The growing condo shadow inventory – CityCenter in Las Vegas and Lexington Park in Chicago. The shadow inventory that is crushing commercial real estate.

- 3 Comment

There is a massive amount of vacant inventory sitting across the United States. A good portion of this is viewable to the public but a large amount of this inventory is simply hidden from data scrutiny. Last week we talked about the commercial real estate bust coming to the most expensive region in California of San Francisco. The fundamental problem was the complex had no way of cash flowing on the apartments with current market rates. So it is no surprise that the giant San Francisco project now enters into another precarious situation. Banks do not move quickly on commercial real estate problems because who is going to buy a multi-million or even billion dollar piece of real estate? In this market the pool is tiny and the pool of those willing to lend is smaller.

One of the hardest hit regions with collapsed real estate prices is Nevada. The enormous CityCenter project in Las Vegas isn’t doing so hot:

“(Las Vegas Sun) The closing of condo sales at CityCenter has gotten off to a slow start, according to analysts who track the housing market.

Through the end of April, MGM Mirage and Dubai World, the owners of the project, have closed on 78 of 1,543 units at the Vdara condo-hotel, according to SalesTraq. Closings started in March at Vdara but CityCenter had announced earlier this year it had sold 698 units there.â€

78 of 1,543 units is not a good start rate for a supposedly ultra-hot piece of property. The spin might be out there but just look at what is happening with price. Some units are already seeing price drops of hundreds of dollars per square foot. Many prospective buyers are waiting for 40 to 50 percent price cuts. Prices on some units have been cut by 30 percent but that doesn’t seem to be pushing inventory. The amount of sales tells us that people are more cautious with their purchases. You have to ask who financed this commercial real estate deal and what bank(s) are into this place. One thing is certain and that is the numbers simply won’t work with what is currently being sold.

“At the ultra-luxury condominium tower Mandarin Oriental, where 205 of 227 condos were reported sold as of earlier this year, 32 units closed between January and the end of April, according to SalesTraq.

“CityCenter just started closing units in the two Veer Towers in mid-May so those numbers won’t be available until the end of June. MGM had reported that 480 of the 670 units had been sold earlier this year.

Through Thursday, MGM counted 110 closings at Vdara, 38 at Mandarin Oriental and 16 at Veer.

“This Manhattanization thing everybody was trying to take credit for a few years ago, the condominium market has fallen on its face in this town,†said SalesTraq President Larry Murphy. “This is the deManhattanization of Las Vegas. CityCenter is right in the middle of the economic (woes), and it is a horrible time to be coming online.â€

A horrible time to come online but who is holding the note? This is why we are simply entering the first stage of the $3 trillion commercial real estate bust. Banks are optimistically hoping something will come to fruition that will suddenly make ultra slick condo units sell like pancakes. But right now consumers are price conscious even in the heart of the Vegas strip.

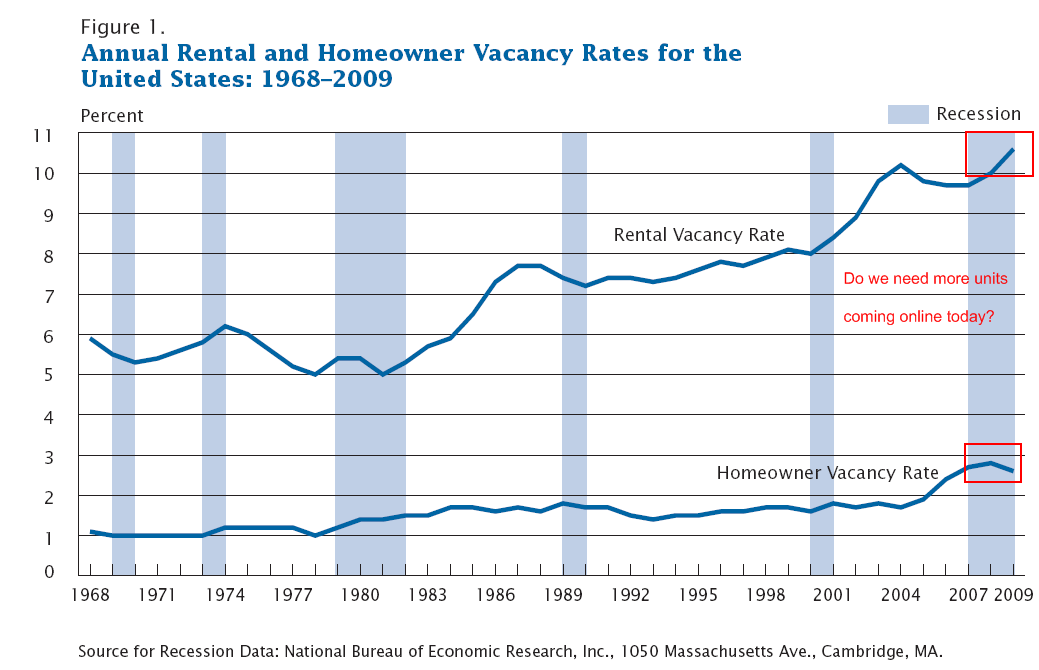

The fascinating thing is these units don’t show up in national data as inventory. Clearly these kinds of projects will skew statistics and it is clear that these are available properties. Whether they are priced right is another story but to exclude these from the overall data is misguided. If we look at the data there couldn’t be a worse time to come online:

