Debt serfdom via student loans: A new class of indentured servants now carry the $1.1 trillion student loan bubble and cracks are already plaguing the system.

- 4 Comment

$1.1 trillion. That is the amount of student debt being carried on the backs of millions of Americans. Student debt has become a rite of passage for many young Americans. In fact, many Americans establish their first credit line with student debt as they enter college. The crisis is large and has a direct connection to the abysmal savings that younger Americans have. The press has tried to downplay this debt sector because students continue to carry the burden making minimum payments on the debt. Yet even with this, student debt is the most delinquent household debt sector in the United States. There are deeper trends at hand yet the amount of debt floating around in the student debt markets continues to expand. Disposable income of younger Americans already ravaged by the recession continues to be sucked away into this gigantic burden. Are we creating student debt serfs via higher education?

From credit cards to student debt

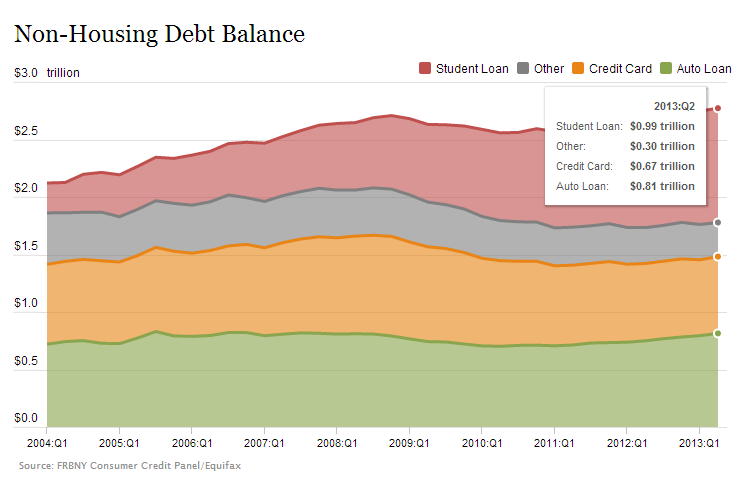

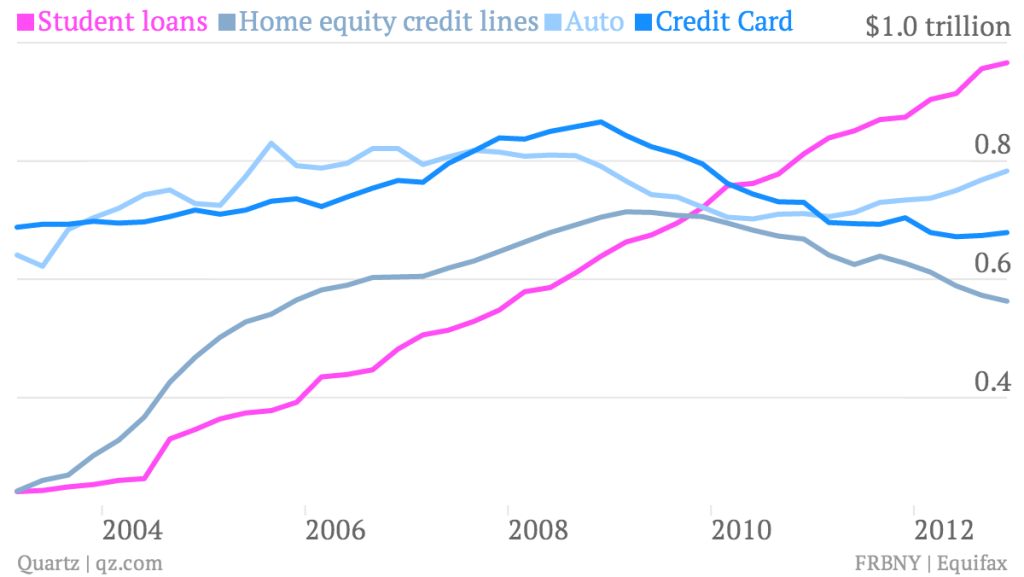

This is an interesting chart showing the shift in household debt over the last decade:

