Credit Card Companies Placing Financial Landmines for American Consumers: How I lost my 4.99 Percent Fixed Rate and got it Back.

- 4 Comment

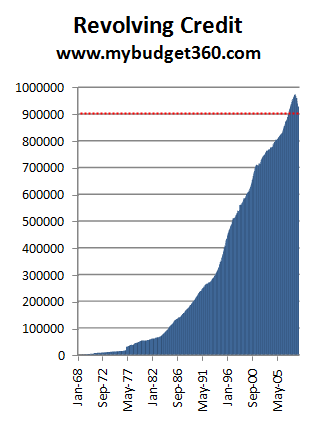

Americans have a love affair with credit cards. Many Americans have more credit cards in their wallets than they do dollar bills. When 8,000,000 credit cards were yanked from circulation many consumers realized that this was a new era of austerity. Credit card debt otherwise known as revolving debt, peaked in September of 2008 at a stunning height of $976 billion. Nearly a trillion (with a t) was reached during the peak and a spike in borrowing occurred because of good and bad times. Americans were attempting to balance their short-fall in wages with debt during the recession but during the boom, credit cards were seen as a form of wealth. As long as access to debt was available, it didn’t seem like much of a problem to many.

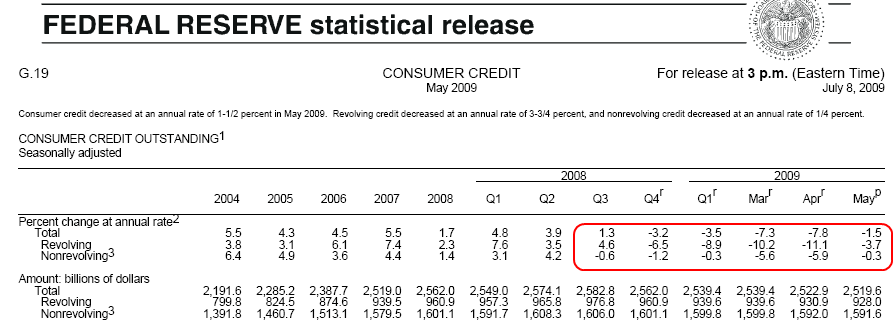

Now with nearly 1 out of 5 Americans eligible for work being unemployed or underemployed the usage of credit cards was trying to spike but credit card insurers have cut back access to debt:

*In billions

Since the peak in September, revolving debt has been on a steady decline. Since that point, some $50 billion in credit card debt has been removed from the system. At the same time, the average credit card interest rate has gone up from 12.72 percent in 2004 to a current rate of 13.31 percent. This is happening in a time when the Federal Reserve is holding rates near their zero bound yet very little of this is making its way to the consumer. Banks are not lending because they realize that for an entire decade they have been giving too much debt to people highly unlikely to pay it back. Under the guise of helping the consumer, banks and Wall Street intimidated the U.S. Treasury and Federal Reserve to give them access to cheap and plentiful amounts of debt. Remember the argument of keeping the life blood of America going linking credit to this premise? Well as you can see, access to debt is becoming more and more restrictive.

But the game is radically changing. Credit card companies cannot squeeze more juice out of a turnip so they are now going after borrowers on good terms and playing fast and easy with contracts and terms:

“(MSNBC) When James received a great credit card offer two years ago – a 4.99 percent interest on balance transfers for the life of the card – he jumped at it. He used the cheap money to remodel the kitchen of his Los Angeles-area home.

He never expected the new kitchen would turn him into a pawn in a chess match playing out among Congress, bank regulators and credit card firms.

The offer, from JP Morgan Chase had only one obvious stipulation: No late payments. Because the rate was far lower than a home equity loan at the time, James used the credit card for the construction project, borrowing around $20,000. His monthly payments were very affordable – just under $300. Paying the minimum 2 percent each month, he’d pay off the loan in about 8 years.

James, who requested anonymity because he’s uncomfortable discussing his personal finances in public -made sure to pay on time each month, jealously guarding the terms of his cut-rate loan. Little did he realize that Chase could find a way to make his life miserable without raising his interest rate.

But Chase recently threw James– and perhaps hundreds of thousands of other consumers – a huge credit card curveball. The firm sent letters to customers beginning in late June indicating that minimum payments would be raised from 2 percent to 5 percent. In August, his monthly payment will spike to $750.”