We are in uncharted territory here. To bring a massive project like this online today will yield troubling results. Chicago is also dealing with this kind of commercial real estate debacle:

“(Chicago Business) A Near South Loop site where Chicago gangster Al Capone once had his headquarters, and where Geraldo Rivera famously found nothing in Mr. Capone’s vault, has gained new notoriety as the city’s biggest condo tower to be taken over by its lender in the current housing crisis.

The 35-story Lexington Park, near Michigan Avenue and Cermak Road, was surrendered last week by its Irish developer through a deed-in-lieu of foreclosure. The private-equity venture that now owns the property acquired Corus Bank’s the distressed condo loans after the Chicago-based lender failed last fall.

Just three buyers have closed on Lexington Park’s 333 units, according to property records. The tower, 2138 S. Indiana Ave., was supposed to be ready for occupancy in 2008.

Limerick, Ireland-based Chieftain Group Ltd. borrowed $84 million from Corus in fall 2006 to finance the tower’s construction, and also obtained $10.6 million in financing from 47 individuals in Ireland, according to mortgages recorded in Cook County.â€

What in the world is a developer from Ireland building in Chicago? So far of the 333 units only 3 have closed! You don’t have to be a rocket scientist to know that isn’t exactly hitting it out of the park. Just run a back of the napkin calculation:

$84 million + $10.6 million / 333 units =Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $284,084 per unit cost

That is pretty high for a condo in Chicago given the current economy (and that is assuming they sell for break even prices). A person put down $15,000 in earnest money back in 2006 for a one-bedroom unit. These deals are largely a bust. These will bring down many banks and show how insane the commercial real estate bubble grew. These units are also part of the condo shadow inventory as if we need more vacant units on the market.

To add to this insanity I saw a piece of legislation being put forward in Congress to encourage building. Only in our currently dysfunctional Congress would they give a tax break for building more units when clearly we already have too many units. The irony of the bill would also put more pressure on these empty projects and thus push more commercial real estate deals over the edge. What we give in tax breaks we will also need to give in bailouts.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

theyenguy said:

MGM spent $8.5 billion to build the CityCenter complex on the Las Vegas Strip; that is truly an insane amount of capital. Yahoo Finance reports, MGM, is loosing $3.56 per share; yet remarkably its stock is up 50% in the last year. Could it be, might it be, that MGM will go bankrupt soon? Personally, I consider it to be a good stock for an insurance company to go short; I personally am invested in gold coins.

Zachery Kouwe and Eric Dash in NY Times DealBook article Starwood Group Strikes Deal for Corus Assets (dated October 6, 2009), report on the FDIC/Starwood Public Private Partnership, relating that the FDIC would sell about $4.5 billion of troubled real estate loans that it recently seized from Corus Bancshares to a group of private investment firms led by the Starwood Capital Group, the real estate development company run by Barry Sternlicht … So the FDIC has an ongoing interest in the Lexington Park property as it underwrote it’s acquisition … I thought I would never see the day when the Federal Government would be in the luxury condo sale or luxury condo rental business.

We are witnessing state-corporatism, that is state corporate rule for the benefit of the elite of business and the elite in government; what a travesty!

Any way good riddance to the Irish developer; many banks in Ireland financed residential properties world-wide; just as banks in Spain did; now these are largely ghost properties. Ireland has or will have to nationalize its banks, and press their debt load on to the public as a type of sovereign debt. And here recently, Spain took over a major cajas, that is Catholic savings bank, that made massive numbers of home loans as well as vacation homes on the coast; so yes, here too more sovereign debt load.

Today, the risk of sovereign debt default is causing the Euro, FXE, and the European stocks, FEZ, and the European Financials, EUFN, to fall lower as I write.

John Hara of Hara Research just wrote the article Into the Abyss: The Coming Cycle of Debt Deflation. Debt deflation is the contraction and crisis that follows credit expansion. Mr. Hara relates one of the most famous quotations of Austrian economist Ludwig von Mises is that “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency involved.”

So yes, look for a global financial collapse coming soon. Probably when it does come the Elite will be leasing in luxury towers, just like in the movie Solyent Green. May God help us all.

June 3rd, 2010 at 1:03 pm -

NOTaREALmerican said:

Not sure why I never noticed your “most popular” list, but those are very informative. Nice work.

June 4th, 2010 at 1:00 pm -

Mikes edinburgh breaks said:

These dollar start housing auctions are a load of nonsense. It is too good to be true and is signs of a housing market on its last legs, again.

July 21st, 2010 at 12:46 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!