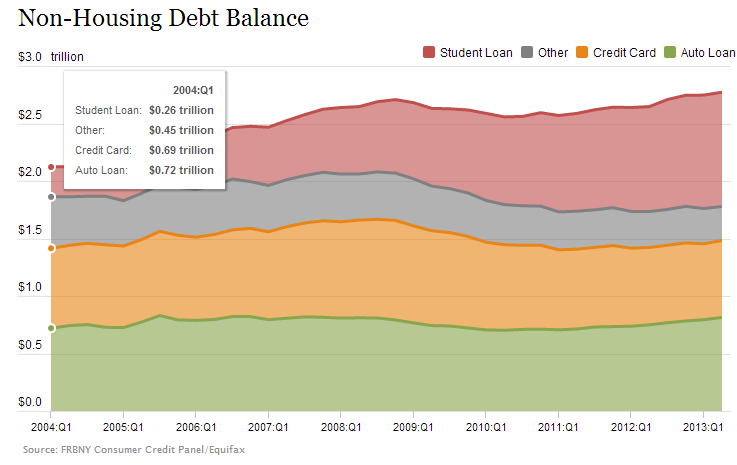

Student debt is now the largest non-housing related debt sector in the country. This is a dramatic shift. In 2004, student debt outstanding was at $260 billion:

Today, it is at $1.1 trillion looking at more recent figures:

And this is a very important point to understand. Credit card debt in 2004 was around $700 billion. Today it is at $670 billion which is a decrease in the last decade! That is a major shift in debt spending habits of Americans. However, with credit card spending this at least added fuel into our consumption based economy (not that this was a positive either when you spent well above your budget). What is being accomplished by students going into massive debt to attend a paper-mill for-profit institution?

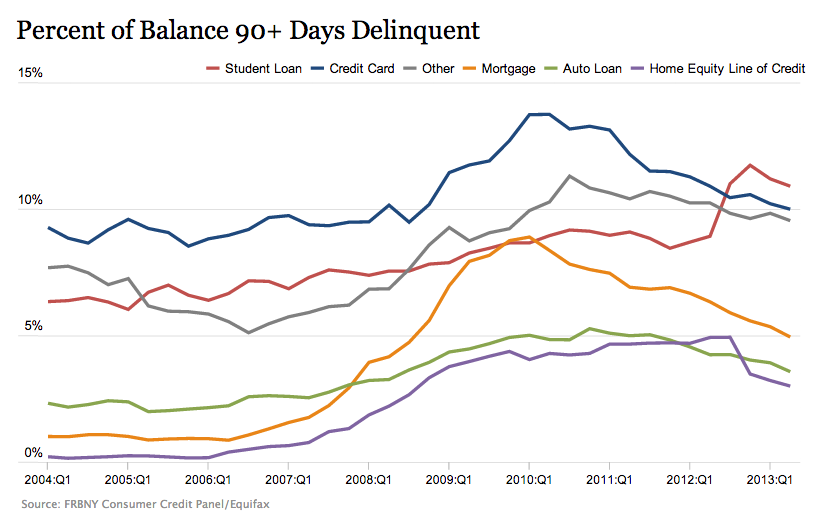

Most delinquent loan of them all

The most delinquent of all household debt today is student debt:

What makes this even more problematic is the inability to dispose of this debt even through bankruptcy. Many Americans find their balances ballooning because of the odd structure of these loans. Late fees and penalties compound over and over to increase balances, at times even doubling the initial principal loaned. It is a vicious cycle that many Americans are simply unable to get out of.

Take a look at this example:

“(Student Loan Justice) I don’t have all the facts and figures about my situation but here’s a synopsis. I graduated from chiropractic school (1989) and defaulted on my federal student loans (for the same reasons that others have had to default) that totaled approximately $40,000 (in 1989) and now total $320,000 (based on a collection agency’s claim in 2005). I can’t renew my license to make a living (much less make payments (they wanted $800 per month in 1996) on the loans) and have experienced feelings of hopelessness, despair, no self-esteem, depression, suicide, etc., etc.â€

You can read through the site but this is not uncommon. So an initial balance of $40,000 ballooning up to $320,000. This is worse than loan sharking! Yet this is the current archaic system that many people find themselves in. And of course, the government backing of student debt makes this bubble even more dramatic. There is a reason housing is bubbling up once again now that the Federal Reserve has taken it upon itself to own the housing market.

