Cronyism and ensuring American taxpayers bailout the finance industry during the next crash: Nostradamus like spending bill will ensure big banks never fail with your money.

- 0 Comments

Do you smell what is in the air? Pine trees? No. Something with a more pungent smell. There is a wonderful whiff of cronyism floating around Washington D.C. In the latest government kabuki theater there was some interesting items being passed. There were major protections given to banks should trillions of dollars in derivatives blow up during the next market correction. While the public is enjoying a few dollars off in gasoline prices so they can spend more money they don’t have during this holiday season, the latest government/banking spending bill was passed by slim margins but puts the taxpayer on the hook for trillions of dollars of risky derivative bets. Great timing given the energy markets are imploding so we know some hedge funds are taking it in the shorts and will likely come to D.C. hat in hand to cash in on those generous campaign donations. Central banks have done very little to help US households because incomes simply are not keeping up in the face of inflation. The latest bill is something to behold.

Minority Report of finance bills

What is so blatant about the latest bill is that it practically says that next time banks implode via derivative bets that taxpayers will be on the hook. The last time we were told that too big to fail banks needed all the help in the world because they would take the economy down with it. Of course the public did not want this but the spin media made it seem like the public was on board. They never were. Yet this was done during the actual correction. This time, acting like Nostradamus the financial industry is basically writing in provisions to protect itself for future transgressions. Like writing a note to your spouse that you apologize for all future mistakes and this piece of paper absolves you from all acts.

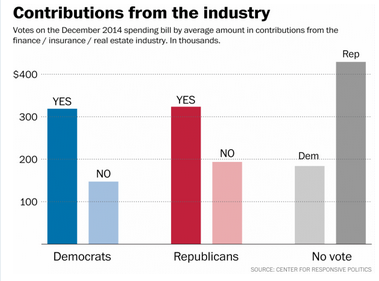

This should be no surprise given that the FIRE industry is backing both Republicans and Democrats equally:

“(WaPo ) on average, members of Congress who voted yes received $322,000 from those industries. Those who voted no? $162,000.â€

Those that think money in politics buys little influence are either naïve or simply are ignoring the facts. It is clear that money is controlling our government to the point of cronyism. And of all those previous bailouts? How have they helped American families?

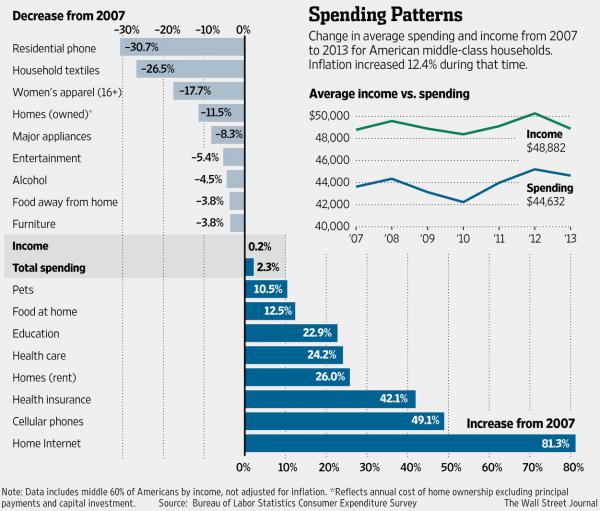

The cost of housing, healthcare, and college tuition are soaring yet incomes are stagnant. Of course inflation occurs because too much money (debt) is flowing into the system. Big banks and investors ended up buying many single family homes and converting them into rentals and pushing rents up. Prices are also up but many families never recovered after the Great Recession hit. The stock market went up but thanks to hot money. Spending and income are not looking so hot:

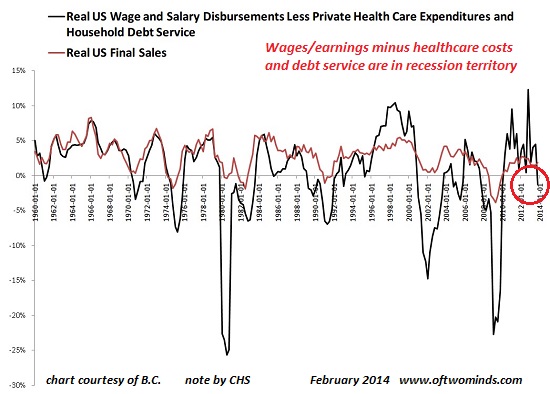

If you look at wages/earnings minus healthcare costs we are actually in recession territory. And since very few Americans actually own stocks, the recent mega run in the stock market has done little for regular families.

But what is certain is that the recent spending bill that was passed is laden with future gifts to Wall Street banks when the inevitable correction hits. Influence peddling in Washington isn’t anything new but the blatant nature of this bill is. These are trillion dollar bets that will likely go bad and a bill was now passed to make it easier for taxpayer bailouts when things inevitably correct. This will come from Americans that are struggling planning for their retirement and have very little in savings. If you need any more proof that the 2014 election was a joke, look no further. We are basically swapping jerseys on the same players here. Get your wallets ready for the inevitable future bailouts that you will not vote on once again. Our government should represent the voters but in this case, they represent their biggest donors. And what the donors want isn’t necessarily what is best for American families. In fact, it is the direct opposite in many cases.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â