â Calculated Risk

So the speed of value declines in CRE is still deep and troublesome. Why is it then that the market is ignoring this data? Part of it has to do with the banking system bailouts. It is now assumed that any large and significant problems are going to be handled by the U.S. Treasury and Federal Reserve. In 2008 when the market was pricing in reality based risk and valuing companies on their own ability to succeed, countless firms were going to zero because that was their actual value. Today, with the entire banking sector bailed out the market is now pricing in no failure and subsequently even companies with enormous amounts of commercial real estate seem to be doing well. Take a look at one of the larger holders of commercial real estate in Simon Property Group (SPG):

This institution is now up by 159 percent since the March lows. Has CRE really changed that dramatically in the last year? And this is one of those areas being hit extremely hard:

“(Reuters) Simon’s Mills properties portfolio is comprised of two types of assets: regional malls and Mills properties, totaling over 45 million square feet of gross leasable area. A Mills property typically comprises over one million square feet of gross leasable area and has a combination of traditional mall, outlet center and big box retailers and entertainment uses, all focused on delivering value for the consumer. These assets are located in major metropolitan markets. The Mills is Simon’s fifth retail real estate platform.

Simon’s Community / Lifestyle Center Division consist of more than 70 centers comprising over 20 million square feet in size. These properties range in size from 30,000 square feet to over 900,000 square feet. All of the properties in the Community Lifestyle Center Division are an open-air format and offer a range of merchandise opportunities in a well located and convenient setting. These daily-need centers operate with the who’s who of big box anchor stores and many national, regional and local small store operators.â€

Giant holding of retail space in a time when retail spending is collapsing. We have seen consumers pulling back usage of credit cards and discretionary spending. The only reason for this enormous price increase is the market is now highly mispricing risk because of the enormous moral hazard embedded in the entire system. We went from having a bank failing causing the market to react to now, we need an entire country to reach collapse like in Greece to yield any reaction to the markets. And this notion that companies are no longer at risk is naïve and at worst, problematic for our entire system. We took systemic risk and digested it to the entire network of our economy. The risk is now directly linked to taxpayers through various bailouts and Federal Reserve programs aiding banks. Yet the problems are still there. Unemployment is still at its peak and we’ve been losing jobs for 25 straight months. Prices on residential real estate and CRE have yet to come back because people no longer have access to loans that don’t verify their income or ability to pay the loans back. The market is mispricing risk yet again believing that these trillions in loans at risk will simply be back stopped by the entire country.

Japan gives us an example of what happens when a country turns their banking system into a zombie like nation. The big banks like hungry alligators demand more and more money and this sucks away from the productive economy. You also have a rise in part-time employment (Japan has one-third of their workers on part-time status). We now have seen a massive rise in this part of our underemployed economy, the largest ever.  And Japan spent trillions in trying to stimulate their economy and here they are two decades later with little to show for their massive financial bailout. Instead of facing the music at once it was spread throughout the Japanese citizens to pay over decades. The outcome is the same, someone has to pay for the bad bets. Will it be the institutions or the people? The United States with their bailout policy has decided that it will be the people who pay for this mess.

So when you look at the CRE market, don’t be deceived that things are suddenly better. In fact, they are as bad as they ever were. The market is simply assuming that the taxpayer will make all these bad loans whole like Goldman getting protected via AIG and taxpayer funding. In the end someone will pay and true values will eventually have to be reflected.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Daniel Simmons said:

Well who do you think help the Japanese with thier economic structure creating the the Zombie Banks? None other tha little Timmy at the traesurary. Research his history and track record regarding his influence on the Japanese economy!! What do think is is doing in America, the same thing. The great Zombie creator.

February 15th, 2010 at 11:11 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!