The death of the American pension: How older Americans are entering their golden years with a lack of retirement savings.

- 0 Comments

Listen carefully to the sales pitch from Wall Street. In the late 1970s and the early 1980s there was a push to get Americans away from pension plans and into 401k style retirement plans. The notion was that Americans would save enough on their own and would have the financial wherewithal to play in the Wall Street finance game. Well here we are a generation later and for most Americans, the self-directed retirement experiment has been an abject failure. We have now learned about a litany of mutual funds that have charged high expense ratios that basically ate into a good chunk of savings. The ETF and index fund world is new for many since it isn’t heavily marketed. And these are the options for the savvy people that actually dive in. Pension plans used to be commonplace. Now, they are rare and are headed to extinction. For most elderly Americans, the number one source of income is coming from Social Security. What happened to the pension plans of America?

The destruction of pensions

Pensions were popular during a time of long-term company loyalty. People worked a large portion of their lives with one organization and after many years, based on your salary and years worked, you would receive a monthly payment until the end of your days. The cost of pensions of course started becoming unsupportable as lifespan grew but also, investment returns were not keeping up.

The 401k became widespread in the early 1980s as a cheaper alternative to pension plans:

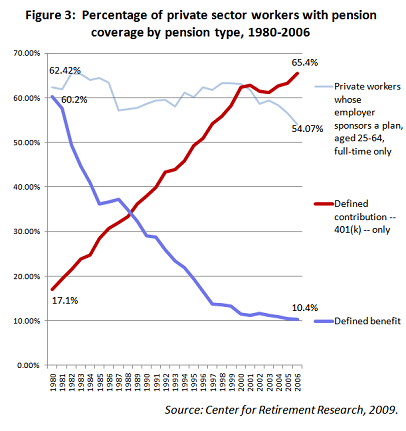

60 percent of Americans working in private sector companies back in 1980 were given access to defined benefit plans. The chart above is unmistakable and shows a clear pathway as to what won out in the private sector. Pensions were let go in favor of 401ks. Defined contribution plans give you the benefit of saving pre-tax. This is a good deal but with the large number of Americans working in low wage jobs, there is very little to save once you factor in all the costs associated with life. As with medical care and college a big portion of the cost is now being shifted to workers.

The number of Americans with no retirement savings is startling:

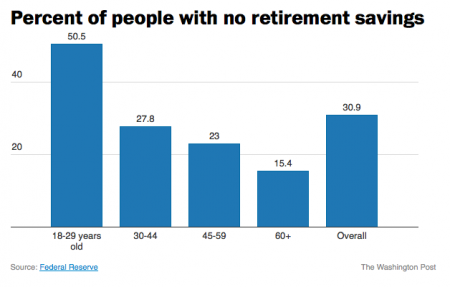

30 percent of Americans have no retirement savings to speak of. Defined benefit plans worked in a similar fashion to Social Security. You paid in and were given a guaranteed payout when you retired. These were great deals for workers because in most cases, more was paid out than went in and since the amount paid was defined, you were guaranteed a fixed amount. You can see how the math on this would get problematic. Of course with a 401k, you are at the whim of the stock market. Just imagine you retired and then 2007 through 2009 hit. Hopefully people are rebalancing appropriately as they get closer to their retirement age. The fact that the numbers look so grim, we know the reality is very different.

The reason pensions have also gone away is the optimistic assumption behind the numbers. Gains are harder to find and many pension plans had unrealistic expectations of 7 to 8 percent returns every year ad infinitum. That gets you into trouble and there are countless underfunded pensions across the country.

It is interesting to hear the narrative around this. There seemed to be an angry backlash against pensions even though these likely were aiding the middle class. Wall Street financial giants don’t need pensions when they can gamble and speculate with all the protection of the Fed and favorable bailout policies. Does the public have this kind of access? Unfortunately they do not.

Many people have a tough time saving. Half the country lives paycheck to paycheck. A better option would be to offer a hybrid plan, one that forces employee savings and a 401k like defined contribution plan:

“(Workforce) Most people are ill-suited to manage their money, so what we might see going forward is one of these hybrid plans, in a defined contribution environment, where the employee still holds the risk but has a more stable retirement fund,” van Iwaarden says. “And I would still not be surprised to see some resurgence of defined benefit plans for tax-motivated employers.”

A hybrid plan works much better because it goes around basic human nature to avoid saving money but also allows those who want to save more to do so. These are rare. Most are afforded only the 401k option. Pensions are heading to extinction and a generation later, we realize most will live a life of work into retirement.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â