Now imagine someone who has lost their job or has had their hours cutback. For most Americans finding an additional $750 a month is not an easy task. I can speak from my own experience that credit card companies are doing these kind of tactics. I had a 4.99 percent balance transfer offer that I went after in 2007 for the life of the entire balance. During that time, the credit card company continually tried to advertise great deals and how I should use the card to purchase goods. Of course, doing this would force the new debt onto the higher 20 percent area. And when you pay back this credit card, your payment would go to the 4.99 percent balance and not the new 20 percent purchase. These are the kind of gimmicks they use but I never purchased anything beyond the balance transfer. However, the system they used switched to paperless and they stopped sending a statement to my home recently. When they sent an e-mail bill it was spam blocked along with Nigerian scams and a few days later I noticed the entire balance was up to 20 percent.

Now I don’t recommend carrying a balance. This is a bad move. But I had figured that at 4.99 percent the money was a good deal. Yet I talked with my attorney and wrote the credit card company a note which brought the promotional rate back. Either way, credit card companies can do what they want. They are not in the business of charity. The U.S. Treasury and Federal Reserve are looking out for banks and Wall Street. American consumers are on their own. You need to be vigilant.

Most of the credit card companies are trying to jack up their rates before new legislation makes it harder in 2010 to pilfer the American public:

“Tens of millions of Chase customers have taken advantage of our promotional low rate financing over the last five years,” she said. “Most of these loans have been paid back in less than 24 months. However, there have been a small percentage of customers that have not made as much progress in paying down these loans. Our desire is to have these balances paid back in a reasonable period of time.”

Bill Hardekopf, who runs LowCards.com, said banks are following through on warnings that credit card expenses for consumers would rise after passage of the Credit Card Accountability, Responsibility, and Disclosure Act.

“From an issuer standpoint, they are looking at their default rates going up, they are in tremendous economic distress and they are trying to minimize their risk as much as possible,” he said. “Issuers feel they need to find ways to make up for revenue they are projecting they are going to lose once the legislation takes effect.”

Chase told msnbc.com that it would work with consumers who are unable to make their new payments, but James said that’s merely an invitation into a lion’s den. The only offer he received was a severe change in terms to his account with a much higher, variable interest rate.

When the new federal regulations take effect next year, they will severely limit banks’ ability to change rates unless cardholders have variable-rate agreements, so banks are trying to steer consumers away from fixed-rate cards. Bank of America, for example, recently sent notices to cardholders with fixed rates telling them their accounts will be changed to variable rates starting next month.”

So for the moment, they’ll be changing rates at will for the tiniest infractions. Or because they feel like it. Also, I have gotten a few letters where you actually have to call to opt-out of a rate increase. I have a credit card with a fixed 6 percent purchase rate but recently, the issuer sent out a notice stating that they would raise the rate to a variable rate of 15 percent if I didn’t opt-out. I nearly tossed the letter into the junk mail bin but did a double-take. Who in the world would sign on to this? They are betting on many, like I almost did, tossing the letter into the trash and one day waking up seeing the rate skyrocket to 15 percent. This is the new reality.

The massive amount of debt created by the multi-decade long housing bubble created a cultural psychology and love with debt. The last generation from the Great Depression knew the slippery slope of debt and many stayed away from it or at the very least, were very skeptical. That was not the case for the past 20 years. Credit cards were glorified and even became a designer symbol. A gold card used to mean something. Now, everyone has a gold card, platinum card, or some titanium card. Who really cares? The real value comes from the terms which have become more onerous. Yet psychology is a big player here because people “feel” richer with a titanium card in their wallet even though they are flat broke and in massive debt.

