Credit card withdrawal – Banks pull the plug on consumer revolving debt. Credit card debt outstanding contracts from nearly $1 trillion to $800 billion. Bankruptcies on the rise even with tougher bankruptcy laws.

- 1 Comment

When people talk about the credit bubble they typically refer to the housing bubble and the trillions of dollars of debt secured by real estate. Yet the credit bubble also applies to student loans, government debt, and those pesky wallet hugging credit cards. The American economy has embraced credit cards as quickly as apple pie or a weekend picnic at the park. During this holiday season many people pulled out the plastic and loaded up on debt to face a hefty bill come 2011. While banks have generously gorged at the taxpayer bailout trough, they have slowly put a tourniquet on the amount of credit Americans can access. In other words banks have applied standards to American consumers that they are not willing to adhere to themselves. The total amount of credit card debt outstanding has contracted vigorously since the debt crisis emerged.

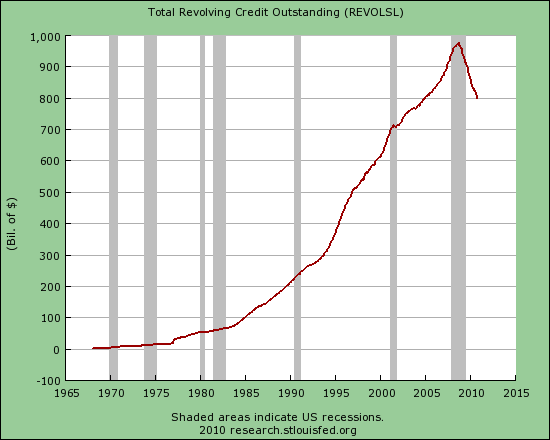

The below chart highlights the total amount of credit card debt in the United States:

The above is a stunning chart because it highlights how quickly discretionary debt has been pulled off the shelf for most average Americans. Banks are selectively going after the quality borrowers while slowly cutting off borrowers who are at the end of their financial ropes. The blank check that was written to the banks will not be extended to these borrowers. Banks still have their platinum credit card with no limit attached to the US taxpayer. The Federal Reserve and US Treasury call this card the bank of too big to fail. At the same time most Americans have seen their credit limits slashed and have seen the amount of 0 percent offers go from a flood to a drought in their mailbox. The above chart went from a peak near $1 trillion to the current $800 billion outstanding in revolving debt. Some of this is being paid off but a large part of it is being written off via bankruptcy.

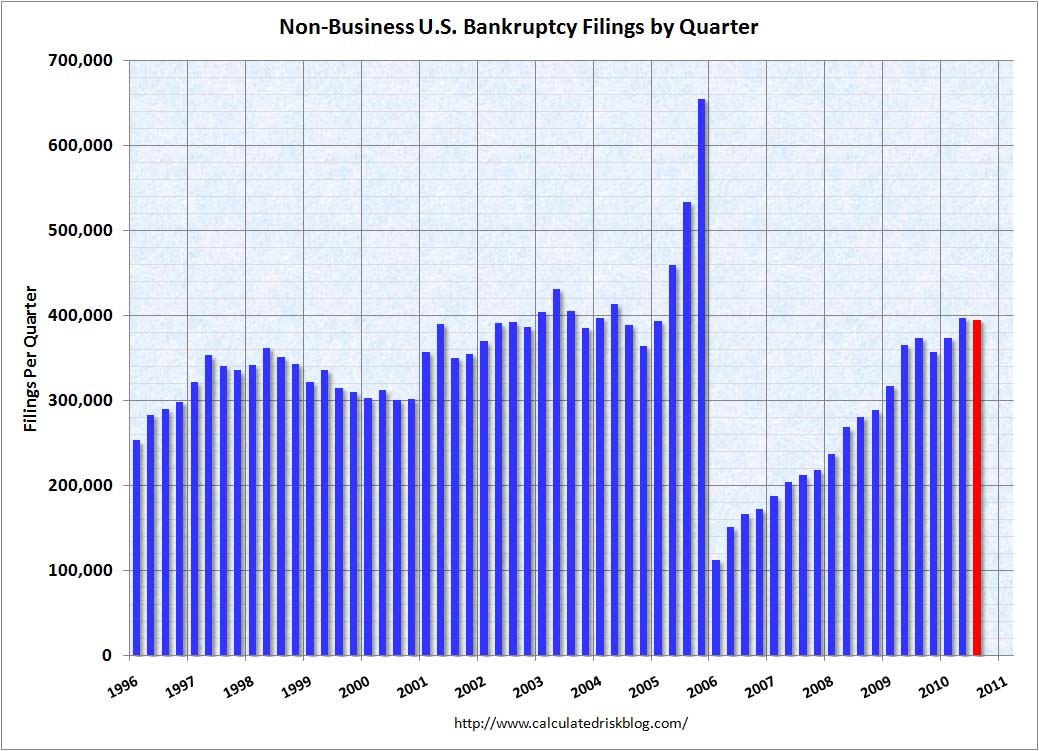

Consumer bankruptcies keep moving up:

Source:Â Calculated Risk

It is interesting that little coverage is given to the crisis in credit cards in the United States. The assumption for spending is always based on the notion that people will spend beyond their means when we look at mainstream advertising. Spend today what you will earn tomorrow is typically the motto. No reasonable retailer will ask a potential customer if they have their household balance sheet in order before making that additional flat screen TV purchase. Yet banks are dealing with peak debt and many Americans are simply unable to make their payments on revolving debt. We already know that many are unable to make their mortgage payments with millions of Americans in foreclosure or living in a home where they are no longer make a payment. With credit card debt banks have little collateral to go after and much of this is gone and is best left to history. Yet the lingering issue of bankruptcies will stay with us for years to come.

