Dark Ages for a modern Middle Class – Modern day debt serfdom and rising prices not seen through the consumer price index. Coffee up 50 percent for the year.

- 3 Comment

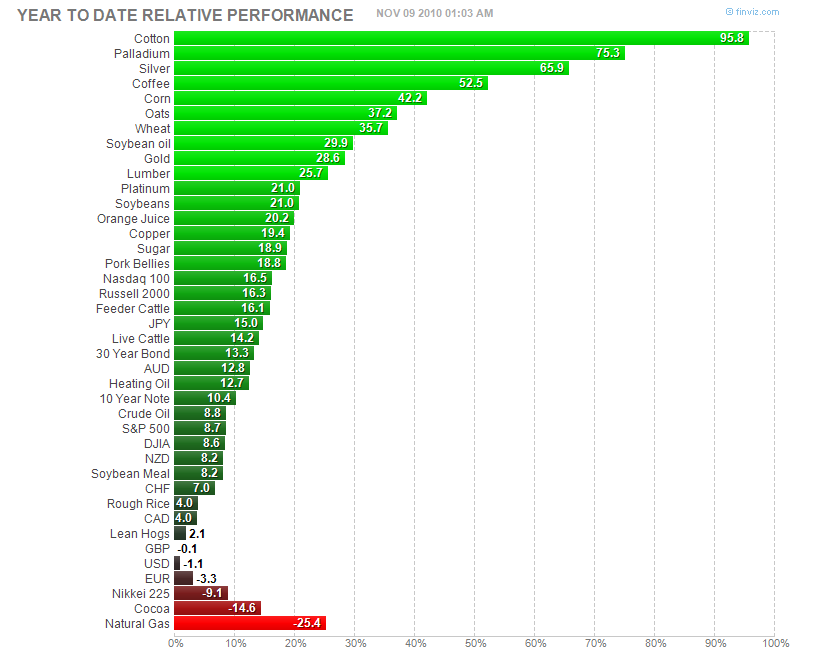

Most Americans enjoy a good cup of coffee. Yet very few realize that coffee futures are now up over 50 percent for 2010. Creative packaging that includes smaller quantities but offers the same price helps delude many Americans into thinking their dollar still has the purchasing power of better days. This all occurs in a relatively subtle and typically hidden process. Cotton for example is now up 90 percent for the year. Corn is up over 40 percent. It would be one thing if this was all based purely on demand but more of this increase in price is coming from the Federal Reserve pursuing actions that are punishing the U.S. Dollar. The below chart is rather startling and shows that even though the CPI has remained weak, principally because of the crashing housing market, many other areas are seeing incredible price increases.

The S&P 500 is up a good 9 percent for the year but that pales in comparison to other sectors:

Source:Â Finviz

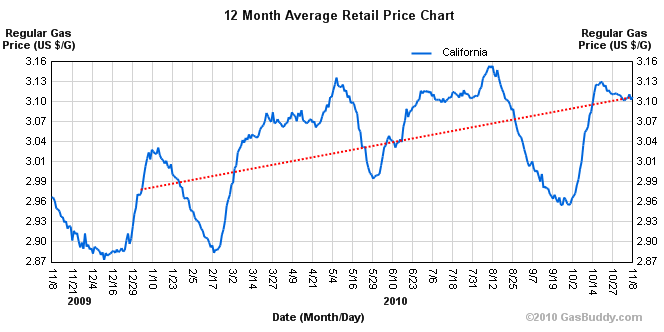

Notice that orange juice is now more expensive? Probably because it is up 20 percent for the year. We also need to remember that the working and middle class feel much poorer because even if wages remain stagnant, the cost of daily goods and items has steadily increased. Part of this doesn’t show up in the CPI because of the large dominance of “owner’s equivalent of rent†which has held the index lower for a good time now. But even oil is reflecting the weakness of the dollar:

Clearly gas prices are not going down. The dollar weakness is already showing up in crude prices because people are having less faith in the dollar especially when the Federal Reserve can go off and print money on whatever whim they desire. Did Congress have any thorough vote regarding quantitative easing? It just seems that the Fed can ram down whatever policy it likes and condemn the middle class in the U.S. to a currency that is weaker and weaker. The Fed and the U.S. Treasury won’t openly say this but what they are doing is exporting the U.S. middle class around the globe and lowering the standard of living for most Americans because of their goal of maintaining the current monetary and banking system in place.

If you think the banking system is doing well just look at non-performing loans:

Source: iTulip

Many Americans are having a tough time paying their debts. Housing, the place where most Americans have their net worth is down by $4.7 trillion since the first quarter of 2007. The wealth effect is showing that it cuts both ways and many are now feeling the pinch. Banks are stricter with their lending because they realize that many Americans are already maxed out on debt. The great deleveraging is taking place and pushing many Americans into what seems to be a modern day financial Dark Age. Some of the actions are simply surreal. I’ve seen people driving in newer BMWs taking large containers of plastic and cans to recycling centers and waiting in long lines for this. It just doesn’t compute on a visual level but this is part of the great debt bubble that burst. Artifacts from better days collide with economic realities of the day. You can drive down empty subdivisions in Nevada with gorgeous homes but no one is around and thus prices have cratered.

Some ask what the future holds. The Federal Reserve has already set a torch to the U.S. dollar. Not only is this an open policy, it is what is desired. The Fed states this will make our goods more competitive globally but in reality what they are saying is that they need to bailout their crony banking friends while lowering the standard of living for the middle class in America.  Bankers don’t care about allegiance to a currency or nation because they’ll just shift money around like a chess game. But most Americans get paid in U.S. dollars and not Euros.

If you feel that your paycheck is buying less you are right. You can thank the U.S. Central Bank for issuing in a new Dark Age for the middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

traineeinvestor said:

Yes the American middle class is being squeezed – and the biggest culprits are (i) the politicians who racked up mountains of debt, unsustainable entitlement programmes and adopted bad regulations and (ii) the middle class themselves who borrowed and spent like the good times would go on forever. The roles of the bankers (in spite of their best efforts and rampant greed) and China’s currency peg are trivial side issues in comparison.

Of course, on a global basis the middle class (however defined) is flourishing with massive numbers rising from relative poverty to the point where they can live and enjoy a middle class lifestyle that was beyond their imagination as recently as 20 years ago.

November 9th, 2010 at 1:56 am -

Claudia said:

At some point the bill for overspending has to be paid. A big problem is that people are still comparing their standard of living from 5 years ago, which was over the top through equity spending, to what they have now. I guess some don’t get that 5 years ago was the exception, not what we have now.

The only downside is that those who followed the rules are paying, too.November 11th, 2010 at 10:35 am -

JohnnnyDoe said:

Thought everyone might find this useful.

Quantitative Easing Explained You just have to…

http://wethesheeplez.blogspot.com/2010/11/quantitative-easing-explained-just-have.html

November 13th, 2010 at 12:12 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!