New definition of retirement = work until you die: Half of Americans have little to no savings for what will likely be a long and drawn out retirement.

- 9 Comment

The ideal vision of retirement is one of constant leisure supported by a sizable nest egg. Building a nest egg takes decades of discipline and careful planning. Unfortunately, many Americans did not adequately prepare and combined with the casino like financial system, many have been washed out of the system. Many retiring baby boomers are going to use Social Security as their primary crutch for retirement income. The Social Security system was never designed to be the primary target for retirement income yet this is what we are facing. The problem of course is that Americans simply do not have much sizable wealth in stocks and bonds. While the majority of Americans own houses, most own very little to no stocks. This is why the current record in the stock market means little in the face of an imminent retirement. Also, the one vehicle to build net worth in housing is largely locking out young future buyers thanks to massive buying from Wall Street and big investors nearly guaranteeing another retirement disaster after this one. One crisis at a time. So why will so many Americans be in dire financial situations as they enter their golden years?

Very little saved = more work

Americans are doing a poor job at saving money for any purpose including retirement. A recent survey found that over one third of Americans have no savings to their name:

“(NY1) For the first time, Bankrate decided to ask Americans how much they’ve saved for retirement. The answer is alarming. Over a third of those polled—36 percent—said they haven’t saved a dime.

“They have nothing. Maybe there’s some money under a mattress somewhere, but as far as into an actual account somewhere that’s accruing interest, there is no savings for these folks,” says Bankrate.com Research and Statistics Analyst Chris Kahn.

That’s especially true for younger workers, which isn’t really surprising. The older they get, the more likely it is that they’ve started to squirrel something away, but not everyone. A full quarter of respondents between the ages of 50 and 64 have yet to start saving.â€

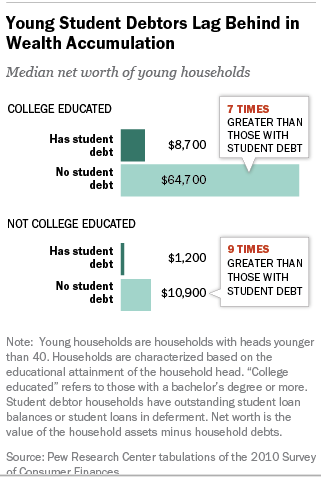

This is not good. In fact, many younger Americans with large amounts of student debt are actually starting off in a position of a negative net worth. Other data has found that Americans with student debt are likely to trail their counterparts with no debt:

Since college with no debt is largely a pipedream for most, many Americans entering college today will need to take on some sort of debt. The young will have a tougher go at retirement compared to the present case of baby boomers. What is troubling about the case of baby boomers is that they had a massive bullish stock market yet somehow, most are poorly positioned for retirement.

“(Think Advisor) A DC system forces workers to choose how much to save and how to invest. Some save more, some don’t save enough, and a lot of workers don’t save anything. According to 2010 Fed data, about 45% of American workers aren’t currently saving for retirement.â€

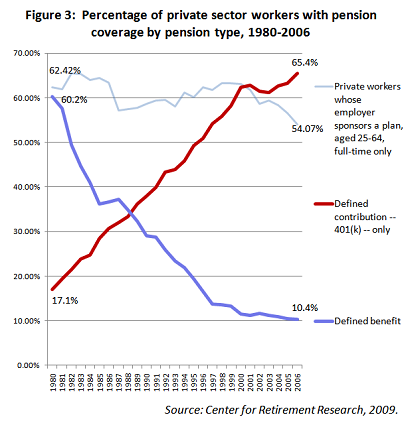

So nearly half of Americans have saved nothing for retirement. Not a good thing. The Employee Benefit Research Institute found that nearly half of workers had less than $10,000 saved. This is probably enough to live 6 months by scraping by on cheap food and water. Less than 10 percent of Americans now have access to a pension:

Back in the early 1980s, this figure was above 60 percent. Rising costs and employers slashing benefits has been a big culprit for this push. But it should be clear that 401ks and self-serve retirement plans have done a horrible job at preparing most Americans for retirement:

“(Business Week) No longer able to afford her four-bedroom house in West Hartford, Conn., which she purchased for $225,000 at the height of the housing bubble, Lee rents it out for $1,600 a month to cover her mortgage and taxes and hopes to hold it until prices rise so she can recoup her investment. She now lives in the basement of her friend Brita Tate’s house in Wellfleet, Mass., paying $400 a month in rent. She found a job managing the spa at the Crowne Pointe Historic Inn in nearby Provincetown, where she earns $13.50 an hour working as a combination hostess, receptionist, fixer of gym equipment, and laundress.â€

The above case is going to be very common. Many baby boomers are going to realize that the notion of retirement is going to include work, even if it is part-time in nature. Thankfully, we are doing a fabulous job of creating low wage work with little benefits to fill this gap. The thought that financial worries would be far in the rearview mirror for most baby boomers is unlikely to be true. Many will be struggling but in light of the battle their offspring is facing, their fight might seem more manageable although time is not on their side. Social Security will be the main source of income for millions of retiring baby boomers. I think many Americans are going to get a rude awakening as to what it means to be retired.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

