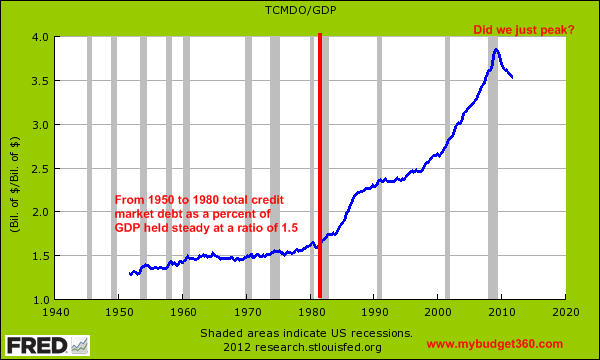

The long debt emergency has arrived – From 1950 to 1980 total US credit market debt to GDP held a ratio of 1.5. Today that figure is above 3.5 with total US credit market debt at $54 trillion.

- 6 Comment

We are reaching a point of no return with global debt. The US will be running deficits for as far as the indebted eye can see. This isn’t a new or novel trend but the magnitude certainly is. Since we stepped on the deficits do not matter accelerator in the 1980s the US dollar has been losing its purchasing power year after year. This might not be a big deal for you if you have a large share of international currencies and major investments overseas but the results for the working and middle class are financially disastrous. Most American workers are paid with US dollars and not with foreign currencies. The troubling aspect of our economy is that we are starting to move backwards and for younger Americans and their parents, it is hard to imagine a world where the subsequent generation will be in worse shape but that is the plate we are being served. We need to look at some data very carefully to see how incredibly indebted we are as a nation.

Total debt reaching peak levels

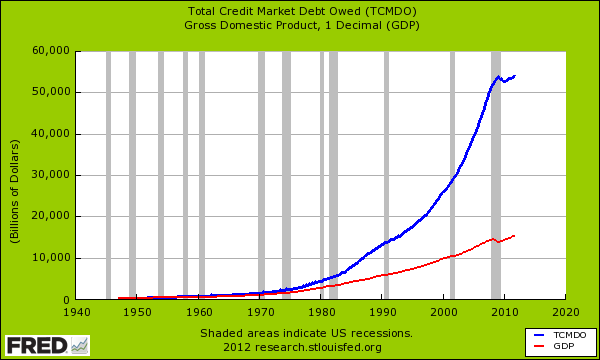

Total US credit market debt is over $54 trillion. To put this in perspective, we went ahead and charted this out with our annual GDP:

One thing is very interesting in the data above. From the 1950s to 1980 the ratio remained around 1.5 but that changed in the 1980s when we suddenly went into “deficits don’t matter†mode and haven’t looked back since. However global debt does have a maximum inflection point. Ask Ireland, Spain, Portugal, Japan, and Greece how good it is to have debt that surpasses annual GDP. Take a look at the total market debt and GDP as a ratio:

Something definitely peaked with this financial crisis. Did we reach a peak debt situation? Keep in mind what is happening right now with all the foreclosures in housing. Say someone bought a home for $500,000. The home now sells for $250,000. What happened to that other $250,000? Did it just disappear? In a sense it did. That is the nature of bubbles. This bubble manifested itself in real estate but is really at its core a debt bubble. It is now migrating to government debt and student debt.

Take a look at some other countries with very high debt to GDP ratios:

You’ll notice the PIIGS (Portugal, Iceland, Ireland, Greece, and Spain) all coupling together. We already know the story with Greece. Spain isn’t exactly looking pretty right now with a 50 percent youth unemployment and headline unemployment of over 23 percent (these are depression like figures for a western industrialized nation). None of the economies on this list are actually booming.

