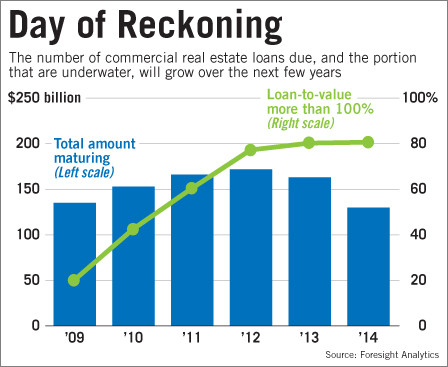

Day of reckoning for commercial real estate in 2012 – largest amount of loans maturing next year as $150 billion in CRE debt comes due. Federal Reserve running out of options in hiding financially disastrous real estate loans.

- 4 Comment

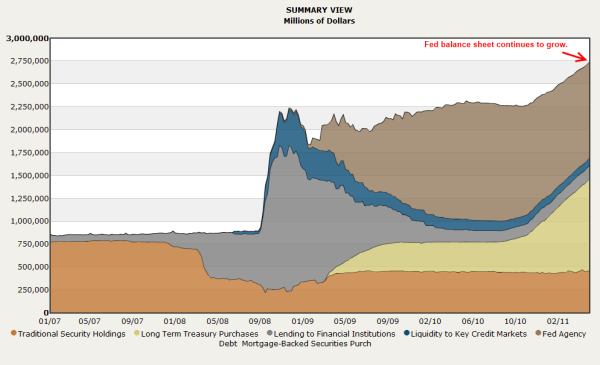

The Federal Reserve has tried its best to hide the secrets of past banking blunders deep in its balance sheet. Commercial real estate (CRE) loans made in haste during the real estate bubble are part of this national disgrace in banking folly. As the Federal Reserve and U.S. Treasury digitally print the dollar into oblivion the bad CRE loans still linger in the Fed balance sheet. As it turns out the Fed has become the dumping ground for all things real estate and has traded toxic loans for quality liquidity to fuel the banks back up. CRE debt in the form of empty shopping malls, failed hotels, and tumbleweed occupied strip malls is only a flavor of what the Fed is taking on. Yet many of these loans are still occupying the balance sheet of many banks. As it turns out, there was so much junk in the CRE market that the Fed could only balloon their balance sheet and still not encompass one half of the CRE market. Many CRE loans are coming due in 2012. Is the day of reckoning for CRE coming in 2012?

$150 billion coming due in CRE loans in 2012

Over $150 billion in CRE loans are maturing in 2012 bringing the day of reckoning closer. Why is this a problem? First, the CRE market has completely imploded:

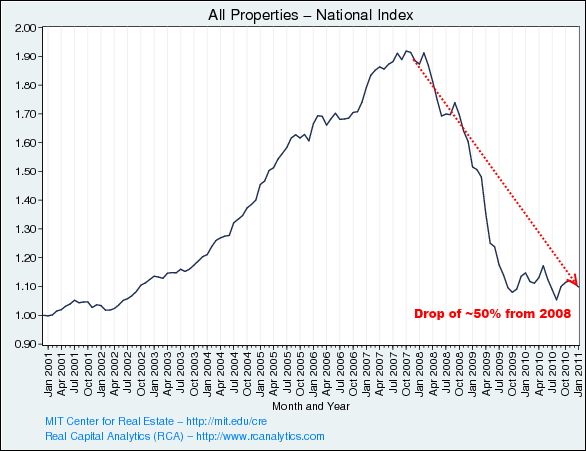

Source:Â MIT

CRE values just like residential real estate have cratered and are down over 50 percent since their peak. Much of these properties require actual economic streams of income coming in for example in strip mall rents or hotel occupancies to keep servicing the debt. Unlike a home that has other sentimental values a CRE property is strictly a business decision. The Federal Reserve is seeing the tanking of valuations at the absolute worst time. The Fed treating the crisis as one of liquidity simply exchanged U.S. Treasuries for toxic CRE debt to drinking buddy banks. After all what is the harm in keeping the junk for a few years and when prices recover, a simple hand off and the public has no idea what happened except they just have to contend with greater goods inflation as their purchasing power falls through the floor. However the bailouts of 2007 never helped the overall economy because the crisis is one of solvency, not liquidity. The working and middle class are struggling because their purchasing power has washed away over the decades and the bailouts were simply geared to the too big to fail banks.

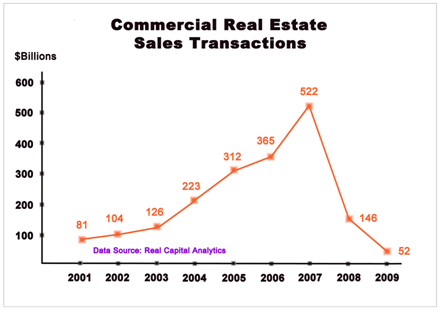

CRE is a giant problem because the number of buyers vying for a strip mall is relatively small. Unlike a residential property, if the price drops low enough on a home the market will respond. If a strip mall was poorly built in a bad location you may have no buyers regardless of cost. And make no mistake banks have shut the door on CRE fairly hard:

Source:Â World Property Channel

The fiasco in CRE can only last so long. The Fed balance sheet has exploded during this crisis and you can rest assured billions of dollars in CRE loans are floating in the un-audited figures:

CRE is merely following the pattern outlined by the residential real estate bubble effectively creating a situation where a double bubble developed:

Source:Â The American

2012 is looking like the day of reckoning for CRE debt. First, you have an American public that is absolutely frustrated by the ineffective handouts to the banking system of the country. The hunger for a full Fed audit is getting louder and louder. Politicians will sway in the way of their financial backers but only to the extent they feel they can get away with their smoke and mirrors and deceive the public. That shell game is becoming harder and harder to maintain. At what point does the government step in and do what is best for the economy and not the big banking interests? How does bailing out a failing hotel or empty strip mall really help the average working American? It doesn’t. Banks were eager to make these loans and profited handsomely during the bubble. Now they don’t want to deal with the consequences of taking on too much risk so they rather socialize the losses on the public. This is not capitalism but a banking corporatocracy. CRE debt will come due in large amounts in 2012 and unless prices soar to the sky in the next year, some major rebalancing will need to occur.

There is no inflating out of the real estate mess and CRE is no exception. Unless household incomes go up disposable income is going to get tighter. We are already seeing more money being eaten up by food and energy and baby boomers will definitely see more money flowing into the healthcare industry complex. From one frying pan to another it will become about priorities and CRE will move lower on the list. The day of reckoning for CRE is coming next year and only time will tell how the market will respond.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

well said:

here’s hoping the old adage works..

there’s a price for everything.

CRE, given the correct price, SOMEONE will buy it..

but it will be a huge hit on us again. how will

this fiasco be survived? that no one knows..

better go stock up on spam and beansMay 23rd, 2011 at 11:57 am -

Howard T. Lewis III said:

Don’t go into debt to the banks. They have pulled the rug out from under much of America and YOU ARE NEXT.

May 23rd, 2011 at 5:31 pm -

tyler said:

Belarus here we come.

May 25th, 2011 at 9:30 pm -

Ken said:

I’ve been wondering when CRE was gonig to tank. It was in a bubble like residential. I agree the stimlus and bailouts only benefit the big bankers (who are still Too big to fail). Inflation will spiral out of control as all the pent up bank money finds it’s way into the market. The average Joe sees a drop in purchasing power while the elites and well connected thrive

May 26th, 2011 at 7:40 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!