BlackDog said:

The assumption that because there are no ‘savings accounts’ for retirement is hardly an indicator of insolvency. The stock market is rigged, our worthless statesmen have passed laws that now allow the banks to ‘bail-in’ at will — that’s ‘steal your money’ in layman’s terms, and an economy that is teetering on imminent disaster has taught the astute to store their ‘savings’ elsewhere. And who would admit to having anything if asked by a stranger? Further, what good is our currency if the banksters and the Federal Reserve can change it’s value, it’s buying power, even the way it looks simply by changing policy? Ronald Reagan outlawed the Kruggerand to ‘fight’ apartheid in the 1980s. How difficult would it be to outlaw gold and silver as a currency, regardless of laws passed by the states? Personally, I am sticking with lead, the only precious metal whose value actually increases as you give it away.

August 24th, 2014 at 10:55 pm -

Bud Wood said:

It may be much too late to give advice, but these people who evidently have burnt the candle at both ends could have been more frugal. My grandmother set an example as to how not to take care of finances. By investing in real estate on margin, she was able to turn a million dollars left to her by her husband into essentially zero. She didn’t know the meaning of frugal. Good example to not follow.

My wife and I have been frugal while raising five offsprings. If we didn’t need it, we didn’t buy it. We have paid little interest on any purchase except our house.

My guess is that the current group of retirees will set an example of what not to do and the coming generation will be better off because of those examples. Of course, that’s after school loans are paid.August 25th, 2014 at 9:43 am -

Confederate said:

Well hell’s bells with the govt. taxing everyone into oblivion, inflation, the “affordable” obamacare, property taxes that are through the roof, the stock market collapse of 08 which incidentally I lost $60,000 is it any wonder why people can’t save? The middle class is constantly being lied to and stolen from. If I were a politician I wouldn’t be in this situation, but in the end, who cares? Don’t preach to me about not being able to save, the govt. is the greatest hindrance. Damn Yankee’s.

August 25th, 2014 at 1:09 pm -

Ame said:

“The problem of course is that Americans simply do not have much sizable wealth in stocks and bonds. While the majority of Americans own houses, most own very little to no stocks.”

The problem many are facing is BECAUSE of the stock market! I can’t tell you how many were lied to about how 401K’s were the way to save for retirement. Millions are placing their savings in these and will be wiped out (yet again) like in 2008.

DON’T save in a 401K. Get yourself a plain-jane vanilla savings account and live well below your means to save at least 40%+ of your income starting out of school. DON’T let anyone persuade you to “invest”!! They are looking to steal your hard-earned wealth.The stock market is RIGGED! Anyone who follows how it’s done realizes that.

August 25th, 2014 at 4:46 pm -

James said:

Why Save?? The government will then steal it and the Federal Reserve will print and print with ZIRP and the savings will be the same place where the non savings persons are. WITH NO RETIREMENT. We are forced all our working lives to pay into Social Security which the government steals for the nonworkers and disability frauds, ( not all are frauds but the majority are) who did not pay a dime into the program. Then they say our forced payments are renamed Government Benefits. What a fraud the government is..

August 25th, 2014 at 5:46 pm -

Voice of Reason said:

Can someone please explain to me how anyone can really plan for the future when there are very real threats that our savings could be drastically reduced by any or all of the following. A) A collapse of the US dollar due to reduced international demand. B) A devaluation of the dollar due to an international currency reset. C) A bank “Bail in” as approved by the FDIC under Dodd-Frank where 30%+ of money market and savings are stolen. D) Political plans to create “MyRAs” requiring everyone to own worthless US Treasuries. E) Theft of wealth through inflation and misleading economic indicators. F) Zero interest rate policy forever so savers cannot live off their interest but must spend their principal to survive. G) when the SEC claims that all markets are manipulated and your not an insider.

August 25th, 2014 at 7:28 pm -

CX said:

this reinforces the view of a long term deflation environment where the vast baby boomer generation sells what they have to survive and buys less and less. The recent generations seem to be in collage debt and move to a shared asset model instead of an owned asset model. Cash may go up in value.

August 26th, 2014 at 5:46 am -

laura m. said:

I know some working past retirement age. Many cannot manage money and /or don’t select a competent financial adviser/ or waste money on slacker adult children who have to be bailed out of situations. Many just can’t quit spending living beyond their means. We took early retirement and recently started withdrawing the 401k. We are a child free couple and both of us worked. Now days being child free is savvy. Some I know in their 30’s and 40’s will do likewise.

August 26th, 2014 at 9:04 am -

Guss said:

I am pleased to see this post and article. It reminds me of the very same article I posted back when TWEETs, FACEBOOK, and all the other IT tools were not so prominent.

I stated the very same notion about the lack of financial planning and how many, many retirees were going to get caught in this this trap. It was when I recognized the fall of pension funds program and how we fail to save. However, I did not make any consideration for the recession. This has caused a much greater impact on retirees, myself included, as I never planned on taking care of an ill parent who had contracted a disease that was not prevalent in the early 2000’s.

Our world has changed and we must consider mechanisms that will allow us to cope with it, including how healthcare must address our needs.August 26th, 2014 at 10:08 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!