Diving into the fiscal economic mess – Fiscal cliff a reckoning for decades of poor financial management and massive debt based spending.

- 4 Comment

The media is making it appear that the fiscal cliff is a sudden event. Like a countdown to a New Year’s party. Yet this cliff was as predictable more than a decade ago as we spent more than we took in as an economy. The challenge is real because our spending is so much more that what is coming in. Sure, we can go into deeper debt and allow the Fed to issue trillion dollar bailouts to the banking system yet what we have gotten in return over the last five years is now a low wage economy. We now bask in reports that show unemployment rates falling not because of substantial job growth but because people are dropping out of the economy like flies hitting the light. The fiscal cliff can really be summed up in one major chart.

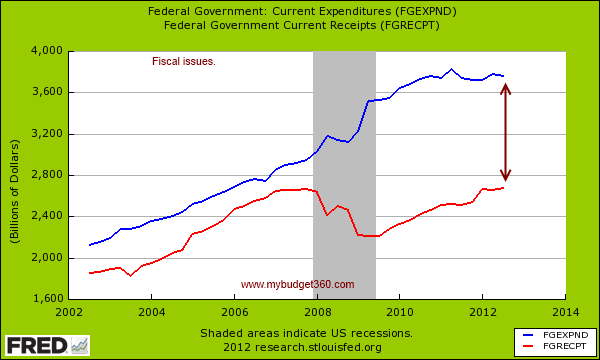

Fiscal cliff in one chart

The fiscal cliff has been a quickly approaching development similar to clouds over the horizon for a couple of decades but when this recession hit, our spending far outstripped our revenues:

This of course is not unusual for government spending to go up during a deep and prolonged recession. But keep in mind we went out of recession “officially†in the summer of 2009 and we are still spending as if we were in the midst of a crisis. Actually, the spending has only accelerated if you look at the above chart. We are seeing revenues now back to pre-recession levels but government spending is up by over $1.2 trillion.

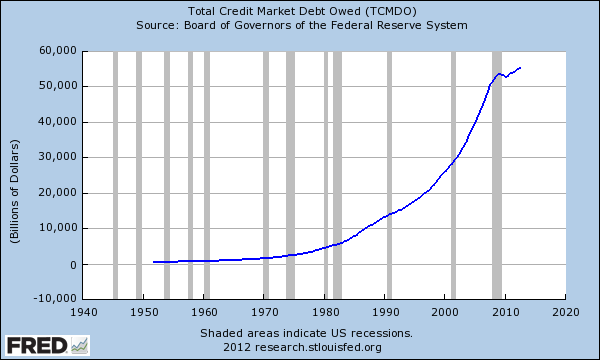

While this might seem unwieldy this does not give the entire picture. Total credit market debt is at record levels:

This is an even more troubling aspect of our current system because we are now largely a debt based system that focuses on bailouts and market manipulation to keep people spending money they don’t have. We obviously want all the luxuries of high spending but don’t want to pay for it. This is similar to a household spending money it doesn’t have to make up for decades of poor financial decisions. These policy moves are largely pushed by the Federal Reserve from the banking side of the equation to aid in propping up large member banks.

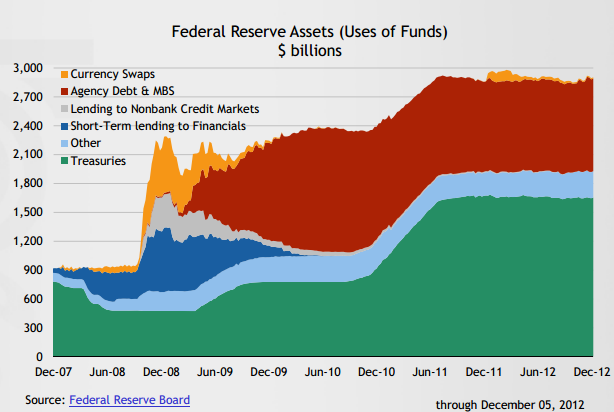

Banks have used the Fed balance sheet as the “toxic bank†and have shifted poorly performing assets there. Again, the Fed balance sheet is operating as if we are still in full recession:

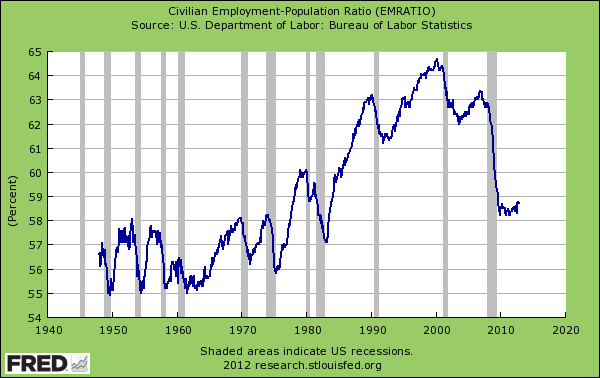

Ultimately the public is not being told the entire story. The narrative now is about the fiscal cliff being a sudden and unexpected turn of events. This was predictable more than a decade ago when we decided to spend more than we earned and thought this kind of deficit spending was somehow never going to catch up with us. Yet now it is. The young in our country are already experiencing their version of the fiscal cliff. We are putting the bill on younger Americans who now face the following:

-Massive student debt

-Lower wages and weaker job prospects

-A weakened Social Security System

-Much higher healthcare costs

-Higher housing costs courtesy of low interest rates

The reality is realized when we look at the employment figures on a basis of our civilian-employment population ratio:

No doubt, what we face is urgent. But don’t think this countdown came out of the blue. Similar to people believing wrongly about the Mayan calendar, once reality sets in we are left with dealing with the real world. A fiscal reckoning is happening and politicians are simply aiming to blame each other or continue spending with money we are not willing to pay. Just remember that most members of Congress are millionaires so think about how that might bias their policy decisions.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Lori Smith said:

Thanks to the financial crisis people lost a lot of money if their pension funds and 401k’s but keep in mind SS is an entirely self financed program and doesn’t add a dime to the deficit. The politicians now keep acting like SS is welfare when it’s not but it goes a long way in brainwashing the younger generation that granny is screwing them.

The Great American Retirement Scam: Why The Wealthiest CEO’s In America Want To Take Away Your Social Security

Why Your 401(k) Match Will Get Cut

http://business.time.com/2012/12/13/why-your-401k-match-will-get-cut/

JPMorgan CEO Pushes Fiscal Cliff Compromise As The Bank Lobbies For Tax Breaks

December 21st, 2012 at 2:45 pm -

Solonsays said:

FGRECPT is overstated because the government counts Medicare/Medicaid revenue as individual taxes collected.

December 22nd, 2012 at 7:48 am -

JD said:

Political ineptitude , greed, and co-opted politicians funded by lobbyists, have unfortunately undercut the promise of America.

I hope it’s not too late to take it back.

Watch the movie Inside Job to get insight into our incestuous conveyor belt between government positions, lobbyists and corporate jobs! A national disgraceDecember 22nd, 2012 at 8:58 am -

TrapperGus said:

You have ignored most of the reasons for the difference between the spending and the revenue, namely the tax cuts in the late 1990’s and early 2000’s and the massive increase in Defense spending in the early 2000s….if we had followed Keynes we would not have this problem…

Also perhaps the best thing we could do because it is politically possible would be to do nothing, meaning allowing the tax increases and spending cuts to occur…the economic multiplier (effect on the GNP from government spending and taxes) less than 1 for taxes and about 1.5 for spending….therefore since the spending cuts are really reductions to the planned spending increases and not really cuts as spending stays the same they will not reduce the GNP from current levels….the tax increases will reduce GNP by less than the amount of the taxes and since most of these taxes will be on the top 10% the multiplier will probably be much less than 1 since the top 1% cannot use money effectively but only can create bubbles with it…

Therefore going over the cliff which will reduce decits going forward by 70% at a small cost to the GNP this year may be the best thing to do.

December 23rd, 2012 at 7:08 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!