Makeup of student debt

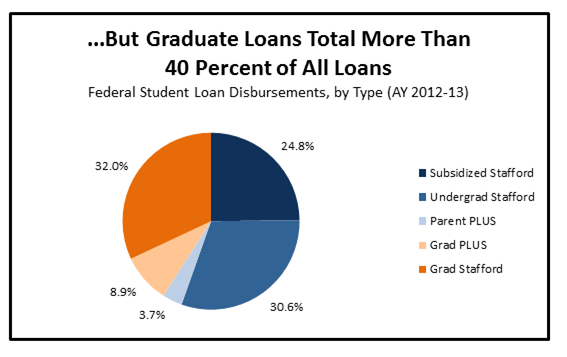

Student debt cuts across all programs:

It is interesting that student debt in 2012-13 is made up by 40% graduate loans. Part of this is programs like law that have insane price tags for a very little return on investment. It is no surprise that law school applications have fallen through the floor. Yet the market is still being pushed by the four year degree model. A large portion of government funding is going to for-profit paper mills where you might as well go on YouTube or TED and teach yourself (you’d probably get a better experience). Yet these institutions go after the poor and underserved since they spend nearly one-third to half of their budget in marketing. Plus, these schools depend on 90 percent or higher government financing. This is how a new form of debt slavery is created.

The bigger ramifications are already being seen by households witnessing incomes falling and younger Americans finding more of their disposable income being allocated to student debt payments. Welcome to serfdom via student debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

4 Comments on this post

Trackbacks

-

Mark said:

Indentured servitude is a good metaphor for what is happening with the student loan fiasco; this is a truly abusive system that takes advantage of the ignorant simply trying to improve their lives.

An indentured servant, historically, at least learned a trade that was with him for life; what are these poor folks getting but a worthless degree and a watered down education.

The Bush administration, “reformed” the bankruptcy laws excluding student debt so now there truly is no way out for these poor souls. What is next? Will they bring back a “debtors prison”?

September 26th, 2013 at 3:12 pm -

Ametrine said:

I think that student loan enslavement is a way for those that “have” to enslave those they don’t want to “have”.

It truely is modern surfdom.

Unfortunately, the educational system has the enslaver’s best interest at heart. From day one, they indoctrinate the children to accept the world-view as they want them to see it. The create the “zombies” by distracting children early on with Disney movies and Hollywood. Then they move on to the “latest” tech gadget and Facebook addiction.

Our kids are being abducted! By those who seek to control us. Perhaps it’s time to say, “NO!” I’m NOT going into debt to get a degree. Let’s encourage our children to stand up and tell these “shadow masters” to take a flying leap! Let’s help our kids become all they can be without any “help” from the establishment-slavers.

The time is NOW. Our kids are depending upon us to advocate for their future.

Will you advocate? Or will you allow the PTB (Powers that Be) take away an essential right-the right to Freedom and the Pursuit to Happiness (DEBT-FREE!!!)

September 27th, 2013 at 3:45 pm -

niphtrique said:

We should look at the underlying cause of debt serfdom. Compound interest is infinite in the long run. Assume that a 1/10 oz gold coin was put in the bank on interest in the year 1 AD on 4% interest. How much gold would there be in the account by the year 2000? The answer is: 3.6 * 10^31 kilogramme of gold weighing 6,000,000 times the complete mass of the Earth. Compound interest must be paid from debts so debts tend to grow until interest payments cannot be met. This is a financial crisis and this often precedes an economic crisis.

Conclusion 1: Interest causes economic crises.

Interest is also an allowance for risk. So, high interest rates make it possible to have questionable loans in the first place, because there is a reward in the form of interest to take the risk of issuing questionable loans. If questionable borrowers have to pay high interest rates this further erodes their capacity to repay the loan. If there was a maximum interest rate, then there is a cap on risk taking in the financial system and questionable borrowers have to reorganise their finances in an earlier state.

Conclusion 2: Interest on money causes questionable lending and borrowing.

Governments try to get the economy on track by spending that increases government debts. Central banks try to solve a crisis by lowering interest rates or printing money. Those measures are meant to offset the effects of compound interest payments. Without interest on money it may be possible to have a more efficient economic system. If interest on money is to be abolished, how can there be credit and how is it possible to have a return on money that reflects the return on capital? These are questions that have to be answered otherwise money without interest will not work.

It can be done, see:

U:\bart\Stage\blog-130911.html

September 30th, 2013 at 2:11 am -

niphtrique said:

Sorry, there has been an error in the previous post, and the link is not mentioned correctly. The correct link is:

September 30th, 2013 at 2:13 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!