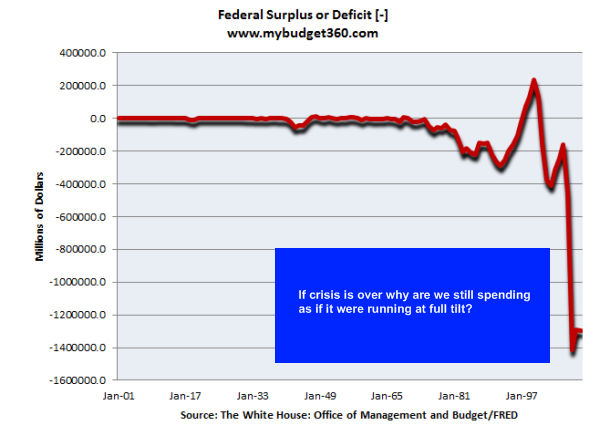

Spending what we don’t have

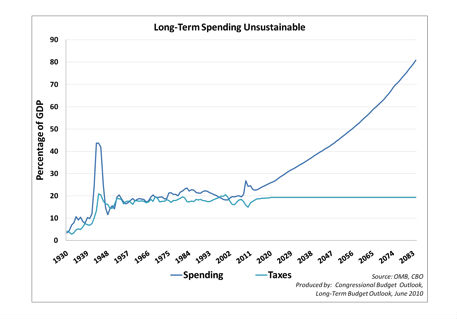

On a micro level, we understand why the fiscal crisis hit. If you are making a per capita income of $25,000 a year there is no way that you can be driving around a leased $50,000 car and carrying a $300,000 mortgage on a McMansion. Of course many Americans lived it up on debt for the last decade and now a painful deleveraging is occurring. Yet this deleveraging isn’t occurring with governments and their bosom buddy too big to fail banks that are miraculously turning giant billion dollar profits. It is easy to turn a profit when you have access to zero percent loans from the Federal Reserve and all loses are passed on to the American people in the form of crushing the US currency. Who needs Congress when the Fed can bypass all laws and crush the dollars you carry in your pocket. Think we are managing our money well? Just look at government spending and revenues:

Clearly the public isn’t benefitting. But just look at the massive profits being made by the too big to fail banks and you will realize what the bailouts were truly about. As a token of appreciation from the bailed out banks and government, we are now adding tens of thousands low wage jobs with zero long-term security.

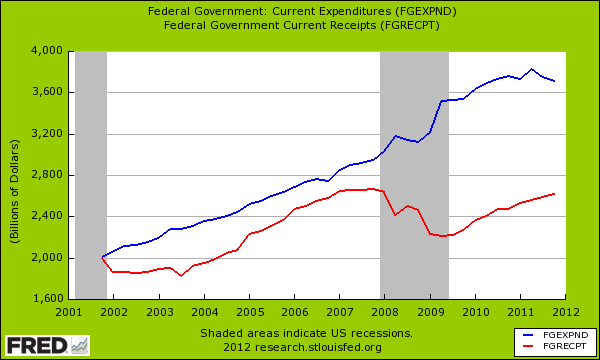

The issue on the surface is rather obvious but the implications are very serious. We are simply spending much more than we are bringing in:

A large portion of the hidden bailouts were done via the Federal Reserve transferring toxic assets and simply letting it fester like month old fish. We are looking at trillion dollar deficits here. This is unsustainable as I’m sure many of you have concluded. So what are the solutions? The government can raise revenues and cut spending. But even that will do little given the major costs coming from built in programs like Medicare:

With 10,000 baby boomers retiring per day theses costs are simply going to rise. Ironically the costs will fall on younger Americans that didn’t have the luxury of a booming economy and many are massively saddled with student loan debt already. You notice a common theme here? Instead of dealing with the actual issues we simply go further and further into debt. There is nothing wrong with debt per se, but the current ratios are flat out into uncharted territories.

The only longshot solution would be if our GDP suddenly went up sky high and revenues increased. Yet every projection we have seen is for slower GDP growth for the US as a mature country with a sizable retiring population. Plus, does anyone in their right mind think we will ever pay off $54 trillion in debt in this lifetime? Get used to the hidden inflation in groceries, fuel, healthcare, and college because the dollar is only likely to get weaker given these policies. There is such a thing as having too much debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Dumbfounded said:

So sad. My country tis of this.

April 17th, 2012 at 8:26 pm -

Kim said:

Brilliant and what I continually need to endure me.

April 17th, 2012 at 10:14 pm -

JD said:

Sobering article. Can you get more specific on fixes to the problem? Or more importantly does this country have the political will to address the required changes?

Both political parties seem unable to come together on this topic in any meaningful way.April 18th, 2012 at 9:15 am -

No one said:

What is there left to say?

April 19th, 2012 at 9:34 pm -

doolster said:

usa has gone PARABOLIC IN THE WRONG DIRECTION, WEIRD IT KINDA RHYMES WITH BUBONIC,which means bush and obuma and congress are rats?

April 24th, 2012 at 12:06 am -

Cincinnaticus said:

In the immortal words of Francis Bacon: “Nature, to be commanded, must be obeyed.” This axiom, applied to over-indebtedness, is as follows: Debts that cannot be paid, won’t be paid. Or as my grandmother used to say, you can’t squeeze blood from a turnip! If Civilization is to survive and we are to avoid a collapse into neo-feudalism and debt-peonage, the absurd level of debt currently outstanding will simply have to be written down or abrogated outright as has always occurred in the past. The ruling financial oligarchy and their political lackeys in Washington D.C. [District of Corruption] may not want to accept this, but eventually they will in order to avoid finding themselves swinging front lamp-posts with nooses around their necks!

CINCINNATICUS

April 27th, 2012 at 3:27 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!