Contagion and the viral spreading of debt based systems – CEO pay at regional banks surge on average to $10.5 million thanks to bailouts while austerity is forced onto the middle class.

- 1 Comment

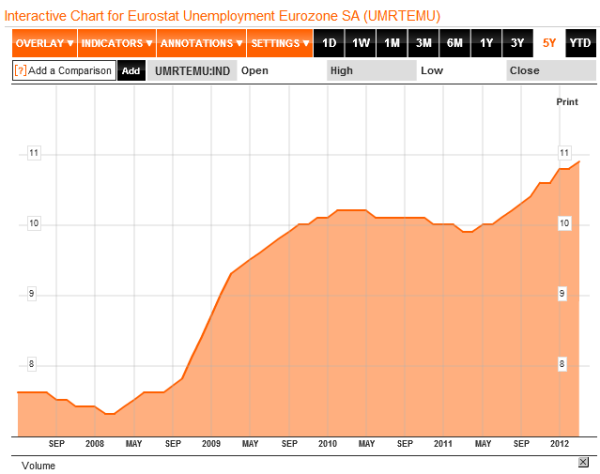

The biggest economy in the world just reached a new peak with their unemployment rate. We are not talking about the United States but the massive block in the Eurozone. The unemployment rate in the 17 country block reached a new all-time high at 10.9 percent as austerity measures are being used to combat massive levels of debt. There is no single rule of thumb as to how much debt is too much. A few respected economists from the 1800s once stated that too much debt is reached when the market suddenly acknowledges that too much debt has been reached. In Europe it appears that this apex of debt has been reached and certainly in a handful of economies too much debt has been reached. The trouble of course is that Europe is a massive trading partner to the US but also the world. It is naïve to think that issues in the European zone will not trickle over to our already fragile economy. The working and middle class are likely to have another tough challenge put ahead of them as countries overseas begin redefining what life is like with too much debt.       Â

The economic impacts of contagion

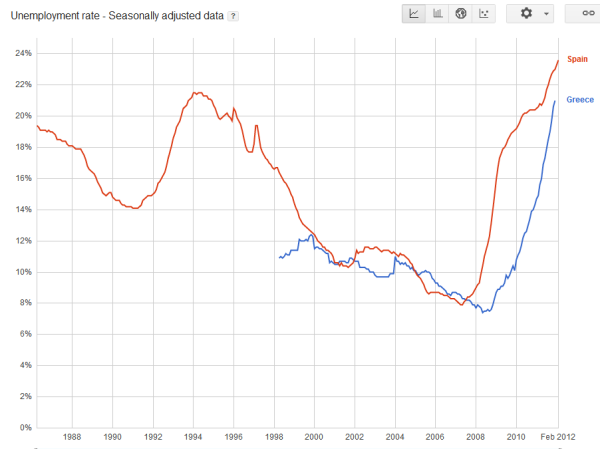

Two economies that are deep into severe recessions, practically depressions are Greece and Spain. Their unemployment rates are reaching levels that are likely to produce political instability:

These are unsupportable levels for any industrialized nation. The middle classes across the world are dealing with central banks that have produced too much debt to cater to large financial interests. Europe has taken severe austerity measures and so far, it has not had a beneficial impact to the EU. The unemployment rate in the Eurozone is now at an all-time high:

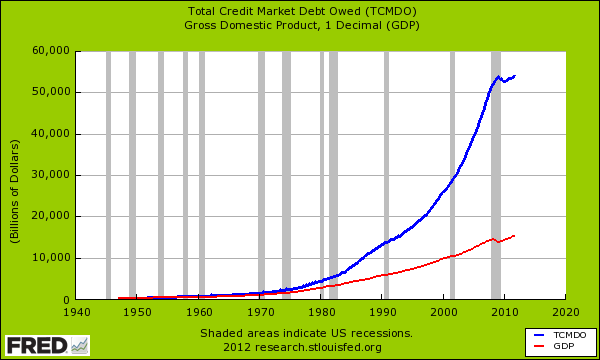

This trajectory is not healthy. It is interesting that while much of the attention is guided towards Europe we here in the US keep on printing digital money like it was going out of fashion. We have a perfect case example of too much debt being misallocated to support the bailout of banks and here we go printing more and more digital currency and to what effect? Think this isn’t the case? Just take a look at total credit market debt in the US:

I find this debt epidemic fascinating from a case study in behavioral economics. Here in the US, many confuse access to debt with money. This is a modern day mentality that is commonplace but very misguided. Debt does not equal money. Yet it is understandable how the public can confuse the two. Money is a medium of exchange for real goods. So if someone can get a mortgage for a $500,000 home and a $50,000 auto loan for a car and a $100,000 for an education, they actually “received†real items from the real economy. Yet they now owe $650,000. Depending on the ability to service this debt, this can be problematic and that is exactly what has occurred. When you look at the total credit market debt it is many times bigger than our current GDP. In other words, we are spending for goods today with money that will be paid off over many decades. It all can work when people believe they will get paid back. It breaks when this perception starts cracking.

The risk of debt spreading over is growing

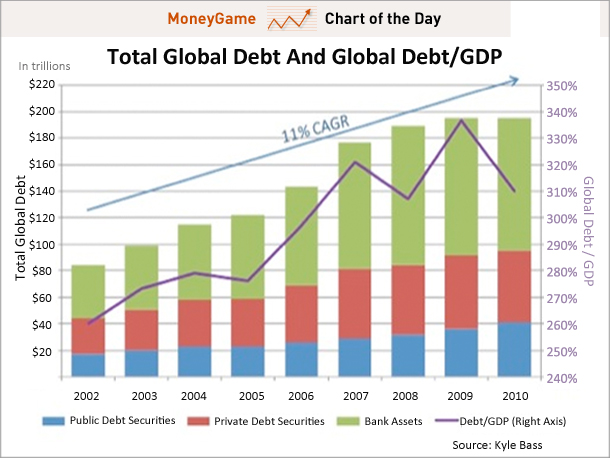

Total global debt has now reached a stunning $190 trillion:

Source:Â Business Insider

Keep in mind that many of the bailouts taking place through central bankers is simply through producing more loans or similar products that keep assets inflated. Total global debt increased by $80 trillion since 2002. While the global economy contracted, actual debt just kept on increasing. We have seen that the impact of this strategy has done very little good for the average worker in Europe and the United States. Yet if we look at the financial sector, we find some are doing exceptionally well:

“(Fierce Finance) CEO pay at the big six banks–JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley–fell to $85.4 million for 2011, from $147.8 million for 2007, according to Bloomberg. Average pay dropped 42 percent to $14.2 million.

Meanwhile, CEO pay at next five largest banks–U.S. Bancorp, PNC, Capital One, SunTrust and BB&T–rose to $52.6 million from $46.4 million for 2007. Average pay increased 13 percent to $10.5 million.â€

The issue of course is the debt being infused into the system is benefitting the financial sector and keeping the same institutions that caused this crisis to stay afloat. The spreading of debt is going viral and at a certain point, the axiom that too much debt is when people realize it is too much debt is starting to ring louder and louder across the world. If the sound of $190 trillion in total global debt doesn’t wake you up, I’m not sure what will.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Cincinnaticus said:

To answer the question, “how much debt is too much?”, all one has to do is look at the impact the level of debt has on the economy’s overall ability to produce and consume. Once the level of debt begins to accelerate past the point of no return, it begins to eat away at the economy’s ability to pay for goods and services as more and more income is redirected towards debt servicing and away from production/consumption.

This is what is known as “debt deflation” and the result is a shrinking economy as less money is available for the production of goods and services.

It’s a vicious catch-22 because in order for the debt to be serviced, the economy must continue to grow but as more money is sucked out of the economy via debt servicing payments to the FIRE sector, growth slows down.

The fundamental problem throughout history is that debts ALWAYS grow faster than economies, hence the “boom” and “bust” business cycles.

Ultimately, the only solution is for the debts to be written down or eliminated altogether in order for the economies of the West to reset themselves. This entails big losses for the creditor class [i.e., ultra-wealthy, financial oligarchs and institutions] and explains why they and their pet-politicians, regardless of ideological stripe, resist such measures.

CINCINNATICUS

May 4th, 2012 at 10:15 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!