Many of you will ask why did bankruptcy filings spike in 2005? This spike occurred because the bankruptcy process became more complicated for average Americans with legislation. Income testing and additional protections for the banks were put in place to siphon off as much from Americans as possible. After all, if banks actually spent time doing due diligence instead of relying on bailouts then things wouldn’t be so bad. Yet banks have little incentive to change their practices and the fact that bankruptcies are elevated with the new legislation is a testament to how bad things are in the real economy.

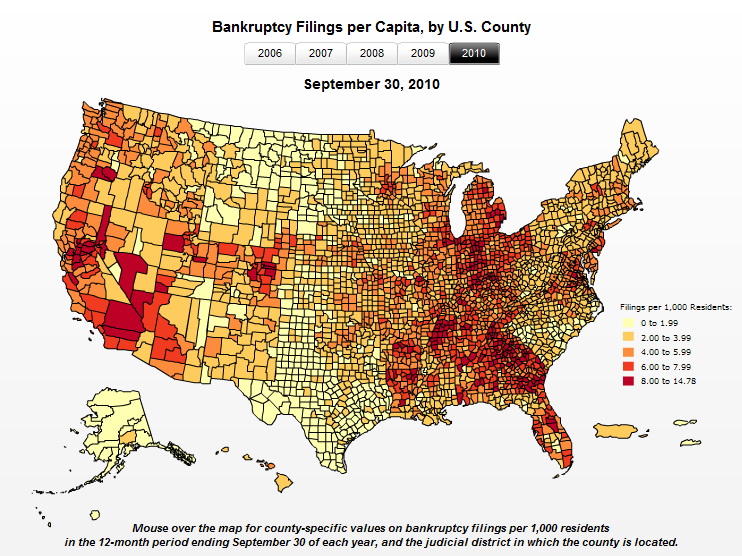

Another fascinating aspect of this is per capita the states with the biggest housing bubble also are seeing the largest amount of bankruptcy filings:

Source:Â US Courts

The too big to fail banks are at the center of this mess with credit cards as well:

U.S. general purpose credit card market share in 2008 based on outstandings

(Note: 2007 ranking in parentheses)

1. JPMorgan Chase – 21.22% (17.74%)

2. Bank of America – 19.25% (19.36%)

3. Citi – 12.35% (13.03%)

4. American Express – 10.19% (11.40%)

5. Capital One – 6.95% (6.95%)

6. Discover – 5.75% (5.65%)

7. Wells Fargo – 4.21% (3.07%)

8. HSBC – 3.47% (3.65%)

9. U.S. Bank – 2.14% (1.84%)

10. USAA Savings – 2.02% (2.01%)

Source:Â Â Creditcards.com

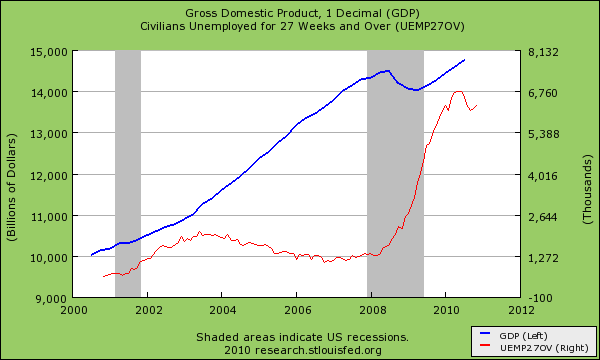

In the end the American consumer is facing a drastically new financial market. Credit card debt never contracted on a year over year basis since 1965 but it did in this crisis. The amount of credit card debt outstanding has fallen nearly 20 percent from its peak only a few years ago. Yet the economy at least measured by GDP has grown:

All the while unemployment remains persistently high.  Banks and large corporations have benefitted from this crisis by suppressing wages, using government plutocracy power to their benefit, and generously taking on bailout after bailout. So the economy has grown for these individuals and that is why the top 1 percent now controls the largest amount of wealth since the Great Depression. Credit cards were merely another hammer in the banking tool bag that hid the fact that the middle class was being banished in America. Little by little with toxic mortgages, 0 down offers, and student loans for bogus colleges did Americans get sucked into a debt pipedream designed by the banks. It is no surprise that for each of these categories, the too big to fail continually show up like unwanted party guests. With credit card debt contracting and bankruptcies on the rise we get a true glimpse of what is going on for average Americans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Iowa Farmer said:

We got good old tomatoes and our own smoke, too. Ain’t too many things these old boys can’t do, and a country boy will survive. I can plow a field all day long, I can catch catfish from dusk till dawn, and a country boy will survive. Now, ya’ll don’t even think about comin’ on my farm in the next few years when you ain’t got nuthin’ to eat, ok? You’ll just end up bein’ smoked and eaten, too.

January 1st, 2011 at 5:52 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!