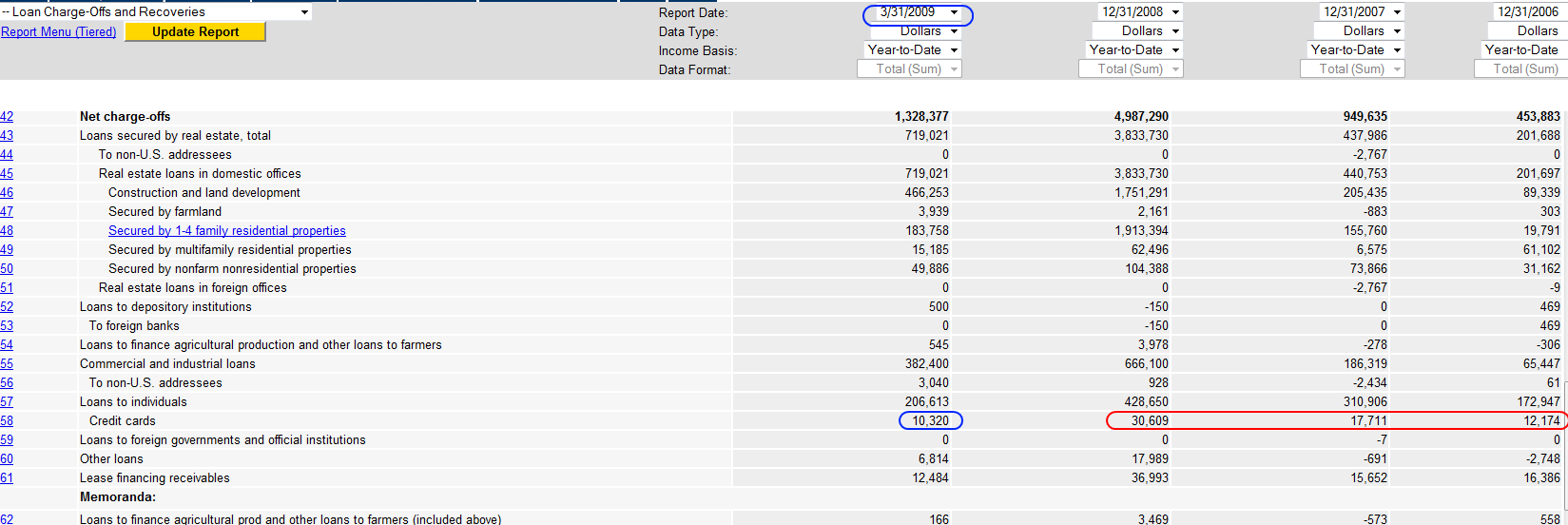

If you want a sample look of where things are going, take a look at FDIC insured charge off rates for California:

The charge off rate went from $12 million in 2006, to $17 million in 2007, to $30 million in 2008. The current rate is tracking over $40 million for the year and keep in mind late payments are shooting up. This may seem tiny but these are highly leveraged products and banks have these items as assets on their books. More losses coming down the pipeline and more pressure for banks to squeeze the American public so make sure you stay vigilant.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Alessandro Machi said:

I don’t quite agree with you implying that the credit card companies prevented a huge spike from occurring.

The credit card companies have caused the current economic distress by raising credit card interest rates and offering NO INCENTIVES for consumers to pay down existing credit card debt.

BLOGGERS AGAINST CHASE BANK.com

CREDIT CARD COMPANIES ME FIRST AGENDA IS CAUSING SOME STATES SERIOUS FINANCIAL LOSSES.

July 23rd, 2009 at 9:17 pm -

Factsnews said:

Brilliant! I need to pay off my credit card ASAP! Each time I make a payment to Amex, they reduce my limit. Last year, I owed $3000 with a limit of 3500, paid it down to 2800, they reduced it to 3000, paid it down to 2400, they reduced it to 2500. Pretty soon, when I pay it all down (when?) they will just take away my credit limit and say get lost. I can see where they are trying to save money by shaving little bits off credit limits, they only cut about $1000 off my limit, but for millions of customers, it adds up.

July 24th, 2009 at 11:33 am -

Don said:

Funny story of a guy sticking it to the credit card companies.

December 8th, 2009 at 6:52 am -

JP Merzetti said:

Credit issuers really are the sharks in the water, circling the fat fish they fed all the leveraged fish food.

It was a dream come true when plastic money and home loans became an interchangeable mix……..angel food cake deluxe.The lenders sucked up profits galore, and now big daddy’s gonna take the T-bird away…

Funny thing – I remember a time not so long ago when no-one under 30 had any credit of any kind, and just bought whatever they could afford – with cash. I suppose we’ll see some of that come back one day.

Seems to me the big problem now is utilizing the card as actual credit – as opposed to convenience. They’re great, standing in for the money sitting in a bank account……..not so good representing hoped-for earnings from next year, and the year after that……….

….creating pork belly futures in the comfort of your own home!I can’t imagine what terrific new schemes come down the pipe to make up for what they lose from regulated restrictions. Should be quite a party. They just won’t quit it.

March 27th, 2010 at 8:35 pm